How Many Employees Do You Need To Have A 401 Plan Can Small Businesses Even Offer A 401

Lets get this out of the way. Yes, any size business can offer a 401 plan. Traditionally, 401 providers charged small and mid-sized businesses exorbitant fees or ignored them altogetherleading millions of smaller businesses out in the cold without an easy way to offer meaningful retirement benefits. Guideline is changing that by offering small businesses an easy, affordable 401.

What Is A Simple Ira

A SIMPLE IRA is a retirement savings plan designed for small businesses, particularly those with less than 10 employees. As such, its typically low cost and easy to set up and administer. Employees who participate in a SIMPLE IRA can defer a percentage of their salary to their savings account and their employer is required to either match it or make non-elective contributions.

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

Read Also: Can You Invest In 401k And Roth Ira

You May Like: Should I Combine 401k Accounts

What Exactly Qualifies As A Hardship Withdrawal

Financial withdrawals are permitted when a certain event is in a dire need of financial aid. For example, emergency medical procedures fall into this category. The amount that you borrow must be used entirely to cover said hardship. In these circumstances, you wont have to pay any early withdrawal penalties, but youll still have to deal with the taxes.

Dont Miss: Do Employers Match Roth 401k

Employer Matching Contribution Formulas

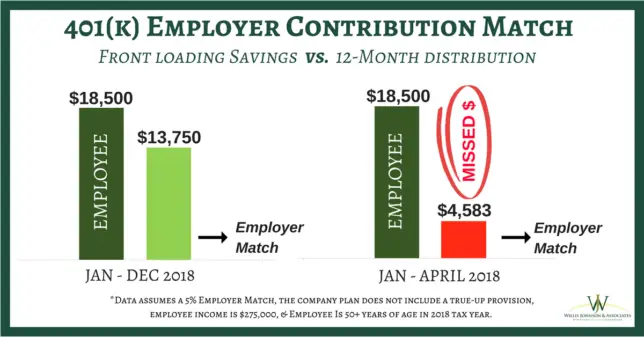

Most often, employers match employee contributions up to a percentage of annual income. This limit may be imposed in one of a few different ways. Your employer may elect to match 100% of your contributions up to a percentage of your total compensation or to match a percentage of contributions up to the limit. Though the total limit on employer contributions remains the same, the latter scenario requires you to contribute more to your plan to receive the maximum possible match.

Some employers may match up to a certain dollar amount, limiting their liability to highly compensated employees regardless of income. For example, an employer may elect to match only the first $5,000 of your employee contributions.

The IRS requires that all 401 plans take a nondiscrimination test annually to ensure that highly compensated employees dont benefit more from tax-deferred contributions.

“Your employer could match 100% or even a dollar amount based upon some formula, but this can get expensive and normally owners want their employees to take some ownership of their retirement while still providing an incentive,” says Dan Stewart, CFA®, president, Revere Asset Management Inc., in Dallas, TX.

Also Check: Should I Take A Loan From My 401k

Review The Investment Choices

The 401 is simply a basket to hold your retirement savings. What you put into that basket is up to you, within the limits of your plan. Most plans offer 10 to 20 mutual fund choices, each of which holds a diverse range of hundreds of investments that are chosen based on how closely they hew to a particular strategy or market index .

Here again, your company may choose a default investment option to get your money working for you right away. Most likely it will be a target-date mutual fund that contains a mix of investments that automatically rebalances, reducing risk the closer you get to retirement age. Thats a fine hands-off choice as long as youre not overpaying for the convenience, which leads us to perhaps the most important task on your 401 to-do list …

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

You May Like: Is 401k Required By Law In California

Pros And Cons Of An Opt

Many workers in the U.S. do not sock away nearly enough for retirement, and some save nothing. Knowing this, some companies enact opt-out plans in an effort to boost the number of employees who save.

The amount deducted in an opt-out plan, typically about 3%, is a good start but too low to build a significant retirement account.

