Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Read Also: When Can I Set Up A Solo 401k

Fidelity Funds Are Renowned For Their Managers Stock

Fidelity celebrates good stock picking. The firm holds a contest every year for its portfolio managers: They get 60 seconds to pitch one idea, and the best pitch wins a dinner for four. The best performer after 12 months also wins dinner.

Maybe thats why many of the best Fidelity funds stand up so well in our annual review of the most widely held 401 funds.

Here, we zero in on Fidelity products that rank among the 100 most popular funds held in 401 plans, and rate the actively managed funds Buy, Hold or Sell. A total of 22 Fidelity funds made the list, but seven are index funds, which we dont examine closely because the decision to buy shares in one generally hinges on whether you seek exposure to a certain part of the market.

Actively managed funds are different, however. Thats why we look at the seven actively managed Fidelity funds in the top-100 401 list. We also review seven Fidelity Freedom target-date funds as a group as they all rank among the most popular 401 funds. And we took a look at Fidelity Freedom Index 2030 it has landed on the top-100 roster for the first time, and while its index-based, active decisions are made on asset allocation.

This story is meant to help savers make good choices among the funds available in their 401 plan. It is written with that perspective in mind. Look for our reviews of other big fund firms in the 401 world, which currently include Vanguard, and will soon include American Funds and T. Rowe Price.

Will You Be Able To Add Crypto To Your 401

Though Fidelity will make it possible to add Bitcoin to 401 accounts, this doesnt mean that every employee whose plan is overseen by the company will be able to do so.

Thats because 401 accounts are ultimately the responsibility of employers, who have a fiduciary responsibility to their employees. At the moment, most analysts predict that most companies wont allow their employers to add Bitcoin at least not right away. Though Bitcoin might be suitable for some employees, its unlikely to be a responsible investment for those close to retirementand because of the way that most employers administer 401 plans, the same investment options must be open to all plan participants.

These concerns have recently been echoed by the Department of Labor. Though the federal agency hasnt gone as far as banning crypto from retirement plans, it issued a compliance assistance document in March 2022 that reminded plan overseersthat is, employers who must act solely in the best interest of participating workersthat they were responsible for choosing prudent options. And it strongly suggested that cryptocurrencies didnt yet appear to meet that bar.

The net effect of these concerns is that most employees wont be able to add Bitcoin to their 401 accounts anytime soon.

Recommended Reading: Should I Transfer 401k To New Employer

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. SmartAssets financial advisor matching tool makes it easy to quickly connect with professional advisors in your local area. If youre ready, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Also Check: What Is A Good Percentage To Put Into 401k

Placing Real Estate Investment Question:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Don’t Miss: How To Calculate Rate Of Return On 401k

