The Power Of Compounding

If you start saving for retirement early, you will allow your money more time to grow. Retirement savings held in a 401 grow through compounding, which are the earnings you make on your 401 interest. When your 401 savings start earning a return, these returns will grow at an accelerated rate.

Compound interest works well when funds are left to grow over a long time. What starts as a small contribution to a 401 could grow exponentially over several decades. For example, if you are 20 and you want to retire at age 60 with $2 million, you will need to contribute $316.25 per month for the next 40 years to achieve this target.

However, if you wait until you are 30, you will need to contribute at least $884.75 per month for the next 30 years to achieve the $2 million target. If you start saving at 40, you will need to contribute at least $2,633.75 per month for the next 20 years to achieve that target.

Tags

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

Recommended Reading: How To Set Up 401k For Llc

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

Contribute The Maximum Amount Your Employer Matches

Robert Johnson, Ph.d., CFA, CAIA, and Professor of Finance at Creighton University

Perhaps the worst financial mistake anyone can make is turning down free money. If one doesnt contribute enough in a 401 plan that has a company match to earn that match, one is basically turning down free money. Contributing the max to your 401 also reduces your tax bill. Investors should do whatever it takes to participate in your companys 401 plan to the level to get your full employer match.

Company matching requirements vary considerably by company. For instance, some firms will match contributions dollar for dollar up to a certain maximum. On the other hand, some plans require the employee to invest a certain minimum percentage of salary before the firm will contribute any employer match.

Don’t Miss: How To Pull Money Out Of 401k Without Penalty

Diversify Plans If Possible

Matthew Yu, Loan Originator for Socotra Capital

Some employers have small matches, but some match dollar for dollar on your first 3-5 percent. Thats 100 percent ROI at the end of each year for your 3-5 percent contribution!

