How To Roll Over Your 401 Into Bitcoin Ira

Bitcoin IRA offers several ways to get investors started with a self-directed crypto IRA. Clients can choose to roll over from SEP, SIMPLE, IRA, 401 and other qualified accounts. Plus, you can start a brand-new IRA with no rollover required.

Heres how to get started, whether you prefer to roll over your 401 to Bitcoin IRA or fund your account with new contributions.

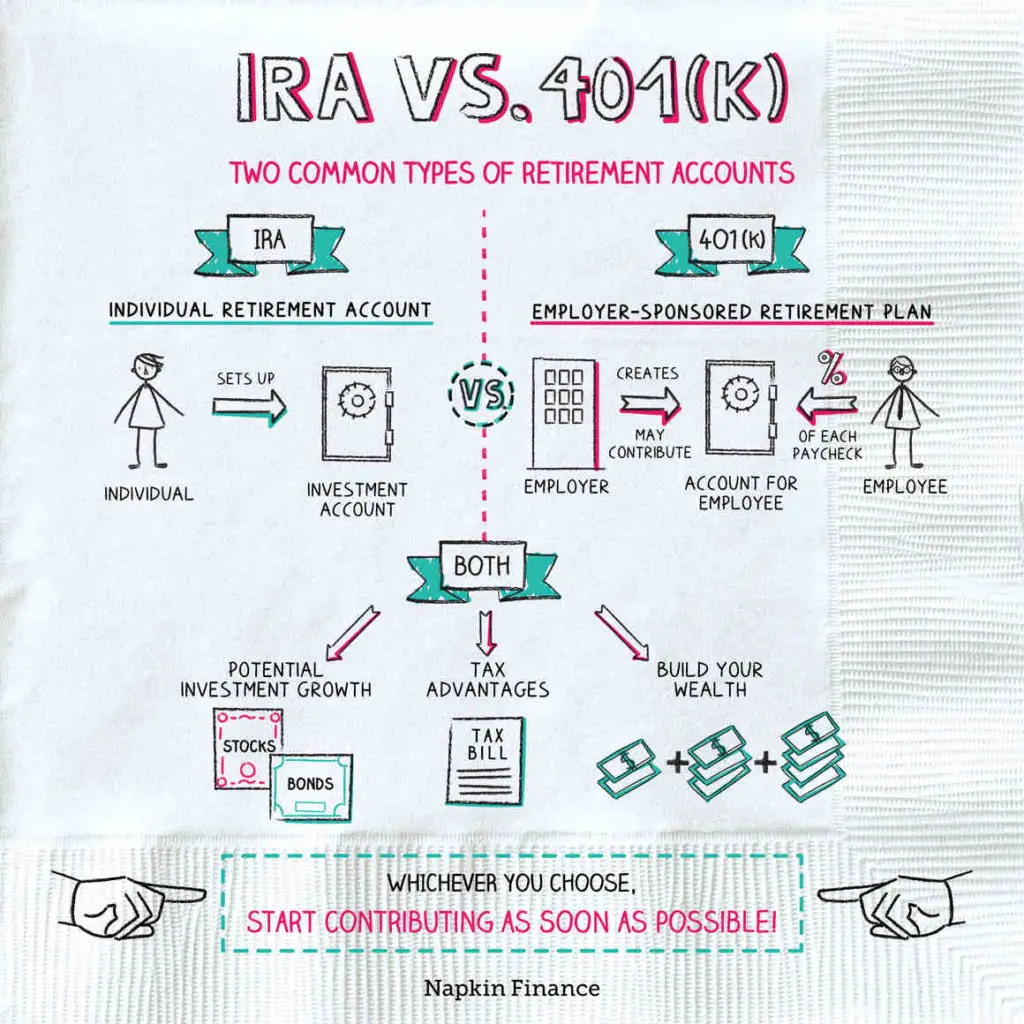

Why An Ira Is Better Than A 401k

A 401 may provide an employer match, but an IRA does not. An IRA generally has more investment choices than a 401. An IRA allows you to avoid the 10% early withdrawal penalty for certain expenses like higher education, up to $10,000 for a first home purchase or health insurance if you are unemployed.

