Why Use A Roth Ira To Buy A Home

Technically speaking, you can withdraw savings from almost any tax-advantaged retirement account to fund a first-time home down payment. IRS early withdrawal rules let you take out up to $10,000 of investment earnings penalty-free to fund the purchase of your first home. And the IRS considers you a first-time home buyer so long as you havent owned a home for the last two years.

But early withdrawals from accounts like your traditional 401 or individual retirement account still raise your tax bill. While youre off the hook for the 10% early withdrawal penalty, youll still owe income tax on everything you withdraw. Thats because your original contributions were tax free.

Withdrawals from a Roth IRA, on the other hand, are tax and penalty free as long as youve had the account open for at least five years. But just because you can withdraw from your Roth IRA to finance your first home purchase doesnt mean you should.

Pulling money out of your Roth IRA could mean missing out on investment growth, says Eric Roberge, CEO and lead advisor of Beyond Your Hammock, a a fee-only financial planning firm. However, it might make sense, depending on your situation.

If you no longer need your Roth IRA money for retirement, then you may be able to tap the account to generate the cash needed for the purchase, Roberge says.

You May Like: Can A Qualified Charitable Distribution Be Made From A 401k

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

What Could Be The Cost Of Missed Retirement Savings

A report from the National Institute on Retirement Security found that 95% of millennials arent saving enough for retirement. And a 2017 study from Wells Fargo shows that other generations arent faring much better. So if youve been trying to beat the odds and put aside adequate savings for retirement, taking out a 401 loan can be a triple whammy.

First, some plans dont allow participants to make plan contributions while they have an outstanding loan. If it takes five years for you to repay your loan, that could mean five years without adding to your 401 account. During that time, you may be failing to grow your nest egg and youll miss out on the tax benefits of contributing to a 401.

Next, if your employer offers matching contributions, youll miss out those during any years you arent contributing to the plan. Loan repayments arent considered contributions, so if the employer contribution is dependent upon your participation in the plan, you may be out of luck if you cant make contributions while you repay the loan.

And finally, your account will miss out on investment returns on the money youve borrowed. Although you do earn interest on the loan, in a low-interest-rate environment you could potentially earn a much better rate of return if the money was invested in your 401.

What are the tax benefits of 401s?

Recommended Reading: When Leaving A Job What To Do With 401k

Also Check: When Can I Take Money Out Of 401k

When You Can Borrow

Once you pull money out of your plan, those dollars no longer benefit from long-term market returns.

If you have a pool of emergency funds, it’s best to use that money first. If you’re managing debt, it’s even better to build that repayment into your budget.

Even your boss wants you to keep your hands off your retirement plan savings.

That said, here are three extreme cases that may warrant a 401 loan.

You have an immediate emergency.“Say that you need to meet the deductible on your high-deductible health-care plan, and you have no money in your health savings account,” said Aaron Pottichen, president of retirement services at CLS Partners in Austin, Texas.

He is referring to the tax-advantaged health savings account that individuals may use to cover qualified medical expenses. It’s also known as an HSA.

You have an urgent cash need, but your credit precludes you from obtaining a competitive interest rate. Ask yourself what you can repay in five years.

You need to pay off high-interest debt that’s hampering your long-term financial goals. This is the case if the interest rate on your 401 is lower than what your creditor is offering you.

“If you’re in ‘pay down debt mode,’ it’s all about what’s your cheapest interest rate and how fast can you get the debt down,” said Pottichen.

Report The Rollover On Your Taxes

In a direct rollover, you shouldnt owe any additional taxes, but you need to report the transaction on your taxes. If you roll over a 401k to an IRA, you should expect a 1099-R form from your 401k plan provider. This is the form youll use to report a direct rollover to the IRS. Fidelity will also send you a 5498 form if your rollover was a direct one. Simply add that information to your tax return at the end of the year.

More on 401k Investments:

Read Also: Is There A Max Contribution To 401k

Read Also: How Do I Start A 401k For My Business

Who Should Withdraw From Their 401 Early

Just because you qualify for a hardship-related withdrawal doesnt mean you should take one without weighing all your other options.

The experts we spoke with were all in agreement that withdrawing from your 401 shouldnt be your first move. However, they also indicated that if youre truly in need, then you should take advantage of the CARES Acts allowances.

