Cons Of Rolling Your Roth 401 Funds Into A Roth Ira

When it comes to Roth IRAs, the most important thing to keep in mind is the five-year rule. The clock starts ticking when you make your first contribution into your Roth IRA, not when you open the account. So even if youve had a Roth IRA for more than five years, you may still have to hold off withdrawals if it took you a few years to start contributing. Any Roth 401 contributions youve made dont make any difference in relation to this timeline.

If you need the money and dont plan to change jobs any time soon, remember that you may be able to get a Roth 401 loan from your plan administrator. To clarify, you could borrow up to $50,000 or 50% of your vested account balance, whichever is less, though the loan must be repaid within five years or immediately upon leaving your employers service to avoid it being treated as a taxable distribution. Roth IRAs dont offer this kind of flexibility, so a rollover would eliminate this option.

You should consider the investment options and fees of a Roth IRA before definitively deciding on a rollover. It may be that your Roth 401 program offers a better selection of possible investments or charges fewer fees than a Roth IRA would.

Is A Roth Conversion Right For You

A Roth conversion can be a smart way to manage your tax bill in retirement if you currently have a large chunk of your savings in traditional retirement accounts. It can also help potential heirs manage theirs.

But given that money you convert is reported as taxable income, it requires a careful approach that doesnt trigger a huge tax bill in any single year. It can be smart to consult with a trusted tax pro or financial advisor who can help you navigate all the moving pieces of a Roth conversion.

Can You Rollover A Roth 401 To A Roth Ira

Dear Carrie,

I’m 56 and have both a traditional and a Roth 401. Right now I contribute the maximum to my Roth each year. I plan to roll the Roth 401 into a Roth IRA before 72 to avoid having to take an RMD. Two questions: Do I need to open a Roth IRA five years prior to the rollover to meet the 5-year rule? And can I contribute to a Roth IRA even though I max out my Roth 401?

A Reader

Dear Reader,

I rarely get questions regarding a Roth 401 rollover, but as this type of retirement plan becomes more widely available, I’m sure more and more people will be looking for similar answers. So thanks for asking.

I think you’re right on target with your basic idea. With a Roth 401unlike a Roth IRAyou must take a required minimum distribution beginning at age 72 if youre retired. So the idea of rolling your Roth 401 money into a Roth IRA before that magic age makes a lot of sense. With your money in a Roth IRA, rather than being required to take a certain amount out of your retirement savings each year, you can choose how much, whenor if everyou want to make withdrawals.

But as you suggest, there are certain things you need to be aware of to make sure you can take full advantage of all the Roth IRA benefits.

Don’t Miss: How Does Company Match Work For 401k

Is A Distribution From My Designated Roth Account For Reasons Beyond My Control A Qualified Distribution Even Though It Doesnt Meet The Criteria For A Qualified Distribution

No, if you have not held the account for more than 5 years or if the distribution is not made after death, disability, or age 59 ½, then the distribution is not a qualified distribution. However, you could roll the distribution over into a designated Roth account in another plan or into your Roth IRA. A transfer to another designated Roth account must be made through a direct rollover.

You May Like: How To Withdraw My 401k From Fidelity

Taxes May Derail Your Roth Ira Plans

When going from a traditional 401 to a Roth IRA, you need a tax plan. The amount you roll over into a Roth IRA will be counted as income.

Let’s say you convert $20,000 from your former employer’s 401 to a Roth IRA. The $20,000 will boost your gross income for the tax year, and will be taxed at your ordinary income rate. Your tax bill would be up to $4,400 on the conversion if your were 22%. But if the conversion bumps you into a higher tax bracket, you could end up owing more money.

Here are the ordinary income tax rates for each filing status that you need to consider if you convert your 401 to a Roth IRA in 2022:

|

Rate |

|---|

You May Like: How To Choose 401k Investment Options

Alternatives To A Mega Backdoor Roth

If youre determined to save extra money for retirement, there are a few options beyond a mega backdoor Roth IRA.

