What Does It Take To Turn Dreams Into Reality

Retirement is the phase of life that can be about your time and how you want to spend it.

You might decide to schedule the majority of your adventures for the early part of your retirement. If so, you may choose an income option that provides more funding up front.

Or, if you have people depending on you, an income option that helps you meet your financial obligations to them may be more appropriate.

Variable annuities and mutual funds are intended as long-term investments for retirement purposes. Its generally considered a good idea to reacquaint yourself with the possible fees and charges these investment vehicles may assess before withdrawing accumulated amounts. Variable annuities and mutual funds are subject to the ups and downs of the market.

What Are My 401 Options After Retirement

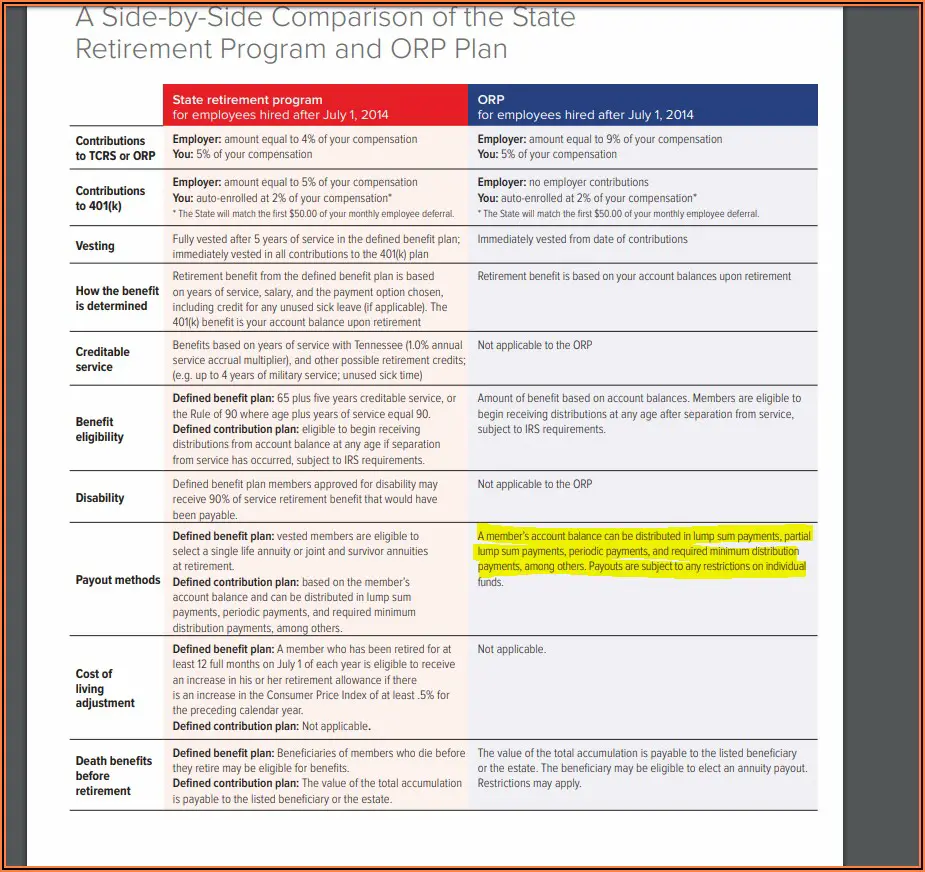

Generally speaking, retirees with a 401 are left with the following choicesleave your money in the plan until you reach the age of required minimum distributions , convert the account into an individual retirement account , or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

What Are The Risks Of Withdrawing 401k Money

If youre using the Covid rules to withdraw cash from a 401k, keep in mind that youll need to pay tax on it or repay the withdrawal.

You also face a shortfall of cash in retirement, unless you already have enough money saved elsewhere.

In November, Fidelity said the average amount withdrawn of those who took advantage of the rule was $10,000.

It may seem small but it could eventually grow to be a significant amount if left untouched due to the benefits of compound interest.

For example, if youre 35, a $10,000 nest egg could grow to more than $100,000 by the time youre 70, assuming a 7% annual return.

Carrie Schwab-Pomerantz, a certified financial planner and president of the Charles Schwab Foundation, said: Even if its possible to borrow from your 401k or take a distribution, consider this a last resort.

While present circumstances may be difficult, Id counsel anyone to avoid jeopardizing their future retirement unless absolutely necessary.

