Think About Switching Jobs

You may be willing to do without benefits when you start working if your goal is to gain experience, or because you really believe in a company. Some startups may not have retirement plans in the first few years, but they plan to offer them later. But you may want to think about switching jobs to a more established company to make the most out of your savings if youve been there for years with no change in benefits.

Td Ameritrade Solo 401k

The TD Ameritrade Solo 401k plans are low-cost in the sense that they do not charge you any fee for setting up or maintaining your plan. They also dont charge commissions or trade fees on stocks, mutual funds, or ETFs. Furthermore, TD Ameritrade lets you borrow against the assets in your Solo 401k and allows you to make Roth contributions as well as a rollover from other retirement accounts.

Save Invest And Save Some More

Most experts say at least 10% of your income should go toward retirement. If youve started saving later in life, you may need to bump that up.1

Not possible right now? Thats OK. Save what you can and commit to increasing 1% every year until you can hit the mark. Try to save enough to get your employers matching contribution so you dont leave money on the table.

Options for saving and investing can include:

- Company sponsored retirement plans like a 401, 403, or a Thrift Savings Plan for government employees

- A variety of investments like mutual funds, stocks, bonds

- Life insurance that builds cash value

The sooner you start, the more potential your money has to grow over time. Its all about compound earningswhen your money earns more money.

Lets say you invest $10,000. And you earn 5% over a year.

So now you have $10,500. Over the coming year, you make 5% not just on your initial $10,000 but also on the $500 you earned last year. Thats the benefit of compounding in action.2

Read When to start investing: 4 signs you’re ready to learn more about the power of compound earnings.

To learn how 401s, traditional and Roth IRAs, and Roth 401s compare, read about retirement savings account options.

Recommended Reading: Do You Lose Your 401k If You Quit

Setting Up A Solo 401

Some paperwork is required, but its not too onerous. To establish an individual 401, a business owner has to work with a financial institution, which may impose fees and limits as to what investments are available in the plan. Some plans may limit you to a fixed list of mutual funds, but a little bit of shopping will turn up many reputable and well-known firms that offer low-cost plans with a great deal of flexibility.

Generally, 401s are complex plans, with significant accounting, administration, and filing requirements, says James B. Twining, CFP, founder and wealth manager of Financial Plan. However, a solo 401 is quite simple. Until the assets exceed $250,000, there is no filing required at all. Yet a solo 401 has all the major tax advantages of a multiple-participant 401 plan: The before-tax contribution limits and tax treatment are identical.

Come Up With A Recordkeeping System

How will you track employee and employer contributions? Come up with a way to track all plan-related info, including:

- Employee and employer contributions

- Distributions

If you use a professional or financial institution to handle your businesss 401, theyll handle recordkeeping on your behalf.

Your recordkeeping system is important for preparing annual reports, which the government requires.

Read Also: How Can I Lookup My 401k

According To 401k Statistics 58% Of 401k Participants See Themselves As Savers

Interestingly, the remaining 42% of 401k plan participants think of themselves as investors. Whats more, 72% believe its more important to save now so you could have a comfortable retirement. These attitudes show a changing dynamic towards savings. Hopefully, it will prompt more Americans to choose a retirement plan as soon as possible.

Donât Miss: What Is The 401k Retirement Plan

Common Questions Plan Participants May Ask Employers About A New 401 Plan:

- What other plans were considered? How does this choice compare?

- When can I start contributing?

- What affect will this have on my taxes?

- Does the company match contributions? How does that work? What is the limit?

- What are the investment options? Can I manage my own investments?

- How often can I change my investment and contribution options?

- Can I access my plan online?

- When can I withdraw money? Can I make an emergency withdrawal from my plan?

Recommended Reading: How Much Can I Take From 401k For Home Purchase

Can You Have Employees And Open A Single

You cant have any full-time employees, but you can contract with freelancers or employ part-time employees who dont work more than 1,000 hours a year in your business. Note that not all individual 401 plans allow for part-time employees, so be sure to check with your provider before hiring employees.

Maintaining 401k Plans For A Business

Most 401k plans are subject to the requirements of the IRC and the Employee Retirement Income Security Act , which provide minimum standards that protect individuals in retirement plans. Administering and maintaining plans that comply with these regulations ranges in difficulty from the moderate to the complex.

