Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Track Down Old 401 Plan Statements

The first thing you can do to find money held in forgotten 401 accounts is to go through old plan statements you may have. The statements could have come in the mail or you may have received them electronically through email.

Finding these statements makes it easier to know which employers you were at during the period when you had the 401 plan and can help you determine who to contact to access your account. You can also check with former co-workers who are still with the company to see who you should get in touch with.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Read Also: How To Switch 401k To Roth Ira

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Read Also: Is There A Max Contribution To 401k

Also Check: How Many Percent Should I Put In 401k

Is It A Good Idea To Take Early Withdrawals From Your 401

There are few advantages to taking an early withdrawal from a 401 plan. If you take withdrawals before age 59½, you will face an additional 10% penalty in addition to any taxes you owe. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs, funeral costs, or buying a home. This can help you skip the early withdrawal penalty but you will still have to pay taxes on the withdrawal.

There Are Many Reasons To Access Your Retirement Account

Paying for college, buying a house, starting a business or paying off debt are just some of the reasons a person might want to access the savings in their retirement account. A 401, 403, or pension are excellent ways to save for retirement. However, sometimes an expense or opportunity presents itself that requires cash flow, and for many, their money is tied up in a retirement account which can be challenging to access.

Also Check: How To Figure Out Your 401k Contribution

Can I Close My 401k And Take The Money

You can close your 401 and take the money. However, you may incur a hefty penalty for early withdrawal. Additionally, you will lose out on any future growth potential. If possible, taking a loan from your 401k may be better than closing it entirely. By doing so, you can avoid the penalties and keep your retirement savings intact.

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

Also Check: How To Roll Over Old 401k

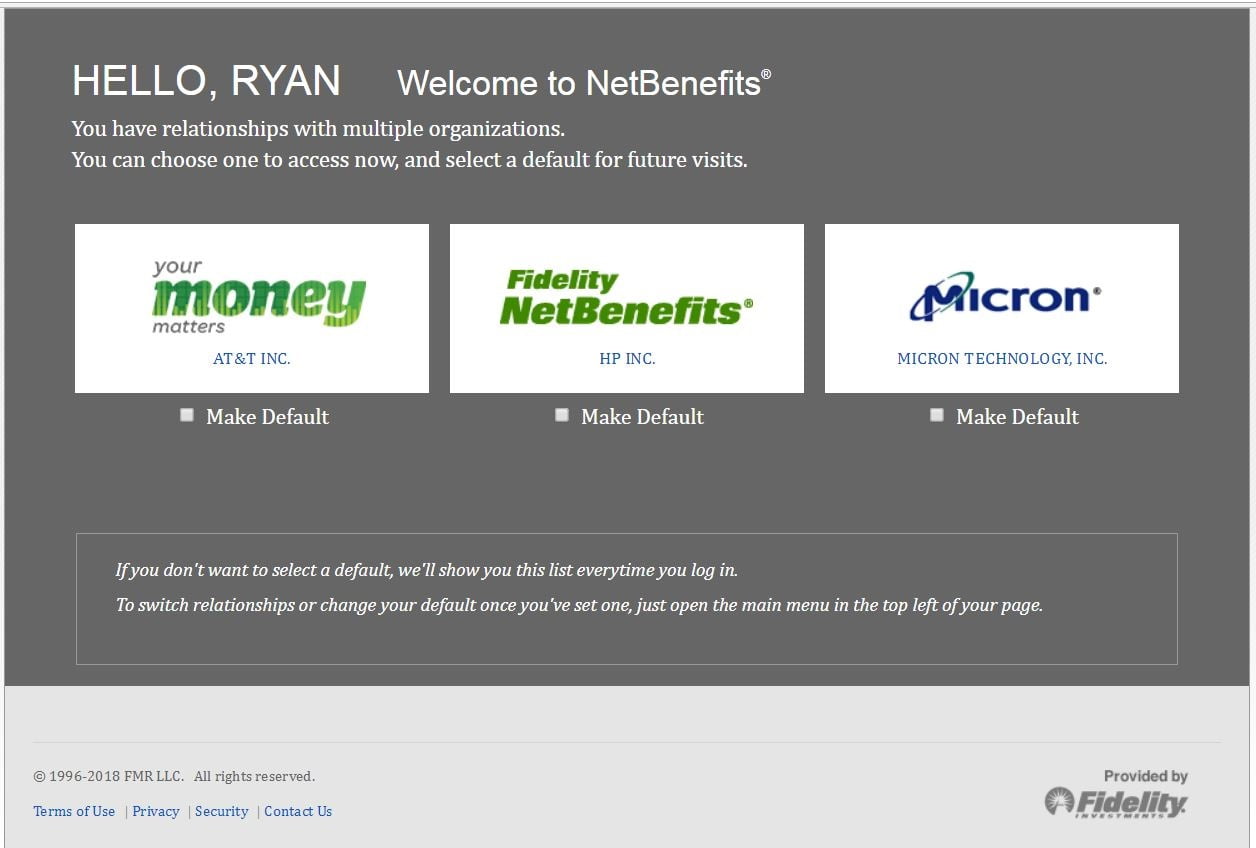

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

Also Check: When You Leave An Employer What Happens To Your 401k

What Is The Purpose Of The My Notes Feature On The Statements And Trade Confirmation Pages Within Fidelitycom

The My Notes feature on your Statement and Trade Confirm pages allows you to associate your own notes regarding your account or confirmation statements. By clicking on Add or Edit within the My Notes column for the Statement/Trade Confirmation date chosen. You may enter a note of up to 100 characters. Each note is associated to a specific statement or trade confirmation. While these notes are not intended to be communications to Fidelity, they are covered under Fidelitys Privacy Policy, and you should not include any notes that are confidential, personal or contain sensitive information. All questions or inquiry to Fidelity, should be addressed to Contact Us.

