Roll Over The Old 401 Account Into Your Current Employers Plan

By rolling the old account into your current employers plan, youll be able to keep all your 401 accounts in one place, making it easier to keep track of them. However, most 401 plans have a limited number of investment offerings, so if youre not happy with your current plans options, youre probably better off rolling the old account into an IRA.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Read Also: How To Cash Out 401k

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Read Also: What Is The Best Way To Roll Over 401k

Investing For Retirement With Sofi

When can you retire? The answer depends on how much you have saved already, including any money thats in an old 401k account or money youve got stashed in an IRA. SoFi offers both traditional and Roth IRAs to help you build wealth for the future. A traditional IRA offers the benefit of tax-deductible contributions. Meanwhile, a Roth IRA offers tax-free qualified withdrawals in retirement.

If youre ready to take the next step, learn more about investing for retirement with SoFi.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Don’t Miss: Can You Take Money Out Of 401k

How To Find An Old : 7 Ways

People prone to leaving things behind usually dont lose a 401 account, but it happens more often than you think especially if you dont have a great deal of cash stashed away in a 401.

Data from Plan Sponsor Council of America shows that 58% of 401 transfer balances are between $1,000 and $5,000 when a career professional leaves an employer. Thats not an insignificant range of money, but its money you could have working for you, if you could only find it.

Additionally, the U.S. Government Accountability Office states that over 25 million Americans with cash in a 401 or other employer retirement plan left that money behind when they moved on to greener career pastures.

People leave old 401 accounts behind for many reasons. The account holder may have engaged in a string of job-hopping experiences and lost an old retirement account in the shuffle. Or, the 401 account holders company merged with another firm, was bought out, or went bankrupt.

You might even automatically have been enrolled in an old 401 company by a firm you only spent a year or so working at, didnt realize it, and completely missed bringing the 401 account along with you to your next job.

If that sounds vaguely familiar, how do you find the money you lost in an old 401 account and what do you do with it when you get it back?

There are plenty of ways to get the job done. Lets take a closer look.

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Read Also: How To Transfer 401k From Old Employer

How To Search For Unclaimed Retirement Benefits: 401

You can take a few steps to search for your unclaimed 401 retirement benefits. The first step is to gather as much information as you can about your former employer. If your employer is still in regular operation, there is a chance that your 401 is still in the account that you had when you were with the company.

If you need to do a bit more digging, here are some steps you can take.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Don’t Miss: How Can I Close Out My 401k

Contact Your Former Employers

Go back to your former employers with your Social Security number and the time you were employed. Better still, locate an old statement from your 401 plan with them. With that information, the human resources department can help reunite you with your retirement savings.

It seems an obvious place to start, but many people dont get that far.

Call Your Old Employer

If you suspect you have missing 401 funds or even if you’re not sure, it’s still a good idea to contact old employers and ask them to check if they’re holding your old account. Your former company will have records of you actually participating in a 401 plan.

You’ll either need to provide or confirm your Social Security number and the dates of your employment, but if you can, you’ll have found the fastest way to dig up a missing 401.

Read Also: Can I Start A 401k For My Child

What To Do With A Lost Retirement Account When You Find It

Once youve found a lost retirement account, what you do with it depends on what type of plan it is and where its located.

Old 401k balances can be rolled into your current employers plan or rolled into an IRA in a trustee-to-trustee transfer. You can also request a payout of the plan balance, but if you are under the age of 59.5, the payout will be subject to income taxes and a 10% penalty for early withdrawal.

If you find an old pension through the PBGC, youll have to go through a process to verify your identity. Once the PBGC has established that you are owed the benefits, you can apply for them at any time once youve reached retirement age.

Its not uncommon for former employees to leave funds in a former employers retirement plan, believing theyll get around to dealing with it later. Years pass by, and maybe youve forgotten about a few old accounts. Even if they didnt amount to much at the time, a few hundred dollars here and there combined with some market growth over the years just might add up to a nice addition to your retirement savings. Its worth a look!

