Understanding The Different Investing Options

The average 401 plan provides about 19 different investment options to choose from. Unless the plan has a default investment option, your contributions could sit in your 401 as cash without being actually invested in anything.

If your contributions are automatically invested in a particular fund, you can always change what your money is invested in. If your 401 plan has an online portal, then you can research different funds and move your money as you please. If not, youâll have to contact your planâs custodian to facilitate moving your money to other investment options.

Your 401 planâs summary plan description will outline the default investment options, the other available investment options, and how to move your money to various funds. Some of the most common funds provided in 401 plans are target-date funds, mutual funds, index funds, and bond funds.

Pick The Right Retirement Stocks Without Emotion Or Guesswork

If we could only provide one retirement investment strategy, it would be this one. One of the best ways to grow your retirement savings is to carefully pick retirement stocks. But picking stocks can be a daunting task especially if you dont have a lot of experience with investing. So many individuals have watched their retirement accounts dwindle down as theyve made poor stock choices.

Fortunately, it doesnt have to be this way. We can help you effortlessly identify the best stocks for retirement without spending all day filtering through charts and tracking technical trading indicators. Without any guesswork, without any emotion. Just tried and true investing principles with decades of results to back them up.

VectorVest is stock forecasting software that simplifies investing and eliminates emotion or guesswork from your strategy. Instead of getting overwhelmed by how complex and time-consuming technical analysis is, you just rely on three simple ratings: relative value , relative safety , and relative timing . These ratings contribute to a clear buy, sell, or hold recommendation for any given stock, at any given time.

This alone is powerful. But it gets even better as we dont make you find these stocks on your own, we bring them to you with our pre-built stock screeners. We have stocks picked out specifically for retirement, too. You can literally just pick our top retirement stocks and set yourself up for a comfortable, lucrative retirement.

Calculate Your Risk Tolerance

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you don’t want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

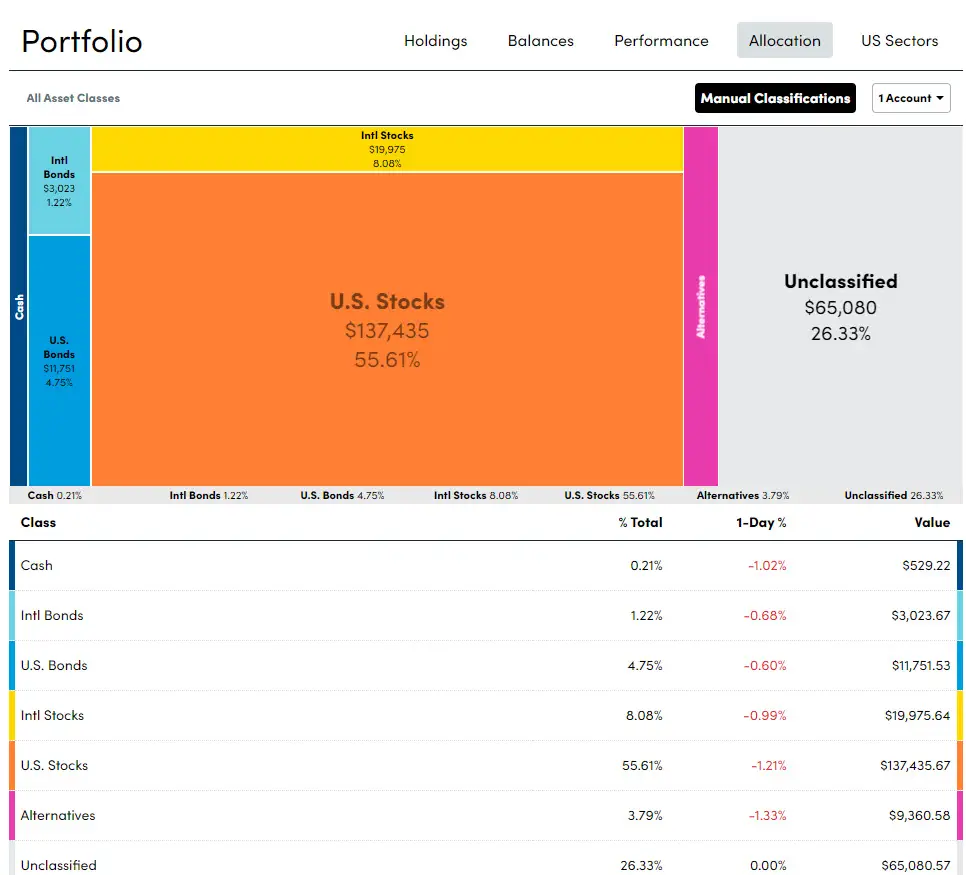

You’ll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in “safer” investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until you’re going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When you’re older, you’ll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.

