Consider Using Roth Ira Withdrawals Instead

If you decide to use retirement funds to help buy a home, consider using money saved in a Roth IRA instead of a 401 or traditional IRA. Because Roth IRA contributions have already been taxed, youll have an easier time accessing this money.

Also, since money in your IRA isnt connected to your employer, you wont face a faster repayment period if you change jobs.

Transfer Your Funds With A Rollover Option

If you’re using your 401 to buy an investment property, you must first change your 401 plan to a self-directed IRA, which can be done with a few rollover options.

- Direct Rollover: This type of rollover allows for the 401 assets to be transferred directly to the self-directed IRA provider. This transfer will come in the form of a check that’s payable to the self-directed IRA provider. Taxes aren’t withheld from the total rollover amount.

- Indirect Rollover: If you receive your 401 assets from your plan administrator before the funds are sent to your self-directed IRA provider, around 20 percent in taxes is going to be withheld before you’re given the check. In this situation, your assets need to be deposited in your IRA within a period of 60 days. Otherwise, the IRS says the full amount is taxable.

How Much Can You Take Out Without Penalty

With a few exceptions, account holders will be expected to pay an additional 10% early withdrawal tax on early or premature distributions . In addition to the 10% penalty, the money taken out will be taxed as income for the year its withdrawn. Therefore, no money can be taken out before the age of retirement without penalty, unless the reason correlates to the exceptions above.

You May Like: How To Access Your 401k Account

How Can I Use My Retirement Account To Invest In Real Estate

Retirement investing in real estate is a broad concept that can involve many types of investment vehicles, varying amounts of risk, and different degrees of involvement required on the part of the investor. Here are a few examples.

1. You can invest your retirement account in real estate stocks, mutual funds or publicly traded REITs

This is the most common way of using a personal retirement account to invest in real estate.

If you own an IRA, you can simply use your account to purchase equity shares of real estate-related businesses. These could be publicly traded real estate development companies or mortgage companies, for example, or mutual funds or publicly traded REITs that are themselves invested in a basket of real estate businesses.

If you have a 401 through an employer, you might also be able to find real estate-related investment opportunities such as these in your plans available offerings. Generally speaking, however, an employer-sponsored 401 can have a more limited range of investment opportunities for you to choose from than your personal IRA might have.

This is the most passive and straightforward way to invest your retirement account in real estate. In essence, you can simply find stocks, bonds or mutual funds to purchase, just as you would with other types of traditional retirement investing. The only difference, in this case, would be that you have chosen real estate as the industry in which to invest.

Cash Out Current 401k Assets To Invest In Real Estate

It is true! QDROs are one of the exceptions that you can use to get at your money without a penalty. If you want to invest in after-tax real estate from your current employers 401k, use a QDRO and cash out to your spouses bank account. Of course, ordinary taxes are due when cashing out, but as the funds were accessed via a QDRO, there is no 10% penalty.

You May Like: How Do I Find All My 401k Accounts

Get A Bank Loan Inside Your Retirement Plan

Getting a bank loan inside a retirement plan is not very common. A Google search comes up with almost no information on the subject, and Iâm not surprised that a CFP on my payroll told me it wasnât possible. But Iâve since learned that depending on the plan documents, it is.

Here is how it works. The lenders qualify your eligibility using a 60-65% LTV and look at how much is in the retirement account to get the loan. Only certain banks offer these loans NASB is one of the most popular ones.

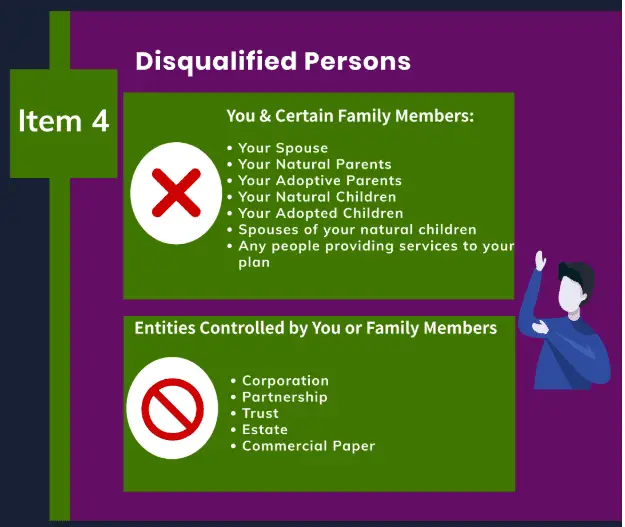

Retirement plans have many prohibited transactions that need to be considered in the loan, including not allowing disqualified persons to benefit, meaning yourself or an immediate family member. A disqualified plan pays hefty fines and loses the benefits.

The loan rates are higher , and flippers are vulnerable to UBIT tax but other than that, it is a viable lending option.

You can even utilize a 1031 exchange. All retirement funds, unless taxes are paid, stay inside retirement plans and the funds remain tax-deferred. A disadvantage is there is no depreciation capture opportunity, but a bonus is that the loan application is also only two short pages.

