Improve Your 401 Balance

Improving your 401 balance depends on how well you can handle your finances and how much you can contribute to it. Doing your research for the best interest options for your 401 plan can be a good way to start building compound interest, which will result in a higher balance.

If you think youre at a good place with your finances and making sure your living expenses and debts are being paid off, it might be worth considering maxing out your 401 contributions. According to Vanguard, only 12 percent of 401participants maxed out their contribution limit of $19,500 in 2020, and you could be one of them.

Whether you start small or contribute close to the limit, consistently contributing to your 401 and making sure your plan meets your goals will help you improve your average 401 balance and save more for retirement.

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the 401 average by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn from Vanguards research on How America Saves in 2021:

| Age |

|---|

Don’t Miss: Can You Take A Loan From Your 401k

The 401 Contribution Limit Increased By $500 For 2020 Plus Workers 50 And Older Can Also Save An Extra Amount For Retirement

One of the best and most tax-friendly ways to build a nest egg for retirement is by contributing to an employer-sponsored 401 account. If your employer offers this benefit, jump in as soon as you can, because its never too early to start saving for retirement.

Also Check: How To Rollover 401k To Charles Schwab

Have A Realistic Understanding Of When You Want To Retire

Having clearly defined goals will help you determine how much you should have saved based on your personal goals. Your savings objectives will be different if you plan to retire at 50 than if you plan to continue working past 70. Additionally, its important to determine as accurately as you can what your cost of living will be in retirement. How much do you need to spend per year to maintain the lifestyle that you want for the rest of your life? Have a good sense of what your costs will be so you can factor that into your overall retirement strategy. Really evaluate how long you want to continue working, and what retirement age is realistic for you based on your income and your current level of savings.

Recommended Reading: How To Start A 401k

How Much Should I Put In My 401k

There are two sets of answers when it comes to the question of how much should I put in my 401k?

The first answer is the technical side as in, how much are you actually allowed to put in your 401k each year? As youll soon see, the IRS caps how much you can put in your 401k each year.

The other answer is more qualitative and much more personal. If youre unable to contribute the maximum amount, then how much should you contribute? Or better yet, should you contribute to your 401k at all?

But first

This blog is about 401ks, but the rules were about to discuss also apply, for the most part, to other types of employer retirement plans like 403bs and TSPs. For simplicitys sake we will use the term 401k as a catch-all since it is the most popular type of employer retirement account.

Consider 401 Alternatives Like An Ira

You dont have to limit your savings to your 401k. You may also be able to save in other retirement vehicles, like a traditional IRA or Roth IRA.

Can you contribute to 401k and IRA plans simultaneously? For example, if youre already contributing to a 401k plan at work, you may be wondering if you can also save money in an IRA.

Or maybe you opened an IRA in college, but now youre starting your career and have access to a 401k. Does it make sense to keep making contributions if youll soon be enrolled in your employers retirement plan?

Don’t Miss: How Much Money Can I Contribute To My 401k

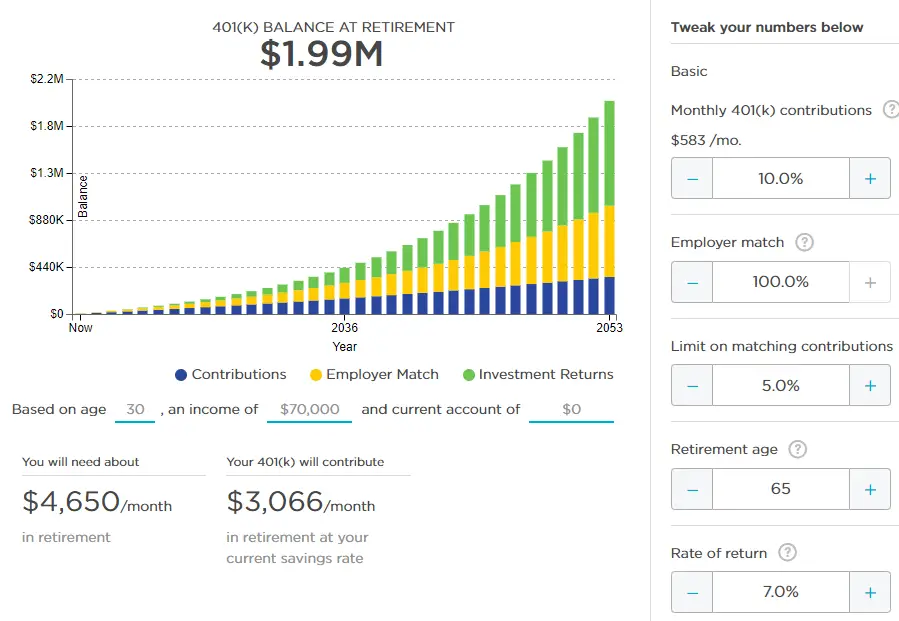

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Also Check: How To Find Out If I Have An Old 401k

Your Employer’s Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

How Much Can You Contribute To Your 401

The Internal Revenue Service sets the contribution limit for 401s annually. This limit varies based on your age, but for 2022, most Americans can contribute up to $20,500 across the entire year. If you’re 50 or older, the limit goes up to $27,000 .

