Advantages Of Withdrawing Retirement Funds For Your Home Loan

Some people are comfortable with keeping debt and making a monthly payment. But for others, the benefits of eliminating debt are clear.

No More Monthly Payment

By paying off your mortgage loan, you get rid of one of your biggest monthly expenses in retirement. Yes, youll still have healthcare expenses and other costs, but reducing your monthly obligations gives you more breathing room and could reduce stress as you prepare for retirement.

Stop Paying Interest

A home loan might be a substantial amountwell over $100,000that generates meaningful interest charges. By paying down the debt, you reduce the financial drain on your resources. Plus, if your money is sitting in cash-like investments or a bank account, its probably not earning as much in interest as youre paying on the mortgage. You might save tens of thousands of dollars by wiping out that debt.

No Worries About Market Movements

Your willingness to take investment risks may decrease as you approach retirement. That makes sense, and we know that the sequence of returns issue makes big losses problematic in the years surrounding your retirement date. You might view a lump sum mortgage payment out of your retirement funds as a guaranteed return on the interest costs you avoid going forward.

While there are certainly good reasons to take money from your IRA or 401 to pay off a mortgage, there are also reasons for leaving the money in retirement accounts.

If You Withdraw The Money When You Retire

For traditional 401s, the money you withdraw is taxable as regular income like income from a job in the year you take it. You can begin withdrawing money from your traditional 401 without penalty when you turn age 59½. The rate at which your distributions are taxed will depend on what federal tax bracket you fall in at the time of your qualified withdrawal.

A few important points:

-

If youve retired, you have to start taking required minimum distributions from your account when you’re 72.

-

If you dont take the required minimum distribution when youre supposed to, the IRS can assess a penalty of 50% of the amount not distributed.

-

You can withdraw more than the minimum.

When The Irs Cannot Take Your 401

While the IRS may take a 401 in situations where taxpayers have not paid their taxes, refused to do so, or have committed some level of tax fraud, there are a few circumstances where the IRS cannot seize your retirement account.

If you have made an effort to pay your outstanding tax debt by enrolling in an Installment Agreement plan or have secured an Offer in Compromise, the IRS cannot take your property this applies whether the agreements are current or pending.

Additionally, the IRS cannot take taxpayer property if they determine that doing so would cause economic hardship to the individual. In other words, if the taxpayer would be unable to meet their basic needs if assets were seized, the government would not move forward with property collection.

Read Also: How Much Can You Save In 401k Per Year

Taxes On Other Types Of 401 Plans

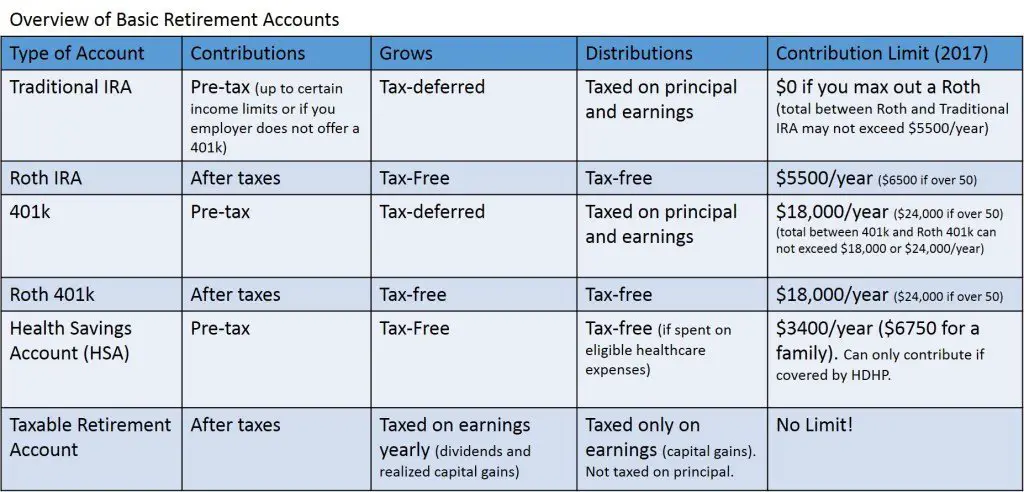

All of the information above applies to traditional 401 plans. However, there are variations on the traditional 401. Some of these have different rules on taxation.

