How To Set Up A 401k For An Llc

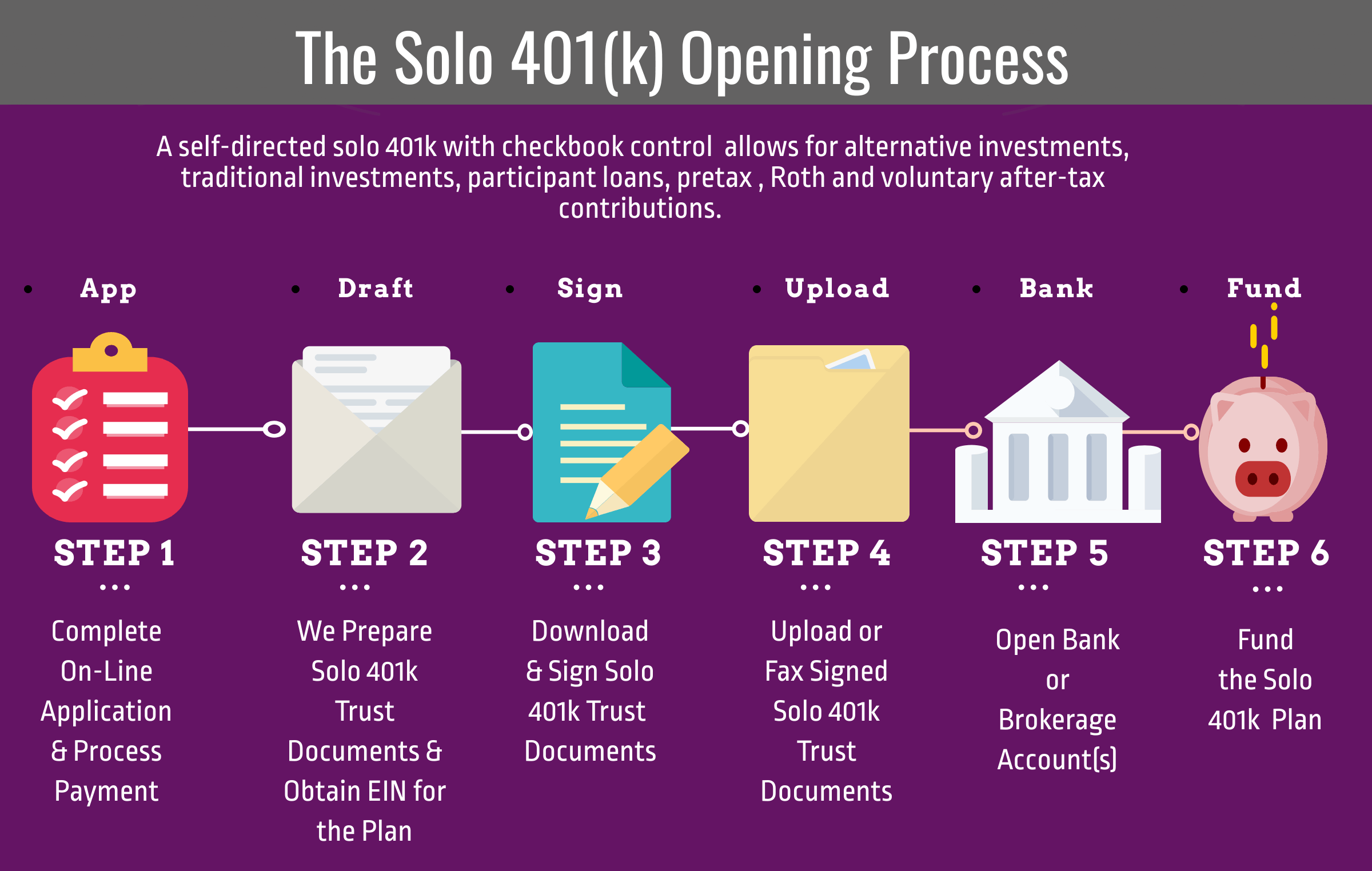

To set up a 401 plan, there are different steps you need to follow:

A Simplified Employee Pension Individual Retirement Arrangement has traditionally been the most popular retirement plan for the self-employed and small business owner. A SEP IRA is a pure profit sharing plan that allows the employer to make up to a 25% profit sharing contribution to all eligible employees up to a maximum of $53,000 for 2015 and 2016. While a SEP IRA does offer high annual contribution limitations, there is another retirement plan that offers better retirement options for the self-employed or small business with no employees the Solo 401 plan, also know as the individual 401 or self-employed 401 plan.

