When Can You Access The Funds From Your 401

The money that you contribute from your paycheck will always be yours. Although you cannot withdraw it before a certain period, you can transfer your account if you leave your company. However, the amount that your employer contributes may be subject to a vesting schedule. A vesting schedule is the amount of time you may need to wait before the money your employer contributes becomes yours fully.

Once you are fully vested with your employers contribution, you can take the entire contribution of your employer when you leave the job. If your employers contribution is not subject to a vesting schedule, all of your employers contribution immediately becomes yours, just like your contribution.

Related:

Should You Get A 401 Loan

Whether a 401 loan is the right for you depends on your situation. For some borrowers, especially those with poor credit, a 401 loan can help you avoid high-interest debt. As long as you can afford to repay the loan, itâs generally better to be paying interest to yourself than to someone else.

But 401 loans arenât without risks, the greatest being that if you canât afford to repay the loan or leave your job early, you may have your loan converted to an early withdrawal. These carry the same possible 10% penalty and tax consequences as any other early withdrawal from a 401.

Youâre also potentially missing out on up to five years of investment gains, depending on the length of your 401 loan. Remember that over the long term, the S& P 500 has gained an average of about 10% every year. While you could get lucky and make your 401 loan during an extended dip or recession, the longer your money is out, the more growth you may miss.

Before taking a loan from your 401, be sure to consider all other options, like emergency funds, taxable investment accounts, low-cost loans from personal lenders, HELOCs if you have home equity or any 0% APR credit cards you may be eligible for. While a 401 loan can make sense in some circumstances, itâs not the best choice for everyone.

Employer Matching For 401 Plans

Additionally, many employers offer a company match, which means that your company will match your contribution, up to a certain percentage or sometimes up to a certain dollar amount.

Heres a simple example of how a company may match by percentage:

Lets say your employer will match whatever percentage you put towards your 401. So you decide to contribute 5% of your salary to your 401k, meaning your employer will match that 5%. If you make $60,000 a year, thats 5% before taxes, which is $3,000. Your employer will contribute that same amount. Thats why its important to contribute at least enough to take advantage of your companys match in full. Free money is always good, right?

However, keep in mind that 401 plans also come with restrictions. In many cases, you cant tap into your companys contributions immediately after youre hired. You must wait a certain amount of time a period called vesting. The IRS also limits the amount of money you can put into your 401 savings, depending on your age and salary. There are also rules on when you can withdraw your money, and you can face penalties for pulling out funds before you reach retirement age.

You May Like: How To Borrow Against My 401k

How Does A 401 Plan Work

Once the plan is established, a 401 goes through a period of tax-deferred growth before the employee reaches retirement. A 401 plans lifespan can be summed up in four steps:

Phases of a 401 Plan

- Step 1

- Your employer offers you a 401 plan in your benefits package. You enroll in the plan and select your underlying investment for growth, depending on your time horizon and risk tolerance. Self-employed workers also have the option to establish an independent, or solo 401 plan.

- Step 2

- You contribute pre-tax money from your paycheck directly to the 401 plan. Your employer may also match your contribution or pay an additional percentage. plans, which you contribute to on an after-tax basis.)

- Step 3

- Those funds are invested in your underlying portfolio, and earnings may ebb and flow with the investments performance over time. The qualified retirement plans contributions and earnings grow on a tax-deferred basis until the time of withdrawal.

- Step 4

- After reaching 59 ½ years old, you may begin withdrawing funds from the plan to use as retirement income. You may pay income taxes on your withdrawals at that time. Depending on the year you were born, you must begin taking required minimum distributions at either age 70 ½ or age 72.

What Are The Benefits Of Contributing To A 401 Plan

One major benefit is the employer match, says Ward. Its like getting free money. Contributing up to the match is one of the best ways an employee can take full advantage of this benefit, he adds.

Providing an easy, tax-advantaged method of saving for retirement, plus the ease of automatic deductions from your paycheck to your account, are also benefits of participating in your employers 401 plan.

Read Also: How Do You Rollover Your 401k To A New Employer

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual â the individual who rolls over his or her existing retirement 401 withdrawal funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business. A C corporation must be set up in order to roll the 401 withdrawal.

