If You Have A 401 Do You Need An Ira Too

Dear Carrie,

I already have a 401. Does it make sense to open an IRA, too?

A Reader

Dear Reader,

A 401 or other employer-sponsored retirement planif you’re lucky enough to have onecan be considered the backbone of your retirement savings. Contributions are easy because they automatically come out of your paycheck you may get an upfront tax deduction and annual contribution limits are sizeable$20,500 for tax-year 2022, plus a $6,500 catch-up for those age 50 or older.

That means, depending on your age, you could contribute up to $27,000 in 2022. Plus, if you get an employer match, that’s extra savings in your pocket. Add tax-deferred growth of earnings, and what’s not to like?

But as positive as all this is, there’s a good case for having an IRA in addition to your 401. An IRA not only gives you the ability to save even more, it might also give you more investment choices than you have in your employer-sponsored plan. And if you have a Roth IRA, there’s also the potential for tax-free income down the road.

But the type of IRA that makes sense for you personally will depend on your filing status and your income, so there’s a bit more to consider.

How To Contribute To A 401k

If you have a 401 plan, you should contribute as much as you can to max out your contributions. Find out how you can contribute to a 401 plan.

If your employer offers a 401, you should take advantage of this benefit to accumulate retirement savings for your golden years. 401 plans allow employees to set aside part of their salary each year for their retirement. Once you enroll in a 401 plan, you should find out how you can contribute to the plan.

Contributions to a 401 plan are typically made through payroll deductions. Usually, the employer withholds the contributions from your paycheck every pay period and then makes direct deposits to your 401. Some employers may also allow employees to make check deposits to the 401. In this case, an employee will be required to write a check to the plan with the amount they want to contribute.

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Recommended Reading: Can You Move 401k To Ira While Still Working

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2021 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

Are Income Thresholds Going Up Too

Yes, income ranges that determine who can contribute to a traditional IRA and Roth IRA are also increasing for 2023.

If you or your spouse are covered by a retirement plan at work, your IRA deduction may be reduced or phased out depending on your filing status and income.

Here are some of the changes for 2023, as laid out by the IRS.

- For single taxpayers covered by a workplace retirement plan, the new phaseout range is $73,000 to $83,000, up from the current $68,000 to $78,000.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phaseout range will be $116,000 to $136,000 in 2023, up from $109,000 to $129,000.

- For an individual not covered by a workplace retirement plan but married to someone who is, the phaseout range for an IRA will go from $218,000 to $228,000, up from $204,000 to $214,000.

- The income phaseout range for taxpayers making contributions to a Roth IRA is increasing to between $138,000 and $153,000 for singles and heads of household, up from $129,000 to $144,000. For married couples filing jointly, the range is $218,000 to $228,000, compared with $204,000 to $214,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phaseout range is not subject to an annual cost-of-living adjustment and remains between $0 and $10,000. The same phaseout range applies to a married individual filing a separate return who makes contributions to a Roth IRA.

Read Also: Where Should I Put My 401k Money After Retirement

How Long Can You Contribute To A 401k

As you approach retirement, you may want to maximize your 401 contributions even in retirement. Find out how long you can contribute to your 401.

A 401 plan is one of the popular ways that American workers use to save for retirement. Usually, 401 plans are offered through employers, and you will be allowed to decide how much to contribute to the plan each year. Your employer will then deduct the contributions directly from your paycheck, and deposit the funds to your retirement account.

As long as you are still working, you can make the full contribution to your 401 up to the annual IRS limit regardless of your age. You can continue contributing to the 401 even after 72. If the employer offers a 401 match, you will continue receiving the matching contributions as long as you are still working for your employer.

How Much Money Should You Have In Your 401k

At IWT, we talk about 401ks a lot.

And, thats with good reason. If you want to be rich, the 401k is one of the most powerful investment tools at your disposal, especially for retirement planning. It is also one of the most misunderstood money-maximizing vehicles, starting with how much you should have in your 401k.

That is a solid question, but it doesnt have a simple answer. To answer that burning question How much should I have in my 401k? we need more details. How much to invest in 401k investments will depend on your age and a few other considerations.

Lets start at the beginning.

You May Like: What Happens To My 401k After I Leave My Job

What Is The Optimal Amount To Contribute To Your 401 Plan

There are many types of retirement accounts out there, but the 401 may just be the most convenient.