How To Use Your 401 Retirement Money For Real Estate Investing

13 September, 2019

If youre not feeling 100% satisfied with the return on investment youve been getting from assets currently held in your 401 account, and are tired of being restricted in the type of investments you are permitted to hold, its time to take control of your own financial future! Now, its easier than ever to roll money over from a 401 into a Self-Directed IRA which permits you to participate in real estate investing and offers a secure, proven path to earning ongoing tax-deferred retirement income. Investing in real estate also provides protection from ongoing stock market volatility along with essential diversification for your financial portfolio and a hedge against inflation.

Your 401 is limited to a few planets in the investment universe in all likelihood, you have the choice of a few mutual funds – mostly equity funds – and thats it, wrote Investopedia.With an IRA, most types of investments are available to you, .

Also Check: How To Get A 401k If Self Employed

Can You Use Your 401k To Buy A House Pros And Cons Explained

First-time homebuyers quickly learn the importance of having cash flow. Between a down payment of 3.5% up to the double-digit range and other closing costs, buying a home is one of the biggest investments most people make in their lifetime.

Its not surprising that consumers are willing to dip into their retirement savings accounts to achieve this milestone. However, even if you could access your 401k to buy a house, does that mean you should?

In this article, we will explore the answer to the question, Can I use my 401k to buy a house and what will happen if you do.

People Are Also Reading

Image source: Getty Images.

The first benefit is cash flow. A good real estate investment will produce positive cash flow for you most months. Unless you have a big repair or an extended vacancy, you’ll find a steady stream of rent checks coming in that more than offsets your expenses.

You can use that cash flow to invest in more rentals or buy assets like stocks and bonds. You could also use that cash to fund your lifestyle, pay for your necessities, or anything you want. If you invest in a rental property in your retirement account, you’ll limit your options for that cash flow. You’ll have to reinvest it in something unless you’ve reached the age at which you can withdraw funds without penalty.

The second benefit is the tax-efficiency of rental properties. You’re able to offset your revenue with a lot of expenses. That includes mortgage interest paid and depreciation of the property . If you use a tax-deferred retirement account, you won’t pay any taxes until you go to withdraw funds, but you won’t take advantage of some of the tax breaks either. You could therefore end up paying more taxes in the long run as a result.

Read Also: How To Borrow Money From Your 401k Plan

K Real Estate Investment Rules

Jump Ahead To

When considering buying real estate with a retirement account, it is best to know the real estate investment rules that govern the account you want to use for the purchase.

The rules that you have to be aware of when it comes to investing in real estate in your retirement accounts are prohibited transactions, repayment periods, borrowing amounts, and withdrawal penalties.

For instance, according to 401k real estate investment rules, you cannot purchase rental or commercial property.

You can however, use the funds in an employee sponsored 401k, a simple IRA, or a traditional individual retirement account or IRA to purchase your first home.

Additionally, it is possible to invest in a real estate investment trust REIT in your employer sponsored 401k if your company provides that as an option.

If you are interested in purchasing land, farmland, commercial property, or rental property you will either have to use a Solo 401k or a self directed IRA.

With a self directed IRA and a solo 401k, you can invest in and hold these types of properties.

With careful planning, rental properties can be added to your retirement assets to increase the value of your retirement accounts and support you when you are older.

The key is to research custodians who can handle alternative investments and help you set up these accounts.

The Pros Of Buying Property With A 401k

The primary benefit of buying investment property via a 401k is that youre able to do so by taking a loan that is both tax-free and penalty-free.

There are other tax benefits worth consideration. For instance, when purchasing a property with a 401k, any income generated from that property will not be taxed. Instead, the income is put directly into the 401k plan. This means that the owner never actually receives the income, but theyll have this income available in their 401k upon retirement.

However, there is one important exception to this rule: loans against a 401k need not be the only investment in a rental property. Lets say you take out the maximum loan amount and then use the proceeds to invest in a property that requires a $200,000 down payment. The property then generates $2,000 per month in rental income. The 401k would be entitled to $500 of that income each month. The remaining funds would be dispersed to other investors accordingly, even if the person investing is the only investor in the deal. In the latter case, the remaining 75% of rental income each month would flow back to him for use as he pleases.

Also Check: Can I Change My 401k Contribution At Any Time

What Is A 401k

A 401k is an employer-sponsored retirement plan that many, but not all, companies establish for their employees and often contribute some amount too. Upon enrollment in the plan, you can choose how much youd like to contribute either a set dollar amount or a percentage of your salary. That amount is then deducted from your paycheck and goes into your 401k investment plan on a pre-tax basis. As of 2019, people can invest up to $19,000 in their 401k each year.

Each plan has its own limited list of available investment options for you to choose from. If you do not select a specific plan, you will be auto-enrolled into a default investment selected by your plan provider.

The big thing to understand about a 401k is that you will be taxed upon withdrawing money from your account in retirement. It doesnt matter if the funds you withdraw came from your own contribution or the earnings from your investment in either case, the funds will be considered part of your gross income on your tax return and taxed accordingly.