Don’t Miss: How Much Can I Put In My 401k Per Year

The 411 On 401 Upsides

Retirement plans are a great way for employers to attract and retain top talent. Employers should also consider the tax benefits of offering a 401 plan, particularly the advantages of matching employee contributions. To ensure compliance, businesses must evaluate the hours of full- and part-time employees when determining who is eligible for company-sponsored retirement plans. But by following the tips above, youll reap the rewards of offering this valuable retirement benefit to your employees.

Kimberlee Leonard contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

You May Like: Is There A Fee To Rollover 401k To Ira

Understanding Reverse Ira Rollovers

Rolling the assets in an IRA account over into a 401 is sometimes referred to as a reverse rollover. Thats because its far more common, at least nowadays, to move assets in the opposite directionfrom a 401 to an IRA. This often happens when an employee leaves a job or decides they would like more investment options than a strict corporate 401 offers.

Its certainly possible to move assets between other types of retirement accounts, though. However, its important to check if your employers 401 accepts this kind of incoming transfer. Some plans do, but others do not. The IRS also provides guides as to what kinds of transfers are allowed and how to report them.

As this guidance states, you are only allowed one rollover in any 12-month period, and you must report any transaction when you submit your annual tax return for both direct and indirect rollovers. If you move assets out of your IRA to put them in your 401 or use them for another purpose, your IRA brokerage will send you a Form 1099-R that will show how much money you took out. On your 1040 tax return, report the amount on the line labeled IRA Distributions. The taxable Amount you record should be $0. Select rollover.

Though this maneuver is unusual, it can have advantages in some circumstances.

Read Also: How Long Will My 401k Last Me In Retirement

Don’t Miss: How To Rollover 401k To Ira Fidelity

Convert Old 401s To Roth Iras

Lets pretend that youve changed jobs at least once in your career, and you still have a 401 from a former employer. If you have enough cash on hand, you can convert that 401 into a Roth IRA. Since the money in that 401 wasnt taxed when you first put it into the account, youll pay taxes on that money when you convert it to a Roth IRA. Doing that rollover is not complicated. Youll have to make some phone calls and fill out some paperwork.

Why would you want to convert that old 401 into a Roth IRA? There are a couple of reasons.

Remember this: converting is an option only if you have the cash on hand to pay the taxes. If you dont have enough, try Door #3.

Dont Miss: How Do I Access My 401k Account

Should You Invest In Company Stock In Your 401

This is part two of a two part series on 401s: determining if you should invest in your company stock in your 401.

If you missed part one, you can find it here. We highlight the five things you should do before maxing out your 401.

Maybe well do a part three. Not sure yet If you have any ideas or questions or 401s then let me know!

Anyway, to the topic at hand.

While in this article we are focusing on whether or not you should invest in your company stock in your 401, this is also a broader topic. It includes if you should invest in your company stock at all .

Well dive into all of that and more, but first, a quick refresher on 401s. If youre already a 401 expert, you can skip ahead to the next section of the article.

And, if you havent heard of Blooom, theyre a 401 robo-advisor that can give you a free 401 check-up, offering great tips and advice on how to optimize your 401. You can get your free analysis with them below:

Not Sure if Youre Doing this 401 Thing Right?

You May Like: How Does A 401k Retirement Plan Work

Can I Buy And Sell Stocks In My 401k

Asked by: Dr. Brendan Vandervort

Because you can buy and sell stocks whenever you want in a 401, you can use a day-trading strategy. Day trading in a 401 has a potential tax benefit over day trading in a regular brokerage account. … When you make a gain in your 401, you don’t owe taxes on the gain as long as the money stays in your account.

