You May Be Able To Invest In Funds With Lower Fees

As a general rule, IRAs tend to be cheaper than 401s. You have more flexibility to find investments with lower fees when you invest with an IRA because its your account that you hold at an institution you choose. Your 401s leave you stuck with what your employer gives you within the plan. Its not out of the question to save 1% per year in underlying fees when you roll over to an IRA.

Traditional Vs Roth: Which Type Of Ira Should I Roll My 401 Into

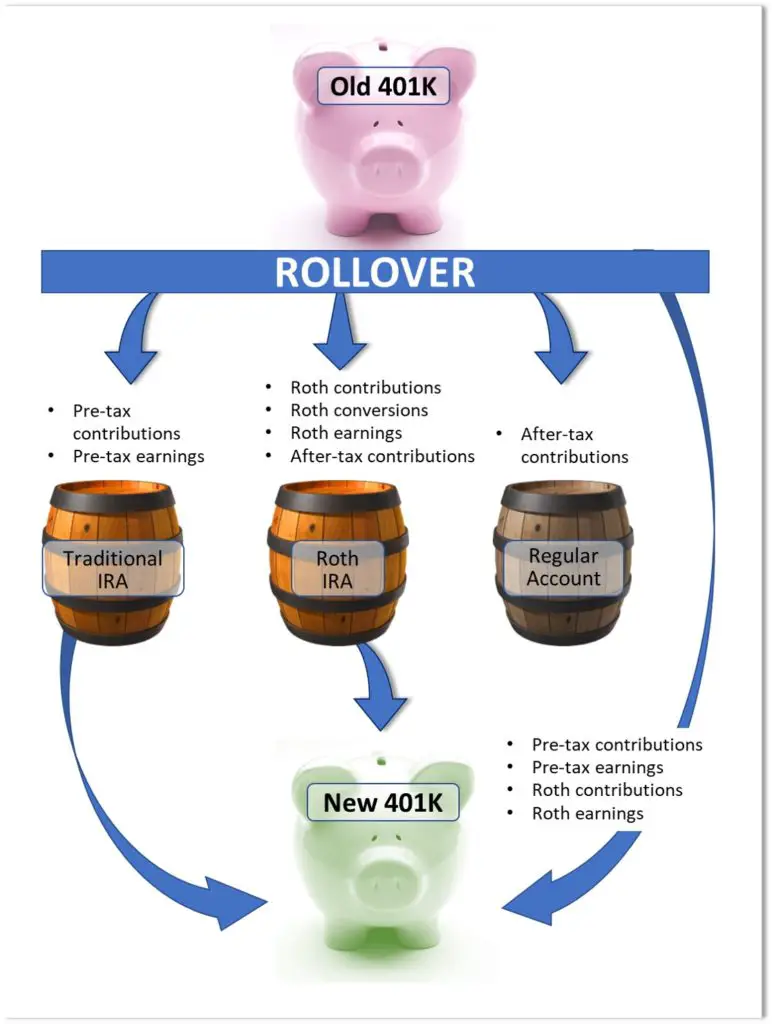

Now, the type of rollover IRA you transfer your money into depends on what type of 401 youre rolling over.

If you had a traditional 401, you can transfer the money into a traditional IRA without having to pay any taxes on it . Likewise, if you had a Roth 401, you could roll the money into a Roth IRA completely tax-free. Easy, right? Traditional to traditional, tax-free. Roth to Roth, also tax-free.

Drawbacks Of A 401 To Ira Rollover

IRA rollovers give individuals more control over their money, but they do come with potential tradeoffs.

Less legal protection: Unlike a 401, money in an IRA may be vulnerable to creditors and civil lawsuits. While blanket bankruptcy protections that 401s enjoy do extend to money that gets rolled into an IRA, those funds may be exposed in other legal proceedings.

Distribution age: The Rule of 55, which 401 investors can tap, does not apply to IRA rollovers. After rolling money over into an IRA, you have to wait to reach age 59.5 to withdraw funds without incurring an extra 10% penalty.

