Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so its important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts youre considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

So I Can Monitor My Asset Allocation

FInally, I want to be able to keep track of all of my different investments easily so I can make sure I am appropriately diversified and exposed to the right level of risk. By rolling over my retirement accounts so all of my money is in one place, it’s much easier to analyze the composition of my portfolio.

For all three of these reasons, I think rolling over a 401 makes the most sense. Of course, everyone needs to make the decision that’s right for them — but a rollover definitely provides some benefits and is worth considering if you’re leaving your place of work.

Read Also: When Can You Rollover A 401k Into An Ira

Tax Consequences Of A 401 Rollover

If you handle it correctly, there are basically no tax consequences that come with a 401 rollover. More specifically, if you complete a direct rollover, your assets seamlessly move from one account to the other without any intervention from the IRS. The rollover doesnt show up on your tax return, nor does the IRS levy any taxes.

Conversely, the 60-day rollover faces a few tax implications. The reason for this is despite the fact that the money will pass through your control only momentarily, the IRS views it as a potential distribution. And because the IRS offers major tax benefits with retirement accounts, its extremely wary of when someone makes a withdrawal, especially a large one.

To cover itself, the IRS orders employers who you take a distribution from to withhold 20%. That can be a massive amount, especially if you have a large 401 balance. Its unfortunately up to you as the account holder to make up that difference before the 60-day period ends, otherwise youll lose the tax-deferred status for that money. Beyond that, if youre making the distribution before age 59.5, the IRS will hit you with a 10% early withdrawal penalty.

In todays day and age, theres virtually no reason a 401 plan provider wouldnt have the technical capabilities to transfer your rollover funds for you. But if the 60-day rollover is unavoidable, simply ask to have the check sent to you in the name of your new accounts custodian.

Advantages To Doing The Rollover:

- While company plans are increasing investment options, rollovers typically provide more flexibility in how you can allocate and use the money. You can rollover your funds into an investment vehicle suited to your particular situation.

- Puts you in charge of your account. Even if you like your current 401 plan, there are no guarantees that your employer will stick with that platform. Plus, what if your employer were to go out of business, merge with another company or endure some other event that could potentially impact your 401 funds.

- Gives you more control over when and how you can withdraw money and manage your account. s often have limits on when you can do this even limiting which holdings you can and can not sell.)

- Offers you the ability to consolidate all of your 401 accounts into one IRA. Many retirees have 401s at various companies. This money will be easier to manage in retirement if you consolidate it in one place even if it is invested in different types of financial products.

- Saves money. According to the Department of Labor, a 1% increase in fees could reduce your retirement account balance by 28%. Be sure to compare the fees associated with with your 401 to those you might be paying in your rollover account.

Recommended Reading: How Can I Get Money Out Of My 401k

What Are The Disadvantages Of Waiting To Roll Over Your 401

If your previous employer had a 401 plan with expensive investment options or otherwise high fees, youll want to look into moving the money to an IRA or your new 401 plan as soon as you reasonably can. The longer you leave the money there, the more the fees are working to eat away your hard-earned investment returns.

Next, leaving the account at your old employer can sometimes lead to it being forgotten. At the same time, a financial life with scattered accounts is much more difficult to manage. Its smart to consolidate to the extent possible and be proactive about optimizing the number of accounts you have.

There usually isnt a lot of upside associated with waiting, so its a good idea to create a plan and consolidate as soon as is practical for you. If you do decide not to roll over your old 401, make sure that its an active choice. So whatever you decide to do, be sure to give it some thought first.