How Much Can I Contribute To A 401 Plan

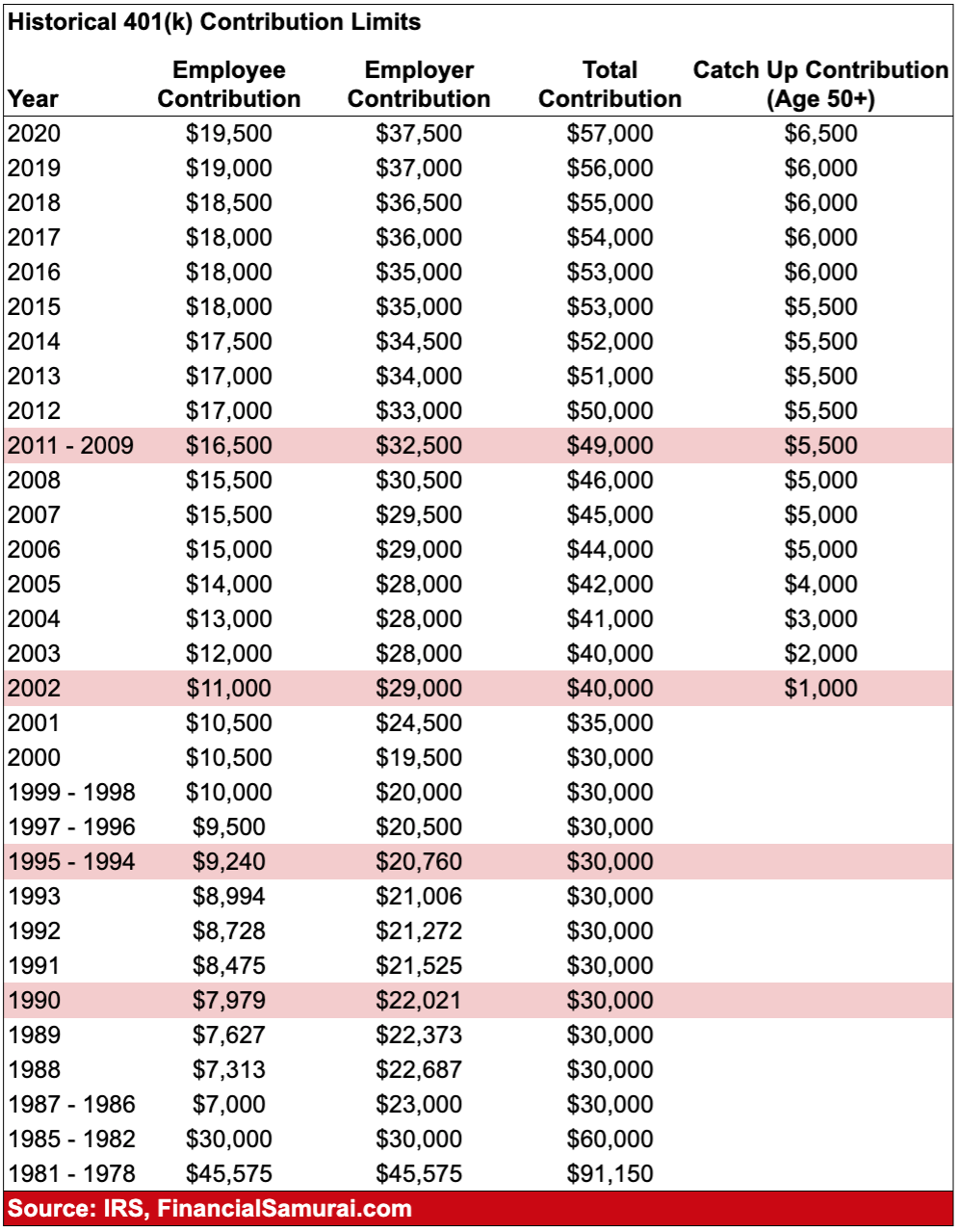

401 plan accounts have higher contribution limits than individual retirement accounts . In 2021, you can set aside up to $19,500 across your 401 plan accounts.

To boost your contributions even further, you might consider catch-up contributions. If you are 50 or older, you can contribute an extra $6,500 to your 401 account. This increased limit can help increase your savings as you near the retirement finish line. But you dont actually have to be behind in your savings to take advantage of catch-up contributions.

Also Check: Charles Schwab Investment Management Reviews

You May Like: What Does 401k Benefits Mean

Don’t Try To Time The Market

There’s a reason why you may have heard this many times: Investment professionals show that timing the market or trying to guess when stocks are at their top or bottom is nearly impossible. Research has shown that people who dump stocks during a market downturn are likely to miss the days when the market rises sharply, and that can make a dent in long-term returns.

For instance, one study published by the investment organization CAIA found that a buy-and-hold investor would have an annual return of almost 10% from 1961 to 2015. But an investor who tried to time the market and missed the 25 best days during that period would have an annual return of less than 6%.

To be sure, if an investor managed to avoid the worst 25 days during that period, their annualized return would have been more than 15%. But predicting both the worst and best days of the market is notoriously difficult, which is why investment pros recommend sticking with the “buy and hold” strategy.

When You Should Not Invest In A Down Market

Now for the scenarios when you shouldn’t invest in your 401 during a down market. It can be a bad idea keep investing when you have low cash reserves and your job outlook is unstable or you’re planning to retire soon.