Don’t Miss: Can I Move My 401k To Gold

What Do I Need To Be Able To Use The Account Download Service

To download investment data, you must have the following:

- Any one of the three most recent versions of Quicken for Windows or Quicken for Mac available from stores, direct from Intuit® at , or via the link in the Intuit Quicken section below.

- An online T. Rowe Price user name and password.

Note: For privacy and security reasons, you cannot download or export your T. Rowe Price account information directly from our website into a file. To get your account information into Quicken, you must first login to your Quicken account and then import your account information from within Quicken using your T. Rowe Price username and password. For more information, please visit Intuit’s Quicken Support page.

Rollover Existing Fidelity Solo 401k/keogh/psp: Question:

Yes your existing solo 401k with Fidelity Investments would get restated to our solo 401k plan which allows for 401k participant loans and investing in alternative investments such as real estate. We would then fill out new Fidelity brokerage account forms so that Fidelity can open a new brokerage account for the self-directed solo 401k that we offer. Note that Fidelity will not simply re-title the existing account. They require new brokerage forms. Subsequently, we would prepare an internal Fidelity transfer form to have Fidelity internally transfer the existing solo 401k equity holdings and cash to the new brokerage account for the self-directed solo 401k. You will then receive a checkbook in the mail from Fidelity for the new solo 401k for placing your alternative investments, and/or you can process the investments via wire.

Also Check: How Many Loans Can I Take From My 401k

Also Check: How To Allocate My 401k

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas.”Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

A Closer Look At Your Available Options

The good news is whatever money thats in your 401 is yours to do with as you like. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may need to roll it over or into a brokerage account that you own completely.

Dont Miss: What Is A Roth 401k Vs 401k

Read Also: What Is Ira And 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Versions Of Quicken Can I Use To Download T Rowe Price Account Information

You can download any of your mutual fund, Brokerage, 4011, or 4031 account information into the three most current versions using direct connections.

1401 and 403 accounts require the Deluxe® or Premiere® version of Quicken.

Please note: Downloading account information via the Direct Connect method is not available for the University of Alaska Savings Plan, the T. Rowe Price College Savings Plan, or the Maryland College Investment Plan.

Don’t Miss: How To Use 401k To Start A Business

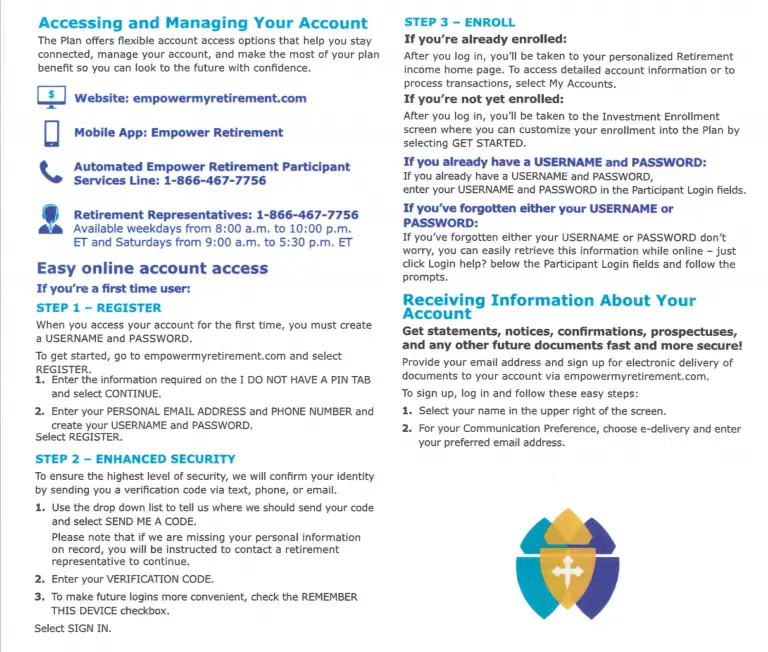

Help With Online Access To Your Employer Account

How to access and administer your benefit plan online

We automatically create an employer account for you when you open or transition to a new Principal retirement plan or group insurance policy.

If youre the Primary Administrator, youll receive an email from us to activate your account. You must click the activation link in the email within 72 hours of receiving it. Then, follow these easy steps:

Want to give someone else access to your account?

As Primary Administrator, you can designate a Secondary Administrator and give them full or limited account permissions. Not sure how? Review the instructions for managing security access .

Weve got you covered.