Higher fees: An IRA will give you more investment options than a 401, but you may lose out on access to institutional funds mutual funds that carry the lowest expense ratios and are only available to institutional investors, like 401 plans and hedge funds.

No loan option: Youll also forfeit the option to borrow against your 401. That choice does not exist for IRAs.

Also Check: Can I Take My 401k If I Leave My Job

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

Donât Miss: Can I Roll Part Of My 401k To An Ira

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

Read Also: Can I Move My 401k To Roth Ira

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Choosing A Traditional Or Roth Ira

Characteristics of a traditional IRA are:

- Individuals can contribute pre-tax money to investments that grows tax-free

- Distributions taken after retirement are taxed as ordinary income

- There are no income limits

- Individuals must start taking minimum distributions by age 70½

Characteristics of a Roth IRA, on the other hand, are:

- Individuals cannot contribute pre-tax money

- Qualified distributions taken after retirement are tax free

- There are income limits

- Individuals do not need to start taking minimum distributions at any point

In general, if youre eligible for both a traditional and Roth IRA, you should go for the Roth unless you expect to be in a lower tax bracket when you retire. It can also be smart to go the route of diversifying and have one of each type of account. If youre like me , youll stick with the Roth for now and open a traditional IRA later. Check out CNNMoneys guide on which type of account is right for you for more guidance.

Importantly, note that if youre moving your money from a 401 to a Roth IRA , you will owe taxes at the time of conversion. After 2011, though, you can spread this over two years. For me, the benefit letting my money grow tax-free in a Roth IRA account outweighs the relatively small amount Ill owe in taxes.

Don’t Miss: Can You Convert A Roth 401k To A Roth Ira

Fees To Consider Before You Roll Over A :

Youll want to pay close attention to the fees in your old employers account , as well as the fees in your new employers 401 or any IRAs you may be considering.

Many savers dont realize this, but 401s have a variety of fees associated with them, from the individual funds youve invested in to administrative fees from the provider itself theyre just usually quietly taken out of the account over time. You dont have much control over the investment options your employer offers in its 401, but you do typically have the option to pick certain funds, so be sure to look for the lower-cost options.

If youre looking to roll over your 401 into a traditional or Roth IRA, youll have to do more shopping to research how the fee structures will work for different types of investments and account providers. There are a few broad types of fees in an IRA you should look for.

First up: maintenance fees, which can be charged as a percentage of your assets or a flat annual fee. Many brokerages no longer charge this fee, especially for passively managed funds.

Then theres the investment fees, known as the expense ratio, for the underlying mutual funds and exchange-traded funds in your IRA. For these, look for a fee well below 1%.

Finally, when looking at fees related to investing, Meadows recommends avoiding IRAs that charge transaction fees, which are applied when you sell funds, or load fees, which are charged when you make deposits into your account.

Fund Selection And Fees

Ideally, you want low-cost fund options with no administrative fees. Consider the choices available with different brokerages to minimize the administrative or brokerage fees you may pay.

When it comes to fund selection, the sheer volume of choices can feel overwhelming. Beginner or hands-off investors may benefit from target date funds or robo-advisors that manage retirement funds for you based on your risk profile.

If you prefer to manage investment choices on your own, most advisors recommend beginners start with a simple portfolio of a broad U.S. stock index fund, a broad international stock fund and a U.S. bond fund. For more on how to invest for retirement, check out our guide.

Recommended Reading: Why Cant I Take A Loan From My 401k

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

Recommended Reading: How Do I Start My 401k Plan

Decide Where You Want Your Money To Go

You have a few destination options to choose from when you roll over a 401.

Use a rollover IRA: The most commonly used is a rollover IRA. This is simply a traditional IRA except it houses funds rolled over from another retirement account like a 401.