An employer-sponsored 401 plan allows you to automatically contribute to your account from each paycheck, invest in professionally-vetted funds, and, in most cases, put off income tax on that income until later in life.

Many employers have a matching contribution to 401s as an employee benefit as long as you put in some cash yourself. But how much should you put in, and what can you do to get the most from your 401 in the long haul? Heres what you need to know.

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

Don’t Miss: When Can You Use Your 401k

What To Do If You’ve Overcontributed To Your 401

If you find you’ve overcontributed to your 401, contact your employer or plan administrator as soon as possible. Tell them you’ve made an excess deferral and the amount.

It’s best if you catch this error before April 15 in the year following the overcontribution.

Once you’ve alerted your plan administrator, processing your overcontribution error may take a bit of time. The plan administrator is required to distribute the excess deferral and earnings attributed to those funds by a certain date laid out in the 401 plan. Earnings are calculated based on the total change in value of the account since the overcontribution.

It’s important that this process be completed before April 15 of the year after the overcontribution is made, so you need to check all your W-2s and records as soon as you get them to make sure you have time to correct the error if you overcontributed.

How Much Should I Contribute To A 401 In My 20s

It might sound like a cliché, but theres a lot of wisdom in the saying that youre never too young to start saving for retirement. Although this might not seem like a high priority for workers in their 20s who have enough on their plates just paying for housing and essentials its still a good idea to start putting aside money for later in life.

Find: 6 Things You Must Do When Planning For Retirement

One of the best ways to do so is with a 401, which lets you grow your savings tax-free until youre old enough to start withdrawing from the account. Better yet, many employers match 401 contributions, which amounts to free money in your retirement account.

Beginning next year, youll also be able to contribute more to your 401. The IRS recently announced that the amount individuals can contribute to their 401 plans in 2023 will rise to $22,500 from $20,500 in 2022.