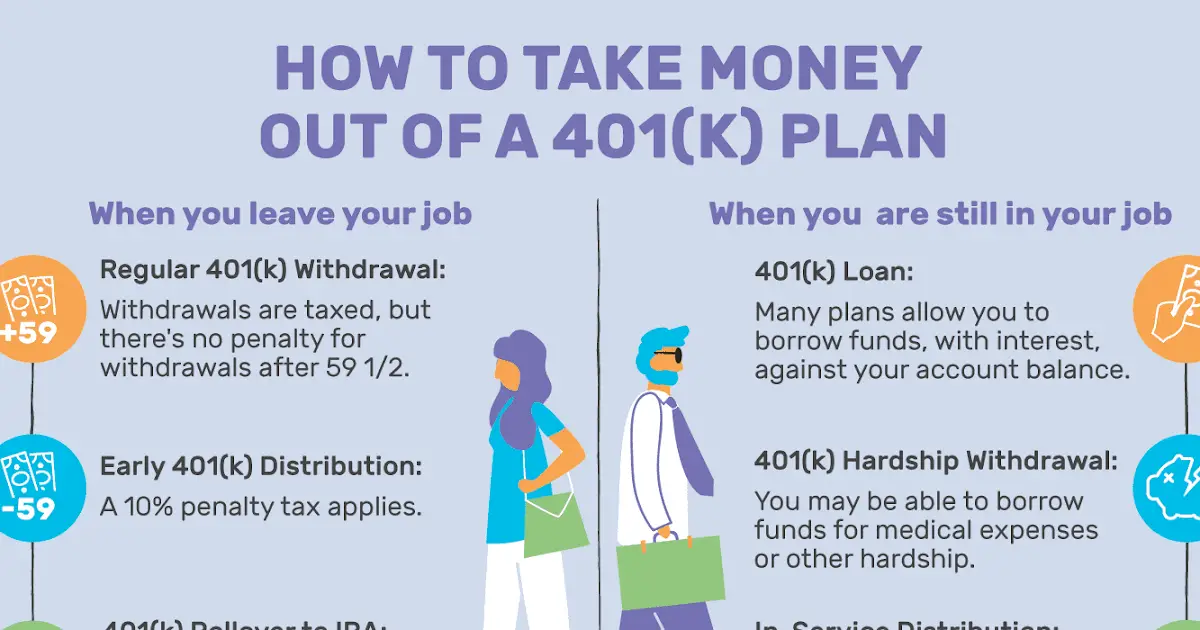

What Happens To Your 401 After You Leave Your Job

Many employers offer 401s as a way to help employees save for retirement. When you leave your job, you’ll need to decide what to do with your 401. Depending on what you do once you leave your job, you have several options. In this article, we describe four options you have when deciding what to do with 401 when you leave a job.

Don’t Miss: What To Invest My 401k In

Direct Vs Indirect Rollovers

A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties. Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. In many cases, you can shift assets directly from one custodian to another, without selling anything. This is known as a trustee-to-trustee or in-kind transfer.

Otherwise, the IRS makes your previous employer withhold 20% of your funds if you receive a check made out to you. It’s important to note that if you have the check made out directly to you, taxes will be withheld, and you’ll need to come up with other funds to roll over the full amount of your distribution within 60 days.

To learn more about the safest ways to do IRA rollovers and transfers, download IRS publications 575 and 590-A and 590-B.

Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

Read Also: Can You Transfer 401k To Roth Ira

Start Investing With Your New Ira

Ever IRA provider will have its own set of investments that it makes available to you. So hopefully during the account choosing process, you picked a brokerage that offers what you want. Once your account is open and fully funded, you can begin making investments as you see fit. Of course, if you go with a robo-advisor, this work is done for you.

In general, those close to retirement keep their investments on the safer side. This could involve investing in bonds or ETFs, both of which are typically reliable. On the other hand, someone further from retirement can afford to be riskier and more speculative. As a result, younger investors often include more stocks in their portfolio in an effort to achieve higher returns.

Pro #: You May Gain Flexibility

Your new employers plan may have different investment options, loan options, protections against potential creditors, or other benefits that better suit your needs than your former employers plan. If you continue working until and beyond 72 years of age, you may be excused from required minimum distributions if your new employers plan allows it.

Also Check: How Do I Find A Lost 401k

Balance Between $1000 And $5000

For 401 balances less than $5,000, your employer doesnât need your permission to transfer your funds out of the 401 plan.

However, if you have over $1,000 in your 401âand you havenât opted to have your funds rolled over to a specific accountâthe planâs administrator is required to transfer your 401 funds to an IRA.

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

Read Also: Can You Take A Loan From 401k For Home Purchase

How Long Do I Have To Rollover My 401 From A Previous Employer

When leaving a job many ask, âHow long do I have to rollover my 401?â Usually, your previous employer will rollover a 401 for you. If you receive a check youâll have 60 days to roll it over to avoid penalties.

