If You Have A 401 Do You Need An Ira Too

Dear Carrie,

I already have a 401. Does it make sense to open an IRA, too?

A Reader

Dear Reader,

A 401 or other employer-sponsored retirement planif you’re lucky enough to have onecan be considered the backbone of your retirement savings. Contributions are easy because they automatically come out of your paycheck you may get an upfront tax deduction and annual contribution limits are sizeable$20,500 for tax-year 2022, plus a $6,500 catch-up for those age 50 or older.

That means, depending on your age, you could contribute up to $27,000 in 2022. Plus, if you get an employer match, that’s extra savings in your pocket. Add tax-deferred growth of earnings, and what’s not to like?

But as positive as all this is, there’s a good case for having an IRA in addition to your 401. An IRA not only gives you the ability to save even more, it might also give you more investment choices than you have in your employer-sponsored plan. And if you have a Roth IRA, there’s also the potential for tax-free income down the road.

But the type of IRA that makes sense for you personally will depend on your filing status and your income, so there’s a bit more to consider.

Will You Need To Adjust Employer Contributions

Although a nice perk to attract potential employees, employer contributions are not required of companies that offer 401 plans. You also have the freedom to set vesting terms, which allows you to require employees remain employed by you for a set time before taking ownership of your contributions to their accounts. Employer contributions to employee SIMPLE IRA accounts are mandatory, though you can choose between two matching arrangements dictated by the IRS. Contributions to a SIMPLE IRA are immediately 100% vested.

» Ready to open a SIMPLE, traditional or Roth IRA? See the top-rated IRA account providers

Vs Traditional Ira Vs Roth Ira Vs Myra

LAST REVIEWED Apr 05 20195 MIN READ

can be downright painful, and its easy to see why. Weighing all of the available options, reading the fine print, and dealing with the uncertainty of whether youve chosen the right plan can seem like a chore, especially given that theres no immediate gratification. Try to remember that there are great opportunities are out there to save for retirement, and the practical, financial advantages are clear. Whether youre an individual looking to learn more about your options, or a company representative researching what to offer your employees, we have a simple breakdown for you.

You May Like: How To Get Money From 401k After Retirement

Tips For Saving For Retirement

- If you havent started saving for retirement, start now. The sooner you start saving up, the more you can reap the benefits of compound interest. With our 401 calculator, you can see how much your 401 will be worth by the time youre ready to retire.

- Get a clear picture of how much youll need to save to retire comfortably. By ironing out details ahead of time, like when you want to retire and how retirement tax-friendly your state is, youll know if youre actually tucking enough away. Check here to see if your retirement savings are on par with your peers.

- Consider working with a financial advisor as you work on a retirement savings plan. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

What Are The Pros And Cons Of A 401

To sum up, the 401 plan offers a variety of pros and cons. Here are the most important:

Pros of a 401

- Potential for free money via a company match

- No income limit on contributing with pre-tax income

- May be able to access a loan

- More secure against creditors

- May not be possible to set up a Roth version

Don’t Miss: How Much 401k Do I Have

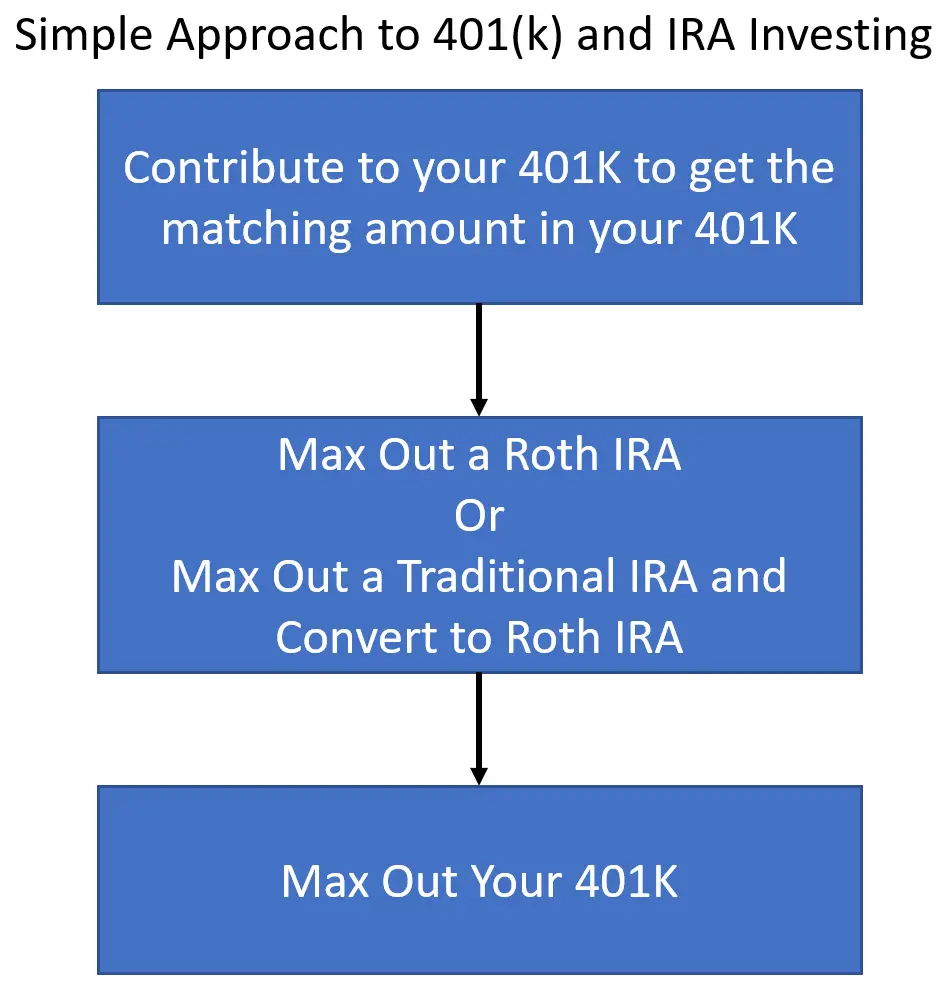

How To Max Out Your 401 And Ira

- A 401 with an employer match is always the best first step. The employer match is essentially free money.

- IRAs and Roth IRAs generally offer a broader selection of investment options but Roth IRAs are subject to income limits so you may not be eligible. A 401 has higher contribution limits.

- For some high-income earners, using a backdoor Roth IRA while maximizing contributions to a 401 can be a great strategy, but you must be familiar with the process and the IRA pro-rata rule to avoid a surprise tax bill.

Simple Ira Vs : The Pros And Cons Of Each Plan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