Before the Economic Growth and Tax Relief Reconciliation Act of 2001 became effective in 2002, there was no compelling reason for an owner-only business to establish a Solo 401 plan because the business owner could generally receive the same benefits by adopting a profit sharing plan or a SEP IRA. After 2002, EGTRRA paved the way for an owner-only business to put more money aside for retirement, gain additional options, as well as operate a more cost-effective retirement plan than a SEP IRA.

Solo 401k Llc And Partnership Contributions

A Limited Liability Company is a very popular business structure. Its easy to setup and simple to maintain. The owner of the LLC is known as the member. An LLC can be a single-member or multi-member company. Further, the LLC may be taxed as a partnership or taxed as a corporation.

LLCs are formed at the state level with the secretary of state. LLCs are a popular business structure because they create a fictitious entity. All business is done under the LLC name, using the LLC tax ID number. This can provide a layer of liability protection for the LLC owner. In the case of a lawsuit, the members assets are generally protected. Only the LLC assets are involved in the suit.

Once your business is generating revenue, you can start contributing to a retirement plan. The easiest way to do this is to setup a Self-directed Solo 401k plan.

The LLC contribution limits may change according to a couple factors:

- Is the LLC single or multi member?

- Is the LLC taxed as a partnership or a corporation

Electronically Filing Form 5500

Instead of filing by mail, you can file electronically. The IRS says electronic filing makes the process easier for the filer and increases data accuracy. However, it is more complicated than filing on paper. You can’t electronically file Form 5500-EZ instead, you file Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan. To file, you must use the Department of Labor’s EFAST2 web-based filing system . The IRS has a free online software application called IFILE that you can use. You’ll need to register and set up an account. For more information, see the EFAST2 website. For telephone assistance, call the EFAST2 Help Line at 1-866-463-3278.

Visit the IRS’s Form 5500 Corner web page, and see the instructions for Form 5500-SF and the instructions for Form 5500-EZ for additional information.

Read Also: Can You Transfer Your 401k Into Ira Without Getting Penalized

Rules Specific To A Self

The primary way that an Operating Agreement for a Self-Directed IRA with checkbook control differs from a standard LLC Operating Agreement is how the IRS rules for Self-Directed IRAs and 401Ks are handled. If you dont follow the rules, you can risk the tax-deferred status of your account. This could lead to the disqualification and result in severe tax consequences.

Here is what you need to know: At a minimum, your Operating Agreement must contain language to handle the following:

Prohibited Transactions and Investments: This is basically self-dealing and certain investments such as collectibles.

Disqualified Individuals: You may not buy an investment from or sell an investment to a disqualified person. You and your family members are disqualified individuals. The list is longer for IRS purposes, but these are the primary disqualified persons.

Indirect Benefits: The purpose of your pension is to provide for your retirement in the future. It is considered to be an indirect benefit if your tax-deferred fund is engaged in transactions that, in some way, benefit you personally today.

UBIT: This is a tax that occurs when leverage is used to develop profits in investments.

What Role Does The Employer Play In 401 Plans

An employer selects the 401 or options for 401 plans and ensures the plan is compliance with relevant laws and regulations. The employer is also responsible for tracking employee contributions, employer matches, reporting of plan contributions in W-2 forms all of which can be done with a benefits partner.

Read Also: Which 401k Plan Is Best For Me

Choose The Right Provider

With your provider, its important to ask questions. Two common questions people ask are how to make contributions with the Solo 401, and how to use the Solo 401 loan.

However, tailor your questions to your specific needs. At IRA Financial Group, you can call at 401 specialist for a free consultation. With the 401 specialist, you can answer any questions you may have regarding the Solo 401 retirement plan.

You have a few options when choosing a provider to set up a Solo 401k plan. Here are the three options you have to easily set up a Solo 401.

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

Recommended Reading: Can I Take Money Out Of My 401k

Employees Who Are Excluded From Coverage

In order to maintain Solo 401 eligibility, the following types of employees may be generally excluded from coverage:

- Employees under 21 years of age

- Employees that work less than a 1,000 hours annually

- Union employees

- Nonresident alien employees

Do you have full-time employees age 21 or older ? Do your part-time employees work more than 1,000 hours a year? If yes, you must typically include them in any plan you set up. However, a business eligible for the plan can have part time employees and independent contractors.

