Disadvantages Of A 401 Rollover Into An Ira

Rolling over a 401 into an IRA does have some disadvantages, so youll have to weigh these against the advantages.

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022: Employees with 401 plans that allow after-tax contributions of up to $58,000 would no longer be able to convert those to tax-free Roth accounts. Backdoor Roth contributions from traditional IRAs, as described below, would also be banned. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, it’s probably best to consult with a financial advisor to weigh your options.

Will Offset Much Of The

“…will offset much of the post 2 year outflows….”………..Have another thread started on “Simple IRAs” as my daughter just joined a small company that has one of these. She previously work for a national company that offered her a 401k………..The tone and trying to read between the lines, it looks like Simple IRA are even worse than 401ks when it comes to “fees”, etc…………So whatis this “2 year rule” ?

Don’t Miss: When Can I Start Drawing From My 401k

Simple Ira Rollovers: The Simpleira Rollover Rules

The IRS hasestablished a number of simple IRA rollover rules. As previously mentioned, youare not able to complete a simple IRA rollover during the first two years fromthe date of your initial contribution to any other retirement account except anew simple IRA. If you do try to complete a simple IRA rollover during the twoyears, the IRS will count the full amount as a distribution. This can lead tothe following consequences:

- The entire amount that was withdrawn will becounted as part of your gross income for the year

- You will be assessed an additional tax of 25percent of the amount that you transferred and

- The contribution to your new Roth account mayexceed the contribution limit and subject you to a 6 percent penalty until youcorrect it.

If you wait to convert a simple IRA to a Roth IRA until after thetwo-year period, you will not have to pay the additional taxes. The amountsthat are included in simple IRA rollovers will not count towards your annualcontribution limit. The taxable portion of the rollover will be included inyour taxable income for the year.

How To Convert A Simple Ira To Aroth Ira

To convert a simple IRA to a Roth IRA, you should first contact theplan administrator for the simple IRA to make certain that you have passed thetwo-year limitations period. Plan administrators use different dates tocalculate when you have met the requirements of the rule.

You do not want to try to complete a simple IRA rollover to a Roth IRAbefore that date. If you do, the IRS will count the amount that you contributeto your Roth IRA as a distribution. This means that you will have to count theentire amount that you transfer as ordinary income that could throw you into ahigher tax bracket. You also may exceed the annual contribution limits for aRoth IRA. Finally, if you are under age 59 1/2, you will have to pay a 25percent penalty.

Once you have satisfied the two-year rule, the answer to can youconvert a simple IRA to a Roth becomes easier. You can open a Roth IRA accountand then fill out paperwork with the administrator of your simple IRA thatinstructs the plan to send acheck directly to your new Roth plan. You do not want the plan to send acheck to you directly because it might be counted as a distribution, subjectingyou to a penalty.

Read Also: How To Find My 401k Money

Irs Updates Guidance On Expansion Of Simple Ira Rollover Options

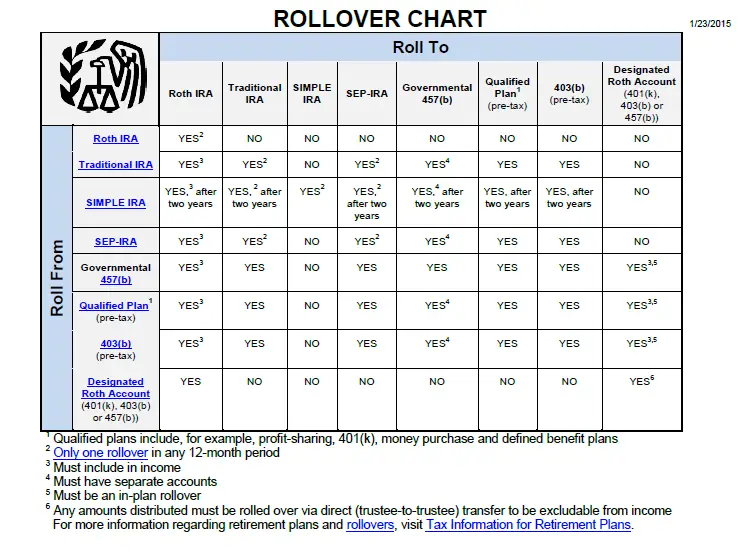

The IRS has updated the information it provides on the expansion of rollover options, which includes SIMPLE IRA plans. The information is contained in an issue snapshot that describes the change made by the Protecting Americans from Tax Hikes Act of 2015 to Code Section 408 to allow SIMPLE IRAs to accept contributions from other plans under certain circumstances.The PATH Act expanded the portability of retirement assets by permitting taxpayers to roll over assets from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403 or 457 plan, into a SIMPLE IRA plan.