Investors typically roll over funds into like accounts — a traditional 401 into a traditional IRA and a Roth 401 into a Roth IRA. You may also roll over funds from a traditional account into a Roth account, but you’ll owe taxes at your current income tax rate on the amount converted. If you expect a year of low income, perhaps from an extended gap between jobs, then this conversion may be advantageous.

Transfer to a new 401: The other option is to roll over funds from an old 401 into your new employer’s 401 plan. This keeps all of your retirement investments consolidated so that they’re easier to manage. For high-income earners, another reason to transfer to a new 401 may be to keep the backdoor Roth IRA option available by sidestepping the IRA aggregation rule. As long as the fees are reasonable for the current 401 plan, this isn’t a bad option.

How Can I Find Old 401 Accounts

If you forget about an old 401 altogether, or If you believe you have a 401 that’s been lost , you can take steps to find it. If your old employer is still in business, you can contact them directly for any information. You can also try reaching out to the plan holder. Another option includes using your state’s database of unclaimed 401 plans.

Recommended Reading: How Old To Start A 401k

Is It Better To Roll Over A 401 To An Ira

If you like your former employers 401 plan the investment options and the expense ratios on the investments then it wont necessarily be better to roll it over into an IRA. But you may find that if you roll your 401 into an IRA, you may have more investment options. Compare expense ratios and fees to see which option is best for you.

Kaleb Paddock, a certified financial planner at Ten Talents Financial Planning in Parker, Colorado, says a typical 401 plan only has approximately 20 to 40 mutual funds available. But an IRA could give you access to thousands of exchange-traded funds and mutual funds as well as individual stocks.

Another reason might be, if you want to invest in socially responsible funds or funds that invest according to a certain set of values, those funds may not be available in your 401 or your prior employer 401, Paddock says.

But by rolling it over to one of these large custodians, youll likely be able to access funds that may be socially responsible or fit your values in some fashion and give you more options that way, he says.

Plus, rolling over your 401 to an IRA may result in you earning a brokerage account bonus, depending on the rules and restrictions that the brokerage has in place.

Trustee To Trustee Rollovers

The IRS separates direct rollovers from trustee to trustee rollovers. But essentially, theyre both forms of direct rollovers, which is what you want.

A trustee to trustee or in kind rollover takes place when the administrator of your previous companys 401 and the administrator or entity in charge of your new account handle the transfer electronically.

This is the easiest method because it involves minimal work on your part.

Don’t Miss: How To Borrow From Your 401k

Direct Vs Indirect Rollovers

A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties. Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. In many cases, you can shift assets directly from one custodian to another, without selling anything. This is known as a trustee-to-trustee or in-kind transfer.

Otherwise, the IRS makes your previous employer withhold 20% of your funds if you receive a check made out to you. It’s important to note that if you have the check made out directly to you, taxes will be withheld, and you’ll need to come up with other funds to roll over the full amount of your distribution within 60 days.

To learn more about the safest ways to do IRA rollovers and transfers, download IRS publications 575 and 590-A and 590-B.

Benefits Of A Rollover Into A New 401

Distributions at 55: Under an IRS provision known as the Rule of 55, you can withdraw funds from your current companys 401 penalty-free starting at age 55, instead of 59.5 . By combining 401s, you may have access to your older assets at 55.

Loan options: By rolling over an old 401 into a new plan, you may be able to borrow against the account, which is not an option with a 401 that remains with a former employer.

Lower fees: As stated above, the fees associated with your new employers plan may be lower than those of your former plan or a future IRA.

Don’t Miss: How To Set Up 401k For My Company

What Is A 401

Sure, you probably know that a 401 is a retirement investment vehicle that allows you to put away pre-tax money, and that your contributions are often matched by your employer. You may not know, however, that theres generally a waiting period before new employees are allowed to invest in the funds . You might also be unaware that while employers may offer matching funds, they also often require you to remain with the company for a certain number of years before youre eligible to receive those funds. At my company, that period was five years. If you move on earlier than that, you forfeited all employer contributions to your 401.

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

Also Check: How Can I Find My Lost 401k