What Exactly Qualifies As A Hardship Withdrawal

Financial withdrawals are permitted when a certain event is in a dire need of financial aid. For example, emergency medical procedures fall into this category. The amount that you borrow must be used entirely to cover said hardship. In these circumstances, you wont have to pay any early withdrawal penalties, but youll still have to deal with the taxes.

Dont Miss: Do Employers Match Roth 401k

Know The Basic Formula But Beware

The basic formula for an early retirement is to build up 25 times your annual expenses and then plan on drawing down no more than 4 percent of that value, every year. If you can afford to live on that, you should be good.

However, there are so many variables that can throw a wrench into or even improve that formula.

To get a more nuanced answer about retiring early, try different scenarios with the NewRetirement Planner. Input as much detail as possible and keep playing with your information until you come up with a plan that really works for you.

Rules of thumb are okay as a starting point, but a reliable retirement plan needs to be customized to you.

Take A Home Equity Loan

If you own a home, you can consider going with a home equity loan instead. Youll need at least 20% equity to secure the loan. The average interest rate on these loans is around 5.33%, which is much better than the rates on other forms of financing . You should also note that there are no tax deductions unless youre reinvesting the loan into your home.

You May Like: How To Divide 401k In Divorce

Should You Withdraw Early From Your 401k

Without question, 401k early withdrawal is something that cannot be taken lightly. There are a lot of moving pieces that must be taken into consideration before fully understanding if this is the right decision for you or not.

Considering the importance and potential ramifications of this decision, you should certainly use Personal Capitals early 401k withdrawal calculator before making this decision. This calculator will help you get the fully baked picture of the true cost of withdrawing from your 401k.

How Can I Avoid Penalties For Cashing Out A 401

Life happens. And believe it not, the IRS understands this. They have instituted several exceptions that waive penalties. You will, however, still need to pay taxes on the funds you withdraw in most cases.

- âSubstantially Equal Periodicâ payments. The IRS allows you to withdraw money from your 401 if you agree to take a series of equal distributions from your account. You must commit to this plan for at least five years or until youâre 59½, whichever is longer.

- If you leave your job after you turn 55, you can withdraw from your 401 penalty-free. Again, youâll still be subject to taxes, but the 10% penalty will not apply.

Federal law enforcement professionals, federal firefighters, customs and border patrol agents, or air traffic control workers can withdraw after age 50 penalty-free.

Being approved for a hardship withdrawal by your employer isnât always guaranteed. For instance, you wonât be eligible if you have other assets you could use instead of your 401.

If your goal is to purchase a home or pay for college expenses you may have yet another option.

The IRS allows you to use funds from a traditional IRA to cover college expenses or to purchase your first home without penalty.

The interest you pay goes into your 401, so it wonât cost you any money in fact, it helps build your 401 back up.

Also Check: Should I Roll Over My 401k To An Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

You May Like: How To Invest My 401k Money

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

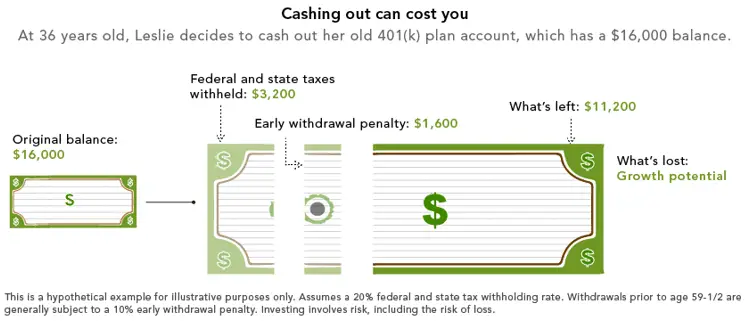

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Read Also: How Does A 401k Retirement Plan Work

Better Options For Emergency Cash Than An Early 401 Withdrawal

It can be scary when suddenly you need emergency cash for medical expenses, or when you lose your job and just need to make ends meet.

The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, a financial professional with Principal® who helps clients on household money matters.

The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

In short, he says, You may be harming your ability to reach and get through retirement. More on that in a minute. First, lets cover your alternatives.

Use A Professionally Managed Fund Or Get Advice

Investing too conservatively could also jeopardize your lifestyle or cause you to run out of money. Striking the right balance sometimes requires professional management. Your 401 plan may offer professionally managed fund options, such as target-date funds, for retirees. And your 401 provider might offer personalized investment advice. Ask your provider about your options for getting help. And if you think face-to-face advice might be better for your needs, find a financial professional with experience helping retirees.

Recommended Reading: Are Part Time Employees Eligible For 401k

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. SmartAssets financial advisor matching tool makes it easy to quickly connect with professional advisors in your local area. If youre ready, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

You May Like: How To Access My 401k Plan

Standard Retirement Is Part Of Early Retirement

Before we dive into the various withdrawal methods though, its worth stating something obvious that people seem to miss.

Normal retirement is part of early retirement.