You may not appreciate the full consequences until much later.

Don’t Miss: Can I Put Money In A 401k And An Ira

Fixed Income Says Who

Once youve determined your sources of retirement income, consider withdrawal strategies that can help make your money last longer. For instance, theres no reason you have to withdraw the same amount every year.

An example: you may want to withdraw more during the early part of your retirement, when youre more active and perhaps want to travel or play more golf. Later in retirement, when youre more inclined to kick back and relax, you may need less income to support your lifestyle. Or you can do just the opposite take it easy on the withdrawals in the early years, maybe even supplement your income with a part-time job. Then, as you feel more comfortable about your income stream, you can gradually ramp up your withdrawals. Medical expenses tend to increase with age, so this is a smart approach for many people.

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. That’s between 10% and 37% depending on your total taxable income.

In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Don’t Miss: Can I Move Money From 401k To Ira

Strategically Managing Your Money To Last Throughout Retirement

For decades, youve stashed away part of your hard-earned paycheck so you could have a good retirement. All those years of denying your urge to spend have paid off. Now, its time to cash in one strategically planned withdrawal at a time.

Once youve retired and the paychecks have stopped, your financial focus should shift from building that nest egg to creating monthly income from your savings. The challenge is to manage your money so you have enough to last throughout retirement. Youll need to watch out for a few things:

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

You May Like: How To Receive 401k Cash Out

Can I Withdraw Money From My Voya Account

There are many types of withdrawals available through the Plan: De Minimis, Unforeseen Emergency, Purchase of Service Credits, Partial Termination Withdrawal, and Full Termination Payout.

How do I withdraw from my VOYA retirement plan?

request a withdrawal online at www.ingretirementplans.com, or call an ING Customer Service Associate at 584-6001. Please note: Transactions may require additional approval prior to processing. Some transactions may also require you to provide further information or complete additional paperwork.

How long does it take VOYA to process a withdrawal?

You may access the prefilled form at the Menu Option: Account, Withdrawals, Request a Withdrawal. After the signed form is received and approved by Voya Financial®, a check will be mailed within three business days. Separated participants can receive distributions no earlier than 45 days from their termination date.

Can I Cash Out My Voya 401k

Since contributions are made on an after-tax basis participants may be eligible to withdraw contributions without owing taxes or a penalty however, withdrawals of earnings prior to age 59½ and holding the account for five years will be subject to income taxes and a 10% additional tax unless an exception applies.

What happens if I remove money from my 401k?

If you withdraw money from your 401 account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax, on the distribution. For someone in the 24% tax bracket, a $5,000 early 401 withdrawal will cost $1,700 in taxes and penalties. Avoid the 401 early withdrawal penalty.

Is Voya a good 401k?

Overall, the Voya 401k plan offers users a good variety of funds from which to build their portfolio. The website is very user friendly, allowing customers to see historical information on fund performance, view portfolio performance across different time periods, and plan for retirements using several calculators.

