Retirement Plan And Ira Required Minimum Distributions Faqs

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

The Setting Every Community Up for Retirement Enhancement Act of 2019 became law on December 20, 2019. The Secure Act made major changes to the RMD rules. If you reached the age of 70½ in 2019 the prior rule applies, and you must take your first RMD by April 1, 2020. If you reach age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72.

For defined contribution plan participants, or Individual Retirement Account owners, who die after December 31, 2019, , the SECURE Act requires the entire balance of the participant’s account be distributed within ten years. There is an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner. The new 10-year rule applies regardless of whether the participant dies before, on, or after, the required beginning date, now age 72.

Your required minimum distribution is the minimum amount you must withdraw from your account each year. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 72 . Roth IRAs do not require withdrawals until after the death of the owner.

For more information on IRAs, including required withdrawals, see:

Withdrawing Funds From A 401 Before 55

If you are younger than 55, you may still qualify to withdraw money without quitting your current job. You can take a hardship withdrawal if you have a qualified expense. For example, you can take a hardship withdrawal to pay qualified educational fees, medical expenses, alimony and child support, repair of damage to your residence or to purchase your principal residence. You will owe income tax on the amount you take out from your retirement savings as a hardship withdrawal.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: What Is A 401k And How Does It Work

How Do I Calculate My Rmd If I Have More Than One Retirement Plan

- If you have more than one retirement plan, your RMDs must be calculated separately for each plan. However, if you have more than one IRA, whether a Traditional, SEP and/or SIMPLE IRA, you can then add the RMDs and take the combined distribution amount from any one or more of your IRAs. Similarly, if you have more than one 403 plan, you can take the combined distribution amount from one or more of your 403 accounts. You cannot, however, satisfy the RMD for your IRA with a distribution from your 403 or vice versa.

- For 401 plans, profit sharing and some other types of employer-sponsored plans, and for inherited IRAs or inherited 403s, you must take an RMD separately from each plan, even if you have more than one plan within a type.

- For example, if you have two 401 plans and two inherited IRAs, you will generally need a total of four withdrawals to satisfy your RMD requirements.

Your Ameriprise financial advisor can help you create a retirement income strategy that fits your unique financial situation.

