Confirm A Few Key Details About Your Massmutual 401

First, get together any information you have on your MassMutual 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Read Also: What 401k Do I Have

How To Generate An Signature For Your Generic 401k Enrollment Form In The Online Mode

Follow the step-by-step instructions below to design your 401k enrollment form purpose:

After that, your 401k enrollment form template is ready. All you have to do is download it or send it via email. signNow makes signing easier and more convenient since it provides users with a number of extra features like Invite to Sign, Merge Documents, Add Fields, etc. And because of its cross-platform nature, signNow can be used on any gadget, desktop computer or mobile phone, regardless of the OS.

Contributing To Both A Traditional And A Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

Recommended Reading: How To Move 401k To Ira Without Penalty

How To Create An Signature For Your 401k Opt

Follow the step-by-step instructions below to design your 401k opt-out form:

After that, your 401k opt-out form is ready. All you have to do is download it or send it via email. signNow makes signing easier and more convenient since it provides users with a number of extra features like Add Fields, Merge Documents, Invite to Sign, etc. And due to its multi-platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS.

How You Can Fill Out The 401k Opt

By utilizing signNow’s comprehensive solution, you’re able to execute any essential edits to 401k opt-out form, create your personalized digital signature in a couple quick steps, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

You May Like: Is It Better To Have A 401k Or Ira

How To Generate An Esignature For The Generic 401k Enrollment Form In Google Chrome

The guidelines below will help you create an eSignature for signing 401 k enrollment form in Chrome:

Once youve finished signing your 401k enrollment form purpose, decide what you wish to do next â save it or share the file with other parties involved. The signNow extension offers you a range of features for a much better signing experience.

How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employerâs matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

Donât Miss: When Can You Use Your 401k

You May Like: Where Should I Be With My 401k

S Two And Four: Income And Assets

Questions 3244 ask for the students and spouses income and assets . Step Four collects similar information about parent income and assets, so the following discussion also applies to parents.

If the student or his or her parent wasnt married in 2019 but is married when the application is signed, the student also needs to provide income and asset information for the new spouse. If the student or their parent was married in 2019 but is separated, divorced, or widowed when the application is signed, the student or parent excludes the income and assets for that spouse even though the information may be on the 2019 tax forms.

The FAFSA form asks for income and taxes paid according to lines on the IRS tax forms for 2019, the base year for 20212022. Data from the completed tax year is used as a predictor of the familys financial situation for the current year. In the rare instance that 2019 tax data is not available yet, best estimates can be used on the application. However, the student is asked to correct this information later when the tax return is filed.

When a student or parent has returns from both a foreign nation and the United States for the same tax year, they should use the data from the U.S. return when filling out the FAFSA form.

You May Like: How To Pull Out Of 401k

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Read Also: How Much Will My 401k Pay Me Per Month

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Read Also: Can I Borrow From My 401k To Refinance My House

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Don’t Miss: How Do I Transfer 401k To Ira

How To Fill Out The Generic 401k Enrollment Form Online:

By utilizing signNow’s complete platform, you’re able to perform any essential edits to Generic 401k enrollment form, make your customized electronic signature within a couple of quick steps, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

How To Make An Esignature For The Prudential 401k Withdrawal Form On Android Devices

Despite iPhones being very popular among mobile users, the market share of Android gadgets is much bigger. Therefore, signNow offers a separate application for mobiles working on Android. Easily find the app in the Play Market and install it for eSigning your prudential withdrawal form.

In order to add an electronic signature to a prudential 401k withdrawal, follow the step-by-step instructions below:

If you need to share the prudential hardship withdrawal form with other parties, you can easily send it by electronic mail. With signNow, you are able to eSign as many files in a day as you need at a reasonable cost. Start automating your signature workflows today.

Don’t Miss: How Do I Get My 401k When I Retire

Start With Your Plan Document

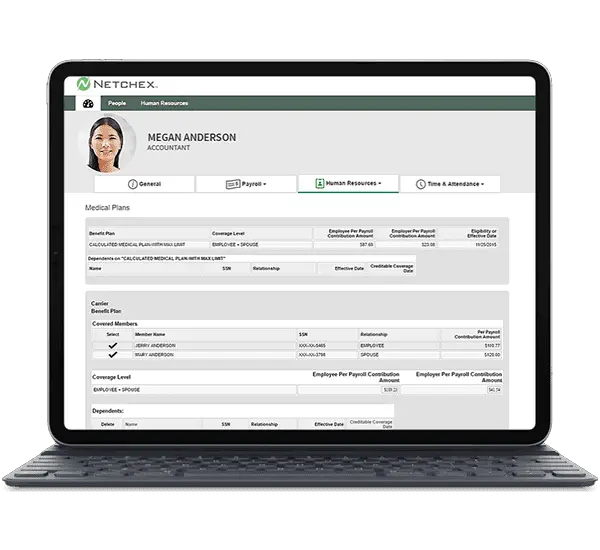

The best place to start making your 401 selections is your companys Plan Document. This document gives you all the important details specific to your companys retirement plan, like the employer match and vesting schedule.

Whats a vesting schedule? Its an outline for when the money your company contributes to your 401 is completely yours. The money you put into the 401 and its growth are always yours. But many companies require you to remain employed a certain number of years before the money they contribute to your 401 is 100% yours. With each year of employment, an increased percentage of the employer match is yours to take with you if you leave your job.

Many companies require you to remain employed a certain number of years before the money they contribute to your 401 is 100% yours.

The Plan Document also includes information about the fees related to your 401, the services available to you, and how to make changes to your 401 portfolio.

Your Action Step: The more you understand about the specifics of your 401 plan, the more confident youll be. If you dont have a copy of your Plan Document, contact your HR department. They should be able to give you a copy or tell you where to find one.

How To Fill Out And Sign Irs Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Choosing a authorized expert, creating an appointment and coming to the business office for a personal meeting makes completing a How To Fill Out A 401k Form from beginning to end stressful. US Legal Forms allows you to quickly create legally valid documents according to pre-created browser-based blanks.

Perform your docs in minutes using our straightforward step-by-step instructions:

Easily produce a How To Fill Out A 401k Form without having to involve experts. We already have more than 3 million users making the most of our unique collection of legal forms. Join us today and get access to the top library of browser-based blanks. Give it a try yourself!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Don’t Miss: Can An Individual Open A 401k Account

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

âMake sure that you still save enough on the outside for emergencies and expenses you may have before retirement,â says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. âDo not put all of your savings into your 401 where you cannot easily access it, if necessary.â

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, youâll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

How To Edit Your 401k Enrollment From G Suite With Cocodoc

Like using G Suite for your work to complete a form? You can integrate your PDF editing work in Google Drive with CocoDoc, so you can fill out your PDF just in your favorite workspace.

- Go to Google Workspace Marketplace, search and install CocoDoc for Google Drive add-on.

- Go to the Drive, find and right click the form and select Open With.

- Select the CocoDoc PDF option, and allow your Google account to integrate into CocoDoc in the popup windows.

- Choose the PDF Editor option to open the CocoDoc PDF editor.

Also Check: Which Investments Should I Choose For My 401k