Invest in a taxable account. Buying and holding common stocks that dont pay dividends can work well to accomplish the same result if the goal is to leave money to the next generation, says Paul Axberg, CPA, CFP and president of Axberg Wealth Management This works because the stocks grow tax-deferred, and at death, the heirs get a stepped-up basis to the value at the date of death. This makes all the capital gains become not taxable. If your stocks do pay dividends, youll owe income taxes on those payments annually, though it may be at a lower rate than your other income.

Make a regular backdoor Roth IRA conversion. If your retirement plan lacks the elements necessary for a mega backdoor Roth, just stick with a regular backdoor Roth IRA conversion. Even if you make too much for a Roth IRA, you can make similar non-deductible contributions to a traditional IRA that you then convert to a Roth. But make sure you do not have other pre-tax dollars in any kind of IRA, like SEP IRAs or SIMPLES IRAs, or you will create a taxable event, notes Weiss.

Contribute to a Roth 401. While this option doesnt provide a way to make big, extra contributions, you can get the tax-free withdrawals you crave by maxing out your annual contributions to a Roth 401.

What Is An In

An in-plan Roth conversion is another way of referring to the process of converting a 401 plan to a Roth IRA. Brokerage and mutual fund companies may use this term to let customers know that the account will remain with the same institution after the conversion. “Backdoor Roth” is another way to refer to this process.

Read Also: How Do I Contact Adp 401k

Beware The Pro Rata Rule On Conversions

If you have traditional IRA accounts with deductible contributions, youll need to factor that in if you convert any nondeductible amounts into a Roth IRA. Youll need to follow the IRSs pro rata rule, which forces you to calculate the tax consequences considering your IRA assets in total.

In effect, youll have to figure out what proportion of your funds have never been taxed that is, deductible contributions and earnings to your total IRA assets. That percentage of the conversion is subject to tax at ordinary income tax rates.

Its a complex calculation and can create significant confusion.

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

Read Also: How Do You Get Money From Your 401k

How To Reduce The Tax Hit

If you contributed more than the maximum deductible amount to your 401, you have some post-tax money in there. You may be able to avoid some immediate taxes by allocating the after-tax funds in your retirement plan to a Roth IRA and the pretax funds to a traditional IRA.

Alternatively, you can choose to split up your retirement money into two accounts: a traditional IRA and a Roth IRA. That will reduce the immediate tax impact.

This is going to take some number crunching. You should see a competent tax professional to determine exactly how the alternatives will affect your tax bill for the year.

H.R. 5376, the Build Back Better infrastructure bill, includes provisions that would reduce some benefits of Roth IRA conversions for all taxpayers starting in 2022. However, despite being passed by the U.S. House of Representatives in November 2021, the bill appears to have stalled in the U.S. Senate. It seems that, for now, Roth IRA conversions for high earners are safe.

Disadvantages Of Roth Conversion

You expect your tax rate in retirement to be lower. If youre in a high federal tax bracket today and expect your retirement income to be low enough that your tax rate will be lower, too, Roth conversions dont make any sense. That said, you still face the wildcard issue of what Congress might do with tax rates in coming years.

Paying taxes upfront. Do you have the free cash flow to handle the extra tax hit from a Roth conversion? If you have high-rate credit card debt, or your emergency fund is a bit thin, you might want to tackle those issues before giving yourself a bigger tax bill.

Social Security issues. If youre already collecting Social Security, whether the payout is taxableand the extent to which it will be taxedis based in part on your income.

The year you do a Roth conversion, your taxable income will rise, which could cause a portion of your Social Security benefit to be taxed or push you into a situation where more of your benefit is taxed.

Less bankruptcy protection. Creditors cant touch money inside a 401 account, but there is a limit on protection of IRA assets. The combined IRA amount protected from creditors in 2021 is $1,362,800. This cap is reset every three years to adjust for inflationthe next adjustment will be in April 2022.

Dont Miss: How Do I Transfer My 401k To A Roth Ira

You May Like: How Much Does A Solo 401k Cost

Transfer To Your New Employers 401 Plan

If your new employer allows it, you can move the funds from your old plan into your new one. It can be easier to manage your investments when they are all in one place, which makes this a good option for some. Keep in mind, you still may be limiting yourself regarding investment choices and expenses could be higher too.

