Is A Solo 401k Worth It

The flexibility around solo 401 contributions, investment options, and relatively low management requirements makes the plan an attractive alternative for small business owners or sole proprietors who want to save for retirement proactively.

Both the salary deferral and the income-sharing contributions are optional and can be adjusted at any time. You could contribute to your solo 401 using either method or not contribute at all in a given year based on the fluctuating profitability of your business.

Contributions to your solo 401 also allow you to leverage other tax incentives that could amount to significant savings in the long run.

Who Can Contribute To A 401k

If your employer offers a 401 plan, you should find out who can contribute to the 401. Here are the eligibility requirements for each type of 401.

A 401 plan is an effective way for workers to contribute to their retirement on a tax-advantaged basis. 401 participants can choose how much to contribute, and set aside part of their salary to their 401 account. However, there are several types of 401 plans, and each plan has different rules on who can contribute.

Both full-time and part-time employees can contribute to a 401 plan. While full-time employees may be eligible to contribute to a 401 immediately, long-term part-time employees must work 500 to 999 hours per year for three consecutive years to be eligible to contribute to the 401 plan. If you are a self-employed individual or business owner, you can contribute to a solo 401 both as an employee and employer.

You Can Take A Loan From Your Solo 401

Most solo 401 providers let account owners take out 401 loans from their accounts. With a Solo 401, you can borrow up to the lesser of 50% of the plan value or $50,000. You must pay back the loan in five years or lessunless its used to buy a primary residence, in which case you have up to 30 years.

Just because youre borrowing from yourself doesnt mean it wont cost you. Youre required to pay your account interest comparable to what youd pay for a similar non-401 loan. Youll also miss out on potential returns that money would have earned if it had stayed invested. While you will eventually earn what you borrow back, plus interest, that interest rate may be less than the returns the money would have earned if you had left it untouched and invested in the stock market.

Also Check: Can A 401k Be Used To Purchase A Home

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Important Plan Provision Changes: New plan loan provisions are no longer offered in the TD Ameritrade Individual 401 plan. All outstanding plan loans must be paid off by May 31, 2022 to continue to use the TD Ameritrade plan document. Roth 401 deferral contributions in the Individual 401 plan will no longer be accepted as of December 1, 2022.

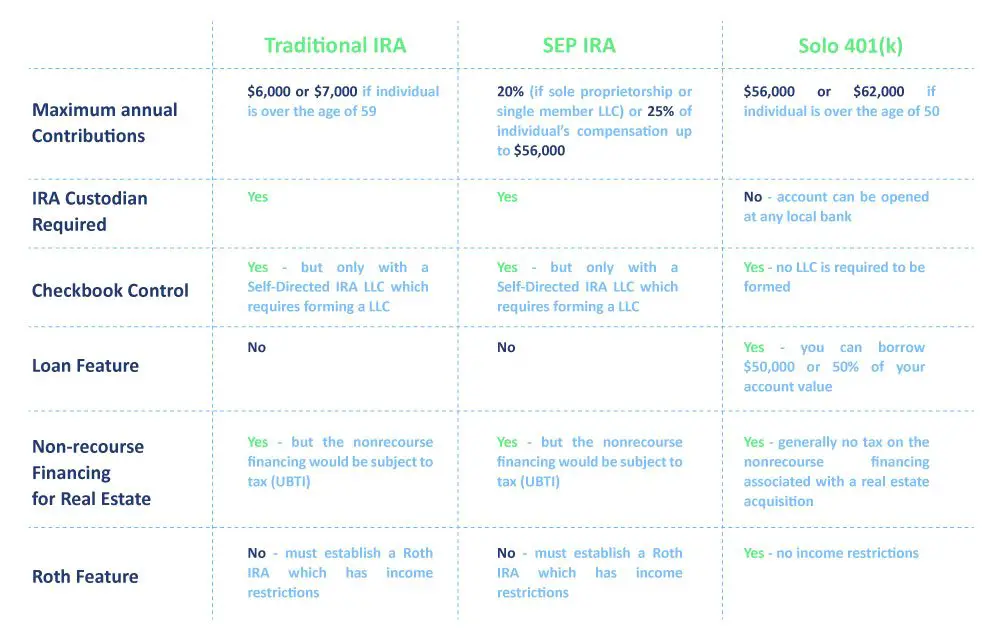

What Is A Sep Ira

A SEP IRA, known as a Simplified Employee Pension, is another option for the self-employed. Its especially beneficial for small business owners who have full-time employees. There are two major differences between a Solo 401 and SEP IRA. First, there is no catch-up contribution. There is no increase in the amount you may contribute at age 50. Secondly, there isnt an employee deferral. All contributions are based on a percentage of your annual income. Generally, its 20% for business owners and 25% for self-employment work. Therefore, its harder to max out your contributions to the max of $58,000.

If you have other employees, you must contribute on their behalf the same percentage you take yourself. However, you do not have to make contributions every year. During a down year, you may skip saving altogether. A SEP is a very cost-effective way to offer a retirement plan for small business owners. On the other hand, it doesnt really make much sense for an owner-only business.

Learn More:How to Correctly Diversify Your Retirement Account

Also Check: Can A Sole Proprietor Have A Solo 401k

How To Open A Solo 401k

The first step is to decide which solo 401k provider you want to use. Most of the major brokerages have them, like Fidelity, Charles Schwab, Vanguard, etc.

You need your Employer Identification Number or your Social Security number, and youll need that when you start preparing your documents. That includes a plan adoption agreement, which youll get from your solo 401k provider.

You need to set up the plan by December 31 of this year if you want to make contributions to it, and then youll have until your tax filing deadline for that year to make contributions. Thats typically April 15 of the following calendar year.

You can choose who to invest whats in your solo 401k. I highly recommend deciding on a provider with lots of different investment options, like mutual funds, bonds, ETFs, index funds, stocks, etc. More choices gives you more control. You can self-direct your investments or use your providers robo-advisor if they have one.

Once your solo 401k hits $250,000 or more in assets at the end of a given year, the IRS will require you to file a Form 5500-SF.

Related: Blooom Review 2021 An Affordable Robo-Advisor For Your 401K

Start Placing Investments Under The Solo 401k Funded Llc

After the LLC has been funded using solo 401k funds, future investments will be placed through the LLC bank account not the solo 401k bank account. Also, investments will be titled in the name of the LLC. If the LLC invests in real estate, for example, the funds for the purchased will flow from the LLC bank account to the seller, expenses and gains will also flow to the LLC bank account not the solo 401k bank account. However, once you are ready to dissolve the LLC or no longer wish to place investments via the solo 401k owned LLC, the funds will flow back to the solo 401k bank account. Also, solo 401k participant loans, and distributions such as required minimum distributions will need to be processed from the solo 401k bank account not the LLC bank account.

Read Also: How To Get Your Money Out Of 401k

Don’t Miss: How Does A 401k Make Money

A Great Way For Small Business Owners To Save Money On Taxes

The Economic Growth and Tax Relief Reconciliation Act of 2001 authorized the creation of a new type of 401 plan called the Roth 401. As you may have guessed, this was designed to create a 401 equivalent of the Roth IRA, to which the investor contributes after-tax funds , but in exchange they will never have to pay taxes again on any of the capital gains, dividends, or interest.

This distinction means that the Roth 401 is, for all intents and purposes, one of the single best tax shelters ever devised in the history of the United States. Nothing comes close to allowing you to put away so much money, compound it for decades, and then live off the passive income without ever sending anything to the federal or state governments again.

For self-employed individuals and their spouses who operate without any employees, setting up a so-called “one-participant Roth 401 Plan,” more commonly known as an “individual Roth 401,” can be one of the most extraordinary wealth-building tools in the arsenal.

Calculations For A S Or C Corporation Or A Llc Taxed As A Corporation

S corporations, C corporations and LLCs electing to be taxed as a corporation pay the business owner a W-2 salary. The calculation of how much can be contributed to a Self Employed 401k is based only on the W-2 salary of the self employed business owner .

Salary Deferral Contribution:

In 2020, 100% of W-2 earnings up to the maximum of $19,500 or $26,000 if age 50 or older can be contributed to a Self Employed 401k .

Profit Sharing Contribution:

A profit sharing contribution up to 25% of W-2 earnings can be contributed into a Self Employed 401k.

- EXAMPLE 1A 50 year old self employed consultant is the owner of a Subchapter S business with $50,000 of W-2 earnings in 2020. In this example, the consultant could contribute $26,000 of salary deferrals + $12,500 profit sharing contribution = $38,500 Total Self Employed 401k contribution.

- EXAMPLE 2 A 50 year old self employed consultant is the owner of a Subchapter S business with $100,000 of W-2 earnings in 2020. In this example, the consultant could contribute $26,000 of salary deferrals + $25,000 profit sharing contribution = $51,000 Total Self Employed 401k contribution.

You May Like: Can I Use My 401k To Buy A Second Home

Who Should Invest In A Solo 401

It’s also a good savings option for someone who works for a company that has a 401 plan but who also does contract work on the side, says Scott Frank, a certified financial planner in Encinitas, Calif.

Just keep in mind that 401 contribution limits apply per person, not per plan. If your solo 401 is for a side job, and you’re also participating in a 401 at your day job, the contribution limits apply across all plans, not each individual plan.

Contribute To Both A Sep Ira And Solo 401k

Importantly, if your SEP IRA and Solo 401k are both connected to the same business, then the contribution limits max out across both plans at $58,000 per participant. The contribution limit increases to $64,500 if you are age 50 or older and able to make catch-up contributions. The key here is that a Solo 401k has two types of contributions: Employee and Employer contributions. However, SEP IRAs only allow for employer contributions. If the sponsoring employer for both the SEP IRA and Solo 401k plans is your business, the $58,000 limit applies across both plans

However, if your SEP IRA and Solo 401k are connected to different businesses, the rules change. Therefore, you can maximize even greater contributions. Always check with your CPA to see if controlled group rules apply and may limit your contributions.

If you have a SEP IRA through one employer and a Solo 401k through your own separate small business, calculate each contribution separately. The maximum employer contribution is per plan. This is because one employer cannot be expected to know how much another employer will contribute.

However, your employee contribution is accumulative across all plans. You are the common denominator of being an employee at various businesses.

You May Like: Can I Invest My 401k

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Also Check: How To Offer 401k To Employees

Savings Incentive Match Plan For Employees

You can put all your net earnings from self-employment in the plan: up to $14,000 in 2022 , plus an additional $3,000 if you’re 50 or older , plus either a 2% fixed contribution or a 3% matching contribution.

Establish the plan:

Learn more:

Who Is Eligible For A Solo 401k

Lets start with one of the most basic solo 401k rules: eligibility. You are eligible for a solo 401k if you are self-employed and do not have any employees. This applies to self-employed small business owners, freelancers, 1099 contractors, and solopreneurs.

The most important qualification is that you do not have any employees. However, solo 401ks are unique in that you can cover your spouse if they are drawing income from your business. Your spouse is the only employee that could potentially qualify under your solo 401k plan.

Recommended Reading: What Is A 401k Annuity

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Possible Drawbacks To Consider:

- Administration and reporting. Unlike the which is not subject to annual IRS filings, annual reporting is required for Individual 401 plans. Filing form 5500 is necessary when the account reaches $250,000 at the end of the year

- No employees allowed. Except for a spouse, Solo 401 plans do not allow any other employees of the business

- More restrictive timelines to set up and fund. Compared to the SEP IRA, the Solo 401 offers less flexibility for business owners to set up and fund. Plans must be set up by December 31st in most cases. Unincorporated businesses must fund their plan by the corporate tax return deadline, including extensions. Individual elective deferrals must be declared by December 31st even though funding can be postponed. Incorporated businesses may also wait until the tax filing deadline, including extensions, for the employer contribution. However, employee deferrals must occur within 7 days of electing the contribution. To avoid issues, annual employee contributions should be done before December 31st

Business Owners: Its Not Too Late to Lower Your Taxable Income for the Year

Recommended Reading: How Do I Find My Old 401k

What If They Are Offered By The Same Business

However, if both plans are offered by the same business, then the individuals contributions to both plans, in total, are limited to the lesser of $57,000 or 25% of the net earnings from self-employment, excluding catch-up contributions from the $57,000 limit, and salary deferrals from the 25% limit.

If you have self-employment income from a side business in addition to W-2 income from employment, consider contributing to a SEP plan and a 401 plan, if available. Doing so will maximize your retirement savings. Contact one of our team members today for more information.

Reference: IRS Publication 560 and IRS.gov FAQs on retirement plans

Like This Article? Share With Your Networks

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Don’t Miss: Should I Rollover 401k To New Employer