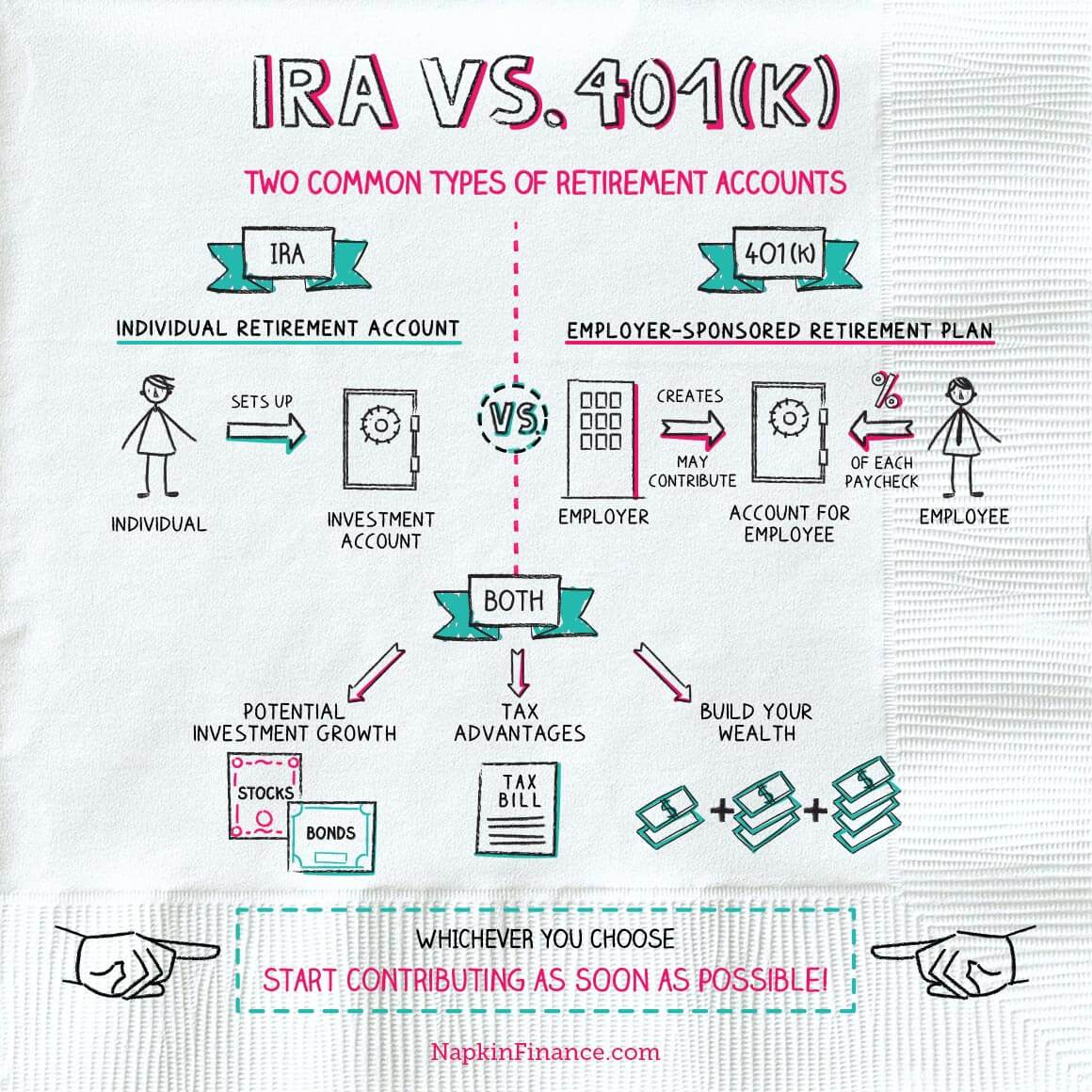

For those with less generous employee matches and limited investment funds, you should carefully gauge your companys 401 plan to see if you could get better returns investing in a Self-Directed IRA. The amount you put into the 401 is just as important as the type of investment that your 401 is invested in.