There is no one-size-fits-all approach to retirement planning or investing, which is important to keep in mind as Roth conversion strategies gain popularity. Roth conversions may play a large part in maximizing future wealth for some investors. Consider your next steps carefully and find a strategy that is consistent with your retirement planning goals and wealth management objectives.

Dont Miss: How Much In 401k To Retire

The 38% Medicare Surtax

The amount you convert from a traditional IRA to a Roth IRA is treated as incomejust like all taxable distributions from pretax qualified accounts. Therefore the conversion amount is part of your MAGI, and it may move you above the surtax thresholds. This may cause you to incur the additional Medicare surtax on your investment income.

For more information on this, read Viewpoints on Fidelity.com: 6 key Medicare questions

But, once your money is in a Roth IRA, the shoe is on the other foot. Because nontaxable withdrawals from a Roth IRA arent part of your MAGI, a Roth IRA conversion may potentially enable you to limit your exposure to the Medicare surtax down the road.

Recommended Reading: Should I Transfer 401k To New Employer

Don’t Miss: How Do I Get A Loan From My Fidelity 401k

Youll Owe Taxes But It Can Still Make Sense To Rollover

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Saving for retirement is an important consideration, and 401 retirement savings plans, offered by many employers, can make it easy. But what happens if you change jobs? You can always keep your existing account, but you also have the option to transferor rolloveryour account into an individual retirement account .