That is just your personal contribution limit, though. You can technically exceed these amounts – up to 100% of your compensation or $61,000, whichever is lower – if your employer also contributes to the account. Some employers offer a matching contribution, meaning for each dollar you contribute to your account, they’ll contribute a matching amount up to a certain threshold.

According to a report from investment management group Vanguard, most employers with matching benefits will contribute 50 cents on the dollar for up to 6% of the employee’s pay. So if you made $50,000, your employer would contribute up to $1,500 per year, provided you contributed at least $3,000 yourself .

Don’t Miss: How Old Do You Have To Be To Start 401k

You Get A Tax Break For Contributing To A 401

The core of the 401s appeal is a tax break: The funds for it come from your salary, but before tax is levied. This lowers your taxable income and cuts your tax bill now. The term youll often see used is pre-tax dollars.

Say you make $8,000 a month and put $1,000 aside in your 401. Only $7,000 of your earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

Yes, you will have to pay taxes someday. Thats why a 401 is a type of tax-deferred account, not tax-free. Well get back to that.

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

You May Like: Can I Roll My Pension Into My 401k

Build Your Emergency Fund

You want to save as much as you can for retirement, but you shouldnt put all of your savings toward retirement. You should always have enough cash reserves to cover necessary expenses like food and rent. Its also a good idea to create an emergency fund.

An emergency fund will protect you from unexpected expenses or difficult financial situations. What would you do if you lost your job or didnt have a regular salary for a month? What if a family member got sick and you had medical bills to pay? A strong emergency fund allows you to get through tough times. Withdrawing money from your retirement accounts should be an absolute last resort. Just as importantly, an emergency fund will ease your mind by providing a sense of security. Its always nice to know that you have a backup plan in case something goes wrong.

Again, there is no perfect answer for how much you should have in an emergency fund. It depends on your situation. In general though, you want enough to cover at least a few months of expenses. That may sound like a lot if currently have no emergency fund, but you can build your fund over time by adding a little each week or month.

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2021 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

Don’t Miss: How To Check 401k Balance Fidelity

Cost Of Skipping Full 401 Match Over Your Career

Leaving $1,336 of a company match on the table over your working career from 25 to 70 would total more than $60,000 in lost money from your employer. You also missed out on contributing $60,000 pre-tax to your 401. You would also pay more state taxes and federal income taxes over your working years by skipping 401 contributions. But these numbers pale in comparison to what you are giving up in retirement income and security. If invested wisely, that money would grow exponentially over time.

For example, putting that $1,336 into your 401 each year, from 25 to 70, and assuming an average return of 10% per year, how much do you think you would have at retirement? The $1,336 per year, with an average return of 10%, would grow to more than $960,000 by the time you were 70. That number alone exceeds the average person’s savings for retirement. But wait, it gets better you would have been contributing $1,336, which would have doubled your 401 balance to around $1,920,000 at age 70.

Skipping the full employer 401 match could cost you two million dollar over your career.

getty

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Donât Miss: How Do You Take Money Out Of 401k

Recommended Reading: Should You Move Your 401k To An Ira

Start Lower And Increase Later

If you find that you cant contribute as much as you think you will need because of your living expenses or debts, figure out what you can contribute. Start by making a budget.

Think about increasing your contributions later on, consider doing so when you get a raise, a promotion, or on a set periodic basis. The important thing is to start saving as early as possible. And if circumstances change, you can update your contribution rate at any time.

What Is Your Employer Match

The exact match amount varies from employer to employer, so you will need to ask human resources or your boss about the plan details to be sure your contributions meet the level of the maximum employer match.

Generally speaking, the average matching contribution is 4.3% of an employees pay. Nearly three-quarters of employers prefer to match 50 cents on the dollar, up to 6% of employee pay. About one-quarter of employers elect to match dollar-to-dollar, up to a maximum of 3% employee pay.

You want to be sure youre contributing at least enough to earn all of the matching dollars your employer offers. After all, this is FREE money.

Also Check: Should I Convert 401k To Roth Ira

How Do I Invest 15% For Retirement

The first place to start investing is through your workplace, especially if it offers a company match. If your employer offers a Roth 401 or Roth 403, then you can invest the entire 15% of your income there and youre done. With a Roth option, you contribute after-tax dollars. That means your money grows tax-free, plus you dont pay taxes on that money when you take it out at retirement . Talk about making investing super easy!

If your employer matches your contributions to your 401, 403 or Thrift Savings Plan , you can reach your 15% goal by following these three steps:

For example, if your company will match 3% of your 401 contributions, invest 3% in that account and then put the remaining 12% in a Roth IRA. If that remaining 12% would put you over the annual contribution limit for a Roth IRA , max out the Roth IRA and then go back to your workplace 401 to finish out investing 15%.7

Here are two key takeaways: First, you need to invest 15% of your gross salary, not your take-home pay. Second, do not count the company match as part of your 15%. Consider that extra icing on the cake!