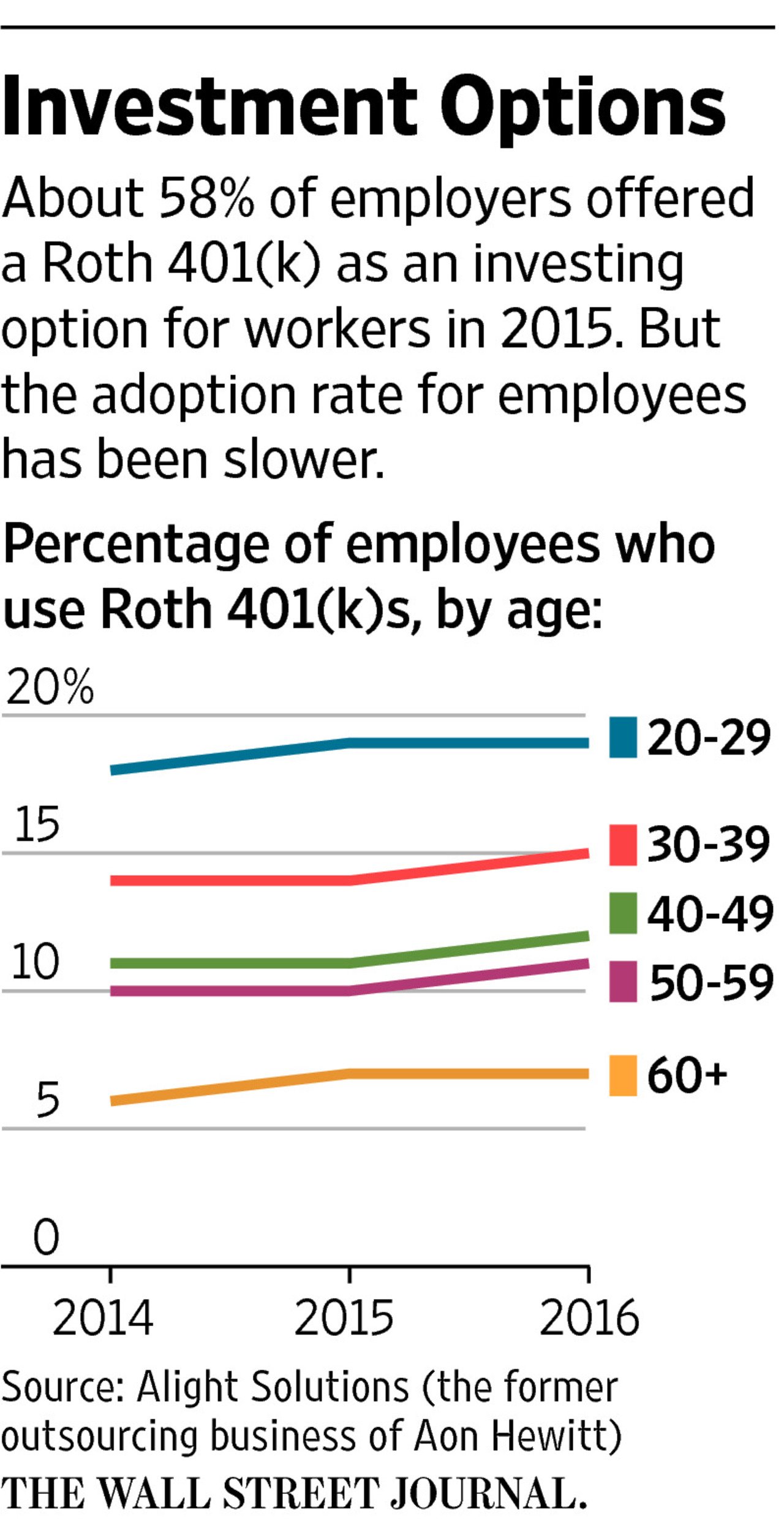

For best diversification, I would recommend those new to the workforce to split up their retirement savings into their 401 and Roth IRAs. Set aside an investment budget that stings, but isnt too painful. Your 401 will be automatically withdrawn every month. Money that doesnt hit your pocket is much easier to invest than the money that comes out of it. Investing early pays dividends.

Be Sure To Layout A Retirement Budget

Deacon Hayes, Owner & Founder of WellKeptWallet

Everyone’s life and circumstances are unique. Therefore, what works for one person is not going to be a magic formula that works for all. That being said, it’s always better to save more than you need rather than less.

Start by determining the age you would like to retire. Then, create a post-retirement budget to help you determine how much money you will need to save up ahead of time. Don’t forget to include vehicles, insurance, taxes, and other expenses that are not always monthly.

You can use a 401 calculator to assist you in determining how much money you should be investing at any age. However, here is a general guideline :

- At age 30 a minimum of one year’s salary

- At age 35 at least two years salary

- At age 40 three years salary or more

- At age 45 four years salary at minimum

- At age 50 at least five years salary

- At age 55 six years salary if not more

- At age 60 seven times your annual salary

- At age 65 at least eight times your yearly salary

Don’t Miss: When Can You Take 401k Out

The Matching Contribution Bonus

For people who start saving early and take advantage of employer-sponsored plans, such as 401s, hitting savings goals isnt as daunting as it may sound. Employer matching contributions could significantly reduce what you need to save per month. These contributions are made pre-tax and it’s the equivalent of “free money.”

Say you save 3% of your income during a year and your company matches that 3% in your 401, “you will make a 100% return on the amount you saved that year,” said Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Mass.

Average Current Retirement Savings Balance

Unfortunately, many people are woefully under-prepared for retirement from a financial standpoint.

Here are some statistics on the median current retirement savings balances of Americans based on their age.

| Families Between |

|---|

| 70+ | 12.3% |

Workers save more for retirement as they get older and pay off other debts like student loans and a home mortgage.

At a minimum, many experts recommend saving at least 10% of your income for retirement. Dave Ramseys Baby Steps recommend saving at least 15% into retirement accounts after getting out of debt and building an emergency fund.

You can use a retirement calculator like NewRetirement to review your personal progress and project how long your nest egg will last. This tool is free but paid plans are available too.

Read our NewRetirement review to learn more about this interactive retirement planner.

Don’t Miss: How To Pay Off 401k Loan

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Maximize Employer 401k Matching

If you can’t afford to contribute the maximum amount, another 401k strategy is to contribute at least up to your employer’s contribution matching percentage. Most employers match a percentage of contributions ranging from 1 percent to 6 percent. For example, your employer might offer a match 100 percent of your contributions up to 5 percent. Therefore, if you contributed 5 percent per paycheck to the 401k plan, you would receive the maximum matching contribution from the employer, and your employer would contribute another 5 percent to your retirement plan. You can use a 401k match calculator to determine what the total contribution would be from all sources, as some employers take a more complex approach and only contribute a percentage of a percentage, or a flat dollar amount.

A different 401k strategy is to begin contributing 1 percent of your salary and slowly adjust the contribution level up over time. This gradual approach helps you avoid budget shocks stemming from suddenly lower cash flow. Eventually you can ratchet up the 401k percentage contribution when salary levels climb.

If you prefer to keep your take-home pay pretty consistent from year to year, you can simply pick a percentage that works for you and maintain it. This keeps your paycheck contribution steady. Dollar-wise, a little more money will go into your 401k plan every year if you earn annual raises and bonuses.

Don’t Miss: How Long Will My 401k Last Me In Retirement

Meet Employers Match At Minimum

When employers match your 401 contribution, it serves as the companys pension plan. Some look at it like free money, but its actually a benefit you earn by working for your employer. At the very least, you should contribute the maximum amount to your 401 that your employer is willing to match. If, for example, your company matches the first 5 percent of the money you contribute, defer 5 percent of your salary to your retirement account. And, dont leave money on the table when you leave the job or retire.

Start Saving Your 401k Immediately

Another thing that can make a big difference in how much you end up with is when you begin. With the generous benefits of the tax code, putting money into a 401k should be a priority. Just starting five years earlier can make a big difference. Plus, the longer compound interest has to work on your behalf, the better off youll be in the long run. You can even set aside a little bit less each month the longer you plan to save. Start now to save and then look for ways to increase your 401k saving until you hit the max. Its vital to your future financial health that you do what you can to improve your situation. The more you do now, the better your retirement is likely to be.

Don’t Miss: When Retiring What To Do With 401k

Are You Contributing To Retirement Wisely

Most experts recommend that if your employer matches your 401 contribution, you should contribute the maximum.5 The majority of plans require workers to save 6% or more in order to receive the full employer-matching contribution.6 And since 42% of companies match dollar-for-dollar6, thatâs a benefit you donât want to pass up.

If your employer doesnât offer a retirement plan, you may want to set up a Roth or traditional IRA. Most experts recommend putting 10 to 15% of your income into a retirement account each year.6 So, if youâre making $50,000 per year and have no employer-sponsored retirement plan, you may decide to allocate 10% of your take-home pay to a standard savings account and the other 10% into an IRA. Talk to a financial planner or tax specialist to determine the type of retirement account thatâs best for you.

Withdrawing From Your 401

You cant withdraw money from your 401 before a certain age without incurring a financial penalty .

The age when you can begin withdrawing is 59-1/2 for most people, 55 in some exceptional cases .

Even though you arent paying taxes on your contributions now, you will pay them eventually, as you withdraw money during retirement.

Don’t Miss: Is There A Limit For 401k Contributions

Other Important Financial Goals To Consider

You should keep a few other things in mind as you decide how much to contribute to your 401 based on your own unique financial situation.

- Do you have a formal estate plan with a will and other critical papers ?

- Can you cover health care expenses? Make sure you’re putting enough into your health savings account , both now and in the future, to cover medical expenses if you have a high-deductible health plan with an HSA combo.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more due to illness or injury?

- Do you have long-term care plans in place if you’re nearing retirement?

Prioritize Your Retirement Savings

Whether you started saving late or are frugal with your finances, there are several things you can do to increase the amount of money you put toward your 401.

Its advisable to add one year of gross salary saved every five years. So when youre 30, youll want to have saved one years worth of your salary at age 35, youll want to have saved two years worth of your salary and at 40, youll want to have saved three years worth of your salary.

Make compound interest work for you: Compound interest is a simple concept that can rapidly cause wealth to snowball. It happens when the interest that accrues on an amount of money, in turn, accrues interest itself. Do your research to see which 401 plans have the best interest-bearing options.

You May Like: How To Withdraw Money From 401k Before Retirement

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021-2022 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $26,000 including catch-ups.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, PA. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

Read Also: How To Save For Retirement Without A 401k

Max Out Your Contribution

While that sounds like a lot of money from a 4% contribution, it may not be enough to sustain the lifestyle you want in retirement. Based on the often-used “4% rule” for retirement and using our preceding example, a $900,000 nest egg would safely produce $36,000 in annual income in retirement. Withdrawing any more than this greatly increases the chances you’ll eventually run out of money. Even when you factor in Social Security, it might not be enough.

Fortunately, you can save more than your employer is willing to match — a lot more, in most cases.

One popular strategy is to increase your contributions by 1% per year until you hit the maximum amount you’re comfortable with saving. Any small increase can make a big difference. Returning to our example, consider how small increases in elective contributions affect retirement savings in the long run.

Assumes $60,000 starting salary and 2% annual salary increases. Also assumes 7% annual investment returns.| Your Contribution |

|---|