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Also Check: Should I Move My 401k When I Change Jobs

Who Oversees Retirement Plans

The IRS qualifies, or approves, plans and regulates them from a taxation standpoint. The U.S. Department of Labor oversees employer-sponsored retirement plans, following the Employee Retirement Income Security Act of 1974 . They deal with fiduciary responsibilities of plan sponsors, participant rights, and the guarantee of benefits.

Safe Harbor 401 Plans

A safe harbor 401 plan is a special type of retirement plan that automatically passes the nondiscrimination test. This means that you dont have to pass an ADP and ACP test each year as you do with a traditional 401 plan.

Safe harbor 401 plans are popular with small businesses because employers can avoid the time and money it takes to pass nondiscrimination tests each year. But theres one caveat: you are required to contribute to an employees safe harbor retirement plan.

With a safe harbor plan, you must contribute to an employees 401, regardless of their title, compensation, or length of service.

Safe harbor 401 plan requirements

Who can offer a safe harbor plan: Businesses of any size can offer a safe harbor 401 plan.

Contribution requirements: You must make either an eligible matching or nonelective contribution. A basic match is a 100% match on the first 3% of deferred compensation, plus an additional 50% for each contribution that is over 3% but under 5%. An enhanced match is a 100% match on the first 4% of deferred compensation. A nonelective contribution is 3% of compensation, regardless of employee deferrals. Employer contributions are required to be fully vested, and your employees are guaranteed your contributions to their safe harbor 401 plan.

Plan requirements: Employers must give each eligible employee a written notice that lists their rights and obligations. Provide written notice to eligible employees before each plan year.

You May Like: Can You Use Money From 401k To Buy A House

How 401 Plan Administrators Get Paid

401 plan administrators generally charge a flat annual fee plus a per-head fee. For example, administration may cost $2,000 per year plus $15 per participant. Additional services create extra charges, usually billed as a flat fee.

Employers can pay for 401 plan administration, or they can pass the cost on to employees. When employers choose to pay for administration, it is generally because they:

- Want to keep investment costs inside the plan as low as possible for employees

- May qualify for a tax benefit if paying for the retirement plan is a deductible expense

When employers pay for administration, they typically write a check annually or quarterly.

When employees pay for administration, the fee may be paid as either a flat fee or an asset based fee. With flat fees, employees see a fee deducted from their account periodically . The dollar amount generally does not change, so it’s a predictable, recurring cost.

Asset based fees come out of employee investments, and they may or may not be visible to employees as transactions in their accounts. Administration fees may be shown transparently as a line-item, or they may be baked into investment expenses .

A Tax Savings Example

Assume you make $50,000 per year. You decide to put 5% of your pay, or $2,500 a year, into your 401 plan. You’ll have $104.17 taken out of each paycheck before taxes have been applied if you get paid twice a month. This money goes into your plan.

The earned income you report on your tax return at the end of the year will be $47,500 instead of $50,000 because you get to reduce your earned income by the amount you put into your plan. The $2,500 you put into the plan means $625 less in federal taxes paid if you’re in the 25% tax bracket. Saving $2,500 for retirement, therefore, only costs you $1,875.