You May Like: How Many Percent Should I Put In 401k

Maximum 401 Company Match Limits

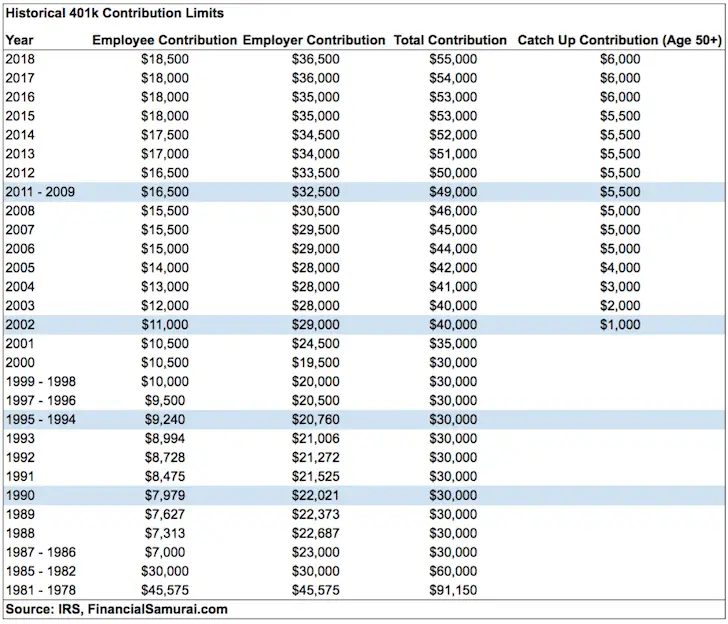

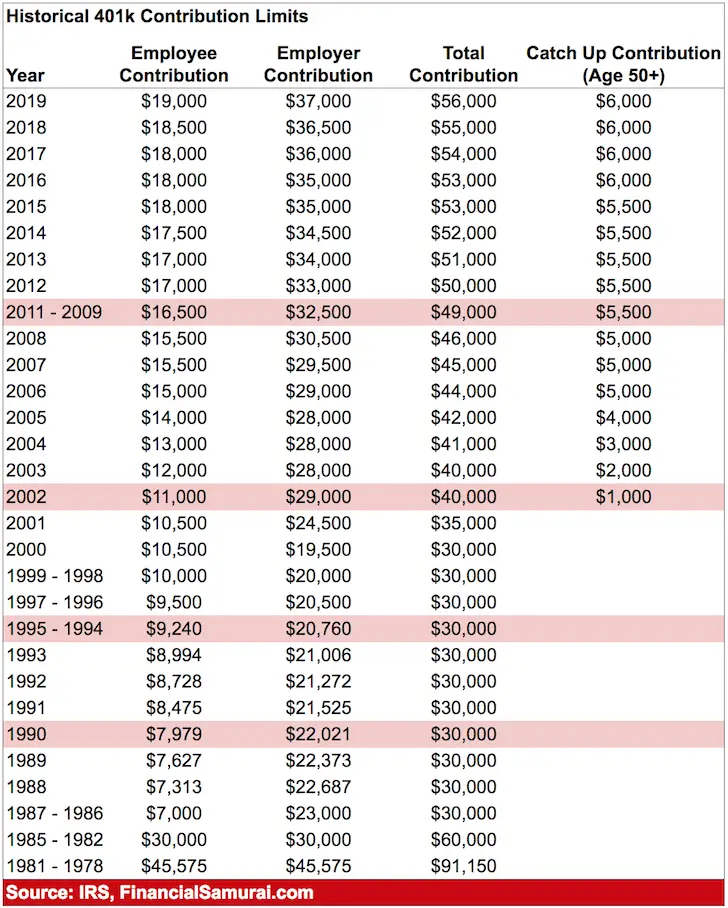

The employee and employer match limits for 401s fluctuate each year to account for inflation. Since inflation is projected to rise, the 401 max contribution is increasing as well.

According to the IRS, the employee contribution amount 401 limits per year include:

Therefore, in 2022, an employee can contribute up to $20,500 toward their 401. The employer can match the employee contribution, as long as it doesnt exceed the separate $61,000 employer-employee matching limit.

Since matching $20,500 in full would only total $41,000, most employees dont have to worry about this dilemma. This problem typically arises for individuals who are contributing to more than one employer-matched 401 plan or have switched or are switching to a new employer within the year. Employers should continue to communicate limits with employees each year to avoid misunderstandings.

If you have employees who are aged 50 or older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2021 and 2022.

The key employees compensation threshold increased from 2021 to 2022, from $185,000 to $200,000. Known as the nondiscrimination testingthreshold, these limits apply to specific individuals within a company to ensure they remain within specific 401 contribution limits.

Key employees are defined as any employee who:

When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesn’t apply, though, if you are age 55 or older in the year you leave your employer.

Depending on the plan sponsor, you may be allowed to borrow up to 50% of your vested account balance or $50,000, whichever is less, but unless the money is used to buy a primary residence, you will generally need to repay the loan within five years, making payments at least quarterly. If you miss a payment, the remaining balance is treated as a distribution, with taxes and penalties for early withdrawals applying.

Don’t Miss: How To Get Money From 401k Early

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways we’ll need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, it’s okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially “free money” so you don’t want to leave any sitting on the table.

What Is A 401 Overcontribution

An overcontribution happens when you defer more than the maximum allowed by the IRS to a 401 plan in any given year. For both 2020 and 2021, the IRS limits 401 employee contributions to $19,500. If you’re 50 or older, you can contribute an extra $6,500 as a catch-up contribution.

Overcontributions most commonly happen when a person contributes to more than one 401 plan in a year.

This can happen if you switch jobs midyear, if you work two jobs, or if you get a substantial raise midyear while keeping your contributions as a percentage of your paycheck the same.

It’s important to differentiate between what is an overcontribution and what isn’t. Catch-up contributions are not overcontributions. Any matching contributions from your employer won’t push you above the wage deferral limit, either. The IRS allows total contributions from both the employee and the employer to reach a much higher limit than the employee salary deferral. For 2021, that amount is $58,000, or $64,500 for those 50 and older. For 2022, the limits have increased to $61,000, or $67,500 for those 50 and older.

Recommended Reading: How To Buy A House With 401k

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2021 is $19,500 or $26,000 if you are 50 or older. In 2022, the maximum contribution limit for individuals is $20,500 or $27,000 if you are 50 or older. For both years, those those age 50 and older can contribute an extra amount of $6,500. Consider working with a financial advisor to determine the best contribution rate.

You May Like: Can I Pull From My 401k

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.