Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

Ira 705 Irs Withdrawal Rules

An IRA can be a useful retirement planning tool.

When you own a traditional IRA you benefit from a number of tax advantages. Your contributions may qualify for a tax deduction , and investment earnings in the plan accumulate tax free. You only pay tax when you begin taking withdrawals.

One major restriction is that you are forced to take distributions once you reach age 70.5. Failure to do so can result in a hefty 50 percent penalty from the IRS.

Also Check: How Do I Rollover My 401k To My New Job

Average 401 Balance By Industry

According to Vanguard data, balances also vary widely among industries. One possible explanation for this is that retirement-savings matches, in which an employer matches an employee’s contributions to their savings up to a given percentage, may be more common in some industries than others. Earnings could also affect how workers in a specific industry save.

Here’s how the average balances break down by industry, according to Vanguard’s data.

|

Industry |

Read Also: Does It Make Sense To Rollover 401k

Required Minimum Distribution Rules For Non

Under IRC Section 401, when a retirement account owner dies prior to their RMD Required Beginning Date and has named a Non-Designated Beneficiary , that Non-Designated Beneficiary is required to distribute all the assets in the inherited retirement account within 5 years. Conversely, IRC Section 401 provides that when the owner dies on or after their Required Beginning Date with a Non-Designated Beneficiary, annual minimum distributions are calculated using the decedents remaining single life expectancy .

The SECURE Act made no direct change to these rules . However, as a result of the change in the age at which RMDs begin, an IRA owners Required Beginning Date is now pushed back to April 1, of the year following the year that they turn 72 . Thus, for Non-Designated Beneficiaries, the 5-Year Rule will still apply if death occurs at an even later age, requiring full distribution of the inherited account within 5 years of the retirement account owners death if they die prior to April 1st of the year after they reach age 72.

Also Check: Should I Keep My 401k Or Rollover To Ira

How To Calculate Required Minimum Distribution For An Ira

To calculate your required minimum distribution, simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. 31st each year. Every age beginning at 72 has a corresponding distribution period, so you must calculate your RMD every year.

For example, Joe Retiree, who is age 80, a widower and whose IRA was worth $100,000 at the end of last year, would use the Uniform Lifetime Table. It indicates a distribution period of 18.7 years for an 80-year-old. Therefore, Joe must take out at least $5,348 this year .

The distribution period also decreases each year, so your RMDs will increase accordingly. The distribution table tries to match the life expectancy of someone with their remaining IRA assets. So as life expectancy declines, the percentage of your assets that must be withdrawn increases.

If you need further help calculating your RMD, you can also use Bankrates required minimum distribution calculator.

RMDs allow the government to tax money thats been protected in a retirement account, potentially for decades. After such a long period of compounding, the government wants to be sure that it eventually gets its cut in a clear timeframe. However, RMDs do not apply to Roth IRAs, because contributions are made with income that has already been taxed.

You May Like: How To Avoid Taxes On 401k

Don’t Miss: What Is The Maximum I Can Contribute To My 401k

Whats So Great About A 401 For Retirement Planning

Quite a few things. Having your contributions taken out regularly is more convenient than having to write a check to banks or investment firms every so often. That makes it more likely that you will continue to save, which makes it more likely youll have enough money to retire when the time comes.

But theres more. Your contributions arent counted as income for taxes, which reduces your annual tax bill. For example, if you earn $50,000 a year and contribute $5,000 of your salary to a 401, youll shelter $5,000 from state and federal income taxes that year. If youre in the 20 percent combined state and federal tax bracket, that will reduce your tax bill by $1,000.

Your earnings also wont be taxed until you withdraw them. In a regular brokerage account, youll owe taxes on income and capital gains the year in which you receive them. A 401 allows your earnings to grow tax-free for as long as you keep the money in your account.

The tax deduction also means that your paycheck wont be hit as much as it would without a 401. If you earn $50,000 a year, for example, you would need to save $417 a month before taxes to have $5,000 saved at the end of a year. If you saved that money in a 401, however, you would still contribute $417 a month, but your paycheck would be reduced by just $333 a month, because youve reduced your tax bill by more than $83 each month.

Average Current Retirement Savings Balance

Unfortunately, many people are woefully under-prepared for retirement from a financial standpoint.