Also Check: How To Fill Out 401k

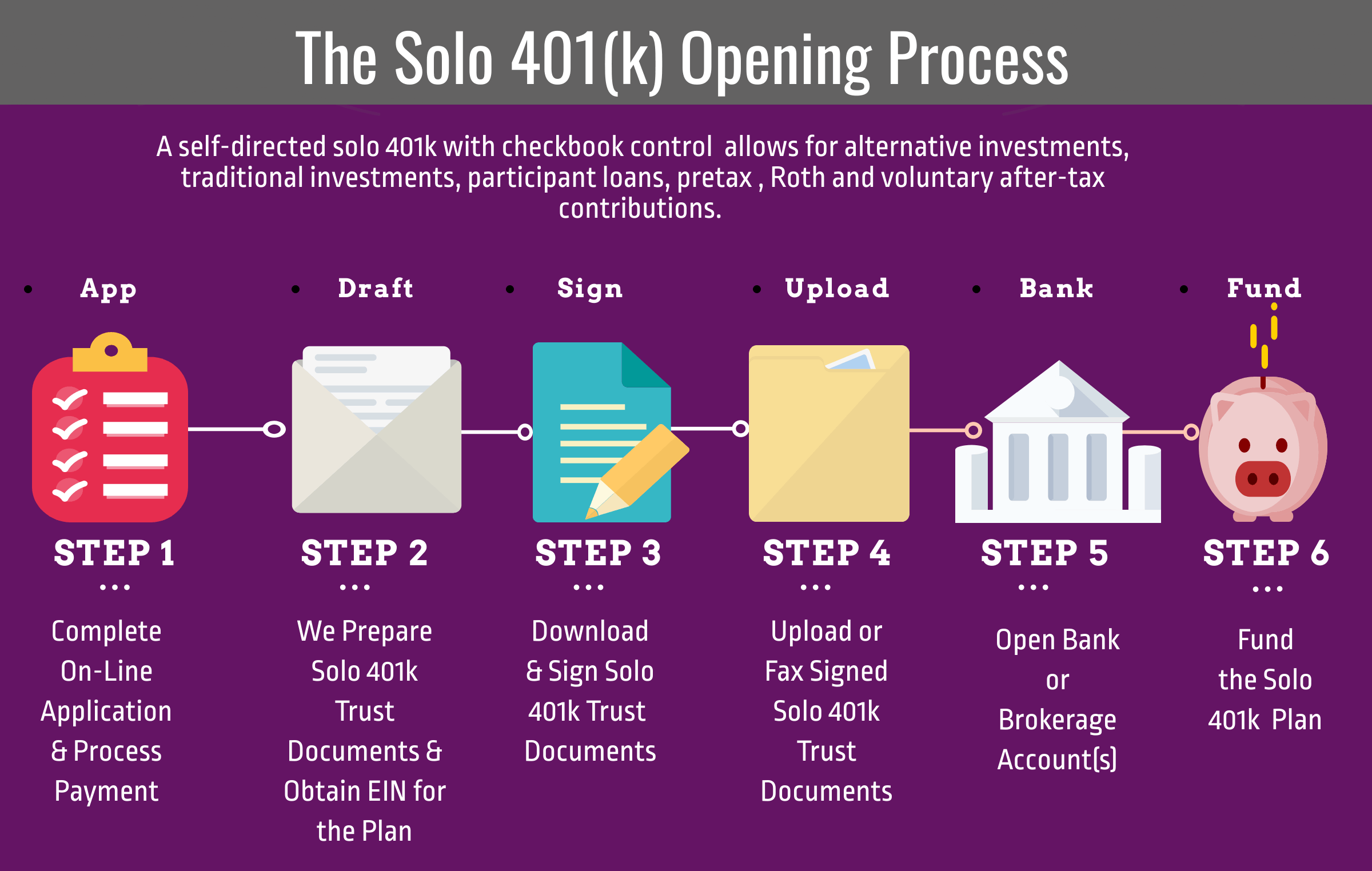

How Do I Create A 401 Plan

Creating a 401 plan for a companyeven a small oneis a complex process. The following is a basic overview of the steps for getting approval and starting the plan:

- Write a plan with the help of a plan adviser and send it to the IRS for a determination letter .

- Find a trustee to help you decide how to invest contributions and manage individual employee accounts.

- Begin making employer contributions, if offered, and allowing employee contributions through your payroll system.