Leaving a job can be a stressful time. Tying up loose ends and preparing for your next venture can cause certain things to fall through the cracks. Namely, forgetting to bring your 401 with you. There are a few things to remember when you go to rollover your 401 from a previous employer.

If your previous employer disburses your 401 funds to you, you have 60 days to rollover those funds into an eligible retirement account. Take too long, and youâll be subject to early withdrawal penalty taxes.

However, there are alternatives to your previous employer cashing out your 401 when you leave that can make the process much easier.

Move Your 401 Into An Ira

If you are looking for greater flexibility with your money, you can rollover over your 401 into an IRA with a financial institution or brokerage. An IRA is also a great option if you want to consolidate 401s left with former employers.

With an IRA, you have access to a wide range of investment options, and you have greater control in determining where to invest in, and the fees you pay. You may also qualify for penalty-free withdrawals when buying your first home, paying higher education expenses, or other qualifying expenses.

The 60-day deadline also applies to indirect 401 rollover to an IRA. The 401 plan administrator will send you a check, and you must deposit it with your IRA within the 60-day window to avoid paying income tax and early withdrawal tax.

Read Also: Can You Transfer 403b To 401k

Option : Roll Over Your 401 To Your New Employer

The most common route people take is rolling over their 401 to their new employer. Typically, this is done through a direct transfer or having your employer automatically transfer your 401.

Alternatively, you may opt for your employer to mail you a check for you to manually deposit into your new 401. The 60-day rule applies again here: If the funds arent deposited into a new 401 after this time, youll pay income tax on the entire balance.

Before transferring your funds to a new 401 plan, make sure you understand your new plans rules, fees, and investment options. Look into your new companys 401 matching program, if there is one. Make sure youre making the most of your new 401 plan by knowing all your options and seeing if your new plan is better or worse than what was available at your previous employer.

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022:

Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, it’s probably best to consult with a financial advisor to weigh your options.

Read Also: How Much Should I Contribute To My 401k

A Closer Look At Your Available Options

The good news is whatever money thats in your 401 is yours to do with as you like. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may need to roll it over or into a brokerage account that you own completely.

Convert Into A Roth Ira

The pros: Withdrawals are entirely tax-free in retirement, provided youre over age 59½ and have held the account for five years or more. Roth IRAs are also exempt from RMDs.

The cons: Because Roth IRAs are funded with after-tax dollars, youll have to pay taxes on your existing 401 funds at the time of the conversion. A Roth IRA must be open for five years in order to withdraw earnings tax-free, and youll be subject to a 10% penalty if you withdraw any money before youre 59½ without an exemption.

You May Like: How To Pull Out Of Your 401k

You Can Keep It Where It Is Roll It Over Into A New 401 Roll It Into An Ira Or Cash It Out Heres How To Decide

Choosing what to do with a 401 when leaving an employer can be one of the biggest financial decisions an investor makes.

Across the board, 401s have taken big hits in recent months. While many investors have heeded the general advice to stand pat and give markets time to recover, there are times when investors are forced to make decisions regarding their accounts.

One of those moments is when you leave your employersomething many people are being forced to do these days. What you do with your 401 as you depart can have a big impact on your financial future.

Reasons For And Against Rolling Over Your 401

Saving for retirement doesnt necessarily have to include a 401 rollover to an IRA. In many cases, youre able to keep your 401 account even if you no longer work for the employer. However, like all financial decisions, there are pros and cons to both sides.

One major reason that rolling over your 401 can be helpful is that IRA providers boast better investment selections. 401s often have minimal choices, with target-date funds being some of the most common. But if you want to diversify your assets across stocks, ETFs, bonds, options and more, a brokerage is the way to go. The same goes for robo-advisors, though those decisions are automatic instead.

Brokerages that offer IRAs may also give out bonuses to prospective clients who open an account. These can come in the form of cash bonuses or even extra features and membership tiers. Taking advantage of offers like this can give a little boost to your retirement savings.

But perhaps the most important reason to roll over your 401 funds into a single IRA is consolidation. After all, the fewer accounts you have to manage, the more likely youll do so successfully. It can also be a pain to watch over multiple 401s at a few employers at once.

On the contrary, you may be fully happy with your 401. Simply put, if youre comfortable with your 401 provider, fees and investments, you may feel completely unmotivated to make a change.

Read Also: How Do I Know If I Have A 401k