Here are some statistics on the median current retirement savings balances of Americans based on their age.

| Families Between |

|---|

| 70+ | 12.3% |

Workers save more for retirement as they get older and pay off other debts like student loans and a home mortgage.

At a minimum, many experts recommend saving at least 10% of your income for retirement. Dave Ramseys Baby Steps recommend saving at least 15% into retirement accounts after getting out of debt and building an emergency fund.

You can use a retirement calculator like NewRetirement to review your personal progress and project how long your nest egg will last. This tool is free but paid plans are available too.

Read our NewRetirement review to learn more about this interactive retirement planner.

Recommended Reading: How To Use Your 401k

Government And Military Pension Resource

Depending on your role in the military, some pensions are available to both veterans and their survivors. Be sure to refer to the U.S. Department of Veterans Affairs website for more information.

- Department of Veteran Affairs: If you or your deceased spouse is a veteran, you can find information on your pension at the VAs pension website.

- State government websites: If you were an employee of your state or local government, be sure to check your states government website to search for information regarding your pension.

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

Recommended Reading: Should I Cash Out My 401k To Start A Business

Average 401 Balance At Retirement

Many U.S. workers retire by the time they reach 65. Vanguard’s data shows the average 401 balance at retirement to be $255,151, while the median balance is $82,297.

For retirees following the 4% rule, the average balance would produce just $10,206 in annual retirement income, while the median would provide only around $3,291. Even when combined with Social Security, this may not be sufficient to provide a comfortable income in retirement.

What Are Qualified Distributions

Qualified distributions are those that can be taken made tax-free and penalty-free. They’re taken after age 59 1/2 or under some other allowed circumstances.

There’s no penalty for withdrawing your money after you reach age 59 1/2, but you’ll pay income tax on the money you take out if you’ve invested in a traditional pre-tax 401 or a traditional IRA with untaxed dollars. You took a tax deduction at the time you made the contributions.

Roth IRAs and Roth 401 contributions are made with after-tax dollars. These distributions aren’t taxed when you take withdrawals, but you must have owned the Roth account for five years or longer.

It’s best to begin taking money from tax-deferred accountsthose for which you claimed tax deductionsafter you retire. You might be in a lower tax bracket at that time, because you’ll no longer be earning income from working.

Also Check: Can Business Owners Have A 401k

Here’s How To Save Up To $700/year Off Your Car Insurance In Minutes

When was the last time you compared car insurance rates? Chances are youre seriously overpaying with your current policy.

Its true. You could be paying way less for the same coverage. All you need to do is look for it.

And if you look through an online marketplace called SmartFinancial you could be getting rates as low as $22 a month and saving yourself more than $700 a year.

It takes one minute to get quotes from multiple insurers, so you can see all the best rates side-by-side.

So if you havent checked car insurance rates in a while, see how much you can save with a new policy.

What Is The Average Age Of A 401k Millionaire

Unsurprisingly, since they have owned 401 s for a long time, Boomers have a huge 401 million average age of 58, according to Fidelity.

What age does the average person become a millionaire?

Self-discipline are important factors. The average age of the wealthy is 57, indicating that, for most people, it takes three or forty years of hard work to accumulate a fortune.

How many people have $1000000 in their 401k?

Fidelity Investments reports that the number of 401 investors with a net worth of 401 accounts for $ 1 million or more has reached 233,000 by the end of the fourth quarter for 2019, up 16% from the third quarter. of 200,000 and over 1000% from the 2009 estimate of 21,000.1 Joining the ranks of

Also Check: Can You Do A 401k On Your Own

When Must I Start Taking Required Minimum Distributions

Many taxpayers wont have to take their first RMDs until April 1 of the year after they reach age 72, but the rule wasnt always this generous.

It was age 70½ before the passage of the Setting Up Every Community for Retirement Enhancement Act in December 2019. Anyone who is covered by the old rules has already begun paying RMDs and must continue to do so. Everyone else can wait until April 1 of the year following the year in which they reach age 72.

If you wait until the last minute for your first RMD, you will effectively have to take two RMDs in the same calendar year. Thats because the deadline for your first RMD is April 1, but all subsequent RMDs are due December 31. Therefore, if you turn 72 in 2021 wait until March 31, 2022 to make your first RMD, youll have to take another RMD in December 2022.