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

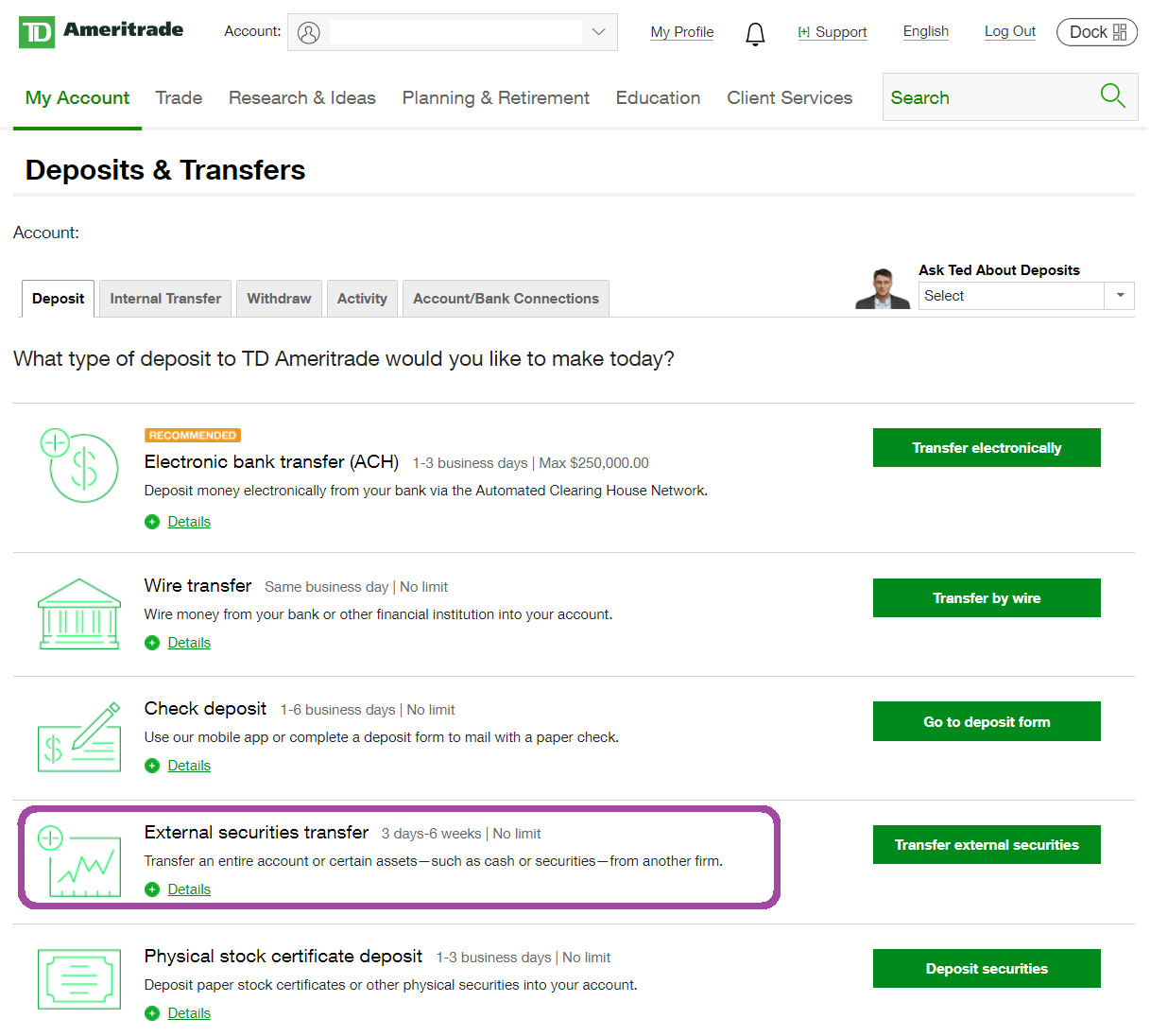

Transfer An Account To Fidelity

Whether you have a retirement account from a former employer or a brokerage account at another financial institution, we can help you easily transfer your accounts to Fidelity.

Transfer investment or retirement accounts

When you transfer an individual retirement account , a brokerage account, or a health savings account to Fidelity, its called a transfer of assets. You can choose to transfer just some of your account, or all of it.

Before you begin

Make sure you have a recent statement from your current firm so you can easily find the information well need to process your transfer.

Read Also: How Can I Find My 401k

Read Also: Can I Open A Solo 401k

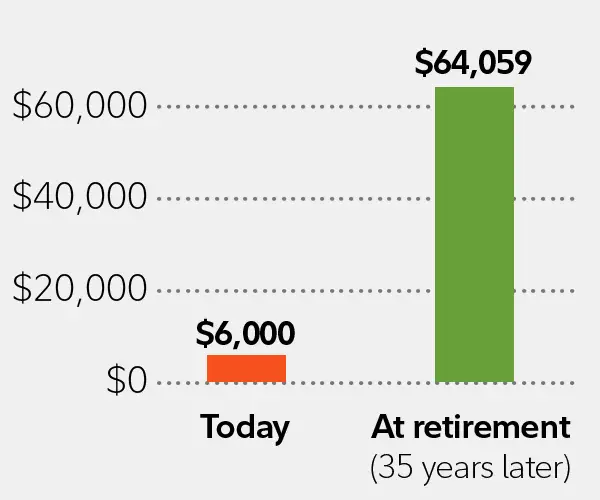

How To Stash More Cash In Your Workplace Savings Plan

Of all the factors that influence the size of your nest egg, you control the one that matters most: How much you contribute to it. You can save whatever you like each year, up to the pre-tax contribution limit set by the IRS.

Your current income and monthly budget will have a lot to do with how much you can save. But if you’re trying to find ways to save more, here are a few things to consider:

- Take advantage of your employer contribution, if your plan offers it. Your employer may match some, or all, of what you contribute, making this one of the fastest ways to boost your balance.

- Automate your savings. Setting up automatic contributions each month and automatically increasing your contributions by 1% or more each year are great ways to save, since the money goes directly to your retirement account.

- If you’re 50 or older, catch up on your contributions. Saving later in life can still pay off. You may be able to contribute an additional amount each year, depending on the plan you’re in.

One final note: If you’re a high-income earner and already reaching the contribution limit, avoid maxing out early. Find out how your employer contributes to your account and spread out your deferral so you don’t miss out on employer contributions.