Also Check: What Happens To Your 401k When You Leave A Company

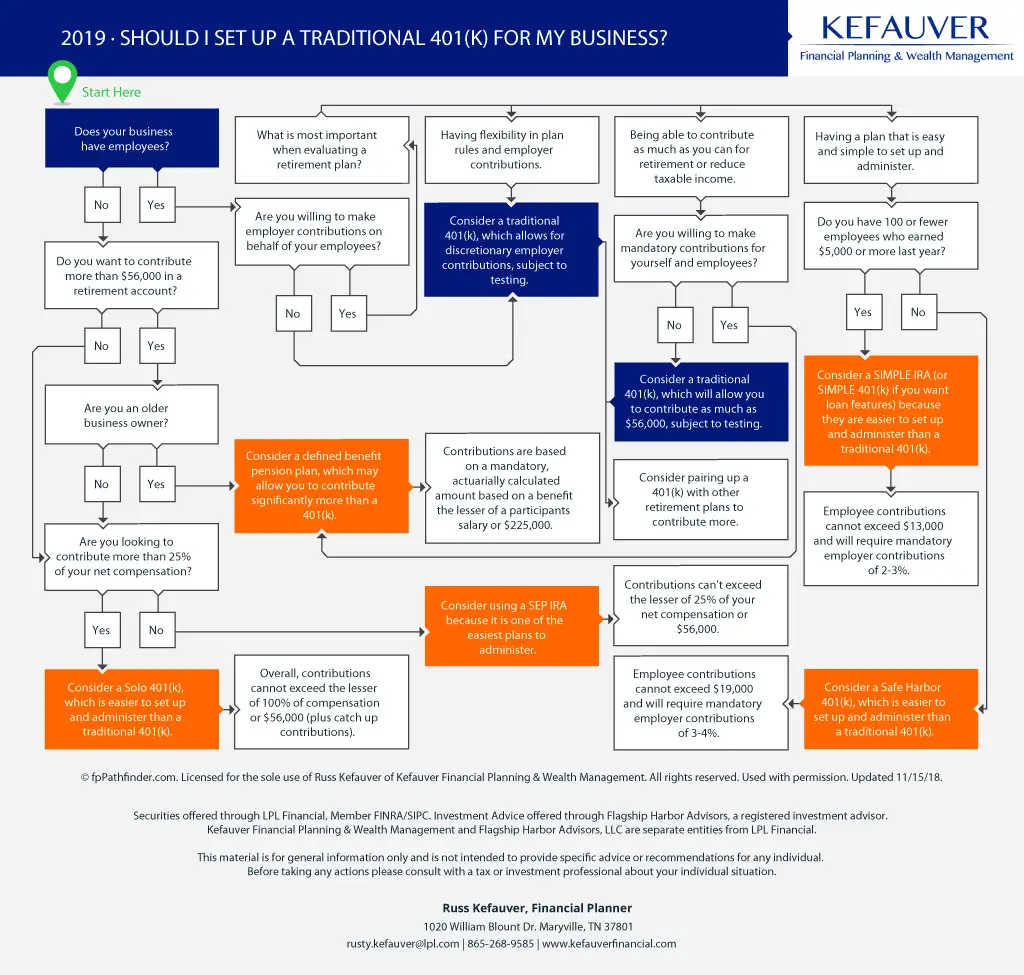

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

How Long Does It Take For A Small Business To Set Up A 401

Establishing a 401 can be a fairly straightforward process. However, without due diligence, that approach would be reckless and make your business vulnerable to expensive fees and risks associated with making hasty decisions regarding something as important as selecting a trustee. Depending on how much preliminary research you do, allow yourself ample time to create a plan document, establish a trust, notify employees, and launch your new benefit.

Read Also: Can I Borrow From My 401k Without Penalty

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

Traditional Or Roth Ira

If none of the above plans seems a good fit, you can start your own individual IRA. Both Roth and traditional individual retirement accounts are available to anyone with employment income, including freelancers. Roth IRAs let you contribute after-tax dollars, while traditional IRAs let you contribute pretax dollars. In 2021 and 2022, the maximum annual contribution is $6,000, $7,000 if you are age 50 or older, or your total earned income, whichever is less.

Most freelancers work for someone else before striking out on their own. If you had a retirement plan such as a 401, 403, or 457 with a former employer, the best way to manage the accumulated savings is often to transfer them to a rollover IRA or a one-participant 401.

Rolling over allows you to choose how to invest the money rather than being limited by the choices in an employer-sponsored plan. Also, the transferred sum can jump-start you into saving in your new entrepreneurial career.

Don’t Miss: What Is Minimum Withdrawal From 401k

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Recommended Reading: When Can You Withdraw From 401k Without Penalty

Take Full Advantage Of The Company Match

The first place to look in your 401 information is your employer match. Employers typically match 3% to 6% of your salary, but that is contingent on your own contribution. Generally, employers match 50% or 100% of your contribution up to the salary limit. Hint: you should always contribute at least up to your employer match, your net worth depends on it.

For example, lets look at someone who earns $50,000 per year and has a 50% match up to 3% of their annual salary. To take full advantage of the employer match, the employee must contribute 6% of their salary, or $3,000 per year, to get the full employer match of $1,500. That $1,500 is like free money from your employer, so this person should be absolutely sure they are saving enough to get that full 3% match.

Combined, that is like contributing 9%, or $4,500 per year, to their 401. That is likely not enough to maintain the same standard of living in retirement, but it is a great start and more than what the average person is doing. Assuming a biweekly pay schedule with 26 annual pay periods, that contribution is only $115 per payday, and that $115 has a tax advantage. Not a bad deal to get $1,500 in free money for retirement.

Take Advantage Of Other Benefits

Startups may offer other options, such as buying stock options instead of a retirement account. This can allow you to benefit from the growth of the company in the first few years. Its a good option when its managed right.

Make sure your portfolio is highly diversified. A startup could fold without warning. Owning this type of stock is riskier.

