Downsides To 401 Loans For Home Buying

While youre paying back the 401 loan, you usually cant make new contributions to your retirement account. And that means your employer wont be matching contributions, either.

All told, you could miss out on five years or more of retirement contributions and five years of compound interest on those funds which will likely make a big dent in your savings later in life.

Qualified 401 loans are penalty free. But if you leave your current company or are laid off while you have an outstanding 401 loan, the repayment period shortens. In that case, youd have to repay the loan by that years tax filing date.

- For example, if you take out a 401 loan on October 1, 2022, then leave your job on December 1, 2022, your entire loan would need to be repaid by April 15, 2023

If your 401 loan is not repaid by its due date, the remaining balance is treated as a 401 withdrawal, meaning its taxable income and subject to a 10% penalty.

Restrictions On Investment Returns

When you enrolled in your 401, you should have received a Summary Plan Description which tells you what you can and can’t do with your plan contributions and balances. In some cases, you will not be earning investment returns while you are repaying the 401 loan.

Similarly, you may also be restricted from making new 401 contributions until the loan is fully repaid.

Be sure to speak with your Human Resources department or your financial investment planner for clarification on anything that may seem confusing.

If I Dont Use My 401 To Buy A House When Can I Use My 401

Put simply, 401s are meant to be retirement accounts, meaning that the money is ideally supposed to be used when you reach retirement age. The early withdrawal taxes that 401s and IRAs use are supposed to incentivize you to leave the money untouched until you reach retirement age.

However, hardship withdrawals do exist to allow you to borrow money early under extenuating circumstances.

Read Also: Should I Take A Loan From My 401k

Ask For Money From The Seller

Whether or not you decide to pull from your 401 for your home purchase, if you truly feel that youre unable to afford the upfront costs of buying a home, it may be a good idea to ask for money from the seller. In this scenario, the seller will pay for a portion of your closing costs upfront and raise the sale price of the home accordingly, which will allow you to pay for your closing cost overtime in the form of a slightly- higher mortgage payment.

While this may sound like a good deal, its important to note that its usually not recommended to go this route unless its absolutely necessary. Often, asking for a seller concession makes your offer appear weaker in the eyes of the seller and may make you less competitive in a hot market.

Using Your 401 To Buy A House: A Guide

If youve been dreaming of owning a home, youve probably imagined yourself cooking in the perfect kitchen or having a fenced yard for the dog. But making that dream come true requires an incredible financial commitment and the first step is to cobble together the cash youll need for a down payment and closing costs.

You may be wondering whether you should consider using the money in your retirement account toward the purchase of a home. Before you decide, you need to be aware that there are both financial and legal considerations to take into account.

Lets examine the pros and cons, and see whether using a 401 to buy a house is right for you.

Also Check: How Do You Take A Loan Out Of Your 401k

Withdrawing From A 401

The first and least advantageous way is to simply withdraw the money outright. This comes under the rules for hardship withdrawals, which were recently made a little easier, allowing account holders to withdraw not just their own contributions, but those from their employers. Home-buying expenses for a “principal residence” is one of the permitted reasons for taking a hardship withdrawal from a 401.

-

You owe income tax on the withdrawal.

-

The withdrawal could move you to a higher tax bracket.

-

If you are younger than 59½, you also owe a 10% penalty on the money you withdraw.

-

You can never repay your account and lose years of tax-free earnings on the money you withdraw.

If you withdraw money, however, you owe the full income tax on these funds, as if it were any other type of regular income that year. This can be particularly unappealing if you are close to a higher tax bracket, as the withdrawal is simply added on top of the regular income. There is a 10% penalty tax, also known as an early withdrawal penalty, on top of that if you are under 59½ years of age.

401 plans do not have a first-time homebuyer exception for early withdrawals, but IRAs do.

How To Rollover A 401 In 4 Steps

While using a 401k withdrawal for home purchases is possible, its not always the best choice. That said, it is possible to rollover a 401 into another account thats more friendly for prospective buyers. Fortunately, rolling over a 401 is not very difficult, if you know what needs to be done. Here are the four steps to successfully rollover a 401:

Choose An IRA Provider

Start Investing

You May Like: Can You Roll Over Your 401k To An Ira

Using Money From An Ira

If you have a traditional IRA, Barzideh says you can borrow up to $10,000 for a down payment without paying a tax penalty if you are a first-time homebuyer, although you will have to pay income tax on the loan. If you are married, each spouse can borrow up to $10,000 for a total of $20,000.

