You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

The Problem With Leaving Your 401 With Your Former Employer

Getty

There should be a Leave No 401 Behind Law. Too many people forget to take their retirement savings with them when they clean out their desks at their old employer. Why is this so pandemic and what should you do to inoculate yourself from this potentially debilitating financial disease?

Theres a trend permeating throughout the retirement plan industry right now. Have you heard of it? Its called set-it-and-forget-it. Its generally credited with encouraging more people to save more for retirement.

Thats a good thing.

On the other hand, this same philosophy may also be responsible for people having less interest and even less awareness of their own retirement nest egg.

Thats a bad thing.

The biggest problem with the way people treat their 401 retirement savings accounts with former employers is that they ignore them altogether, says Laura Davis, a Financial Planner at Cuthbert Financial Guidance in Decatur, Georgia.

This isnt a temporary problem. Its chronic. Once people have set it, they then naturally forget it. How long does it usually take before an ex-employee finally notices their orphan 401 account?

Typically, the employee does nothing with it, says Wesley Botto, a Partner at Botto Financial Planning & Advisory in Cincinnati. It sits unmanaged for years before the employee makes any changes to it.

But, is it better to roll your precious retirement savings into your new employers plan or into your own personal IRA?

Don’t Miss: How Do You Transfer 401k

Rolling The Assets Into An Ira Or Roth Ira

Moving your funds to an IRA is the route financial experts advise in most instances. Now youre in charge and you have more investment flexibility, said Smith. Try not to go it alone, he advises. Once you roll the money over, its you making the decisions, but getting a financial professional should be the first step.

Your first decision: whether to open a traditional IRA or a Roth.

Traditional IRA. The main benefit of a traditional IRA is that your investment is tax-deductible now you put pre-tax money into an IRA, and those contributions are not part of your taxable income. If you have a traditional 401, those contributions were also made pre-tax and the transfer is simple. The main disadvantage is that you have to pay taxes on the money and its earnings later, when you withdraw them. You are also required to take an annual minimum distribution starting at age 70½, whether if youre still working or not.

Roth IRA. Contributions to a Roth IRA are made with post-tax income money you have already paid taxes on. For that reason, when you withdraw it later neither what you contributed nor what it earned is taxable you will pay no taxes on your withdrawals. Investing in a Roth means you think the tax rates will go up later, said Rain. If you think taxes will increase before you retire, you can pay now and let the money sit. When you need it, it is tax-free, said Rain.

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Don’t Miss: What Is The Maximum 401k Contribution For Self Employed

Con: Delayed Access To Funds

Withdrawals from 401 accounts before the age of 59 1/2 are subject to a 10% penalty. There is one exception to this rule: if you retire at the age of 55, you can remove money from your 401 account without penalty. This exception does not apply to IRA accounts, so youll have to wait until youre 59 1/2 to take money out without penalty.

Rolling Over To The New Employers Plan

The main advantage of rolling the money to the new employers plan is the money will have the greatest creditor protection afforded by law. The law that governs 401s and many other employer retirement plans offers you unlimited protection of your retirement money from creditors and lawsuits. This can be extremely important for business owners, surgeons, or others who are at a heightened risk of being sued.

I often advise clients with a heightened risk of lawsuits to leave money in their 401 for the asset protection provide provided under ERISA. If you are exposed to significant liability or have a high chance of being subject to a lawsuit, leaving the money in the 401 is likely the better idea. If youve received advice to roll over to an IRA and would like a second opinion, please feel free to schedule a no-cost consultation.

Don’t Miss: Do I Need Life Insurance If I Have A 401k

Keep Your 401 With Your Previous Employer

In this instance, you wont change a thing. Just make sure that you actively monitor your investments in the plan for performance and remain aware of any significant changes that occur.

If you really like your current investment options and are paying low fees on the investments, this might be the right choice for you.

How Much Of Your 401 Do You Get When You Leave An Employer

You are entitled to 100 percent of any contributions youve made into the 401 plan, but how much of an employer match youre entitled to is based on how the plan is set up and the vesting period. A vesting schedule is based on the length of time required to have ownership in the employers contributions. If you are 100 percent vested in employer contributions, you will receive all of the money the company has contributed on your behalf.

If you have not been with the company for the required amount of time, you may receive a percentage of employer contributions, based on the plans vesting schedule. The rest of the money set aside for you is forfeited back to the company. Most 401 providers delineate how much of your balance is fully vested. If youre not sure, you can always call to inquire.

Read Also: What Is The Phone Number For 401k

Can I Rollover My 401k While Still Employed

In recent conversations, the question has come up as to whether you call rollover your 401k to a traditional IRA while still employed at the sponsoring employer. There seems to be some confusion about this and rumors of new laws that allow it.

The short answer to the question is, no. By law, you can not withdraw 401k contributions, that is, pre-tax salary deferrals, before severance, plan termination, turning 59 1/2, death, disability or hardship .

The long answer is, yes, under certain circumstances, you can.