Access More Investment Choices

In a 401 plan, youâre limited to the investment choices picked by your employer, usually a selection of mutual funds. If you roll over your 401 to an IRA, you may be able to expand your investment choices to include a broader range of funds, exchange traded funds or even individual stocks and bonds. Youâll get more control over your portfolio, especially if you use a self-directed IRA, which allows you to invest money into more unorthodox assets like real estate.

You May Like: Can You Rollover A 401k Into An Existing Ira

Recommended Reading: How Do You Pull Money Out Of Your 401k

What Are The Maximum Contribution Limits For A 401 And Ira

Every year, you have the opportunity to contribute a certain amount to your 401 and/or IRA accounts that count towards the annual maximum.

For 401s, the annual maximum you can contribute as an employee is $20,500 this amount increases by $6,500 to $27,000 if youre over age 50. These contributions come out of your paycheck before taxes, and youll see it on your pay stub as 401 deferral or 401 contribution.

For Traditional and Roth IRAs, which are opened outside of your employment relationship, the annual maximum for contributions is $6,000, with another $1,000 available to those over age 50 . Traditional and Roth IRAs come with different tax considerations, but the contribution limit for both accounts is the same.

What You Need To Know

- Violating this IRS rule is one of the most expensive mistakes a client can make.

- The rule doesn’t apply to rollovers from a 401 account or to Roth IRA conversions.

- The simplest way to avoid mistakes is to use trustee-to-trustee transfers between financial institutions.

To say that 2020 and 2021 have presented a planning challenge is an understatement. Now, with the most serious dangers of the pandemic receding into the rearview, many clients might be interested in taking steps to consolidate their retirement accounts and simplify their finances.

That can be trickier than many clients anticipate, especially for clients with multiple IRAs. Violating the once per year IRA rollover rule is one of the most expensive mistakes a client can make and, unlike RMD mistakes, cant simply be corrected or waived.

Because the IRS cant waive the clients violation of the once-per-year rule, its especially important to pay close attention to avoid falling into the potential traps that can cause the client to violate the rule and incur significant tax consequences.

Read Also: How Do I Get My 401k If I Get Fired

Open A New Account Or Use An Existing One

You may need to open a new 401 or establish an IRA before initiating a rollover. After all, you need an account to roll your funds into. If you already have a 401 or IRA account that you want to use, then you dont need to open a new account. However, if you prefer to keep your rollover funds separate from an existing account, then opening a new account is still an option.

Opening an IRA is a simple and straightforward process with most online brokers. It can be done entirely online with just a few forms and clicks.

Are There Taxes And Fees Associated With Ira Rollovers

You do not have to pay taxes on the IRA rollover itself, but you do have to report the rollover on your taxes. If, however, the rollover was from a traditional IRA to a Roth, youll also need to report and pay taxes on the funds that are rolling over.

Keep in mind that the 60-day rule applies in the case of an indirect rollover. If you reinvest your funds in another IRA within 60 days, your distribution isnt taxed. If you miss the deadline, you will likely owe income taxes, and possibly penalties, on the distribution.

Don’t Miss: How Much Can I Rollover From 401k To Roth Ira

Ira Rollover Rules And The 60

An IRA rollover is generally the transfer of assets between two, non-like retirement accounts, such as from a 457 to an IRA. IRA rollovers have specific rules depending on how the funds are transferred and the type of account you are rolling from and into.

The 60-day limit refers to when a retirement distribution is paid to you: If you roll those funds within 60 days into another retirement account, you wont pay taxes or an early withdrawal penalty on the distribution.

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

Don’t Miss: What Is Max 401k Contribution For 2021

What Is A Rollover Ira

A rollover IRA is an account used to move money from old employer-sponsored retirement plans such as 401s into an IRA. A benefit of an IRA rollover is that when done correctly, the money keeps its tax-deferred status and doesn’t trigger taxes or early withdrawal penalties.

Rollover IRAs can also provide a wider range of investment options and low fees, particularly compared with a 401, which can have a short list of investment options and higher administrative fees.