SIMPLE 401 plans and safe harbor 401 plans function mostly the same as far as employee taxes are concerned. They differ mostly in that employers have to make certain contributions. SIMPLE 401 plans also have a lower contribution limit.

The other type of 401 to note is a Roth 401. These work quite differently from traditional 401 plans. All contributions you make to a Roth 401 come from money that you have already paid payroll and income taxes on. Since you pay taxes before you contribute, you do not need to pay any taxes when you withdraw the money.

Its advantageous to use a Roth 401 if you are in a low income tax bracket and expect that you will find yourself in a higher bracket later in your life. This is very similar to why you might want a Roth IRA.

What Is A 401 Loan

A 401 loan gets taken out against your 401 savings. Taking out a 401 loan is practically borrowing from yourself. This means that the interest you pay on a loan goes back into your account. However, just like with any other loan, youre taking a risk: If you cant pay it back, you might be left without retirement savings.

This loans name comes from the section of the tax code that governs it. Under section 401 of the tax code, you are allowed to borrow up to $50,000 or 50% of your vested account balance from your 401.

Another important thing about 401 loans is that they are not tax-deductible, meaning that you will have to pay taxes on the money you borrow. The money you decide to withdraw can be used for any purpose, but it will be treated as a withdrawal and taxed accordingly if you dont repay it within five years.

Read Also: How To Transfer 401k To Another 401 K

Watch Your Tax Bracket

Since all of your 401 distribution is based on your tax bracket at the time of distribution, only take distributions to the upper limit of your tax bracket.

One of the best ways to keep taxes to a minimum is to do detailed tax planning each year to keep your taxable income to a minimum. Say, for example, you are . For 2021, you can stay in the 12% tax bracket by keeping taxable income under $81,050. For 2022, you can stay in the 12% tax bracket by keeping taxable income under $83,550.

Avoid Early Withdrawal Penalty

Withdrawals made before age 59 ½ are subject to a 10% early withdrawal penalty and income taxes depending on your tax bracket. However, if you leave your current employer at age 55 or later, you may qualify to get a penalty-free 401 withdrawal. However, the distribution will still be subject to ordinary income tax at your tax bracket. The IRS requires that an employee must have left their employer to qualify for a penalty-free distribution. This rule is known as the Rule of 55, and it does not apply to earlier plans or Individual Retirement Accounts.

Recommended Reading: How To Access Your 401k Early

How Much To Save In Your Emergency Fund

An emergency fund should cover three to six months worth of expenses, but saving that amount takes time. To help get you started, begin with small goals, such as saving $5 a day. Then work your way up to a reserve to cover several months worth of expenses.

Your savings goal will depend on your income and expenses. Focus on having enough to cover expenses, not on replacing your entire income.

Sole breadwinners, business owners or those with variable incomes should aim for nine to 12 months worth of expenses in an emergency fund.

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Recommended Reading: Do You Get Your 401k When You Quit

Is It Worth Taking A 401 Withdrawal To Buy A House

Taking a 401 withdrawal for a house can be a costly way to fund your home purchase. Youll pay income taxes on the distribution most likely at a higher rate than you would when withdrawing funds during your retirement years. And unless youre 59½ or older, youll pay an additional 10% penalty on the withdrawal.

Besides the immediate costs, using your 401 for a house down payment has long-term consequences. Youll be removing money from your nest egg money that may be harder to replace later on. And youll be unplugging a chunk of your money from future growth.

| Note: Withdrawing money from your 401 for a house down payment and other purchase costs qualifies as a hardship distribution as long as its for your primary residence. But the withdrawal will still be subject to income tax and, if youre under 59 ½, the 10% early withdrawal penalty. |

Tax Rules: Withdrawals Deductions & More

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pretax money in 2021 or $20,500 in 2022. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

You May Like: Where Should I Roll My 401k Into

Where To Keep Your Emergency Fund

The best place to keep your emergency fund is in a high-yield savings account, which offers easy access and pays a competitive yield. Look for banks and credit unions that insure deposits through the Federal Deposit Insurance Corp. or the National Credit Union Administration .

Online-only banks are good options for an emergency savings account because they typically offer higher yields and charge lower fees than brick-and-mortar banks. Fees can eat into your emergency fund balance, which makes comparing savings rates and account features key.

Also, theres no need to stick with an account just because youve had it a while. Consumers keep their savings accounts for an average of nearly 17 years, according to a recent Bankrate survey, but if the current account charges monthly fees or pays a subpar APY, its worth some inconvenience to find a new account that offers better terms.