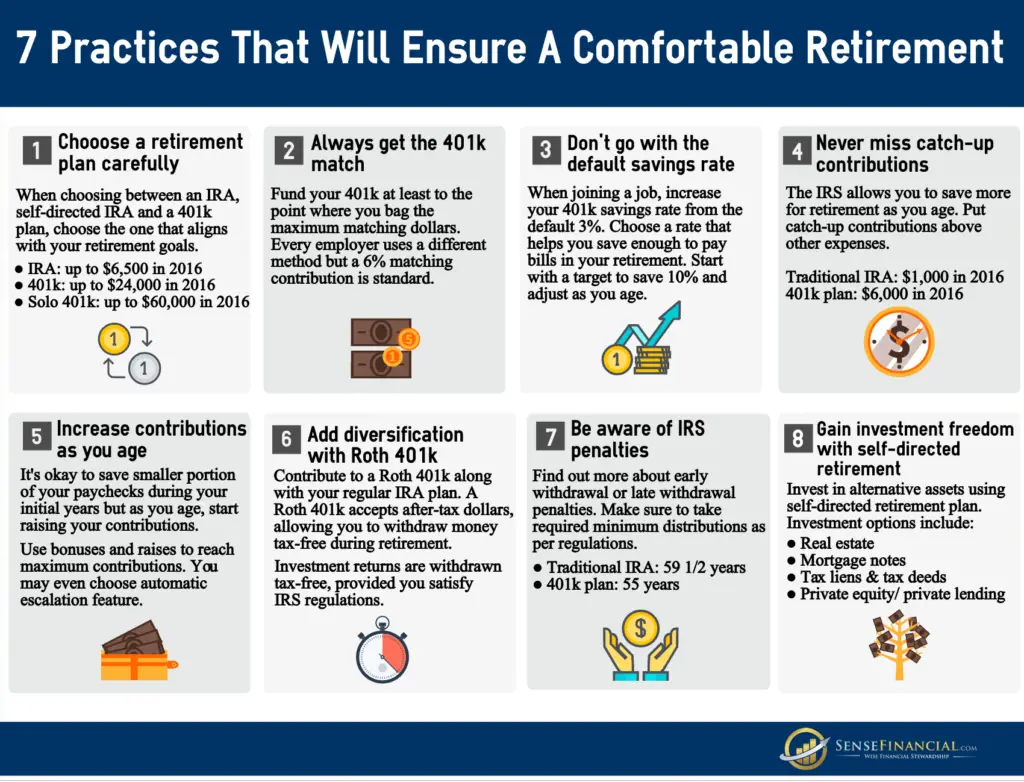

Tips For Retirement Planning

- SmartAssets retirement calculator can help you figure out exactly how much youll need to save for the retirement you want. To best use this tool, make sure you have on hand some important information. This includes your annual income, your monthly savings, how much you expect to spend annually in retirement, details about your Social Security benefits and more.

- There are many outside services available for retirement planning, with perhaps the most popular being financial advisors. The financial advisor matching tool from SmartAsset can set you up with as many as three advisors in your area. Your responses to our short questionnaire will dictate which advisory matches you receive, so be sure to answer as accurately as possible.

Recommended Reading: How Soon Can I Borrow From My 401k

Managing 401 Plans For A Small Business

Setting up a 401 can be complicated, but you don’t have to do it alone. Look for a provider with an excellent track record that can help you get started, manage your plan, and even share ideas and guidance to maximize the value to you and your employees. Doing so can go a long way in ensuring an ongoing, positive benefit for years to come.

**Largest 401 recordkeeper by number of plans, PLANSPONSOR magazine, 2022

How Much Can You Borrow From Your 401

In general, you can borrow the greater of $10,000 or 50% of your vested account balance up to $50,000. You are limited to the balance in your current companyâs 401, not the collective balance of all of your retirement accounts. You may, however, be able to roll over funds into your current 401 to increase the amount you can borrow. You are limited to borrowing from the assets in your current employerâs 401 plan.

Don’t Miss: How Can I Invest My 401k

Should You Get A Simple 401 Plan

Supporting your employees is a great way to keep turnover rates down and retention up. Retirement plans, including SIMPLE 401 plans, can help your employees save for their futures while still working for your company.

While SIMPLE 401 plans have a lot of benefits, like easy-to-manage rules and the ability to take out a loan, theyre not for every company. Limited availability and low contribution limits might hinder your opportunities.