It should be a last resort option. People shouldnt get carried away and start using their 401 assets just because they can, Pfau says.

When To Borrow From Your 401

Only borrow from your 401 when no other reasonable loan rates are available and only if the situation is dire.

Vacations are ruled out. So are 50-inch 4K TVs, shopping sprees and any form of consumerism that might be considered excessive. There are, however, emergencies or dead-end scenarios when a 401 loan may be your best or only option.

If youre suffering a medical setback and need cash fast, your 401 may be a good place to look. You may even qualify for a hardship withdrawal. In this case you wont have to pay the loan back, but youll still have to pay income taxes, plus the 10% early withdrawal fee.

The qualifications for hardship withdrawal differ from plan to plan. Check with your employer to see what yours may cover.

If youre looking at your 401 as a way out of debt, youre looking in the wrong direction. Debt is often the result of undisciplined spending or an unforeseen emergency like job loss or medical setback. Its rarely a one-time purchase that sends the consumer into financial despair.

Read Also: How Much Should I Have In My 401k At 55

Also Check: How To Start My Own 401k

Early Withdrawal Calculator Terms & Definitions:

- 401k â A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket â The division at which tax rates change in the federal income tax system .

- State Income Tax Rate â The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution â The withdrawal of funds from a 401k.

- Rollover â Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties â The payment demanded for not adhering to set rules.

- Future Value Before Taxes â The value of oneâs asset at the end of the term before taxes are paid.

- Future Taxes to be Paid â The taxes that are required to be paid at the end of the term.

- Future Net Available â The amount left after taxes and penalties are deducted.

- Annual Rate of Return â The percentage earned every year by having funds in an account.

Why You Shouldn’t Use Your 401 To Buy A House

Even if it’s doable, tapping your retirement account for a house is problematic, no matter how you proceed. You diminish your retirement savingsnot only in terms of the immediate drop in the balance but in its future potential for growth.

For example, if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7% return.

Note that a Roth 401 allows you to withdraw the money you’ve contributed at any time tax- and penalty-free.

Read Also: How Do I Open A Roth 401k

Loans To Purchase A Home

Regulations require 401 plan loans to be repaid on an amortizing basis over not more than five years unless the loan is used to purchase a primary residence. Longer payback periods are allowed for these particular loans. The IRS doesn’t specify how long, though, so it’s something to work out with your plan administrator. And ask whether you get an extra year because of the CARES bill.

Also, remember that CARES extended the amount participants can borrow from their plans to $100,000. Previously, the maximum amount that participants may borrow from their plan is 50% of the vested account balance or $50,000, whichever is less. If the vested account balance is less than $10,000, you can still borrow up to $10,000.

Borrowing from a 401 to completely finance a residential purchase may not be as attractive as taking out a mortgage loan. Plan loans do not offer tax deductions for interest payments, as do most types of mortgages. And, while withdrawing and repaying within five years is fine in the usual scheme of 401 things, the impact on your retirement progress for a loan that has to be paid back over many years can be significant.

If you do need a sizable sum to purchase a house and want to use 401 funds, you might consider a hardship withdrawal instead of, or in addition to, the loan. But you will owe income tax on the withdrawal and, if the amount is more than $10,000, a 10% penalty as well.

Prior Outstanding Loan Balance

The participants highest outstanding loan balance during the twelve-month-period ending on the day before the date a new loan is issued must be taken into account. That amount is applied to reduce the overall cap of $50,000, so it primarily comes into play only when a participant is seeking a fairly sizeable loan. This is true even if the previous loan has been paid in full.

However, that does not mean we can ignore it in the case of smaller loans. Weve seen a number of situations in which a participant has taken out a $50,000 loan to meet a short-term need and repaid it just a few months later. If that same participant then requests another loan less than 12 months later, he or she would not be able to take it even if it is a small amount. Why? Because the overall limit of $50,000 is reduced by the highest balance the participant had in the trailing twelve months, which in this case, is also $50,000.