You Can Only Withdraw From Your Current 401

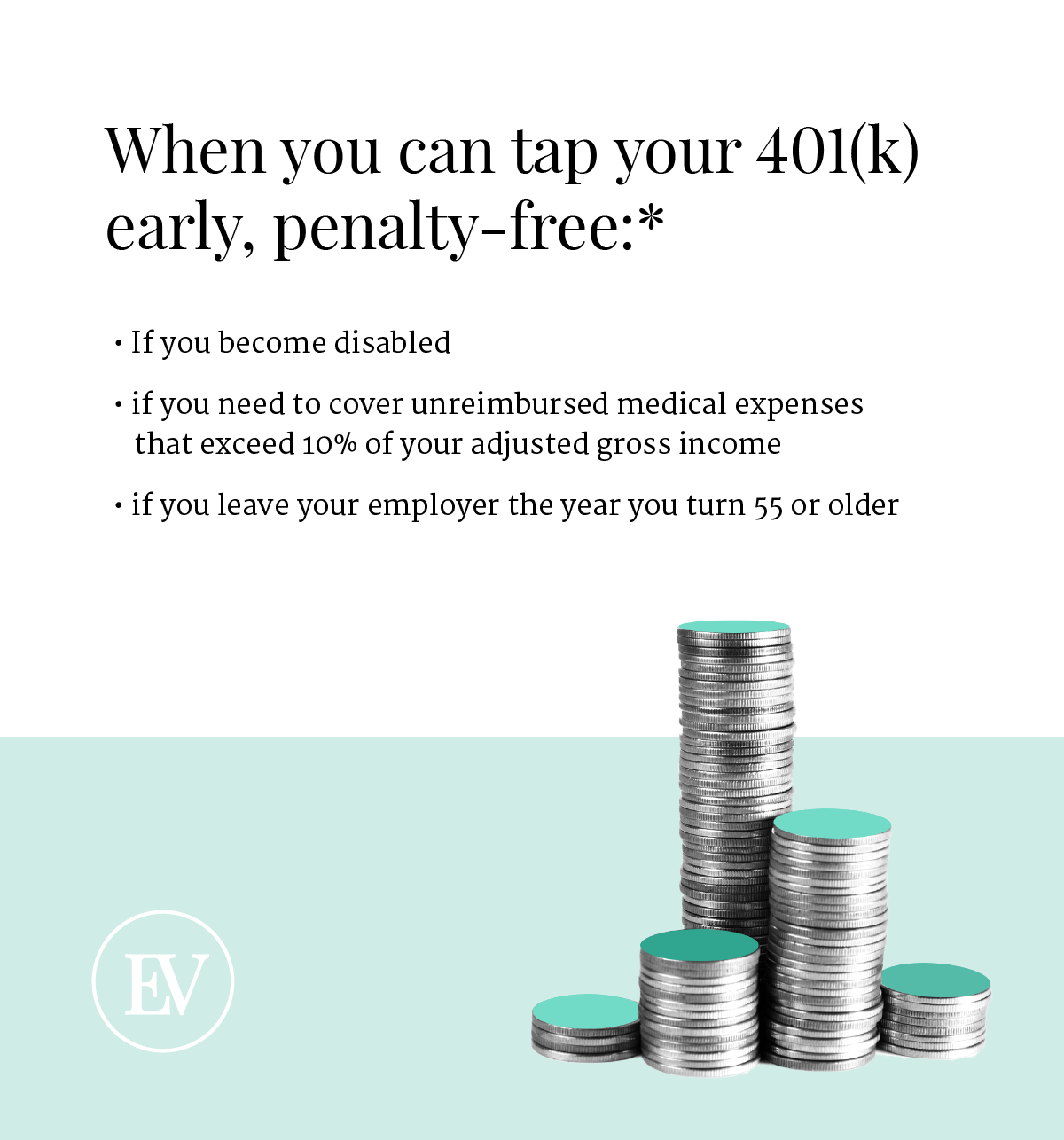

Penalty-free early withdrawals are limited to funds held in your most recent companys 401 or 403 under the rule of 55.

Even if youre 55 or older, you cant reach back to old 401s and use that money, says Luber. Additionally, this rule doesnt apply to individual retirement accounts , so you need to leave your IRA alone if you want to avoid the penalty.

If youre actively planning how to retire early, Roger Whitney, certified financial planner and host of the Retirement Answer Man Show, suggests rolling retirement funds from old jobs and other retirement accounts into your current 401 before you leave. This way, you can get access to they money with the rule of 55.

Read Also: Should I Invest In 401k

How Much Money Should A 65 Year Old Have Saved For Retirement

The maintenance tips mentioned say you need ten times your annual salary in maintenance when you reach retirement age. The average salary of a 65-year-old is $ 54,000 a year â which means you will need up to $ 440,000 in security if you want to retire at the age of 65.

How much does the average 65-year-old have in retirement savings?

According to data from the Federal Reserve, the average retirement savings for those aged 65 to 74 is just north of 426,000.

How much money should I have at 65?

At the age of 65, you should have a saving / net worth of money equal to your 20X -25X annual operating expenses. In other words, if you spend $ 50,000 a year, you should have $ 1,000,000 â $ 1,250,000 in savings or nets necessary to live a good retirement life.

What Age Can You Take Money Out Of Your 401k Without Penalty

The IRS allows for the removal of the penalty-exempt from retirement accounts after the age of 59 ½ and requires removal after 72 years . There are some options for these 401ks rules and other relevant programs.

Can I subtract from my 401k at 55? What is Rule 55? Under the terms of this rule, you can deduct money from 401 or 403 of your current job plan without 10% tax if you resign that job within or after the year you reach the age of 55 years.

Also Check: How To Take Out A 401k Loan Fidelity

How To Calculate Required Minimum Distribution

Required minimum distributions are withdrawals you have to make from most retirement plans when you reach the age of 72 . The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. If you have more than one retirement account, you can take a distribution from each account or you can total your RMD amounts and take the distribution from one or more of the accounts. RMDs for a given year must be taken by December 31 of that year, though you get more time the first year you are required to take an RMD. If youre not sure whether to return the RMD or you need help with other retirement decisions, a financial advisor could help you figure out the best choices for your needs and goals.

Also Check: How Does A 401k Retirement Plan Work

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choicesleave your money in the plan until you reach the age of required minimum distributions , convert the account into an individual retirement account , or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

You May Like: How To Use Your 401k In Retirement

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

Rmd Rules For 401 Plans

RMD rules required that workers begin taking RMDs by April 1 of the year after the accountholder turned 70 1/2.

RMDs must be taken not just from 401 plans but from other retirement plans including different types of IRAs. These include SEP and Simple IRAs, as well as from 403s, 457s, profit-sharing plans, and other defined contribution plans. The amount of your RMD is based on your account balance and life expectancy.

The IRS provides worksheets and tables to calculate RMDs. If you do not take your RMD, youll face a 50% penalty on whatever amount you fail to withdraw. So if youre looking at a $5,000 RMD and you dont remove any money from your 401, youll lose $2,500.