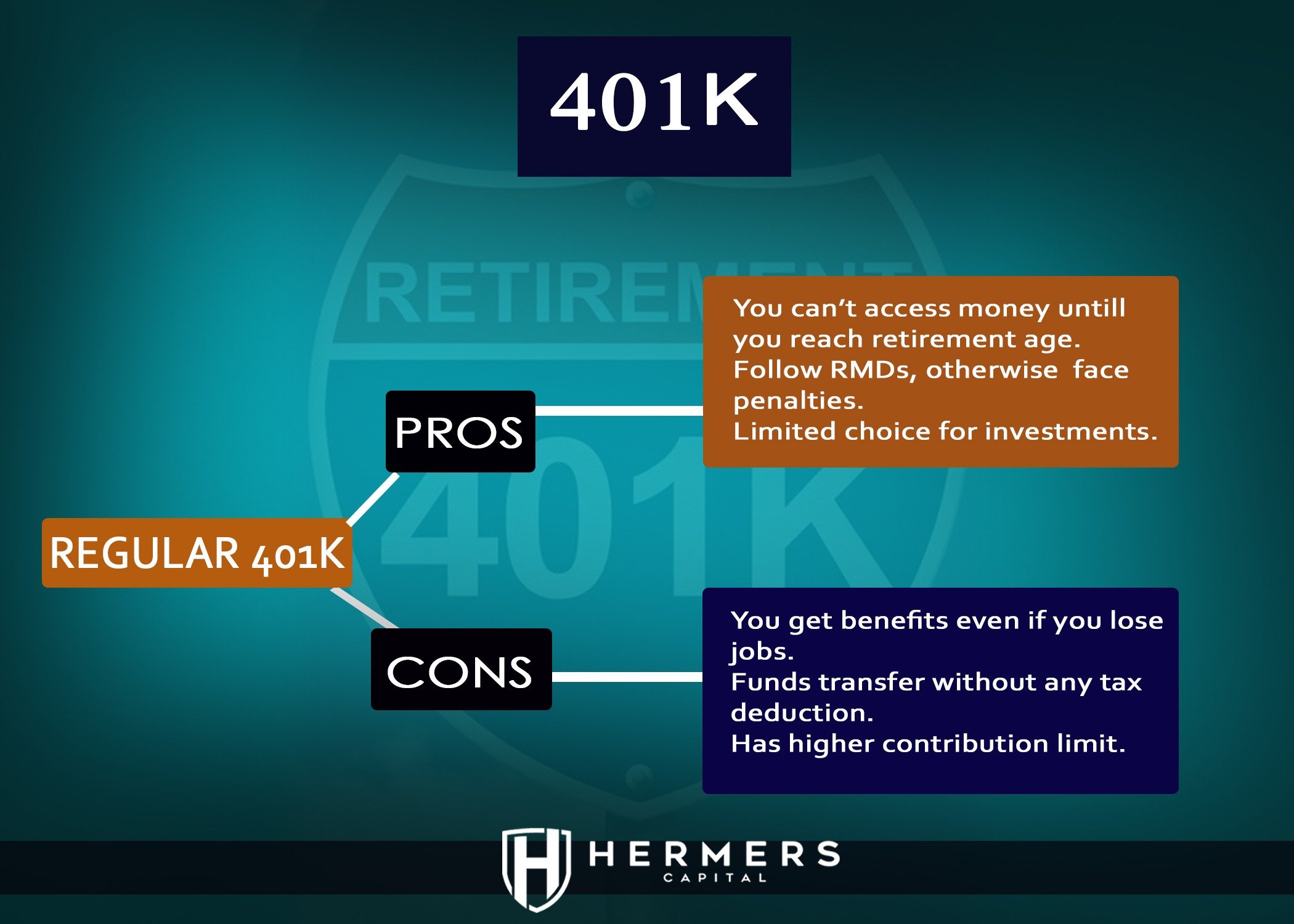

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

Don’t Miss: Can I Buy Individual Stocks In My 401k

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

How Does A 401 Work

401 accounts can only be sponsored by an employer. In most organizations, the 401 plan is offered as an optional retirement benefit.

A 401 is a defined contribution account. If an eligible employee participates in a 401, they will decide an amount of their salary that will be deducted from their paycheck into a separate account.

Employer matching. Employers may or may not match the employee’s contributions, up to a limit. Employers who decided to match employee contributions do so according to a determined formula. Employer contributions might be on the basis of $0.50 or $1.00 for every $1.00 contributed by the employee.

Investments. Companies typically offer employees several investment options for their 401 accounts. These can include mutual funds, index funds, large- and small-cap funds, real estate funds, bond funds and foreign funds. These options are managed by financial service groups.

For traditional 401 accounts, contributions from employee paychecks are made with pre-tax dollars and taxed as ordinary income upon withdrawal. Contributions to Roth 401s are made with post-tax paycheck deductions but are not taxed upon withdrawal.

Withdrawals. Usually, once the money is deposited into a 401, employees must meet certain criteria in order to make an unpenalized withdrawal from their 401 account . These criteria are known as triggering events:

Early withdrawals that do not satisfy these criteria are typically subject to income taxes and an additional 10% in penalties.

Read Also: How To Draw Money From 401k

How Does A 401k Work

A 401k plan technically a 401 is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account.

The account is managed by an investment company of the employer’s choosing. The 401k contributions are invested in stocks, bonds, and mutual funds, which the employee can select themselves.

Depending on the details of the plan, the money invested may be tax-free and matching contributions may be made by the employer. If either of those benefits are included in your 401k plan, financial experts recommend contributing the maximum amount each year, or as close to it as you can manage.

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

Recommended Reading: How To Sell 401k Plans