How Can You Avoid Tax Penalties

When combining accounts, you should make sure the assets are being moved in a rollover. That means it’s a direct transfer of assets from one account into another.

For instance, let’s say you are moving an old 401 plan into your IRA. You will then fill out paperwork or an online form that directs your old 401 plan to make the check payable directly to the new custodian for the benefit of you.

If your IRA is at Charles Schwab and your name is Jane Smith, then your 401 provider would make the check payable to Charles Schwab for the benefit of Jane Smith.

You won’t ever see that check, and that’s a good thing. It means the rollover was done the right way, and you’ve avoided a 20% tax penalty. But if the custodian of the account mails you a check made out to you, you can still spare yourself a tax penalty if you act quickly.

You have 60 days to deposit this check into the IRA. Keep this in mind: It will have 20% withdrawn for federal income tax. You must also deposit the amount that was withdrawn for income tax you can get that money back from the IRS when you next file a tax return. If you don’t deposit that entire sum of moneythe amount of the check and the amount that was taken out for income taxand you are under age 59 1/2, you may also be subject to a 10% early withdrawal penalty.

Recommended Reading: Should I Roll Over My 401k When I Retire

Is It Better To Roll Over A 401 To An Ira

If you like your former employers 401 plan the investment options and the expense ratios on the investments then it wont necessarily be better to roll it over into an IRA. But you may find that if you roll your 401 into an IRA, you may have more investment options. Compare expense ratios and fees to see which option is best for you.

Kaleb Paddock, a certified financial planner at Ten Talents Financial Planning in Parker, Colorado, says a typical 401 plan only has approximately 20 to 40 mutual funds available. But an IRA could give you access to thousands of exchange-traded funds and mutual funds as well as individual stocks.

Another reason might be, if you want to invest in socially responsible funds or funds that invest according to a certain set of values, those funds may not be available in your 401 or your prior employer 401, Paddock says.

But by rolling it over to one of these large custodians, youll likely be able to access funds that may be socially responsible or fit your values in some fashion and give you more options that way, he says.

Plus, rolling over your 401 to an IRA may result in you earning a brokerage account bonus, depending on the rules and restrictions that the brokerage has in place.

According To Irs Ira Or 401k Rollover Rules Generally If You Make A Tax

IRS Publication 590, page 25 explained through an example that the one 60-day rollover per 1-year period applies per IRA and that IRC 408 should follow the same. The example was delivered exactly in this way:

You have two traditional IRAs, IRA-1 and IRA-2. You make a tax-free rollover of a distribution from IRA-1 into a new traditional IRA . You cannot, within 1 year of the distribution from IRA-1, make a tax-free rollover of any distribution from either IRA-1 or IRA-3 into another traditional IRA.

However, the rollover from IRA-1 into IRA-3 does not prevent you from making a tax-free rollover from IRA-2 into any other traditional IRA. This is because you have not, within the last year, rolled over, tax free, any distribution from IRA-2 or made a tax-free rollover into IRA-2.

Though this example made from the IRS publication is clear that the 60-day IRA or 401k rollover rules apply per account, the IRS has decided that the second 60-day rollover made by Mr. Bobrow from his separate IRA violated the code under IRC 408 and is, therefore, subject to tax because of the fact that it was done within the 1-year period from the first 60-day rollover he made on his other IRA. The IRS ignored the point that the two 60-day rollover was actually from two separate accounts which has the same idea to the example they provided on the IRS publication.

You May Like: Where To Put 401k After Retirement

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

How To Roll A Roth 401 Into A Roth Ira

Roth IRA contributions can be withdrawn at any time, tax-free and penalty-free, regardless of age. However, the rules for distributions of earnings vary. A qualified distribution from a Roth IRA is one that meets the five-year rule and is also made after age 59½, after death, or as the result of a disability or a first-time home purchase. These qualified distributions are free of both taxes and penalties.

If these conditions are not met, withdrawals from the account will be subject to both selective income taxes and a penalty. If you do make a non-qualified distribution, income taxes will be levied pro-rata on earnings on your contributions, and a 10% penalty may apply to part of the distribution.