Recommended Reading: Who Can Open A Solo 401k

Don’t Miss: How To Access 401k From Old Job

Contributing Too Much To Your 401 Can Work Against You

How much should you contribute to your 401? Experts often say you should contribute 10% to 15% of your salary.

Saving and investing 10% or 15% of your income in a 401 can produce a sizable nest egg over time, but guess what? There are situations when that rate is too high for your 401. Read on to learn about four of those situations and what you can do instead.

What Is The Tax On 401 Withdrawls After 65

Putting money aside in a 401 during your working years is one of the most effective ways to accumulate wealth for your retirement years. But accumulating that money is only half of the battle. The other half is devising a strategy that allows you to meet your daily living expenses while minimizing your taxes. Understanding how 401 withdrawals impact your taxes makes devising such a strategy a lot easier.

Recommended Reading: Is A Rollover From A 401k To An Ira Taxable

Do You Have To Pay Taxes On 401k After 60

A withdrawal you make from a 401 after you retire is officially known as a distribution. While you’ve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw.

At What Age Should I Start 401 Withdrawals

There are plenty of best practices for growing your money in a 401, but in this article, we tackle the rules related to the age at which you can withdraw from 401 plans.

During retirement, intentionally or not, youll begin a decumulation strategy . Think of this as a game that aims to minimize taxes and get the maximum after-tax income from your nest egg. By knowing the age-related rules, you can create a better withdrawal strategy and decide when to begin taking money out of your 401 plan.

You May Like: Can You Borrow From Your 401k Twice

Convert To A Roth Ira

Money in a 401 plan isnt taxed when you contribute to it, but the money is taxed when you start taking out funds. When you have a Roth IRA, you pay taxes on the money you contribute, but you withdraw tax-free in retirement as long as you meet the qualifications.

Whereas a 401 is set up through an employer, youll have to open your own Roth IRA account through a bank or investment firm.

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone withdrawals until the date you must start taking Required Minimum Distributions.

Don’t Miss: How To Roll Old 401k Into New 401k

How Much Can I Withdraw From My 401k After 59 1 2

There is no limit to the number of deductions you can make. After you turn 59 ½, you can withdraw your money without having to pay the first withdrawal penalty.

At what age 401k deduct tax free? The IRS allows for the removal of the penalty-exempt from retirement accounts after the age of 59 ½ and requires removal after 72 years .

Tax On A 401k Withdrawal After 65 Varies

Whatever you take out of your 401k account is taxable income, just as a regular paycheck would be when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on withdrawals. On your Form 1040, you combine your 401k withdrawal income with all your other taxable income. Your tax depends on how much you withdraw and how much other income you have. If you have a $200,000 account, you could legally withdraw it all the year you turn 70. The amount of a 401k or IRA distribution tax will depend on your marginal tax rate for the tax year, as set forth below the tax rate on a 401k at age 65 or any other age above 59 1/2 is the same as your regular income tax rate.

Don’t Miss: Will Walmart Cash A 401k Check

Can I Retire At 58

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70.

Planning Out The Timing Of Your Withdrawals

The timing of your early withdrawals is important, says Dave Lowell, certified financial planner and founder of Up Your Money Game.

If you were employed for most of the year and had a relatively high income, then it makes sense to not withdraw money under the rule of 55 in that calendar year, since it will add to your total income for the year and possibly result in you moving to a higher marginal tax bracket, Lowell says.

The better strategy in that scenario may be to use other savings or take withdrawals from after-tax investments until the next calendar rolls around. This may result in your taxable income being much lower.

Don’t Miss: What Is The Maximum Amount To Put In A 401k

How Much Can You Take Out Of 401k At Age 59 1 2

There is no limit to the number of deductions you can make. After you turn 59 ½, you can withdraw your money without having to pay the first withdrawal penalty.

What is the 59.5 rule?

Most Americans who are fortunate enough to have a retirement savings in the Individual Retirement Account are likely to be aware of the 59.5-year law, where dividends from IRA before that age began not only on tax deductions, but. a 10% penalty on initial distribution.

How much can you withdraw from your 401k at one time?

Generally, you can borrow up to 50% of your closed bar account or $ 50,000, whichever is less. The Senate Bill also doubles the amount you can borrow: $ 100,000. Generally, if you lose your job with a 401 credit book, the loan is treated as a deduction and you are at the tax office.

Its All About Decumulation Planning

To learn more about how planning for retirement is different, read our Founder, Dana Anspachs 5-star rated book Control Your Retirement Destiny. It gives you a step-by-step outline of how to plan for a transition out of the workforce. Or check out her course, How to Plan the Perfect Retirement, on Wondrium.

You can also watch & share our short video below,Age Related 401 Plan Rules in 5 Minutes Or Less.

Don’t Miss: Is There A Limit For 401k Contributions