Opt-out plans tend to raise participation rates. However, they are set at contribution levels that are too low to meaningfully help the employees in retirement. Employees who dont proactively change their contribution levels may under-invest over the long term. Without a periodic reminder that a 3% contribution, for example, is just a starting point, many may not save enough in the long run.

For this reason, some argue that opt-out plans may encourage wider participation in retirement savings plans, but they tend to lower their total retirement contributions. To counter this possibility, some employers raise the employee contribution rate by 1% each year, with 10% being the usual maximum.

There are other ways employers can encourage retirement contributions. Raising the company match is one of them. Most employees who have retirement savings plans know that failing to save enough to take advantage of the full company match is just leaving money on the table.

How To Set Up A 401k For A Business

The path to a successful retirement savings program starts with plan design. And while its true that employers can set up 401ks on their own, its generally recommended to seek the help of a professional or a financial institution. Theyll provide expert guidance throughout each of the following steps:

You May Like: How To Find Old 401k Money

Are There Any Hidden 401 Fees That Can Drive Up Costs

In addition to these standard fees behind your 401 cost, there may be some surprise expenses that youll want to watch out for. These could include costs for services like:

- Terminating the plan

- Rolling over funds from a previous provider or to a new one

- Changing your plan design, which requires a plan amendment

- Integrating your 401 with your payroll platform

- Loan and withdrawal administration

Just be sure to carefully check your quote or fee schedule so you know what youre being charged.

Why Aren’t Employees Participating In Retirement Plan Offerings

The reasons for lower retirement plan participation can be multidimensional. When analyzing employees’ 401 data, it’s helpful to understand that it may be more than a single element contributing to their lack of enrollment.

Consider the following factors:

Read Also: Should I Transfer My 401k To An Annuity

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Keep It Running Smoothly

Ongoing nondiscrimination testingOffering a retirement plan takes regular upkeep and a close eye on 401 plan compliance deadlines to ensure you dont run afoul of ERISA and IRS rules. Most 401 plans are required to pass nondiscrimination testing each year. These look at the value of each employee’s account, employee contribution rates, and other details. Employer matching and profit sharing also come under scrutiny. Your company may also want to regularly review or revise your plan features as the company’s situation changes.

Government filingsIn addition to keeping up with compliance testing, youll need to file an IRS Form 5500 each year. This federally-mandated form includes information about your business, your retirement plans, number of participants, and more.

How much will a small business 401 cost?Guideline 401 starts at a $49 base fee plus $8 per employee per month. Learn more about our fees and services here.

When evaluating a small business 401, consider if there are hidden fees for key functions such as compliance, recordkeeping, and investment management. Also ask about setup fees, monthly fees, annual fees, Form 5500 fees, and whether a provider expects you to pay fees to anyone else. All these standard services are included in Guideline’s pricing.

*This content is for informational purposes only and is not intended to be construed as tax advice. You should consult a tax professional to determine the best tax advantaged retirement plan for you.

Recommended Reading: Can I Roll My 401k Into An Index Fund

Can You Withdraw Your 401k After You Quit

- Answered August 3, 2018 â Orderfiller/Housekeeping â Mebane, NC

Yes and/or transfer to your next job

Upvote

- Answered April 10, 2018 â Licensed Pharmacy Technician â Layton, UT

I believe you can

- Answered February 10, 2018 â Produce Associate â Rochester, NH

Yes and put it into another 401k

Upvote

- Answered February 8, 2018 â OVERNIGHT STOCKER â Ocean City, MD

401k was not provided for part time employees

Upvote

- Answered January 29, 2018 â Overnight Stocker â Dalton, GA

I believe so

- Answered January 28, 2018 â Department Manager â Boonton, NJ

Yes you can withdraw your 401k

Upvote1Report

- Answered January 25, 2018 â Cashier/Customer Service â Anderson, SC

Yes but they try to get you to invest in something else or put it somewhere else but you can withdraw

Upvote

- Answered January 25, 2018 â ASSISTANT STORE MANAGER/ SUPPORT MANAGER â Rohnert Park, CA

After a 6 month wait

Upvote

Help job seekers learn about the company by being objective and to the point.