Johnson says withdrawing money from a traditional IRA is the least advantageous way to access your retirement savings because of taxes. He says withdrawing funds from a Roth IRA is the most advantageous because the withdrawal of any contributions to the account is tax-free and penalty-free.

“The problem is, Roth accounts are capped so that higher-income people cannot have them,” he says. “That means you may not be able to replace the money in the account with future deposits.”

Withdraw From Your Ira

Even though your IRA is still retirement savings, there may be advantages to choosing this investment vehicle over your 401k. In particular, if your Roth IRA plan allows for hardship withdrawals, you’re allowed to withdraw any amount. However, even if hardship withdrawals are not allowed under your plan, as long as you’re a first-time homebuyer, you can withdraw up to $10,000 tax-free to go toward your down payment.

On the other hand, if you have a traditional IRA, you also have the option of taking out up to $10,000 to go toward your down payment. You won’t be required to pay any early withdrawal penalties on this money, but it will be taxed as income. If you take out a distribution larger than $10,000, you will pay a penalty and regular income tax on that amount.

Recommended Reading: How To Transfer 401k From Old Job

K Loan: Pros And Cons

The first way to borrow from your 401k is to take out a loan. As the name suggests, some of this method involves borrowing the money temporarily and then paying it back with interest over time. We’ve listed the pros and cons of choosing to take out a loan so you can get a better idea of how this process works.

Can I Use A 401 To Buy A House

If you have a 401, then you already know its a type of retirement savings account sponsored by your employer. Over time, you contribute a predetermined amount from each paycheck, and your employer may even match some of your contributions to help fund the account.

Your 401 account can be a powerful tool when it comes to financial goal-setting and retirement planning. Not only do the funds in this account earn money over time, this type of savings account comes with some key tax advantagesnamely, contributions you make into a 401 come from your gross income as an employee.

In other words, your money can grow tax-free. And because taxes havent been taken out of this money yet, the entire sum of your contributions can be written off to reduce your total taxable income at the end of the year. You dont have to pay taxes on the money you put into a 401 or the earnings that accrue in that account until you withdraw it later in life.

For many people, a 401 account contains the largest percentage of their total savings portfolio. If thats the case for you, it might be tempting to put that money toward a worthwhile purchaselike buying a new home.

While it is technically possible to make an early withdrawal and put money from your 401 toward your home purchase, there are also some serious downsides to this tactic.

You May Like: Can You Transfer An Ira Into A 401k

You Can Drop Or Refinance Pmi

If you have a conventional loan, you can drop private mortgage insurance once you build 20% equity in your home. And servicers automatically cancel PMI once you reach 22% home equity.

If you have an FHA loan or USDA loan with permanent mortgage insurance, you could get rid of it by refinancing into a conventional loan later on.

PMI is temporary, but the effects of pulling funds from your 401 could have permanent consequences.