There are also rules for how soon you can sell your stock after purchasing it so this should not be your whole retirement plan. These rules can vary by company.

Some companies offer deferred compensation programs that allow you to defer pay until some future date, such as when you retire. This option lets you reduce your taxable income now. Youll save money on income taxes, earn interest on the money, then take the money as either a lump sum or over a period of time when you decide you want it.

The rules for participating in such a program, and for how these programs are operated, can be tricky. Consult with a qualified retirement planning specialist before you enroll.

Recommended Reading: Can I Transfer My 401k To My Spouse

What Are The Benefits When You Open A 401k Without An Employer

Not owning a small business today is a big mistake. Owning a small business allows you to open a 401k without an employer. A solo 401k allows you to fully control all aspects of your retirement account. This begins with the amount that is contributed to your account. With a Solo 401k, you decide how much to contribute as your own employee, and you decide how much your company contributes as profit sharing.

A traditional employer 401k controls how much you can contribute as an employee and limits the amount the company contributes in matching funds . Those limitations are costing you tax money today and limiting how much you will grow your retirement funds for your future.

When you open a 401k without an employer, you can maximize your retirement contributions as well as take business deductions. Taking business deductions increases the profits that can be added to your retirement contributions. A spouse that is part of the Solo 401k can double the contributions. A traditional employer 401k is dramatically more limiting in all these aspects of your retirement account.

When you open a 401k without an employer, you gain much more flexibility over how the account is managed. You decide how to deal with your tax obligation. You can maximize or minimize how much is contributed each year. You decide how much is contributed as an employee and how much your business contributes as your employer.

Stay Competitive By Offering A Retirement Benefit

Not only can offering a 401 provide tax benefits for employers, but it can also help your business compete when recruiting and retaining top talent. In fact, employees said healthcare and retirement were the two primary benefits they consider when evaluating a compensation package, while 78% of employees rated retirement plans as a must-have benefit. Additionally, half of all Americans say they would leave their current job for another with better benefits.

Also Check: How To Choose Fidelity 401k Investments

Work Directly With Trained Tax Professionals With An Ira Financial Group Solo 401k

Working with educated trained tax & ERISA professionals when looking for a Solo 401k plan provider is crucial in ensuring that your plan will be properly setup, as well as remain in full IRS compliance. The Solo 401k is based on the rules found in the Internal Revenue Code, which can be quite complicated to the someone without a tax professional background. Therefore, it is strongly advisable to work with a Solo 401k plan provider like the IRA Financial Group who was founded by a tax attorney who has written seven books on the topic of self-directed retirement plans, including two books on the Solo 401k plan.

Note IRA Financial Group is not a law firm. IRA Financial Group does not provide legal services. Relying on the advice of a document processor or no-tax professional when it comes to establishing and maintaining your retirement plan puts your retirement future at great risk.

Too many times, plan participants have unknowingly violated IRS rules when operating their Solo 401k because a plan provider representative that was not qualified to provide relevant tax advice gave them inaccurate and incomplete tax advice or drafted the plan documents incorrectly. Make sure this does not happen to you work only with qualified 401 Plan tax & ERISA professionals who have been specifically trained on the special tax aspects of the Plan to establish and maintain your Solo 401k Plan.

What Small Businesses Should Consider When Selecting A 401 Provider

-

Quality: For starters, its worth considering the status of the provider itself. This means examining the health of the business , their financial structure, and the caliber of customer service they provide. Its also important to evaluate how much support or education both your business and your team will desire, and what support systems your prospective provider supplies.

-

Technology: If youre a small business owner, for example, you most likely have tons of work on your plateand adding 401 plan administration would be no small feat. Similarly, your employees may want onboarding or education offerings at their disposal, should they need assistance setting up their plan. In these scenarios, it may be worthwhile to consider a tech-forward 401 provider that automates most of the manual work of plan administration.

-

Fees: Its also worth looking for providers that are transparent about their pricing structure. For example, some providers may advertise low costs, but actually add in additional transaction fees that can add up over time. When comparing providers, look for affordable, transparent 401 plans with low-cost funds.

You May Like: Should I Do Roth Or Traditional 401k

Dmitriy Fomichenko President Sense Financial

401k accounts are typically offered through your employers, so usually individuals cannot open their own 401k account.

The exception is if you own a business yourself, or considered self employed. In this case, the Solo 401k retirement plan becomes available to you . You can qualify even if you are working full time for an employer, and also do some freelancing work on the side.

If this doesnât apply to you, you can also look into setting up an IRA, which is also a retirement plan with tax benefits, but for individuals. To contribute to an IRA, you only need to have an earned income, and since youâre working for your employer, you should be able to set up an IRA without any issue.

If your employer offers a matching contribution, be sure to take advantage of this. It is essentially guaranteed return for your contribution, which you can hardly get with other investments, regardless of the types of account. Beyond that, you can decide if contributing to an IRA or a Solo 401k is more beneficial. The perk is, when you set up an IRA or Solo 401k, you get to choose the plan provider and have access to more investment products. However, you will also need to do your research to find the best options for your needs.

You May Like: Can You Transfer Money From 401k To Ira