Your answer will be posted publicly. Please donât submit any personal information.

You May Like: How To Get My 401k Early

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

You May Like: Can You Take All Your 401k Money Out

K Plan Based On Company Size

While 401 becomes a promising motivation for employees and appealing addition to the job postings to attract more talent, businesses must consider the best strategies to reap the benefits of this benefit. Below are some of the best practices and the types of 401 plan that is ideal whether you are operating for a small, medium, or large enterprise:

Small to Medium Enterprise

Small to mid-sized businesses, aiming to expand their operations and company size will benefit from offering 401 to their employees and business partners. But to better manage your organizationsâ 401, the Department of Labor has given the following steps when establishing this retirement plan:

Adopt a written plan documentâ

This documents a day-to-day plan for your businessâ 401 plan. You may seek help from financial institutions or retirement plan professionals to draft a plan that best works for you.

Arrange a trust for the planâs assets

âSetting up a trust ensures that the planâs assets will be allocated solely for this benefit. It must have at least one trustee to handle the contributions, investments, and distributions on the plan.

Develop a recordkeeping systemâ

What Are Your Fiduciary Responsibilities

As you vet plan providers, its also important to consider your own fiduciary duties.

Retirement plans must follow a complex set of laws and regulations. And to provide savings opportunities, employers must do some heavy lifting to sponsor and administer a 401. The Employee Retirement Income Security Act is a federal law that controls retirement plans and includes a set of standards , often referred to as ERISA fiduciary duties.

The primary ERISA fiduciary duty is to run the plan in the interest of participants and beneficiaries. 401 plans must have a plan sponsor, a plan administrator, a Named Fiduciary, and a trustee. Below is an admittedly non-comprehensive breakdown of fiduciary responsibilities*:

*For a more detailed overview, please refer to 401 plan administrator and sponsor duties.

Whats the difference between a trustee and a custodian?

Its important to not confuse a custodian with a trustee. A custodian is often hired by the trustee to hold the plans assets and handle the buying and selling of investments. While the services of a custodian are documented in a custodial agreement, trustees are generally responsible for their actions.

For more information on fiduciary responsibilities, please refer to our detailed article about 401 plan administrator and sponsor duties.

You May Like: How To Get 401k Money After Quitting

Competitive Ability To Recruit And Retain Talent

Retirement benefits are increasingly important to employees. According to a study by Accenture, 68% of workers worldwide ask during the job application process whether a company has a retirement plan like a 401, and 62% seriously consider the availability of such a plan when deciding whether to accept or remain in a job.

There can also be big financial benefits from a 401 in helping to retain and attract top talent and the associated cost savings and productivity gains, said Stuart Robertson, CEO of ShareBuilder 401k.

According to Robertson, research shows that replacing an employee costs 29% to 46% of an employees annual salary, depending on whether that employee is in a managerial position.

Its estimated that an employee who earns $50,000 a year can cost $14,500 on the low end to replace, he said. A 401 plan is a small price to pay, not only for retirement but also for building and keeping a great team.

Brian Halbert, founder of Halbert Capital Strategies, said his business clients have reported significant increases in worker loyalty and productivity when they added a 401 plan to their employee benefits packages.

The single largest benefit coming from a 401 is financially wise employees that have a zeal for working hard for their company, Halbert said. Oftentimes, we see the ROI in productivity and loyalty.

Make Enrollment Easier & Consider Removing Waiting Periods Before Employees Can Contribute

In the past, enrolling in a retirement plan involved intimidating amounts of education and paperwork enough to cause most anyone to hesitate. Today’s online tools and resources have changed that landscape. Providing seamless online access helps minimize enrollment challenges, provides flexibility, and centralizes information about plan options. You may even want to host a series of virtual sessions where employees work with HR to learn about the retirement plan and enroll on the spot.

Removing waiting periods may also encourage more employees to contribute to the 401 plan. While filling out their new-hire paperwork, they can also set up their retirement savings and have a portion of their paycheck deducted starting on day one.

You May Like: How Do I Access My 401k From A Previous Employer