Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred. But the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

What Are The Special Rules For Retirement Plans And Iras In Section 2202 Of The Cares Act

In general, section 2202 of the CARES Act provides for expanded distribution options and favorable tax treatment for up to $100,000 of coronavirus-related distributions from eligible retirement plans and 403 plans, and IRAs) to qualified individuals, as well as special rollover rules with respect to such distributions. It also increases the limit on the amount a qualified individual may borrow from an eligible retirement plan and permits a plan sponsor to provide qualified individuals up to an additional year to repay their plan loans.

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

You May Like: How Do You Roll A 401k Into Another

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

If My Company Closes What Happens To My 401

If you work for a company that is shutting down, changing ownership, or filing for bankruptcy, you might be concerned about what will happen to the money in your 401 account.

In accordance with federal law, your employer must keep your 401 funds separate from the companys assets, so business creditors have no access to them. You’ll be able to keep most of the funds in your 401, and you can move them to another type of account to keep your nest egg safe.

You May Like: Can You Rollover Your 401k Into A Roth Ira

Is The Federal Government Giving Out Grants

The federal government does not offer grants or free money to individuals to start a business or cover personal expenses. For personal financial assistance, the government offers federal benefit programs. These programs help individuals and families become financially self-sufficient or lower their expenses.

Whats The Difference Between A Withdrawal And A 401 Loan

With a 401 loan, you must repay the money back into your account over a period of time. With a standard withdrawal, there are no repayment requirements. You will be charged interest on the loan, although you are technically paying the interest back to yourself. The money goes back into your 401 account, and you usually can spread the payments out up to 5 years. If you are using the money for a down payment on a home, you can even spread them over 15 years. A loan is usually a much better option than a withdrawal because at least you will be replacing the money. However, not all plans offer 401 loans, so that might not be an option for you.

You May Like: Should You Borrow From 401k To Pay Off Debt

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Recommended Reading: How Can I Get A 401k Plan Without An Employer

Convert The 401 To An Ira

Individual retirement accounts typically have different withdrawal rules compared to 401s. So, converting to an IRA first might save you the 10% early withdrawal penalty.

Theres also no mandatory tax withholding on IRA withdrawals, so youre almost certain of a bigger check. Youll still pay the tax when its time to file returns, but youll have more money to deal with the situation in the immediate term.

Its a perfect option to go with for those in a lower tax bracket sure of getting refunds.

However, before switching to an IRA, you need to make sure you understand the peculiarities, including fees.

K In Divorce: A Tip That Can Save You Thousands

There are many expensive financial mistakes that are commonly made when people are going through a divorce. It makes sense. Emotions are running high and it’s common not to want to engage a financial professional if you are already paying legal fees. That said, the cost of a financial professional relative to the amount they can save you in financial mistakes is minimal. One of the most common financial mistakes I see is how money is withdrawn from a traditional pre-tax 401K in a divorce.

NOTE: I want to be clear that I’m not talking about just any retirement account here. There is a lot of confusion when I’m talking with clients about types of accounts. In this post, I am specifically referring to a pre-tax 401K account that is still held with an employer .

Unfortunately, going through a divorce leaves many people completely cash-strapped. While not ideal, if you have not built up enough liquid savings, you might be considering a withdrawal from a 401K. If you are under age 59.5, this is an important tip you need to know about a 401K in divorce. This only works if you are awarded all or part of your spouse’s 401K. It does not work on your own retirement account.

Read Also: How Do You Find Lost 401k Accounts

Early Withdrawal // 11 Ways To Cash Out Without Penalty

If you are in financial need, it might seem extremely tempting to simply withdraw some money from your 401, IRA, or other retirement account to cover the need. However, that withdrawal generally comes with a heavy penalty of 10% of the withdrawal amount. Retirement accounts are intended to be used for retirement, so the IRS imposes this penalty to discourage you from withdrawing money from your retirement savings. But what if you are in a true financial hardship? When can you withdraw from your 401 without this penalty? In some cases, you might be able to take some cash from your 401 without a penalty. Here is everything you need to know about early withdrawals from your 401 plus some ways that you can cash out without a penalty.