Also Check: How To Get Out Of 401k Without Penalty

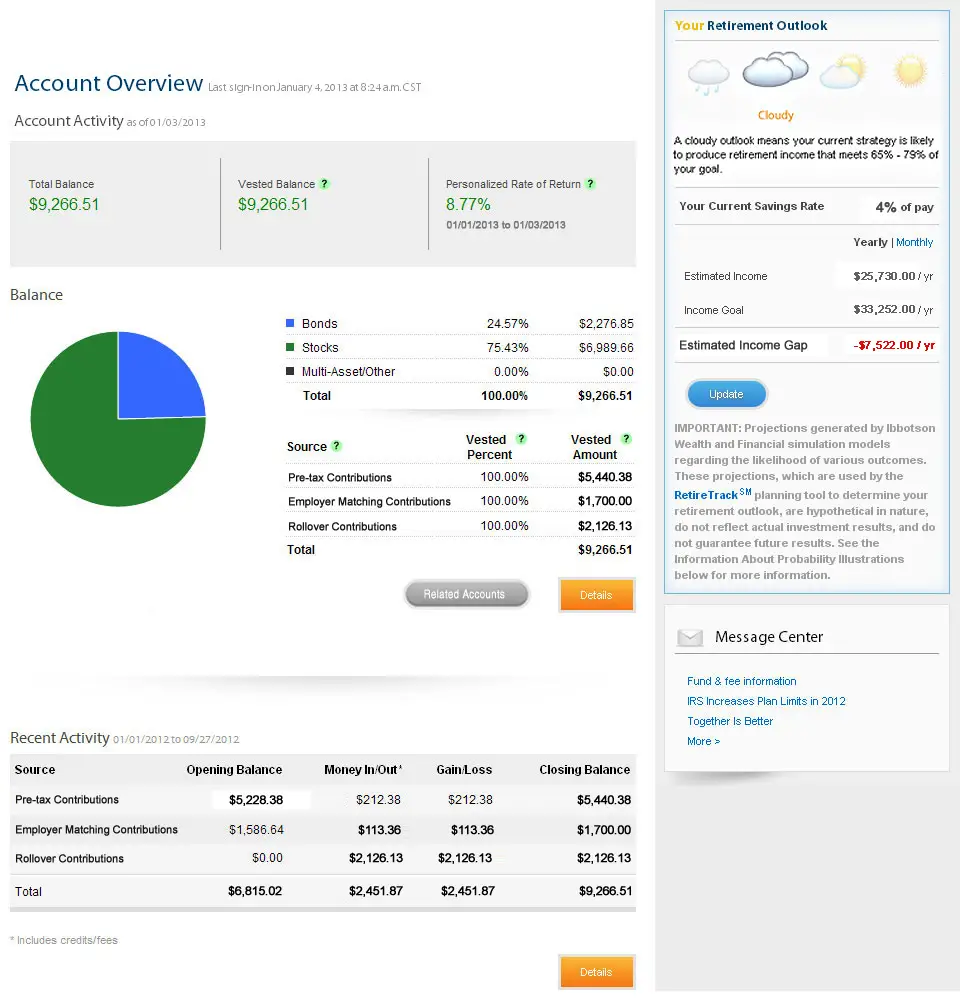

Voila Your Savings Just Became Income

As employer pensions become less common, most of us will rely on Social Security and personal savings to help fund retirement. Start by determining your annual withdrawal rate. This is the amount of money youll take each year from your portfolio, including returns and principal. Youll also need to decide which assets to draw down first. Keep in mind that with tax-deferred retirement accounts, required minimum distributions kick in once youre 70½. Failing to take one could result in tax penalties.

Keeping Your 401 With Your Former Employer

If your former employer allows you to keep your funds in its retirement account after you leave, this may be a good option, but only in certain situations, says Colin F. Smith, president of The Retirement Company in Wilmington, N.C.

Staying in the old plan may make sense if you like where you are and they may have investment options you cant get in a new plan, says Smith. The other main advantage is that creditors cannot get to it.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining the money management services.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think youll start withdrawing funds before turning 59½, the withdrawals will be penalty free.

Some things to consider when leaving a 401 at a previous employer:

- If you plan on changing jobs a few more times before retirement, keeping track of all of the accounts may become cumbersome.

- You will no longer be able to contribute to the old plan and in some cases, may no longer be able to take a loan from the plan.

- Your investment options are more limited than in an IRA.

- You may not be able to make a partial withdrawal and may have to take the entire amount.

- If your assets are less than $5,000 you may have to proactively remain in the plan. If you dont notify your plan administrator or former employer of your intent, they may automatically distribute the funds to you or to a rollover IRA.

Recommended Reading: How To Pick Investments For 401k 2020

How Is Your 401 Taxed When You Retire At 60

Traditional 401 plans offer tax-deferred savings, which means that since the contributions are never included in your taxable income, you have to pay taxes on the withdrawals. For example, if you withdraw $15,000 from your 401 plan before age 60, thats an additional $15,000 that will be included in your taxable income.

Can You Be Denied A Hardship Withdrawal

This means that even if any employee has a qualifying hardship as defined by the IRS, if it doesnt meet their plan rules, then their hardship withdrawal request will be denied.

What are considered hardships for 401k withdrawal?

Reasons for a 401 Hardship Withdrawal

- Certain medical expenses.

- Costs related to purchasing a principal residence.

- College tuition and education fees for the next 12 months.

- Expenses required to avoid a foreclosure or eviction.

- Home repair after a natural disaster.

How much tax is taken out when you withdraw from 401k?

20%The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw the $10,000 in your 401 at age 40, you may get only about $8,000. The IRS will penalize you.

How can I access my retirement money early?

The first method for accessing tax-advantaged money early is the Roth IRA Conversion Ladder. When you leave your job, immediately roll your 401/403 into a Traditional IRA.