Can You Reduce Taxes With A 401

401 retirement accounts allow employees to save for, well, retirement. In a tax-deferred 401, workers contribute a percentage of their pre-tax dollars into the account. The money they contribute lowers their taxable income so they pay less in taxes. A person can also save money by not paying taxes on the earnings of your account.

Sounds great, right? There’s a catch. You will ultimately have to pay taxes on the money that you withdraw. However, when you retire, your income will probably drop. That will put you in a lower tax bracket. As a result, when you start withdrawing money from your tax-deferred 401, you’ll be taxed at a much lower rate than what you paid when you were working .

You can also lower your tax bill by deducting your contributions to your 401, based on your filing status and income level. It’s called the saver’s credit, or retirement savings contributions credit. The government kept the income ceilings for this credit very low so those with low incomes can put money aside for retirement . The income limits are:

- $27,750 for people who are single, widowed or married but filing separately

- $41,625 for a head of a household

- $55,500 for couples married and filing joint returns

You May Like: How To Find Out Your 401k Balance

Taxes On Roth 401 Plans

Some employers offer another type of 401 plan called a Roth 401. These savings plans take the opposite approach when it comes to taxation: Theyre funded by post-tax income. This means your contributions wont lower your AGI ahead of tax-filing season.

The biggest benefit of a Roth 401 is that because youre paying taxes on your contributions now, you can withdraw the money tax-free later. A few other important notes:

-

You can begin withdrawing money from your Roth 401 without penalty once youve held the account for at least five years and youre at least 59½.

-

You can withdraw money from a Roth 401 early if youve held the account for at least five years and need the money due to disability or death.

-

Roth 401s also require taking RMDs.

What Is Required 401 Distributions Or Required Minimum Distributions

If you dont take any distributions and reach the age of 70 ½, the IRS will step in and force you to take a distribution. They are called Required Minimum Distributions . The IRSs rationale is hey time to pay up you arent getting any younger. The IRS has a schedule and they will tell you how much your minimum distribution will be. This distribution of course will be considered income and will add to your other income for the affected year.

Assuming your 401 k is traditional and not ROTH, a distribution will be taxed as income. This distribution will be added to your other income for the year and may or may not push you into a higher tax bracket. It would be prudent to seek a tax professional and do some tax planning.

Need Help with understanding Minimum Distributions ?

Don’t Miss: How Do I Check My 401k Plan

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

Drawbacks To 401 Loans

Now the downsides to 401 loans:

Theres a limit to how much you can borrow no more than 50% of your vested account balance or $50,000, whichever is less. One exception: if your 401 has less than $20,000, you may be able to borrow up to $10,000.

Another drawback: If you leave your employer before your 401 is paid off, youll need to either come up with the rest of the cash within 60 days or face a tax bill, because the IRS will view the outstanding loan as a taxable distribution. If youre under 55, thatll mean paying ordinary income tax on the money and probably a 10% penalty.

Also, it can take about a month to get your hands on the money once you apply for a 401 loan. So youll likely need to ask for one by early- or mid-March to ensure you’ll have the funds when your tax return is due. It can be a bit of an administrative nightmare, said Meadows. Loan checks are not easy to cut. So you dont want to wait until April 1 to get the ball rolling.

And, of course, with a 401 loan youll miss out on any tax-deferred earnings you wouldve had if you hadnt borrowed from the plan. You probably wont see the growth in your 401 as you would have seen without the loan, said Meadows. More money makes more money.

Also Check: Should I Transfer My 401k To An Annuity

What Using Your 401 For A House Down Payment Can Cost You

Homebuyers who use 401 withdrawals for home purchases may be solving their short-term cash-flow issue, but theyre doing it at the expense of their future financial stability.

Lets look at how taking out a 401 withdrawal for a house down payment can impact your future earnings. In this example, our borrower is 35 years old, has $75,000 in their 401 account, and wants to withdraw $10,000 for their home purchase. Well compare the potential growth of the account with and without the withdrawal based on a 7% annualized return.

| Starting 401 Balance |

| $407,057.45 |

As you can see from this illustration, unplugging $10,000 from a $75,000 balance means our borrower is missing out on over $54,000 of growth. And because our borrower is under age 59 ½, the $10,000 withdrawal was taxed and penalized.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Recommended Reading: When Can I Rollover My 401k