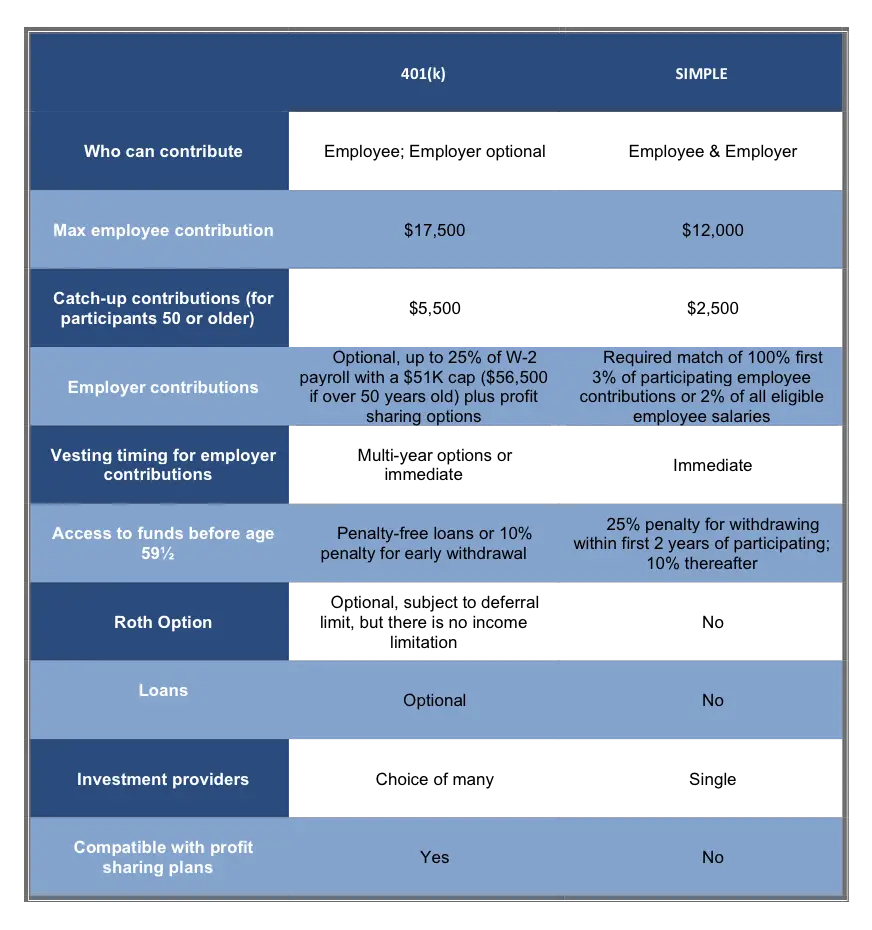

The SIMPLE IRA vs. 401 decision is, at its core, a choice between simplicity and flexibility for employers.

The aptly named SIMPLE IRA, which stands for Savings Incentive Match Plan for Employees, is the more straightforward of the two options. Its quick to set up, and ongoing maintenance is easy and inexpensive. But if you have employees, you are required to provide contributions to their accounts.

Although a 401 plan can be more complex to establish and maintain, it provides higher contribution limits and gives you more flexibility to decide if and how you want to contribute to employee accounts. Another big difference is that you can opt for a Roth version of the plan, whereas the SIMPLE IRA allows no Roth provision.

Don’t Miss: How To Pull Money Out Of Your 401k

Employer Matching Contributions To A 401

Many employers provide a matching contribution for some or all of an employees 401 contribution, incentivizing employees to participate in the plan. Matching contributions are considered to be traditional 401 deposits, even if the employee contributes to a Roth 401.

For example, some employers may match 50 percent of an employees contributions up to 8 percent of their salary each year. If the employee contributed 8 percent, the employer would add another 4 percent, and the employee would effectively enjoy a total of 12 percent saved. But if the employee contributed 10 percent, the employer would still add a maximum of 4 percent.

Employers offer different matching amounts, and some employers may offer no match at all.

Many employers require matching contributions to vest over time. For example, if the employer requires three years of vesting, employees must remain with the company for at least three years before any matching funds become fully theirs. However, once the employee has surpassed the vesting period, any subsequent matching funds immediately become theirs.

Matching funds may partially vest, depending on the employees length of service. For example, with a three-year vesting schedule, an employee who stays two full years may be able to keep two-thirds of any matching funds. But the rules depend on the details in the employers plan.

Taxes With 401k Or Traditional Iras

No matter the type of retirement account you choose to open, there will likely be associated tax questions. At H& R Block, were here to help. With many ways to file your taxes with H& R Block, you can opt for in-office or virtual tax preparation, keeping all tax laws related to retirement savings accounts in mind, we can make sure youre producing an accurate tax return that maximizes allowable tax deductions.

Not in need of tax preparation at the moment? Read more about taxes on retirement income, pensions and annuities.

Related Topics

Learn more about the qualification rules for tax-exempt military pay with the experts at H& R Block. Find out if you qualify for tax benefits.

You May Like: What Age Can You Start Withdrawing From 401k

Comparing Iras And 401ks

If youre having trouble deciding between an IRA or 401k, we have good news for you: you can have both! So what are the differences between an IRA vs. 401k?

A 401k typically offers an employer match, meaning you invest more money than you contribute. All of the investments in your 401k are pre-tax investments, meaning that when you withdraw your contributions, youll owe taxes on them. Because your 401k is maintained by your employer, you have less of a say in your investments.

While IRA benefits and restrictions can vary, this individual retirement account typically holds after-tax investments, so you will pay no taxes on your money if you withdraw it after age 59 and a half. Youll have access to a much larger investment selection with your IRA and can grow investments on stocks, bonds, real estate, and CDs.

So, what are the differences between a Roth IRA and a 401k? Lets break down the differences between a Roth IRA and tax-deferred 401k:

Simple 401 Vs Simple Ira: Which Is Better For Small Business

Both SIMPLE plans allow small employers to provide employees with a retirement savings option. They both permit employees to contribute to a retirement savings account via salary reductions, and allow for catch-up contributions to participants over 50 years old. Some key differences include the following:

- SIMPLE 401 plans may permit loans, while a SIMPLE IRA doesnât allow this feature.

- Companies with a SIMPLE IRA may not sponsor another plan with one exception: employees covered by collective bargaining agreements.

- There is no minimum age requirement for SIMPLE IRA eligibility, while SIMPLE 401 plan participants must be at least 21 years old.