If you forgot your username:

- Go to the Forgot username page.

- Choose Employers & Plan Sponsors as your role and click Continue.

- Enter the email address you use to do business with us, and we’ll send you an email with your username.

If you forgot your password:

The Primary Administrator has full access to your employer account on principal.com. This person can grant full or limited access to other individuals .

Roll Over The Old 401 Account Into Your Current Employers Plan

By rolling the old account into your current employers plan, youll be able to keep all your 401 accounts in one place, making it easier to keep track of them. However, most 401 plans have a limited number of investment offerings, so if youre not happy with your current plans options, youre probably better off rolling the old account into an IRA.

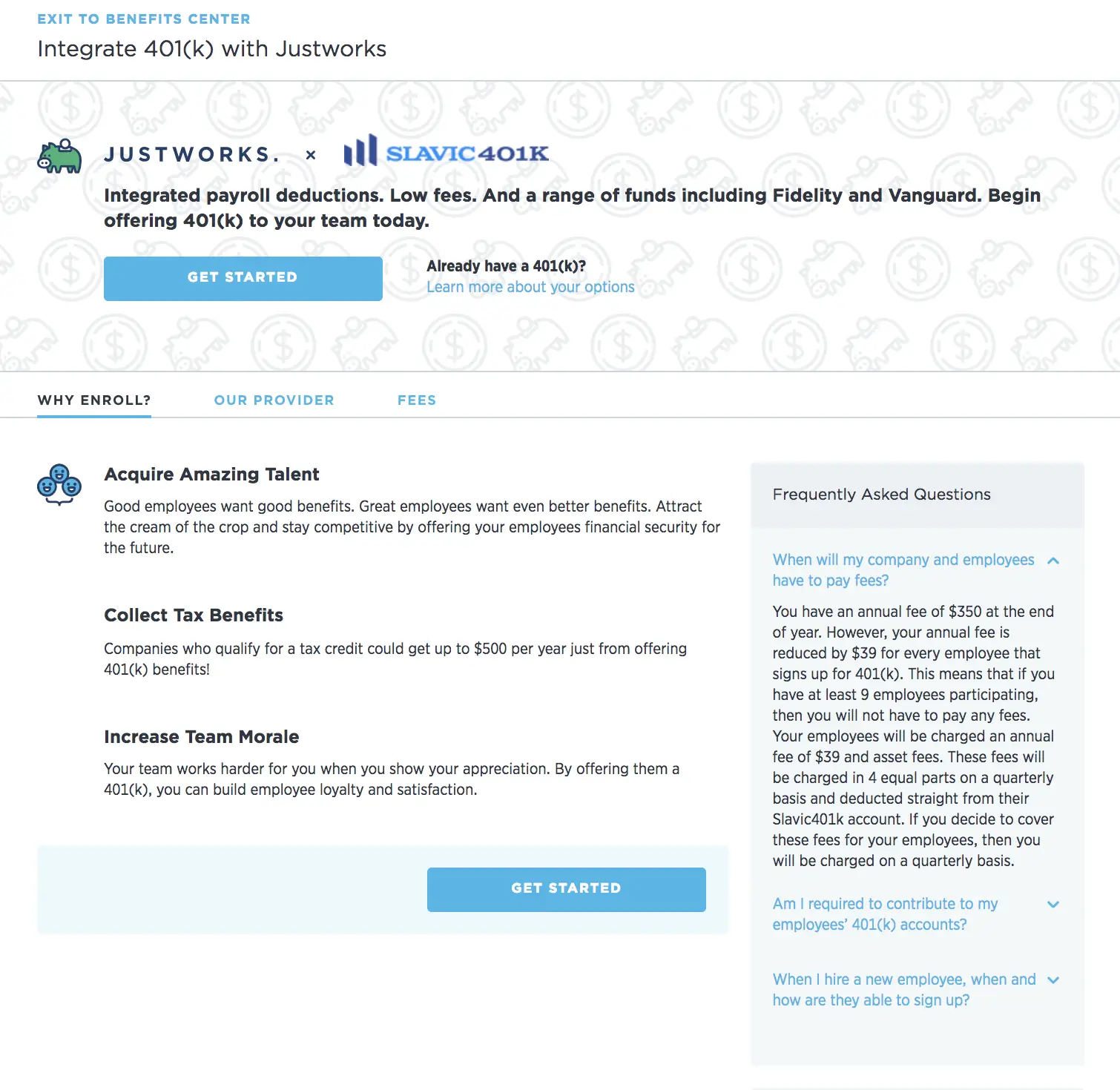

Read Also: How To Offer Employees 401k

Private Sector Employees Can Invest For Retirement With A 401 Plan

A retirement plan may be one of the most valuable benefits of employment. Used effectively, it can deliver a long-term impact on your financial well-being. See how a retirement plan works and learn about the power you have to control your financial future.

In general, a 401 is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the account. These contributions are placed into investments that youve selected based on your retirement goals and risk tolerance. When you retire, the money you have in the account is available to support your living expenses.

Dont Miss: How To Set Up A 401k Plan

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Recommended Reading: Should I Roll My 401k Into An Annuity