How To Withdraw Money From Fidelity Fidelity Withdrawal Fees

While depositing money to a brokerage account is free in most cases, this is not necessarily always true for withdrawals. International bank transfers and wire transfers in particular can sometimes incur high fees, so always check carefully if this is something that would apply to your transactions.

We have good news for you: basic withdrawal at Fidelity is free of charge. See the table below for details and possible exceptions, as well as how Fidelity compares with some of its immediate competitors.

Fidelity withdrawal feesRecommended Reading: Does Having A 401k Help You Get A Mortgage

What Are The Risks Of Including Bitcoin In Your 401

Cryptocurrency is a risky and speculative asset that has proven its volatility time and time again. Bitcoin hit a high of $20,000 in 2017 before crashing to below $5,000 the next year. In 2021, it surged to around $68,000 per coin at its peak, but is now trading around $38,000. A 10% drop in a day is not uncommon.

The digital asset also isn’t regulated in the same way stocks and bonds are, and that unclear regulatory landscape makes crypto’s future uncertain. Earlier this year, President Joe Biden signed an executive order to establish the first-ever federal U.S. strategy on cryptocurrencies, and that effort is ongoing.

Levine says investors need to understand that there’s a difference between financial experts saying bitcoin doesn’t belong in 401s and saying that you shouldn’t invest in cryptocurrency in general, adding that he’s not “anti-crypto” himself.

It’s one thing to invest at most 5% of your overall investment portfolio in cryptocurrency via a brokerage account or even a self-directed individual retirement account . It’s quite another to invest money you’re relying on for your future in such a speculative asset via your 401.

As mentioned, there are risks to the plan sponsors, too.

Handling A Previous 401k

You usually have a few options when it comes to handling a 401k from a former employer. These include leaving the 401k where it is, rolling it into a taxable or nontaxable Individual Retirement Account or transferring it to a 401k with your current employer and cashing it out. Of all your options, cashing out will cost you the most now and in the future. You will have to pay income taxes on the withdrawal along with a 10 percent early withdrawal penalty. Youll also lose the tax benefits offered by the 401k as a qualified retirement plan.

Also Check: How Much Should I Have In My 401k At 55

How To Withdraw Money From Fidelity Fidelity Withdrawal Options

Withdrawal via bank transfer is by far the most common option. It is available at basically all brokers, and Fidelity is no exception.

You can also withdraw money to electronic wallets. This is a nice feature that isn’t available at all brokers. At Fidelity, you can withdraw money to the following electronic wallets: PayPal.

Speed also matters. Unlike some deposit options, withdrawal is rarely instant. It usually takes at least 1 business day, but often several business days for your money to arrive.

We tested withdrawal at Fidelity and it took us 2 business days, which is considered fairly average.

To withdraw money from Fidelity, you need to go through the following steps:

- Log in to your account

- Select ‘Withdrawal’ or ‘Withdraw funds’ from the appropriate menu

- Select the withdrawal method and/or the account to withdraw to

- Enter the amount to be withdrawn, and, if prompted, a short reason or description

- Submit your request

Please note that you may only withdraw money to accounts that are in your name.

If You Get Terminated From Your Job You Have The Option Of Cashing Out Your 401 However This Is Probably Not The Smartest Move

Image source: Andrew Magill.

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you havent reached 59 1/2 years of age. This includes any money youve contributed and any vested contributions from your employer plus any investment profits your account has generated. However, you may face a 10% early withdrawal penalty from the IRS for cashing out early, so this might not be the best option. Heres what you need to know to make an informed decision about your 401 after youre no longer with your employer.

How to cash out and the implications of doing soThe procedure for cashing out is usually rather simple. All you need to do is contact your plans administrator and complete the necessary distribution paperwork. However, there are a few things you need to keep in mind, especially regarding the tax implications of cashing out.

Unless your 401 is of the Roth variety, all of the money you withdraw will be treated as taxable income, no matter how old you are or the reason for the withdrawal. So, even if you are older than 59 1/2, its important to consider how cashing out will affect your tax status for the year. If you have a large 401 balance, cashing out could easily catapult you into a higher tax bracket. Your plan provider will be required to withhold 20% of the amount you cash out for taxes , and will also file a form 1099-R to document the distribution.

You May Like: How To Transfer 401k To Bank Account

You Can Still Withdraw Early Even If You Get Another Job

You arent locked in to early retirement if you choose to take early withdrawals at age 55. If you decide to return to part-time or even full-time work, you can still keep taking withdrawals without paying the 401 penaltyjust as long as they only come from the retirement account you began withdrawing from.

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Don’t Miss: Can I Roll Money From 401k To Roth Ira

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if youre cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.