Funds from a Roth 401 rolled into another such account are subject to favorable treatment with respect to the five-year holding period. However, the same treatment does not apply to the timing of a Roth 401 that’s rolled over to a new Roth IRA. On the other hand, if you already have a Roth IRA account, the holding period for that account applies to all of its funds, including those rolled over from a Roth 401 account.

To illustrate this impact, let’s assume your Roth IRA opened in 2010. You worked at your employer from 2016 to 2019 and were then let go or you resigned. Because the Roth IRA that you are rolling the funds into has been in existence for more than five years, the full distribution rolled into the Roth IRA meets the five-year rule for qualified distributions.

Read Also: What Percentage Of 401k Should I Contribute

Rolling Over To A New 401

If your new employer allows immediate rollovers into its 401 plan, this move has its merits. You may be used to the ease of having a plan administrator manage your money and to the discipline of automatic payroll contributions. You can also contribute a lot more annually to a 401 than you can to an IRA.

Another reason to take this step: If you plan to continue to work after age 72, you should be able to delay taking RMDs on funds that are in your current employer’s 401 plan, including that roll over money from your previous account. Remember that RMDs began at 70½ prior to the new law.

The benefits should be similar to keeping your 401 with your previous employer. The difference is that you will be able to make further investments in the new plan and receive company matches as long as you remain in your new job.

But you should make sure your new plan is excellent. If the investment options are limited or have high fees, or there’s no company match, the new 401 may not be the best move.

If your new employer is more of a young, entrepreneurial outfit, the company may offer a Simplified Employee Pension IRA or SIMPLE IRAqualified workplace plans that are geared toward small businesses plans). The Internal Revenue Service does allow rollovers of 401s to these, but there may be waiting periods and other conditions.

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

Don’t Miss: How To Set Up 401k Contributions

When To Consider A 529 Plan Rollover

Investments within 529 plans tend to be similar from state to state. Only details such as the investment experience, fees, and prepaid tuition options tend to vary among states. However, here are a few scenarios where rolling over your 529 account may make sense.

- Youve always lived in a state with no state income tax.

- Your current dont offer tax deductions for 529 plan contributions.

- Your current or former state allows you to receive a state income tax deduction regardless of the 529 plan you use.

Be sure to check the rules carefully, because you dont want to experience a state deduction clawback if you roll over to another states account. A CPA or a fiduciary financial advisor can help you determine which account makes the most sense for you.

If you do decide to rollover your old 529 plan to a new one, here are some of the best places to open a 529 plan today. Or if youre looking for a tool that makes it easy to automatically invest in new or existing 529 plans, you may want to consider CollegeBacker, where you can link your 529 plan account and start saving easier!

Balance Between $1000 And $5000

For 401 balances less than $5,000, your employer doesnât need your permission to transfer your funds out of the 401 plan.

However, if you have over $1,000 in your 401âand you havenât opted to have your funds rolled over to a specific accountâthe planâs administrator is required to transfer your 401 funds to an IRA.

Also Check: What Is The Max Percentage For 401k

You May Like: When Can You Access Your 401k

Does A Ira Rollover Make Things Simpler

On the surface, having all your retirement accounts in one place seems like a good idea but there are a couple things to watch out for when converting a 401. If your income will be high enough in the future to exclude you from Roth contributions then holding a traditional IRA will eliminate the backdoor Roth option for you. Since tax law doesnt allow people with income over a certain amount to contribute to a Roth IRA or deduct traditional IRA contributions, theyre forced to do whats known as a backdoor Roth.

Since theres no income restriction on converting to a Roth, the backdoor Roth strategy requires the investor to make non-deductible IRA contributions and then convert them to a Roth. If youve got a big traditional IRA lying around though, this backdoor method wont work since non-dedutible and deductible contributions are all treated as a single account. This is known as the pro-rata rule and it basically prevents you from doing a backdoor Roth if you have a traditional IRA in your name.

One smaller thing to watch out for is that if you ever need to borrow from your IRA, you would only be able to do a 60-day loan. But with some 401 plans youre often allowed to borrow for much longer periods, even after you leave the company.