Don’t Miss: What Happens To Money In 401k When You Quit

Tips For Rmd Planning:

- Make a plan Your RMD is the minimum you must take out. Create a withdrawal strategy to make sure you are taking out enough to meet your needs, but not so much that youll deplete your accounts too soon. Some retirement accounts offer distribution options that satisfy the RMD rules so that you dont have to do the math. If you dont take the RMD by the deadline, you may be subject to a 50% excise tax on the amount that should have been withdrawn.

- Consolidate multiple accounts Since you need to calculate your RMD every year, consider consolidating your retirement accounts to simplify the process.

- If you are still working at age 72 your plan may permit rolling over your IRA accounts to the employer plan where you are actively working prior to age 721. Then you will not need to take your RMD until you separate from service.

- Reinvest unneeded RMDs If you dont need the income to help cover your retirement expenses from your RMD, you could reinvest the distribution in one of your taxable accounts to cover future unanticipated expenses or invest it for your grandkids future education.

- If you dont want to deal with RMDs Roth IRAs do not have RMD requirements for the original owner or your spouse. However, RMDs will apply after the owners death for beneficiaries who are not your spouse. Please also note that there may be tax consequences associated with the conversion of an IRA to a Roth IRA.

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

Recommended Reading: How Does A 401k Loan Work

How To Boost Your Retirement Savings

DONT know where to start? Here are some tips on how to get going.

- Understand where you start: Before you consider your plans for tomorrow, youll need to understand where you stand today. Look into your current pension savings and research when youll be eligible for social security benefits, if at all.

- Take advantage of a 401k: The 401k plans are tax-effective accounts put you in a better place financially for your retirement. If you save, your employer may too.

- Take advantage of online planning tools: Financial provider Western & Southern Financial Group and comparison site Bankrate have tools that give you an idea of what your retirement income will be based on how much youre saving.

- Find out if your workplace offers advice: Some employers offer sessions with financial advisers to help you plan for your future retirement.

With a Roth, employees make contributions with post-tax income but can make withdrawals tax-free.

Most employees can currently put in $19,500 a year of their own money in a 401k account, excluding employer contributions.

However, workers who are older than 50-years-old are eligible for an extra catch-up contribution of $6,500 in 2020 and 2021.

Who Is Qualified For A 401 Qualified Disaster Distribution

Disaster relief is available to individuals who reside in FEMA declared disaster areas , such as areas impacted by hurricanes and wildfires that occurred after December 31st, 2019 through 60 days after the enactment of the law . An individual must have also suffered an economic loss due to the qualified disaster.

The Consolidated Appropriations Act also has provisions for disaster related hardship withdrawals:

Dont Miss: Can You Have A Roth Ira And A 401k

You May Like: How To Get A Loan Against Your 401k

What Happens If You Take Out An Early Withdrawal Against Your Workplace Retirement

Unexpected hardships or emergencies may require us to think of alternative sources of getting money quickly. Sometimes this may take the form of withdrawing early from your workplace retirement plan. In some cases, withdrawing from a retirement plan may not have a major impact in others, the consequences may be significant from a financial perspective. Which consequences youll face depends on how, when, and why you tap into retirement plan funds. There are several potential outcomes when you withdraw from your workplace retirement plan early. Heres what you need to know as well as some alternatives that might be a better fit for your finances.

Recommended Reading: Amount Of Money To Retire

Can I Withdraw Money From My Account

De Minimis Option

- If you have not contributed to the Plan for a two year period ending on the date of distribution, and

- If you have a total account balance of $5,000 or less

- If there has been no prior distribution paid to you

- the distribution must be lump sum and the entire account balance must be withdrawn

Unforeseeable Emergency Withdrawals

- Sudden unexpected illness, accident, or disability of the participant or dependant.

- Loss of the Participants property due to unforeseeable circumstances .

- The determination as to weather an unforeseeable emergency exists is based on the merits of each individual case.

- Purchase of Real Estate

- Purchase or repair of an automobile

- Payment of income taxes, interest, or penalties

- Payment of Credit Card Bills

Purchase of Service CreditPartial Termination WithdrawalFull Termination WithdrawalWithdrawals from the plan may be subject to 20% federal tax withholding. Employee Unforeseeable Emergency Withdrawals are not subject to the 20% withholding. Also, federal income taxes may apply and other applicable taxes.Note:

Recommended Reading: Are Part Time Employees Eligible For 401k

Convert To An Ira To Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.