How To Withdraw 401k Money

As with any decision involving taxes, consult with your tax professional on considerations and impacts to your specific situation. An Edward Jones financial advisor can partner with them to provide additional financial information that can help in the decision-making process. When considering withdrawing money from your 401 plan, you can withdraw in a lump sum, roll it over or purchase an annuity. Your financial advisor or 401 plan administrator can help you with this.

Also Check: Should I Roll My 401k Into A Roth Ira

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Also Check: How Much In 401k To Retire

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Can I Get My Refund Back After An Offset

You must request that loan file within 20 days of receiving the notice. That said, you can request a tax refund offset reversal after these deadlines, and whether the refund was already garnished or not. If you do qualify for a tax refund offset hardship exception, you may not ever be able to get one again.

Don’t Miss: Where Is My 401k Account

How Can I Get Money From The Government Without Paying It Back

6 Ways to Get Free Money From the Government

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

Also Check: How To Calculate Max 401k Contribution

What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

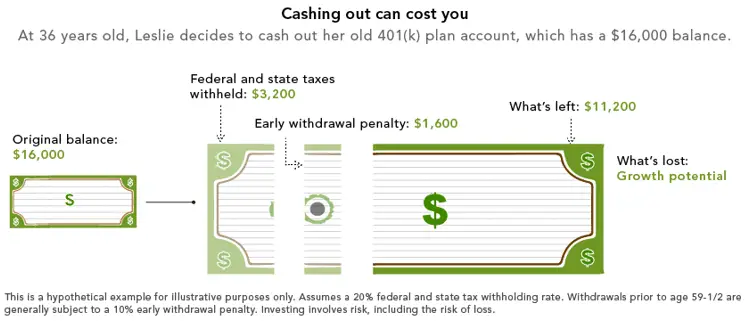

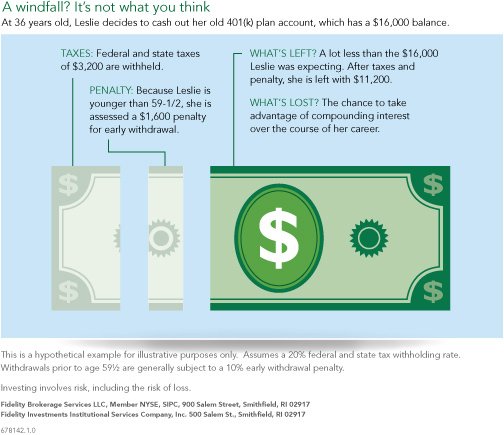

You Are Penalized By The Irs

If you withdraw money from your 401k before youre 59 ½ , the IRS penalizes you with an extra 10 percent on those funds when you file your tax return. If we use the example above, an additional $1,000 would be taken by the government from your $10,000 leaving you with just $6,000. If youre 55 or older, you could try to get this penalty lifted by the IRS through the Rule of 55, which is designed for people retiring early.

Also, there are exceptions under the CARES Act, which is designed to help people affected by the pandemic. There are provisions under the act that state individuals under the age of 59 ½ can take up to $100,000 in Coronavirus-related early distributions from their retirement plans without facing the 10 percent early withdrawal penalty under certain conditions.

Don’t Miss: Can You Use Your 401k For A House Down Payment

Reasons To Proceed With Caution

Experts suggest moving slowly with any withdrawal. Here are three things to consider.

Hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, you’ll be paying income taxes on the contributions and earnings withdrawn.

“You get a three-year period to pay the taxes to Uncle Sam,” said Paul Porretta, partner at Pepper Hamilton LLP in New York.

Plan ahead to cover the tax bill and spread it over that period of time, perhaps out of your cash flow.

Know your 401 plan’s rules. Be aware that a workplace retirement plan may allow hardship distributions from participants’ savings, but it isn’t required to do so.

You’ll need to talk to your human resources department or your plan administrator before you proceed.

“A 401 plan or a 403 plan, even if it allows for hardship withdrawals, can require that the employee exhaust other sources of money before taking a withdrawal,” said Porretta.