Read Also: How Do You Find Out Your 401k

Can You Combine A 401k And Ira

Both 401ks and IRAs are essential investment accounts you should consider to prepare for retirement. And while you dont need to have both, its definitely an option.In fact, many people choose to combine a 401k and an IRA so they can keep better track of their savings and make sure their investments are working. However, if youre just starting to invest, it might be a better idea to start with one so you can get an idea of how it works before you take on both.

Investing can get intimidating, so be sure to read up on retirement investment terms before you open an account.

Ira Vs : The Bottom Line

You probably already know that having a 401 or an IRA retirement plan is a good long-term investment. Knowing which one to choose might be a bit trickier, however. The good news is that you cant really go wrong as both plans are similar and offer long-term benefits. If your employer offers a 401 , its smart to take advantage of that benefit as matching contributions are basically free money and you can make significant contributions on a yearly basis.

If your employer doesnt offer a 401, or if you simply want to have the freedom to make more investment choices on your own, you will want to consider an IRA. One of these accounts is simple to set up on your own and you can choose how aggressive or conservative youd like to be. Dont forget, theres nothing that prevents you from having both types of accounts as well.

Read Also: Can You Roll Over Your 401k To A Roth Ira

Can You Lose Money In An Ira

Yes. IRA money held by a brokerage or investment firm is usually invested in securities such as mutual funds or stocks, which fluctuate in value. Note that an IRA is no more or less likely to decline in value than any other investment account. The owner of an IRA faces the same market risks as the account holder of a 401.

Roth 401 Vs Traditional 401 + Roth Ira

Individuals with access to 401s may therefore be in a position to take advantage of both a 401 and a personal IRA. How do you decide which ones to contribute to and how much?

Here are some considerations on how to answer that for yourself:

To put some numbers on it, the table below shows the cost of maximizing contributions to a traditional 401 vs. a Roth 401 for someone under 50. as post-tax dollars.)

|

Tax bracket |

You May Like: How To Choose Fidelity 401k Investments

What Are Traditional And Roth Iras

Traditional and Roth IRAs are retirement accounts that individuals can set up and manage by themselves. IRAs are easy and inexpensive to set up and can be established through brokerage firms, mutual fund companies, and banks.