I Failed To Take Out Rmds In Prior Tax Years Is There A Penalty

Yes. There is no statute of limitations on how far back the IRS can look for RMD mistakes. If you have discovered mistakes in prior years withdrawal amounts, correct those figures immediately.

If you can provide evidence that you made a reasonable mistake when calculating distributions for prior years, the IRS does have the ability to waive penalty fees. The most common reasons considered for waiving fees include serious illness or dementia.

Read Also: How To Take A Loan Out On Your 401k

Your Employer’s Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

Am I Eligible For Old Age Security

Eligibility for Old Age Security depends on how much income you earn. The default value in the calculator is the 2019 maximum monthly payment regardless of your marital status. You can check the latest Old Age Security payment amounts to find out exactly how much money youll receive and add it to the calculator for more accuracy.

Read Also: How To Fill Out A 401k Withdrawal Form

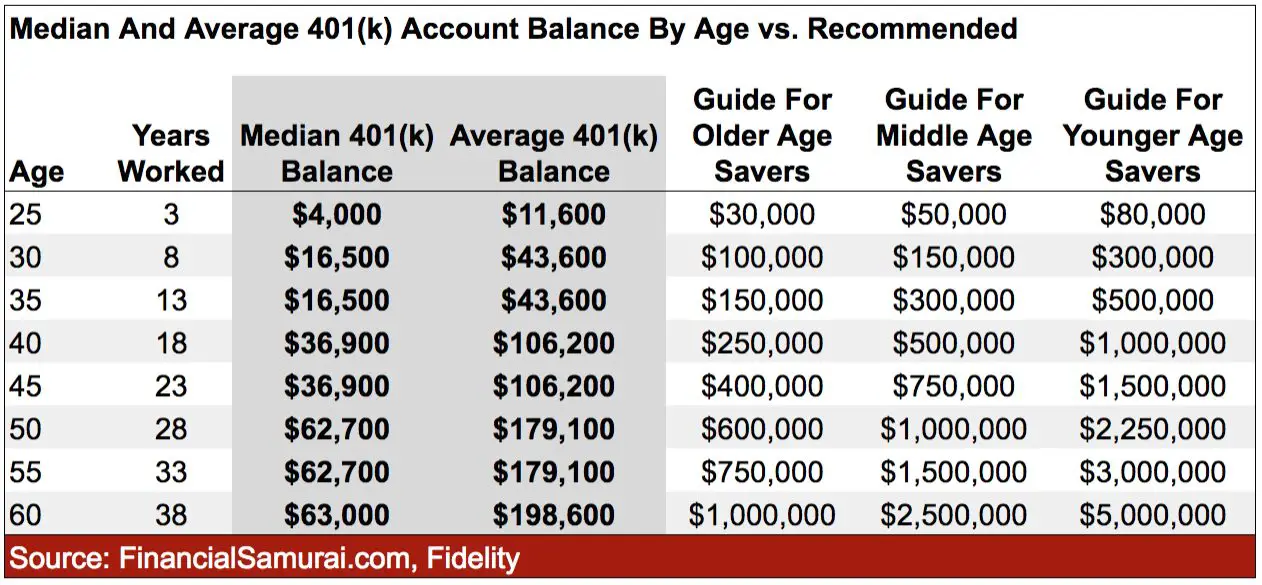

Average And Median 401 Balance By Age

These are the average and median balances for specific age groups at the end of 2020, according to Vanguard, which gathered data from 4.7 million defined contribution plan participants across its recordkeeping business.

| Age |

|---|

- Average 401 balance: $6,718

- Median 401 balance: $2,240

The median balance for people just getting started in their careers is $2,240. That means half of 401 plan participants in this age group have less than that amount saved and half have more. Thats a start and offers plenty to build on. The average balance is quite a bit higher, skewed by those who are able to save more in their 401.

How much should you strive to save for retirement? Fidelity, which manages employee benefits programs for more than 22,000 businesses and offers a variety of financial planning services, suggests saving at least 10 times your annual salary by age 67. The firm also advocates following another metric: Save 15 percent of your pretax income from the time you begin your career including any company match. So, if your employer matches 3 percent of your salary, youd need to save 12 percent. If current expenses preclude this possibility, work toward that amount as a goal.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Collect My 401k Money

Don’t Miss: When Leaving A Job What To Do With 401k