What Is The Difference Between A 401 Loan And A 401 Withdrawal

When you withdraw money from your 401, you have to pay income taxes on the amount you withdraw and you may also have to pay a 10% early withdrawal penalty if you are not at least 59½ years of age. Unlike a 401 loan, you do not have to repay a 401 withdrawal, which can make this type of funding sound good to first-time homebuyers. Remember, though, the money you withdraw will no longer be there for you at retirement.

If your 401 is the only funding source you have, then you might consider buying your home using a 401 loan instead of a 401 withdrawal. Before considering this option, however, remember to check to see if your 401 plan allows for a loan. These often allow you to borrow up to half the value of your vested balance, and repay yourself, with interest. While most 401 loans require repayment within 5 years, for some first-time homebuyers, that period may be extended.

Recommended Reading: Should You Borrow From 401k To Pay Off Debt

A Qdro To Cash Out A 401k

The concept of using an in-marriage QDRO is not made up. Estate lawyers have trademarked a different term for a happily married QDRO.

Briefly, a QDRO is a state-specific document usually used to separate qualified assets in a divorce. There is no mention of divorce in IRS language, however, and real estate investors are using it to cash out 401k plans penalty-free.

How To Pay For Repairs On Your Rental Properties

Im not a CPA, and I definitely suggest asking one this question about saving money for repairs without taking a big tax hit. But I can tell you what I do, personally I dont have an extra account that has a lot of reserves for repairs. Instead, I use a business credit card to pay for any extra expenses that pop up throughout the year. Additionally, its important that you consider other ways to reduce your overall tax burden. Check out this episode on The Buy Til You Die Strategy, and be sure to check out our friends at WealthAbility if you need a smart tax team on your side.

Read Also: How Do I Roll Over My 401k

Frequently Asked Questions For Solo 401k Real Estate Investment

What is Tenancy-in-Common Ownership?

This provides you with an opportunity to purchase real estate with Solo 401K and personal funds. Ownership will be split per the agreement . Thus, all expenses and income will be split according the percentage agreement between the owners. This arrangement allows you to invest with certain family members. It is important to follow the percentage split agreement for expenses and income.

What is a Non-recourse Loan?

This allows the Solo 401K the opportunity to obtain a loan from an investor or a bank to purchase Real Estate. Much like normal collateral, if the loan is not paid back, the lender has the right to take ownership of the real estate. However, one very important note is that the lender has no recourse to touch your Solo 401K assets. Only the real estate used as collateral is at risk, not your Solo 401K.

Is it permissble under IRS rules to use a Solo 401K to Invest in Real Estate?

If the Solo 401K Plan Documents allow it, then yes you can use it to invest in Real Estate. A Solo 401K is also referred to as a Self-directed 401K. For a Solo 401K plan, the IRS lists approved investments. Under ERISA, or the Employee Retirement Income Security Act , certain rules apply to investments in retirement plans. Those rules include that you cannot invest in art, gems, antiques, coins, and other collectibles or alcoholic beverages. Although it is permittable to invest in precious metals, if meeting the requirements outlined in IRC Section 408.

Use A 401 Loan To Invest 401 In Real Estate

Most plans permit you to take a loan against your 401. This loan does not incur any early withdrawal penalties and does not count as a distribution. Instead, the plan administrator amortizes it and sets the interest rate . Through payroll deductions, youll pay yourself back the loan. Its worth noting that any interest you pay to yourself also goes back into your 401 account. It does not go to the financial institution.

IRS guidelines permit taking out $50,000 or half your 401 balance, whichever is less. Assuming you have more than $100,000 in your 401, you could take out a $50,000 loan and invest that money in a real estate syndication, for example. Since most real estate syndications run for about five years, youd typically be able to make the loan payments with rental income and then have the final sale of the building free and clear.

While no investment is guaranteed, its conceivable that at the end of the five years, youd have $50,000 in non-retirement fund cash plus your 401 loan paid off. That 401 loan could be the seed money necessary to jumpstart your real estate investing career!

Also Check: What Happens To My 401k If I Leave My Job

What Are The Requirements To Buy A Property With An Ira

Pursuant to the Employee Retirement Income Security Act of 1974 , the custodian of a self-directed IRA is free to invest however he or she pleases. If your IRA is managed by a third-party, the custodian may not allow you to invest in real estate. But theres no legal reason why you cant. A growing number of financial firms are offering self-directed IRA plans that make it easier to invest in real estate through your IRA.

The rules around buying real estate through your IRA are somewhat complicated. The government wants you to have at least an arms length distance from the investment. As such, if you purchase real estate through an IRA, you cannot live in or actively manage the property. Technically, the title to the property is held by a custodian for the benefit of the IRA . You must also hire a third party to handle all operations. Any revenue generated by the property whether it be rental income or sales proceeds must flow back to the IRA to protect the tax-deferred status of the account.