- Low cash reserves: You should have enough cash on hand to cover three to six months of living expenses. If you don’t, it might make sense to lower or pause 401 contributions to build up your cash.

- Unstable job outlook: If you’re worried about getting laid off and you have low cash reserves, don’t lock up too much money in your 401. It’s counterproductive if you end up taking a hardship withdrawal later. Save in cash until you’re comfortable you can survive temporarily without your job.

- Retiring within five years: When you retire, you take distributions. To fund those distributions, you normally must sell shares. It’s not ideal to liquidate in a down market, because you get less cash in those transactions. You might have the option to delay retirement. In that case, it’s appropriate to keep investing. If you can’t or won’t delay retirement, you might trim your 401 contributions in favor of higher cash deposits. Your cash fund can cover some of your living expenses if the down market lingers.

Don’t Miss: How Do I Access My 401k Funds

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Choose Your Asset Mix Carefully

Its essential to think about your asset mix, which simply means the different types of investments that go into your portfolio. For example, investing in stocks may help you grow your retirement fund faster, but if they drop substantially, you could also see plenty of losses. Thats why its essential to choose your asset mix wisely and make sure there are different types of investments in your portfolio.

Some tips about how to choose assets are:

Invest more in stocks when youre young.

When deciding how to allocate your funds, a general rule of thumb is that the younger you are, the more you can invest in stocks. This is because stocks offer much higher returns than other assets and have always shown a historical tendency to go up. However, they can also crash the hardest, which is unacceptable for someone who is reaching retirement age.

However, if youre young, you can afford to take on more risk and even some temporary losses because its almost a certainty that stocks will end up climbing again in the future. If you keep a long-term mindset, youre bound to end up winning in the end.

As you get older, choose safer investments.

Investing in low-cost index funds will provide you with an average return without taking on too much risk. But if you really want to reduce risk as much as possible, investing in bonds or bond funds rather than stocks or stock funds is the way to go.

Don’t Miss: How To Get A 401k On Your Own

Should I Change My Asset Allocation

This could be a good time to talk with your financial adviser about your goals and to check whether your portfolio aligns with those objectives, experts say. That could result in an asset allocation shift if, for instance, you want to reduce your equity exposure to lower your risk or cut back on investments in certain sectors, like tech.

“For most investors, the best approach to long-term success is broad diversification that aligns with their risk tolerance,” Richardson said. “When you diversify your portfolio, you spread your money across different assets, understanding that all investments will go up and down at different times depending on different factors.”

People who are close to retirement or already retired may want to add Treasury Inflation-Protected Securities, or TIPS, to their portfolio, she added. Investors can buy TIPS directly through the Treasury Department, or via their bank or broker. But an investor can only buy $10,000 worth of TIPS annually for each account, which limits the amount of inflation protection they can offer.

“Commodities are also a good offset to inflation,” Richardson added.

What Is The Best Company To Invest In 401k

The 6 Best Solo 401 Companies of 2021

- Best Overall: Fidelity Investments.

- Best for Low Fees: Charles Schwab.

- Best for Account Features: E*TRADE.

- Best for Mutual Funds: Vanguard.

- Best for Active Traders: TD Ameritrade.

- Best for Real Estate: Rocket Dollar.

Why investing in a 401k is a bad idea?

Theres more than a few reasons that I think 401s are a bad idea, including that you give up control of your money, have extremely limited investment options, cant access your funds until youre 59.5 or older, are not paid income distributions on your investments, and dont benefit from them during the most

Can you lose your 401K if the market crashes?

Surrendering to the fear and panic that a market crash may elicit can cost you more than the market decline itself. Withdrawing money from a 401 before age 59½ can result in a 10% penalty on top of normal income taxes.

Can you lose all your money in a 401k if the market crashes?

Don’t Miss: How To Calculate Employee 401k Match

Be Aware Of The Fees Associated With Your Plan

The goal of investing in a 401 plan is to grow your money over time through investments. Because its an active investment , there are fees included. Your plan negotiates these fees on your behalf. They can include amounts needed to cover administrative costs and management expenses. While you dont have complete control over the fees in your 401 plan, its important to be aware of what youre paying. If youre choosing your own investments, look at fees and returns to ensure that you get what you pay for.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Don’t Miss: Is An Annuity The Same As A 401k

How Do Day Traders Pay Taxes

How day trading impacts your taxes. A profitable trader must pay taxes on their earnings, further reducing any potential profit. … You’re required to pay taxes on investment gains in the year you sell. You can offset capital gains against capital losses, but the gains you offset can’t total more than your losses.