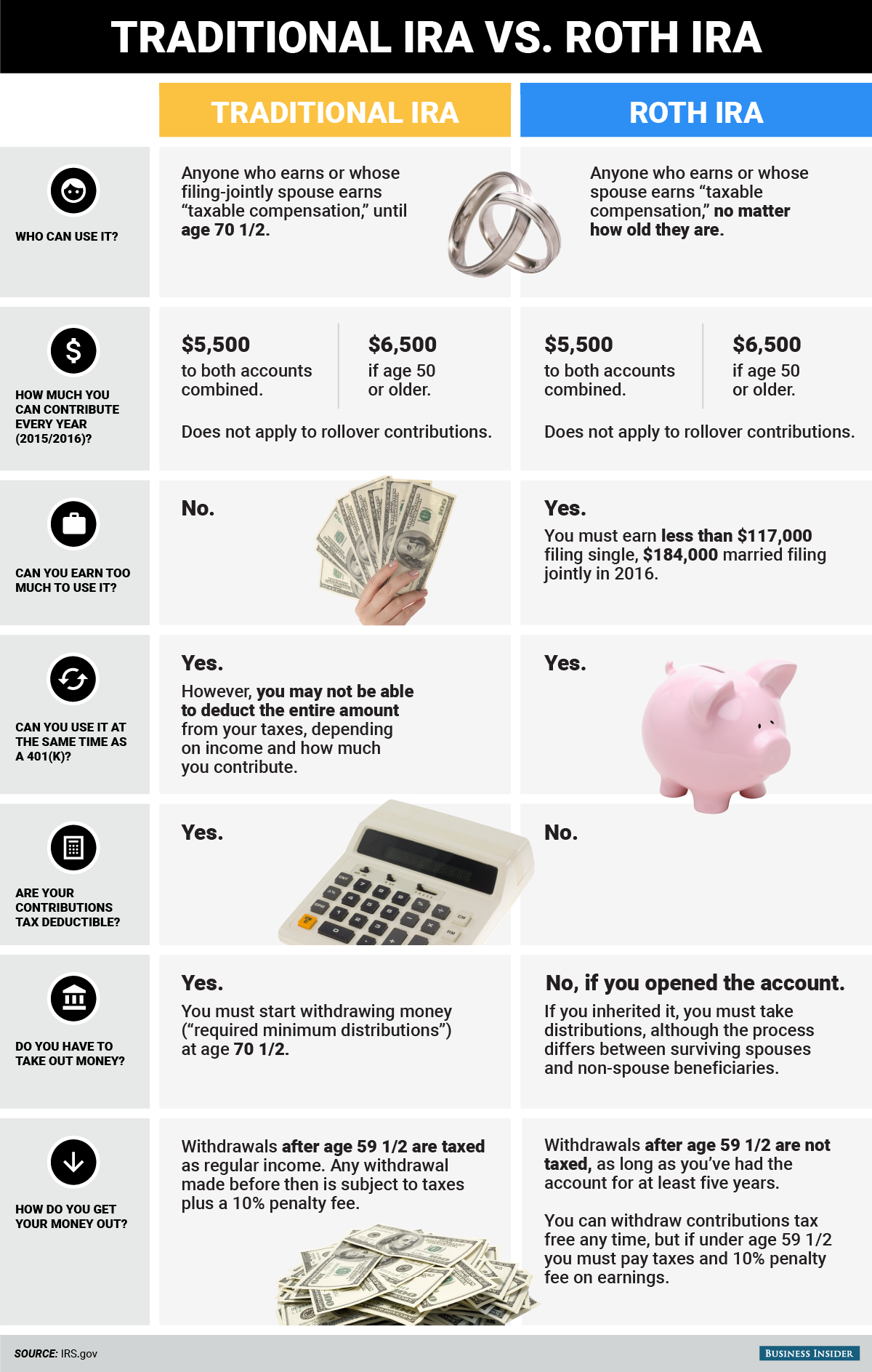

There are two main types of IRAs from which to choose. Traditional IRAs let you set aside some of your income, before its taxed, just like your typical 401. Youll pay taxes later, during retirement, when you make withdrawals. By contrast, Roth IRA contributions are made from funds that have already been taxed. When you withdraw those funds during retirement, you wont be taxed again.

Depending on the type of 401 you have, rolling over to a Roth IRA may have some tax consequences. Lets take a look.

Your 401 Lets You Move Your After

If your plan doesnt allow in-service withdrawals to a Roth IRA or in-plan rollovers to a Roth 401, then your opportunity to do the mega backdoor Roth is delayed until you leave your job. If thats the case, you might want to reconsider this strategy.

The point is to get as much money into the Roth as soon as possible to get as much tax-free growth as soon as possible.

Ideally, executing the mega backdoor Roth means throwing all of your after-tax savings into your after-tax bucket contribution limit). Then, youre almost immediately getting your money out of that bucket and into either a Roth IRA or Roth 401 before it starts accruing investment earnings. Thats because if left in the after-tax bucket, youre going to eventually owe tax on those earnings. But once that money is in a Roth, your money grows tax-free.

The point is to get as much money into the Roth as soon as possible to get as much tax-free growth as soon as possible. If your after-tax contributions accumulate investment earnings, the IRS has said its OK to split up that money, by rolling your after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA. That means your contributions will still grow tax-free, and your investment earnings will grow tax-deferred youll pay income taxes when you take them out in retirement.

Recommended Reading: How To Open A 401k Self Employed

Option : Open An Inherited Ira Life Expectancy Method

With this option, the assets are transferred into an inherited Roth IRA in your name. Youll have to take the RMDs. But you have the option to postpone them until the later of:

- The date when the original account holder would have turned age 72

Distributions are spread over your life expectancy. However, if there are other beneficiaries, then distributions are based on the oldest beneficiarys life expectancyunless separate accounts are established before Dec. 31 of the year following the year of the original owners death.

Other considerations:

- You can withdraw contributions at any time.

- Earnings are taxable unless the five-year rule is met.

- You wont be subject to the 10% early withdrawal penalty.

- Assets in the account can continue to grow tax free.

- You can designate your own beneficiary.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

You May Like: Can I Move My 401k To Roth Ira

Can You Contribute To A Roth Ira And A 401

Many, if not most, retirement investors can contribute to both a Roth IRA and a 401 at the same time.

You can and should have both a Roth IRA and a 401, says Gregory W. Lawrence, a certified financial planner and founder of retirement planning firm Lawrence Legacy Group. Future tax rates are heading higher, possibly much higher, so maxing out both a Roth IRA and a 401 will give you more net after-tax dollars in retirement.

If your employer offers a 401 plan, you can choose to contribute to either a traditional 401 account or a Roth 401 account . The difference is when you pay income taxes: Upon making withdrawals in retirement with the former, or when youre making contributions in the present with the former.

Meanwhile, contributions to a Roth IRA are always made after you pay income taxesand qualified withdrawals in retirement are always tax-free. Heres the catch: You can only contribute to a Roth IRA if your annual income is below certain thresholds: