Cant I Just Write A Check

For most workers, the answer is no. Your regular contributions to your 401 account typically only happen through salary deferral. In other words, the Payroll department needs to send money, and you cant just write a personal check if youre hoping to invest a large chunk or reach the maximum contribution limit by the end of the year.

Why not? For starters, the law does not allow you to defer funds that you already received. If the money is in your checking account, you received it. Also, your 401 plan might have specific rules saying you cant make your own payments into the plan.

Catch-up contributions: Those over age 50 can make additional catch-up contributions to retirement accounts. But 401 catch-up contributions, like other employee contributions, generally must go in through payroll deduction.

The Average 401 Balance By Age

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

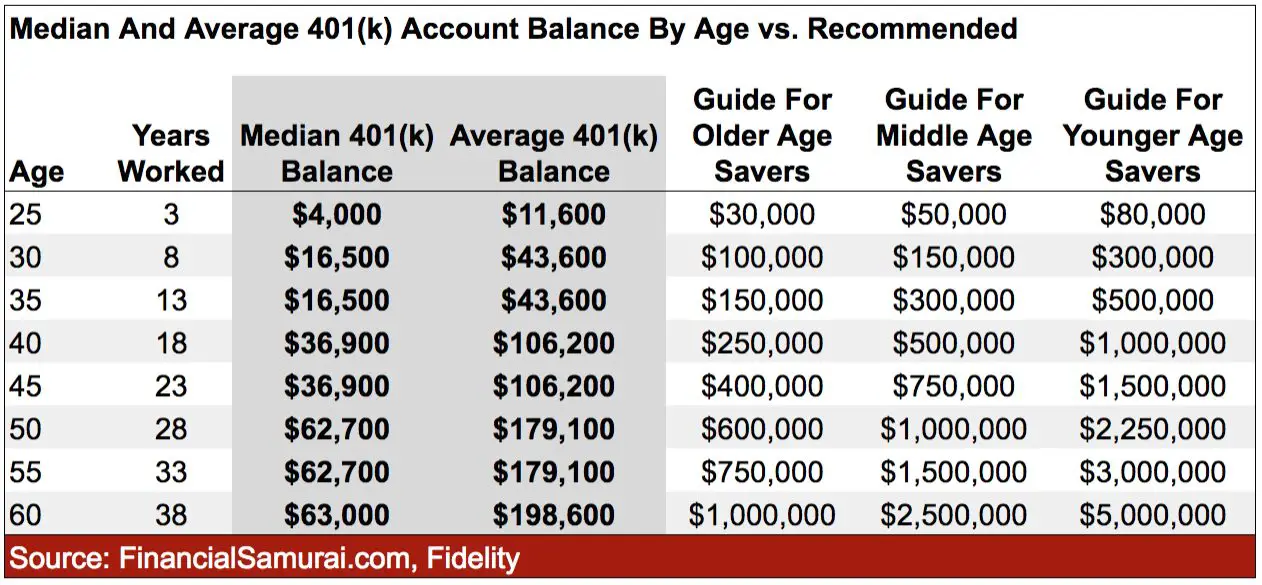

A record number of 401 holders at Fidelity Investments hit millionaire status in 2018. Not one of them? Youre in very good company: A seven-figure 401 balance is the exception, not the rule.

In fact, the average 401 balance at Fidelity which holds 16.2 million 401 accounts and is consistently ranked as the largest defined contribution record-keeper was $103,700 as of March 2019.

If that still seems high, consider that averages tend to be skewed by outliers, and in this case, that number is being propped up by those rare millionaires. The median, which represents the middle balance between the highs and lows, is just $24,500.

No matter which number is closer to your reality and certainly for some, both will feel out of reach its important to remember that numbers like this are akin to train wrecks: They will tempt you to gawk, but they wont likely offer you much actionable information.

Also Check: How To Start Withdrawing From 401k

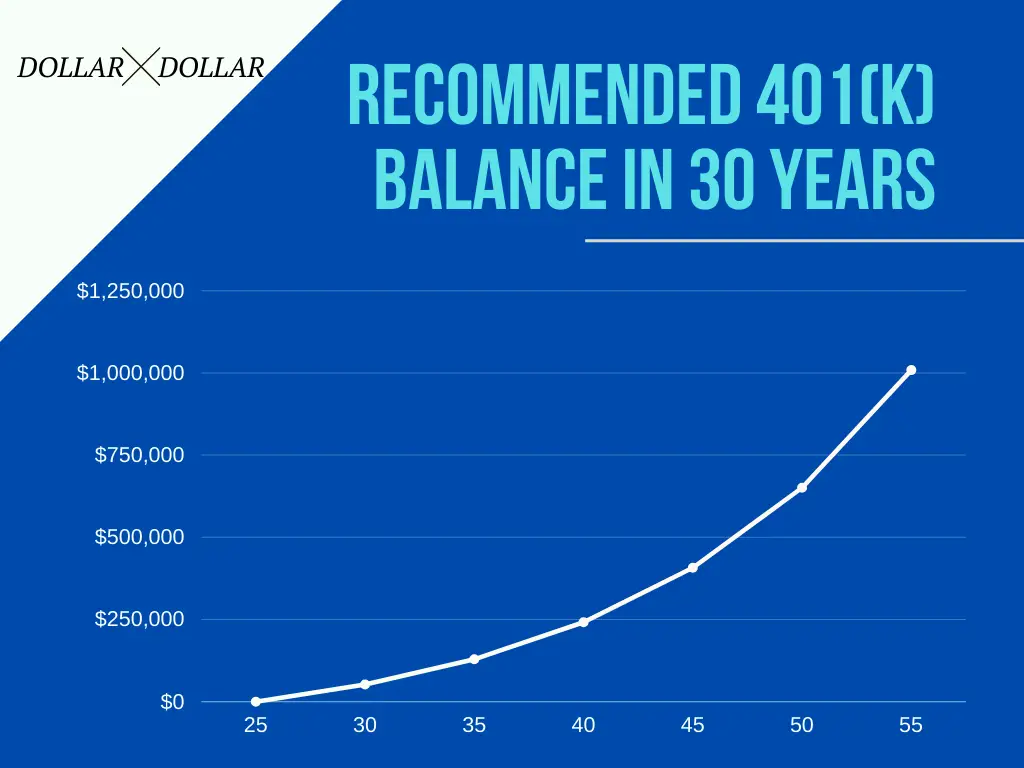

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Also Check: How To Sell 401k Investments

Don’t Miss: How To Find Out Where Your 401k Is

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Also Check: Can You Move Money From Ira To 401k

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

You May Like: How Can You Get A 401k

How To Find A Lost 401 Account

Think you may be one of the millions with forgotten 401 money floating around somewhere? Start by scouring your personal email or laptop for any old 401 plan statements that you may have saved in the past.

“Your statement will provide your account number and plan administrator’s contact information,” Corina Cavazos, managing director, advice and planning at Wells Fargo Wealth & Investment Management, tells Select. Your former coworkers may have old statements that you can reference, too.

If you don’t have any luck, Cavazos says that your best bet is to contact your former employer’s HR or accounting department. By providing your full name, Social Security number and dates of employment with that company, you can have them check their 401 plan records to see if you were once a participant.

If you’ve tried contacting your 401 plan administrator or former employer to no success, you may be able to find old retirement account funds on the National Registry of Unclaimed Retirement Benefits. Upon entering your Social Security number, the secure website allows you to conduct a free database search to see if there’s any unpaid retirement money in your name.

Another search database is the FreeERISA website, which indicates if your former employer rolled your 401 funds into a default participant IRA account on your behalf. FreeERISA requires you to register before performing a search, but it is free to do so.

Retirement Planning With Merrill Edge

For more information on rolling over your IRA, 401 , 403 or SEP IRA, visit our rollover page or call a Merrill rollover specialist at 888.637.3343. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Read Also: Can You Convert A 401k Into A Roth Ira

Don’t Miss: Can You Use Your 401k For A House Down Payment

What Do Average 401 Balances Tell Us

According to Mike Shamrell, vice president of thought leadership at Fidelity Investments, the latest data shows that despite economic uncertainty, retirement savers stayed the course and didnt make significant changes to their retirement savings habits.

Shamrell said that the total savings rate across all Fidelity managed 401 plans, including contributions from both employees and employers, reached a record 14% in the first quarter of 2022.

Individuals did not make significant changes to their asset allocation, he says. Only 5.6% of 401 savers made a change to the asset allocation within their account, and of those people that made a change, more than 80% made only one.

This trend aligns with expert advice that long-term investors should always resist the temptation to let market conditions impact their investing strategy. Instead, they should focus on the things they can control, such as their individual contribution rate.

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Recommended Reading: How Much Will My 401k Be Worth When I Retire

How Much Does It Cost

ADP is rather transparent about its direct fees.It is easy to understand their:

- Base record-keeping fee

- 5500 preparation fee

- Trustee fee

These fees are all reported clearly in their 404a-5 participant fee disclosure forms, plan statements, and 5500 forms.

However, when it comes to revenue sharing fees, they are not as upfront.

Why does this matter? Because revenue sharing fees can be the same as the direct fees, meaning that the total of your fees for having the plan may be double what you may think.

Revenue sharing payments are based on a percentage of the plans assets. As assets grow, so do the revenue sharing fees. And they can grow quickly. The bigger your plan design grows, and the more assets you have, the more fees youll have to pay.

You May Like: What Is The Minimum Withdrawal From 401k At Age 70.5

According To 401k Statistics 58% Of 401k Participants See Themselves As Savers

Interestingly, the remaining 42% of 401k plan participants think of themselves as investors. Whats more, 72% believe its more important to save now so you could have a comfortable retirement. These attitudes show a changing dynamic towards savings. Hopefully, it will prompt more Americans to choose a retirement plan as soon as possible.

Donât Miss: What Is The 401k Retirement Plan

Don’t Miss: Is There A Fee To Rollover 401k To Ira

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

What Is Your Vested Balance

Your vested balance is the amount of money you currently have ownership of. If you leave your job or want to withdraw funds from your retirement plan, your vested balance tells you how much money might be available to you.

Once you are fully vested in your retirement plan, your employer cannot take money back from your account. Plus, vesting is important because it allows you to potentially access your funds through loans and withdrawals from 401, 403, and other workplace plans.

You May Like: Can I Buy Individual Stocks In My 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Happens To My 401k When I Leave My Job

Why Adp Is Best For Small Businesses

If your business has employees, its usually a good idea to use an independent payroll services provider. Whether you already use ADP or still need a payroll provider, its an easy way to streamline payroll, retirement and health benefits. The 401 Essential plan makes it easier to offer an employee retirement plan by simplifying employee account setup and maintenance, and ADP Run is a cost-efficient payroll option for businesses with fewer than 50 employees.

You May Like: How Much Income Will My 401k Generate

Checking Your 401k Balance

Now you are currently working with an employer, having been withdrawing money from your retirement plan under the financial hardships category, yet you want to know how much money left in your plan. To check your 401K balance, is one way of knowing how much you indeed have in your plan. However, with the dramatic change of the current economy who knows how much you do have in your retirement plan.

First, let us define what is 401K before deciding to check your check 401K balance. 401K is a retirement plan which is sponsored by your employer, the employee can also set aside a portion of his or her salary and be contributed to the retirement plan. However, the federal government has limited the contribution, it had laid down the maximum amount one should contribute. Upon retirement, the employee can get his money and the amount will now depend the growth of the plan. Therefore, the employee should be keen enough to choose which investments his or her plan should invest into. When the employee, starts taking the money then, such withdrawals are now taxed. If money is being withdrawn before reaching the age of 59 and a-half, then there is such a thing for early withdrawal penalty.

- Mon Fri: 10 am 8 pm

- 234 56 78

How Many Occurrences Are Allowed At Walmart

4.5 occurrencesYou are only allowed 4.5 occurrences in a six month period. If you reach 5 occurrences, you will be automatically terminated from the company. Remember, Walmart doesnt coach or write up employees based on attendance. It is your responsibility to keep up with how many occurrences you have.

Dont Miss: Where Can I Get A 401k Plan

Recommended Reading: How To Invest 401k After Retirement

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

How To Check Your Gift Card Balance At Walmart Stores

Another way to check your Walmart gift card balance is to visit your local store.

To check your balance in-store:

You May Like: Can I Get A 401k

Follow These 2 Tips To Prevent This Issue

Read Also: Is Fidelity Good For 401k

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Don’t Miss: How Do I Rollover My 401k Into An Ira