Both An Employee And Self

You can be an employee of a business and also be separately self-employed. In this case, you are still eligible to establish a Solo 401 for your own business, even if you may also be participating in a 401 or other retirement plan through your primary employment. In such cases, your ability to make employee contributions will be capped at the overall limit of $19,500 if you are under age 50 or $26,000 if you are 50 or older. Your business that sponsors the Solo 401 can make a profit sharing employer contribution up to the plan maximum, independent of the other employer plan, however.

Also Check: How To Move 401k To Another Company

Create An Operating Agreement

An operating agreement contains the details of the financial, legal and management rights of all members of the LLC. More specifically, it can include how profits will be distributed, how members leave the LLC and who contributes capital for the business. In essence, it should contain all relevant information pertaining to the operations of your LLC.

Many states dont require an operating agreement, but that doesnt mean you dont need to craft one. LLCs with more than one member or partner will want to create one to ensure everyone agrees on their rights and responsibilities. Even solo business owners will benefit from outlining the details in writing.

Crafting your own operating agreement is one option, especially for single-member LLCs. And there are plenty of free templates online to get you started. For more complex situations such as LLCs with multiple owners, hiring an experienced attorney may be well worth the expense.

Solo Contributions Vs Other Plans

In comparison with other popular retirement plans, the solo 401 plan has high contribution limits as outlined above, which is the key component that attracts owners of small businesses. Some other retirement plans also limit the contributions by employers or set lower limits on salary-deferred contributions.

The following is a summary of contribution comparisons for the employer plans generally used by small businesses.

| Account |

| $3,000 for 2021 and 2022 |

Read Also: When Can You Draw Money From 401k

Robs Can Fund Franchises

Senior tax analyst Dick O’Donnell notes that many people think 401 business financing is particularly suited to funding franchise startups. Franchises are typically associated with successful businesses that have proven track records, while a small mom-and-pop startup business leans more toward speculation and sentiment than concrete statistics.

Crypto Price Prediction: $100000 Bitcoin Could Come Even Sooner Than You Think With Ethereum Leading The Way

2. Get an EIN. Once you obtain the Articles of Organization or Incorporation, you need to reach out to the IRS. Why is that? Because the IRS will now register your corporation and give you a Federal Employer Identification Number . There are several ways to apply, such as online.

Once you have an EIN, your new baby has a Social Security number and is officially in the IRS system. Whether you have a corporation or an LLC, youll need an EIN, and its important to have it memorized or written down in safekeeping. Once you have your EIN, you create a filing requirement with the government and will then be responsible for filing your tax returns annually on particular dates.

3. Open a business bank account and fund it. Once you have your articles and EIN, you will need to open an official bank account for your business entity and capitalize your entity. You are going to be required to provide those two documents to open a corporate or LLC bank account. Capitalizing your entity means putting money into your businesss bank account to properly fund the business and make sure your entity is moving in the right direction. However, if you are just getting started with a business checking account, there are banks that dont require minimum account balances. Once youve completed this step, you can say you have an official business.

Wishing the best of luck to all you business owners!

Read Also: What Happens To Money In 401k When You Quit

Solo 401 Plan Components

There are two components to the solo 401 plan: employee elective-deferral contributions and profit-sharing contributions.

- Employee Contribution Limits: You may make a salary-deferral contribution of up to 100% of your compensation but no more than the annual limit for the year. For both 2021, the limit is $19,500 , plus $6,500 for people age 50 or over.

- Employer Contribution Limits: The business may contribute up to 25% of your compensation but no more than $58,000 for 2021 . An employee age 50 or above can still contribute an additional $6,500 for 2021 and 2022.

What Is A Self

A 401 plan is an employer sponsored retirement savings plan established per provisions of the US tax code. Such plans first came into existence following the enactment of the Employment Retirement Income Security Act of 1974 .

A Solo 401 is a relatively new iteration of this type of plan dating to 2001 and passage of the Economic Growth and Tax Relief Reconciliation Act . This law increased the contributions available to the self-employed version of the 401 and generally streamlined the administration of such plans.

Income from the sponsoring employer may be contributed to the plan on a tax-deferred or Roth basis. Contribution limits are more generous than with IRA based plans, potentially as high as $63,500 per participant.

Since its introduction, the Solo 401 has become the favored option for successful business owners to save for their retirement future, and offers many advantages over options such as SEP IRAs, SIMPLE IRAs and Keough plans. For self-employed investors who qualify, this is our recommended plan of choice.