Restrictions

There are some restrictions to the changes made by the PATH Act:

- SIMPLE IRAs cannot accept rollovers from Roth IRAs or designated Roth accounts.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law applies to rollovers from other plans to SIMPLE IRAs made after Dec. 18, 2015, the date the PATH Act was enacted.

- The one-per-year limitation that applies to IRA-to-IRA rollovers applies to rollovers from a traditional, SIMPLE, or SEP IRA into a SIMPLE IRA.

The IRS also notes that the PATH Act did not change the limitations for payments made from a SIMPLE IRA during the two-year period following initial participation.

Audit Tips

The IRS offers the following audit tips related to the changes the PATH Act made.

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense notto roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt notto defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell it , your taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment. The usual more-than-one-year holding period requirement for capital gain treatment does not apply if you dont defer tax on the NUA when the stock is distributed to you.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

You May Like: How To Calculate Company 401k Match

Who Can Open A Simple Ira

To open a SIMPLE IRA, you and your employer must meet certain criteria:

- Employer Eligibility for a SIMPLE IRA. An employer must have 100 employees or fewer to open a SIMPLE IRA, and it must make contributions each year. It can switch between matching contributions and non-elective contributions as long as it provides notice.

- Employee Eligibility for a SIMPLE IRA. Employees may participate in a SIMPLE IRA if they have received at least $5,000 in compensation during any two of the previous calendar years and expect to be paid that much in the current year. Employers may use less stringent requirements, though whatever rules they set must be applied identically to all employees. Employers dont have to let an employee participate in a SIMPLE IRA plan if they receive union benefits.

How To Roll An Ira Into A 401

The IRS offers two to consider when making the switch from an IRA to a 401. However, each company may have its own rules about whether theyâll accept rollover funds. A companyâs HR department may be able to advise how to proceed.

- Direct rollover: With this approach, the IRA plan administrator rolls funds directly into the 401 account. No taxes will be withheld from the transfer amount.

- 60-day rollover: Here investors have 60 days from the date they received a distribution to roll it over to another plan. Taxes will be withheld from a distribution, so investors will need to use other funds to roll over the full amount of the distribution.

Having a clear rollover plan ahead of time can help investors avoid unnecessary tax liabilities when transferring IRA funds into a 401.

Investing well for retirement is a crucial act. At Titan, our expert investment analysts steward your capital through actively-managed, high growth-potential portfolios. Sign up takes minutes, and our Client Experience team is here to help you step-by-step as you migrate your retirement funds over to Titan. Get started today.

Titanâs Legal Page for additional important information.

Also Check: Can I Withdraw From 401k To Buy A House

What Is A Simple 401 Plan

The SIMPLE 401 plan offers a cost-effective way for small businesses to offer retirement benefits to employees. It is a qualified plan and must follow the rules for required distributions. However, SIMPLE 401 plans are not subject to annual nondiscrimination testing. Contributions are immediately vested , which means that an employee who meets the requirements to receive distributions from the plan may withdraw their entire account balance at any time. Also, the annual contribution limits are lower for a SIMPLE 401 plan than for a traditional 401 plan.

SIMPLE 401 plans have a few stipulations that employers and employees must follow:

- Eligible employers must have no more than 100 employees.

- Employees must have received at least $5,000 in compensation from the employer for the previous year.

- Employers cannot maintain any other qualified retirement plan for employees who are eligible to participate in the SIMPLE 401. A second plan may be offered to employees who are not eligible.

- Employers must make either a matching contribution of up to 3 percent of an employee’s pay or a 2 percent non-elective contribution based on employee’s pay.

Exceptions To Additional Taxes

You dont have to pay additional taxes if you are age 59½ or older when you withdraw the money from your SIMPLE IRA. You also dont have to pay additional taxes if, for example:

- Your withdrawal is not more than:

- Your unreimbursed medical expenses that exceed 10% of your adjusted gross income ,

- Your cost for your medical insurance while unemployed,

- Your qualified higher education expenses, or

- The amount to buy, build or rebuild a first home

You May Like: How To Get Your 401k Without Penalty

Roll Over An Ira To A : The Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

In the world of retirement account rollovers, theres one type that doesnt get much love: the IRA-to-401 maneuver, which allows you to roll pretax traditional IRA assets into a 401. Its frequently overshadowed by rollovers in the other direction 401 to a rollover IRA because theyre more common. But in some cases, this less common move is also worth considering.

Take Steps To Ensure A Tax

Confirm the date. Once you think it has been two years since your first SIMPLE IRA contribution, confirm with the plan’s custodian. Be sure that you have met the two-year rule before beginning any transfer paperwork. Keep in mind that some custodians calculate that period with different start dates.

Remember the IRA One-Rollover-per-Year Rule.Per IRS rules, you are limited to one non-taxable IRA rollover per 12-month period. If you make more than one per year, the distribution will count as income. It may be subject to the 10% early withdrawal tax.

Consider waiting until the two years are up.Are you concerned about the timing of your IRA rollover? To keep things simple, you may want to keep the funds where they are until the two years are up. Again, be sure to confirm with your plan’s custodians that you have met the two-year rule before starting the rollover.

Recommended Reading: Is Fidelity A 401k Plan Administrator

Can You Convert A Simple Ira To Aroth Ira

As someone who is working to save for retirement, you probably haveheard that you should try to save around$1 million or more to be comfortable. Having a sizeable nest eggcan help to generate enough cash on which to live.

If you have stashed away money into a simple IRA through your formeremployer, you might want to consider a simple IRArollover to a Roth IRA. Can you convert a simple IRA to a Roth IRA?The answer is yes, but there are some rules that you must follow to convert asimple IRA to a Roth IRA.

The answer to can you convert a simple IRA to a Roth IRA is yes, butyou must wait for at least two years after you first began participating inyour employers simple IRA plan. If you dont wait, the amount will be countedas a distribution. This means that you will have to include it in your incomeand pay apenalty of 25 percent unless you are older than age 59 1/2.

The Limitations On Retirement Plans Can Prevent You From Doing What You Want

401 plans can be an effective way that workers can save toward their retirement. However, many employees don’t like the investment choices that their employers’ 401 plans allow them to make, and they would prefer to move money out of their 401 plan accounts into an IRA in their own name. Most employer plans don’t allow employees to transfer money from a 401 account to an IRA while they’re still working, but a few do offer what are known as in-service rollovers that make that option available to a limited number of workers.

The general rule: No rollover while workingWorkers generally aren’t allowed to take money out of their 401 plan accounts while they’re still working. Limited exceptions apply for hardship withdrawals, but workers aren’t allowed to take those withdrawals and roll them over into an IRA. Similarly, money ta ken out of a 401 for uses like a first-time home purchase or educational expenses might qualify for exceptions to the 10% penalty for early withdrawals, but they don’t open the door to IRA rollovers.

If you do take a 401 withdrawal and deposit the proceeds into an IRA, the IRS will treat it as a taxable distribution followed by an IRA contribution. The distribution will be taxable and subject to an early withdrawal penalty if appropriate, and the contribution will be subject to normal IRA limitations. If you’re not allowed to make an IRA contribution in that amount, additional penalties will apply.

You May Like: Can You Roll Over 401k To Roth Ira

Simple Ira Contribution Limits

For 2021, the SIMPLE IRA contribution limits are $13,500 or $16,500 for people who are age 50 and older. For 2022, the SIMPLE IRA contribution limits rise to $14,000 or $17,000 for people 50 or older.

If you want to contribute more than that amount, you can also invest up to an additional $6,000 in a traditional or Roth IRA. You cannot, however, max out both a SIMPLE IRA and another employer-sponsored retirement plan, like a 401.

The annual total for both SIMPLE IRA contributions and 401 contributions cant be more than $19,500 for 2021 . In 2022, this increases to $20,500 . Because an employer cannot offer both a 401 and a SIMPLE IRA, this scenario would only occur if you changed employers during one year, your employer changed your plan mid-year or you had multiple jobs with retirement benefits.