Don’t Miss: How To Take Money Out Of 401k Without Penalty

How To Apply For A Loan

Current faculty and staff who are a participant in the Plan, are eligible to take a loan against their voluntary, pre-tax account balance held at Fidelity . You may apply for a loan by calling Fidelity at 800.343.0860. Your application will specify the amount you wish to borrow and the duration of the loan, in whole months. If you are married, spousal consent is required.

Before requesting a loan, you should be aware of the general provisions of the loan program:

- You can have only one outstanding loan at any time.

- The minimum amount you can request is $1,000.

- You may not borrow more than 50% of your total balance in your Plan accounts reduced by your highest outstanding loan balance during the one-year period ending on the day before your new loan is made.

- The interest rate is the prime rate plus 1% The prime rate is determined using the rate published by Reuters and is updated quarterly.

- The term for repayment of the loan may not exceed 5 years , unless the loan is extended due to a leave of absence for military service.

- A $75.00 non-refundable loan application fee will be withdrawn from your account each time a loan is issued to you. A $25 loan maintenance fee will also apply to each loan.

- Loan repayments must be made monthly on a level repayment schedule through ACH debit from your bank account.

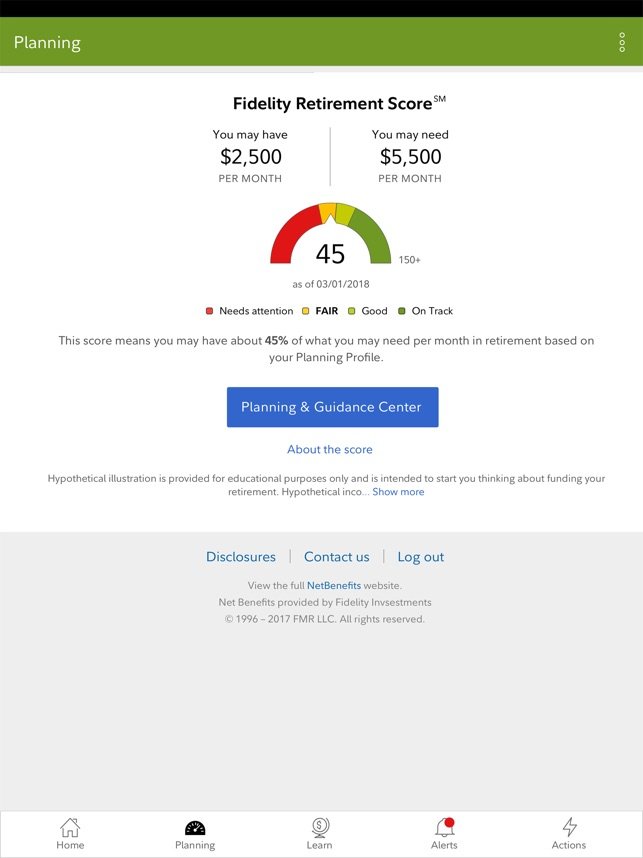

To learn more about or request a loan, log on to Fidelity NetBenefits at www.netbenefits.com/vanderbilt or call the Fidelity Retirement Service Center at 1.800.343.0860.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

You May Like: Who Is Eligible For Solo 401k

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Recommended Reading: Do Employers Match Roth 401k

Convert Existing Fidelity Solo 401k And Take A 401k Participant Loan Question:

I was looking for a 401k alternative to Fidelity and stumbled on your site and wanted to send an email with a few questions. I am in the process of buying a new house and was hoping to take a loan out from my solo / self employed 401k plan at fidelity however to my surprise they said that my 401k plan doesnt have the loan feature because it is a self employed / small business type. Needless to say I am looking for a new 401k provider where I can transfer my and my wifes 401k monies from fidelity and shortly after take a loan for the down payment. Does this sound like something you folks would be able to help me with? If this sounds doable, please give me a call when you have some time to go over next steps.

Also Check: Where Is My Fidelity 401k Account Number

Financial Hardship Withdrawal Process

- If you are married, your spouse must sign in the presence of a notary public.

- Mail completed forms and copies of your supporting documentation directly to Fidelity at the address on the form. Do not mail your Fidelity forms to Vanderbilt Human Resources.

Note: The Office of Benefits Administration no longer handles hardship distribution or loan request forms. Mail these forms directly to Fidelity to the address on the form.

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Read Also: Why Is It Called 401k

Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.