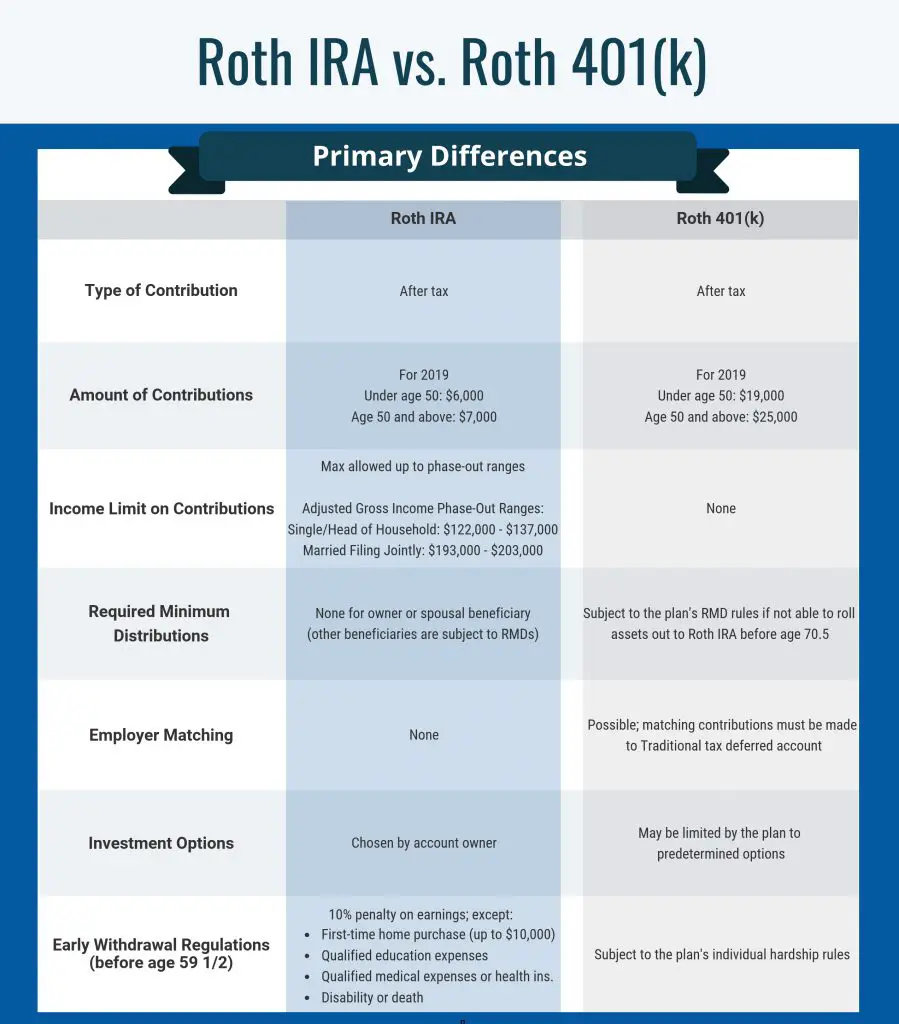

Contributions to a traditional IRA are generally tax-deductible, while contributions to a Roth IRA are not. But the money in a traditional IRA will be taxable when you ultimately withdraw it, while the Roth IRA contributions will not be taxed upon withdrawal.

Roth IRAs are thus similar to Roth 401 plans in terms of taxation. The main differences are that 401 plans allow larger annual contributions but will restrict your investment choices to whatever your plan sponsor allows.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Where Should I Put My 401k Money

Withdrawing Funds From Your 401

Similar to an IRA, there is generally a 10% penalty for withdrawing funds from your account prior to the age of 59½. There are a few exceptions for things like unreimbursed medical bills or for disability. Also, even if you have one of the few qualifications to avoid a penalty, traditional 401 withdrawals are considered taxable income.

What Is A Roth Ira

A Roth IRA is a retirement savings account you can open yourself. When you hear the word Roth, your ears should automatically perk upbecause a Roth IRA allows your savings to grow tax-free. Thats right: tax-free. That means once you turn 59 1/2, you can withdraw money from your account, and you wont owe a penny in taxes!

You May Like: Can I Put Money In 401k And Ira

Conversions Into Other Types Of Accounts:

401k: If you leave your job, you have several options for your 401k.

- You can leave it alone with the current provider.

- You can roll it over into the new account.

- You can roll it over into an IRA with a new financial provider.

There can be a number of variables such as taxes or fees that will dictate whether this is the best move or not. Make sure you ask both the new and old financial service providers what the implications will be.

IRA: You can not convert a Roth IRA into a Traditional IRA. But you can convert a Traditional IRA to a Roth IRA.

You May Like: How Much Should I Have In My 401k At 55

What Are The Pros And Cons Of An Ira

The IRA offers a similar variety of pros and cons. Here are the most important:

Pros of an IRA

- Available to anyone with earned income

- Non-earning spouses can contribute, too

- Wide array of investment options

- Easy to set up traditional or Roth versions

- A Roth IRA is great for estate planning

- A Roth IRA offers flexibility, including penalty-free withdrawals of contributions

Cons of an IRA

- Deductibility of contributions is limited due to income

- No investment advice

Recommended Reading: Can I Rollover My Ira To A 401k

Learn To Trade Stocks Futures And Etfs Risk

Both are fantastic options for saving for your retirement and financial futures. Both offer a sustainable and growth focused plan. Lastly, the IRA and 401k allow you deduct your contributions.

Whats nice about these options is that there is no tax or interest on capital gains until you start withdrawing the money as a distribution. And they are both subject to the same penalty for early with drawls up to a 20% tax and 10% penalty if you take it out before you are 59 ½. Thank you, IRS.

Retirement Planning: Roth Ira Vs Traditional Ira Vs 401

Along with building your financial independence comes the responsibility of retirement planning. For many, guaranteed pension plans are not an option and Social Security isnt enough. Its up to you to decide what amount of money you can save now in order to provide a living well into your golden years. Heres a look at the three most popular savings accounts: Roth IRA, IRA, and a 401.

You May Like: What Happens To My 401k When I Quit My Job

Ira Vs 401k: What Are The Key Differences

IRA vs 401k: is there a difference?

Yes, there is a big difference between an IRA and 401k. The main difference between the two is that an IRA is a form of retirement plan that you can create and fund yourself.

Whereas, a 401k plan is a tax advantaged retirement plan created by your employer, in which you can contribute a certain amount from your salary.

Lets explore more key differences between IRAs and 401s.

Note, if you have questions beyond an IRA and 401k plans, a financial advisor can help you determine the best saving options to help you reach your retirement income goals.