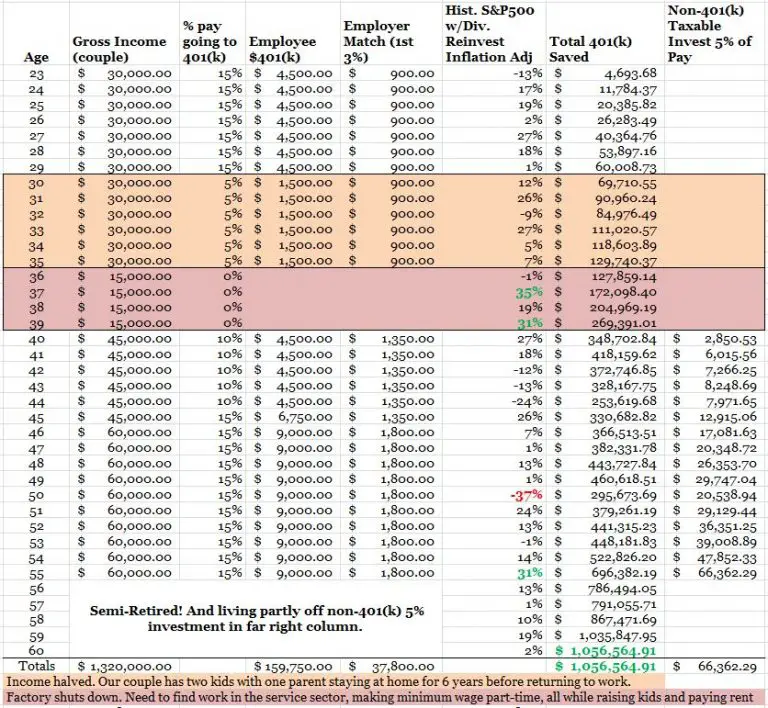

Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Don’t Miss: How Much Can Be Put Into A 401k Per Year

Where Has My 401 Gone

There are a few scenarios in which someone might lose track of their 401.

If you did a bit of job-hopping early in your career, you may have moved on and forgotten about your 401 plan. Or perhaps your company merged with another, but your 401 plan didnt transfer over. In other cases, you may have automatically enrolled in your companys 401 plan without realizing it.

You know all the paperwork from human resources you ignored? The information youre looking for probably was in there.

Regardless of why you lost track of a 401 plan, the good news is that whatever contributions you made no matter how long ago that may have been are yours to keep and always will be. Heres what you need to know to track down your old 401 and make it work in your favor again.

Contact Your Previous Employer For Information About Your Old 401

Permitting that your previous employer is still in operation, you can reach out to them directly. Typically, the human resources department will have information on your account or point you in the right direction.

Most companies try to reach out by sending mail regarding your account when you leave the company. If you moved when you changed jobs, you might have missed those notifications. If the company did not hear from you for an extended period, it might have transferred your funds to a separate, unmanaged account.

Also Check: Should I Roll My Old 401k Into My New 401k

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

How Can Plan Sponsors Avoid Having The Issue Of Lost Participants In The First Place

One of the most effective steps is to distribute benefits to former employees as soon as possible after termination of employment, before they have an opportunity to become missing.

The IRS has rules in place that dictate when terminated participants can/must take distributions of their account balances from 401 plans. Embedded within those rules are certain options that can facilitate the efficient payout of smaller balances to many former employees.

- Balance Over $5,000: Generally, a participant who has a vested account balance in the plan of at least $5,000 is permitted to keep their money in the plan as long as they wish, subject to Required Minimum Distributions on attainment of age 70 ½.

- Balance Under $5,000: Participants with balances below that threshold can be forced to take their money out of the plan as long as they are given appropriate notice 30 to 60 days prior to the payment.

For plans with $5,000 force-out option, it is important these are processed on a consistent and timely basis such as each quarter.

You May Like: Can I Roll A 401k Into An Existing Ira

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isn’t a good example of that mindset.

Exhibit “A” is the U.S. Department of Labor’s Abandoned Plan Database. The database can tell you if your company’s old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plan’s name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Searching The National Registry

Another place to try is the National Registry of Unclaimed Retirement Benefits . This is an online database you can use to search for an unclaimed 401k that you may have left with a previous employer. Youll need to enter your Social Security number to search for lost retirement account benefits.

In order for your name to come up in the search results, your former employer must have entered your name and personal information in that database. If they havent done so, its possible you may not find your account this way.

Also Check: How To Put 401k Into Ira

Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

Also Check: How To Pull From 401k