Withdrawal To Buy A House

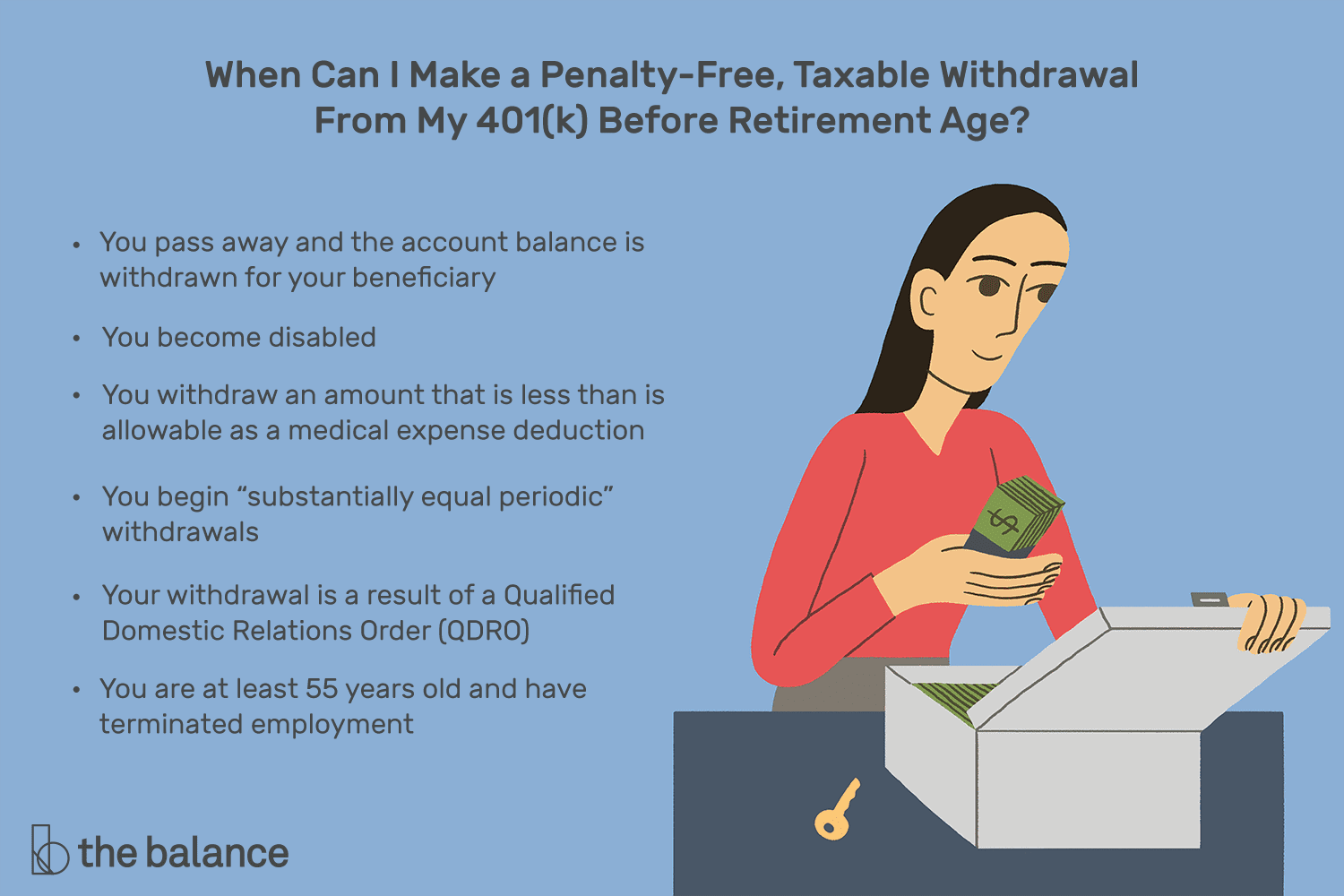

Usually, youre not supposed to withdraw funds from your 401 until age 59. If you lose or leave your job, you can withdraw at age 55. Any withdrawal before this gets a 10% early withdrawal penalty, plus taxes you must pay on any 401 withdrawal.

If you need more than $50,000 or your 401 provider does not allow loans, then you will need to make a withdrawal. This has special rules its called a hardship withdrawal. Usually, the IRS allows it if you need money to pay for a primary residence.

There are two drawbacks:

- Youll almost certainly pay a 10% penalty exceptions are available, but they are rare

- Youll owe income tax on the amount, which cannot be more than your financial need

In effect, this means youll end up paying income tax on your withdrawal out of pocket, no matter how much you need to spend. Plus, your 401 will lose some of its growth. Even if you start to rebuild as quickly as you can, youre sure to lose a big amount of future value.

Read Also: How Do I Rollover My 401k Into An Ira

Low Down Payment Alternatives To Using A 401

In the 1980s and 1990s, first-time home buyers used 401 plans to help buy homes because low- and no-downpayment mortgages were scarce.

Using a 401 to buy a home is not necessary today.

The government backs multiple low- and no-downpayment mortgage loans for first-time buyers, and the typical first-time home buyer doesnt put twenty percent down.

Here are some popular alternatives to using withdrawing money from a 401 to help buy a home.

Can A 401 Help You Make A Down Payment

The short answer is yes. The longer answer is yes, but

First things first your 401 is your money to use at your discretion. While it doesnt function the same way as a standard deposit account, you still have the right to access it if you choose to do so. If youre like many, your 401 is your largest financial account, and it can certainly be tempting to use these funds as the source of your down payment. However, there are some distinct drawbacks to this strategy, including penalties, taxes, and potential repayment requirements.

Typically, those who decide to use their 401 as a down payment source are first-time homebuyers who likely dont have the savings or assets to make a down payment otherwise.

If youve weighed the pros and cons and believe using the funds in your 401 is the best choice for you, you have two options for accessing your money.