Heres a highly-detailed diagram to help explain this even further:

People have said to me that they arent contributing to their 401s because they plan on retiring early. Thats insane! Even if you plan to retire early, you still need money to live on in your 60s, 70s, and beyond so why not pay for those years with tax-deferred money?

Everyone should utilize retirement accounts for standard-retirement-age spending but for people who think theyll have more in their retirement accounts than theyd ever be able to use after they turn 60 and want to start accessing that money during early retirement, here are your options

You May Like: How To Check 401k Amount

Most People Have Two Options:

- A 401 loan

- A withdrawal

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

How Much Are You Penalized For A 401k Early Withdrawal

On the surface, withdrawing funds from your 401k might not seem like a bad option under extenuating circumstances, but you could face penalties. Young adults are especially prone to early withdrawals because they figure they have plenty of time to replace lost funds.

If youre not experiencing a significant hardship, 401k early withdrawal probably isnt the right choice for you. Ultimately, you could lose a substantial portion of your retirement savings if you choose to withdraw your 401k early to use the money to make other risky financial moves. Below, lets delve further into the penalties that usually apply when you withdraw early.

Recommended Reading: What Percentage Should I Be Contributing To My 401k

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

Alternatives To A 401 Early Withdrawal

As we mentioned, a 401 early withdrawal can be used in a financial emergency, but it shouldnt be your first choice. The good news is there are plenty of other options available to you.

There are several alternatives to an early withdrawal from retirement, however, most of them mean going into debt, Woodward said. The only difference is your credit will not be used in determining your eligibility for a 401 loan. Your credit will be used for credit cards , HELOCs, personal loans, and any other type of loan.

Your creditworthiness is a major factor when youre borrowing money. Some of the options below may only be available if you have good credit. In other cases, a poor credit score could make the loan cost-prohibitive.

Read Also: How Long Do You Have To Roll Over Your 401k

Work One Extra Year For Extra Cushion But Not Another And Another And Another Year

Jeske felt like he could retire a year or two before he actually did. However, it is such a massive decision that he decided to work a little longer to give himself an extra cushion.

Gilbert also worked an extra year. I talked to my uncle, he retired early and he said, let me just give you one piece of advice. He said, If youre not quite sure on the numbers, put in one more year. But, then he added: Dont put in one more year, and then one more year and then one more year. Right? Just put in one more year, pad the numbers because youll never make the kind of money youre making now, right in the peak year career.

However, Mamula likens the idea of working one more year to playing a game of chicken. He said, Are you going to run out of money or are you going to run out of life first? So youre trading in this lifestyle that we didnt like working all the time, for a different undesirable lifestyle where youre constantly worried about money.

Read this if you want to know what one more year might really mean to your future.

How Much Will I Get If I Cash Out My 401 Early

Dylan Telerski / 19 Jun 2020 / 401 Resources

Considering a 401 withdrawal? Heres how much you can get if you choose to cash out your 401:

- Traditional 401 : Youll get 100% of the balance, minus state and federal taxes.

- Roth 401 : Youll get 100% of your balance, without taxation.

- Cashing out before age 59.5: You will be subject to a 10% penalty on top of any taxes owed.

Cashing out early will also result in lost growth. Therefore, its recommended that you let your money sit as long as possible to reap the full reward of your retirement savings. Of course, in some scenarios, its easier said than done to let the cash sit.

Also Check: Can A Roth Ira Be Rolled Into A 401k

What Is The Penalty For Taking Out 401k Early

If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

Make Some Adjustments To Your Current Budget

Heres where that work comes in: No matter how you want to slice it, retiring early means making some changes to how Current You earns and spends money, so Future You gets to relax. And for many people, that means cutting their budget to the bare minimum. Many people with early retirement ambitions aim to live on 50% of their income . The rest gets funneled into savings.

FIRE devotees have all kinds of strategies for getting their spending down to this level, ranging from the obvious to the insane. Wiping out debt including debt traditionally considered good, like mortgage loans is key, as is cutting large and small expenses. Youll want to get creative about how you can save money on transportation, utilities, food and housing costs. Do you have a bike? Get ready to ride it.

It’s also wise to find ways to bring in some extra income that can go directly into your early retirement coffers. There are actually two groups of FIRE devotees: The lean FIRE group, which aims to live as lean as possible, and the fat FIRE group. Followers of fat FIRE focus less on frugality and more on increasing their earnings either through investments or side hustles so they can live a comfortable lifestyle and retire early. If that sounds more appealing to you, dont get rid of the car just yet. Youre going to need it when you start driving for Lyft.

» Dont know where to start?Check out NerdWallets guide to frugal living

Read Also: How Much Can I Borrow From My 401k Fidelity

What Is An Early Withdrawal From A 401

An early withdrawal from a 401 happens when you take distributions from your account before the age of 59 ½.

The accounts are designed to provide you with an additional source of income during retirement, hence, the age requirement on distributions. If you decide to make an early withdrawal from your 401, the IRS will charge you a penalty.