Income from the sponsoring employer may be contributed to the plan on a tax-deferred or Roth basis. Contribution limits are more generous than with IRA based plans, potentially as high as $63,500 per participant.

This type of qualified retirement plan is also sometimes referred to as an Individual 401, Owner 401 or self-employed 401.

Recommended Reading: Should I Roll My 401k Into An Annuity

Choose Your Eligibility Requirements

As noted above, the solo 401 plan may be adopted only by businesses in which the only employees eligible to participate in the plan are the business owners and eligible spouses. For eligibility purposes, a spouse is considered an owner of the business, so if a spouse is employed by the business, you are still eligible to adopt the solo 401.

If your business has non-owner employees who are eligible to participate in the plan, your business may not adopt the solo 401 plan. Therefore, if you have non-owner employees, they must not meet the eligibility requirements you select for the plan, which must remain within the following limitations.

Who Should Choose A Solo 401 Instead Of A Sep Ira

The conventional wisdom regarding the solo 401 vs SEP IRA question is that self-employed people should choose the solo 401 because in most cases, the potential tax savings are higher.

The primary question many taxpayers ask when deciding between a SEP and a solo 401 is What is the maximum I can contribute? In most cases, the solo 401 allows for a greater contribution and tax deduction, especially in cases where the individuals self-employment income is limited, says Dave Cherill, a certified public accountant and member of the American Institute of CPAs Personal Financial Planning Executive Committee.

But thats not the only reason to pick a solo 401. Solo 401s also offer features more on par with other employer-sponsored retirement plans that SEP IRAs lack: You can, for example, generally take out a loan from your solo 401 equal to the lesser of $50,000 or 50% of your account balance. Solo 401s also offer catch-up contributions for people 50 and older as well as a Roth option, which lets you pay income tax now in exchange for tax-free withdrawals in retirement.

I would say that the biggest benefit of all is the Roth option, says Desmond Henry, a certified financial planner based in Topeka, Kan. For someone who is a high earner, the solo makes sense because of the Roth option.

Also Check: Can I Use 401k Money To Start A Business

How A 401k Works

The tax benefits of a 401k are the same for the self-employed as they are for employees who participate in a company-wide plan. When you open the 401k account, the IRS allows you to make a maximum amount of annual contributions that are tax deductible on your personal return. However, if you are age 50 or older, the law allows you to increase the annual tax-deductible contributions you can make.

In addition to the tax deduction, the funds within the account grow tax-free until you begin making withdrawals during retirement. For example, if you invest your 401k funds in a low-risk interest-bearing investment, no tax is due on the interest income. In contrast, if you open up a normal savings account instead, you must report your annual interest earnings on a tax return each year. Ultimately, this deferral allows you to reinvest all income earnings within the account.

How Do You Choose The Best Funds To Offer To Your Employees

The contributions you make to your 401 are invested in a portfolio made up of mutual funds, stocks, bonds, money market funds, savings accounts, and other investment options, as permitted by the plan.

Beneficial funds allow your employees to choose the types of investments they make. The fund choices are transparent, have a low fee, and follow well-researched investment approaches. Again, speak with a finance professional while you are researching options.

Recommended Reading: How To Save Without 401k

Fund The Llc Using Self

After the LLC bank account has been opened, the next step is to fund with solo 401k funds. Funding the LLC bank account can be done by check or by wire, and the funds have to flow directly from the solo 4o1k bank account to the LLC bank account. If funding is done by check, the check will need to be made payable in the name of the LLC not your personal name.

Choose A Plan That Meets Your Business Goals

Plan design optionsThe big difference between 401 plan designs is how and when an employer makes contributions on behalf of its employees. Here are three types of plan designs, their requirements, and some other implications:

What other 401 plan features should I consider?Offering retirement benefits is a great way to attract and retain talent. But specific plan features can really boost participation and make your small business 401 plan even more enticing.

Traditional vs. Roth 401. Whats the difference?Generally speaking, the key difference between the two is when employee contributions are taxed. With traditional accounts, contributions are made before taxes are taken out of pay. Under Roth accounts, contributions are taxed first and then deposited. When an employee retires, withdrawals from traditional accounts are taxed at ordinary income rates, whereas Roth withdrawals can generally be made on a tax-free basis.* Read more about traditional vs Roth accounts.

Should I match employee contributions?Matching contributions can be hugely beneficial for both employees and employers. For employees, theyre an additional form of compensation that can help maximize their retirement savings.

Recommended Reading: How To Transfer My 401k To My Bank Account