- 401 Loan: In this scenario, you are simply borrowing from yourself. All funds you withdraw will have to be repaid with interest .

- 401 Withdrawal: By withdrawing money, you avoid any repayment requirements. However, you will incur a 10% penalty and be required to pay income tax on the amount withdrawn.

Lets take a deeper look into each of these options.

Also Check: How To View My 401k Account

Buying Your First Home May Be One Of The Most Important Purchases You Ever Make Read On To Learn The Pros And Cons Of Using Your 401 To Purchase A House

What you’ll learn:

One of the biggest barriers to buying a house is saving enough money for the down payment. You may be able to get a loan with a down payment as low as 3.5%. Still, many experts suggest making a 20% down payment when buying a home. But deciding how you will come up with the down payment is often a key first step. For some, their 401 may be one source of funds for a down payment. Read on to learn whether dipping into your 401 to buy a home is the right decision for your situation.

Should I Use My 401 To Buy A House

There are good reasons for not using your 401 to buy a house. Even if youre comfortable with the 10% early withdrawal penalty, you will still be incurring long-term consequences by reducing your savings. That, in turn, will damage your future growth potential.

Taking out $10,000 from a $20,000 401 account, for instance, leaves you with only $10,000 that will continue accruing interest. With a 7% annualized rate of return, that $10,000 could become $54,000 over 25 years compared to $108,000 had you not withdrawn $10,000.

Withdrawing from your 401 account is essentially taking out a loan against yourself. If you want to pay it back, you also need to pay interest, and the time spent paying it back is time that could have been spent on growth.

Read Also: Is 401k The Best Way To Save For Retirement

Borrow Against Your 401

Borrowing from your 401 is generally the more advantageous option if you want to tap your plan for a down payment.

If your employers plan allows employees to take out loans against their 401 accounts, youll typically be able to borrow up to 50% of your vested account balance or $50,000, whichever is less.

Tip:

Youll then have to make more or less equal payments at least quarterly, with interest until youve repaid the loan. Youll typically need to repay it within five years.

Upsides

- Wont affect your credit

Downsides

Learn More: 401 Loans: Should You Borrow Against Your Retirement?

How Much Can You Take Out Of Your Ira To Buy A Home

Account holders can take out as much money from their IRA as they want to fund a home purchase. However, to discourage premature withdrawals, the IRS will tax any money thats taken out as income in the year it is withdrawn. There is, however, a provision for first-time home buyers. Anyone looking to buy a home who hasnt owned in the last two years may take out up to $10,000 without incurring the 10% penalty which usually accompanies early withdrawals.

You May Like: How To Find Out If Deceased Had 401k

Can You Use A 401 To Buy A House: Two Paths You Can Take

There are two paths to cashing out a 401 to buy a house: taking an early distribution or borrowing against your 401 balance. Heres an overview of both options:

| 401 Withdrawals for Home Purchase | 401 Loan for Home Purchase |

| Subject to Income Tax | |

| Up to your contributions | The lesser of $50,000 or 50% of your vested account balance |

Is There A 401 First

Unfortunately, at this time, there is no such thing as a first-time homebuyer 401 withdrawal exception. While there is an IRA exemption that lets qualified, first-time homebuyers borrow up to $10,000 from an IRA without paying tax on the early deduction, this exemption does not currently exist for those borrowing from a 401.

Also Check: How To Contact My 401k

How To Use Your 401 For A Down Payment

While its possible to fund a down payment from a 401, its generally not recommended. Still, if you want to proceed, there are two main ways:

These are the key differences between 401 loans and withdrawals:

| 401 loan | |

| Amount limited to the lesser of 50% of your vested account balance up to $50,000 | Cant exceed the amount needed to purchase your home |

| Might become due in full if you lose or leave your job | Not affected by losing or leaving your job |

| Not taxable unless you fail to repay it | Income tax is due on the amount withdrawn |

| No tax penalty unless it isnt repaid | Might incur a 10% early withdrawal tax penalty |

| Might not be able to make new contributions during loan repayment | New contributions can be made after |

Take Out A Personal Loan

Typically, acceptance for personal loans is based on your income and . While every lender is different, in some circumstances, it’s possible to take out up to $100,000 to put toward a down payment.

However, it’s important to be aware that taking out a new loan can raise your debt-to-income ratio, which can hurt your ability to be approved for a mortgage. You’ll want to check with your lender to verify you’re able to take on more debt before taking out any new loans.

Also Check: How Much Do You Get From 401k