The standard exceptions do apply, for example, if you are 60 years of age or older, and still working, most qualified plans allow age 59 1/2 rollovers. If a particular plan does not, they most likely allow rollovers at age 65. The exceptions can add to the confusion and there is such a thing as the in-service withdrawal.

To me, the most interesting exception being the fact that the law only applies to your pre-tax salary deferrals. You CAN rollover employer contributions, or employee contributions. And you can do so without any required taxes or penalties.

This can be a big deal. I know someone whos matching contributions from his company were paid in company preferred stock and it ended up comprising a whopping 75% of his total plan holdings. He was not allowed, then, to diversify any matching funds elsewhere within the plan.

I need a book on the subject of in-service-withdrawals from a credible source.

Any suggestions?

How To Get Emergency Cash From Your 401 And Keep On Investing

With a partial cash withdrawal, you would first roll all of your 401 funds into an IRA. By leaving part of your funds in a cash position within the IRA, you have cash as needed. Meanwhile, you can invest the remainder as per your retirement strategy. Its really an option of last resort. However, a partial approach makes the most of a dire situation, says Markwell.

No matter what options you consider or eventually choose, Markwell has this advice to offer: One of the advantages of working with a financial advisor during a career transition is that you can reduce your stress level and emotions, says Markwell. And with a clearer head, you can make decisions that will help in putting you on a more solid track to a successful retirement when the time comes.

Don’t Miss: How To Open 401k For Individuals

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words direct rollover are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, youd need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

Background Of The One

Under the basic rollover rule, you dont have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you cant make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Recommended Reading: How Can I Take Out My 401k

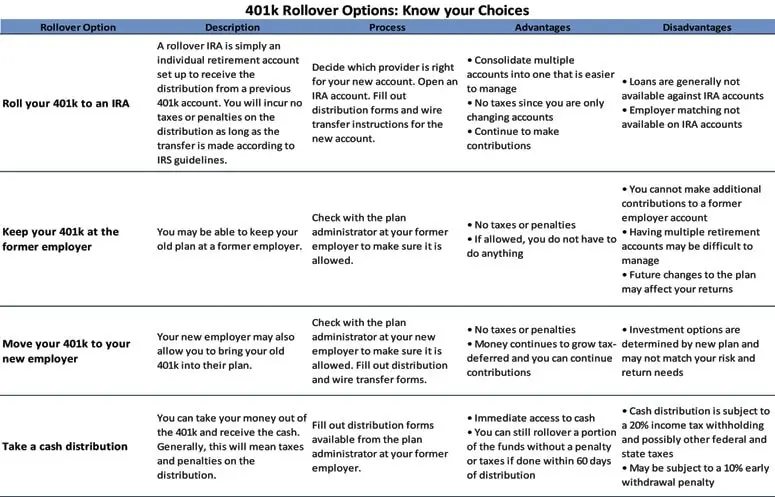

Plan Options When You Leave A Job

If you have an employer-sponsored 401, you will likely be faced with four options when you leave your job.

- Stay in the existing employers plan

- Move the money to a new employers plan

- Move the money to a self-directed retirement account

- Cash out

Before deciding, here are a few things to consider with each option.

What Happens To Your 401 After You Leave A Job

It’s becoming increasingly common for professionals to switch jobs several times throughout their working careers, meaning that most people have to decide what to do with 401 after leaving the job. When you switch jobs or get laid off, you have to evaluate your options on what do you with your 401 account.

After leaving your current job, you have up to 60 days to decide what happens to your retirement savings. Otherwise, your savings will be automatically transferred to another retirement account. In most cases, employers have clear guidelines indicating .

Also Check: How Do You Pull Money From Your 401k

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

There Are A Lot Of Reasons Why Rolling A 401 Over Into Your Own Ira Is The Best Choice For Most People But For Some There Are A Couple Of Cons That Could Outweigh The Pros

2015 A Dogs Life Photography 2015 A Dogs Life Photography –

Most of us have worked for a company that offered 401 plans to their employees. In fact, you and I have likely worked for multiple companies that provide this benefit. And as a result, you might have a number of 401 plans to your name if you opened an account with each employer.

Thats not necessarily a bad thing. After all, most people should always use a 401 if their employer offers one even if the employer doesnt match. 401s are powerful tax-advantaged accounts that you should take advantage of, whether or not your company chips in, too.

So lets say youve been diligently pumping money into your 401 at every company that offered one. But then you changed jobs. You started a new 401 at that new company and then got busy and left the old accounts behind . What happens to all those old accounts? Should you do anything about them?

Maybe. Its important to understand what you can do with old 401s from previous employers and then know the right choice to make for managing those accounts. Heres what you should know.

Recommended Reading: How To Figure Out 401k Contribution

How A Roth Ira Conversion Can Leverage Currently Low Tax Rates

One of the potentially overlooked silver linings of the past years economic challenges is a favorable income tax environment created by the 2017 Tax Cuts and Jobs Act. If youre considering a Roth IRA conversion1 from your 401, youll be paying some of the lowest tax rates in history on those converted assets and doing it all at one time. However, if you went with a traditional IRA rollover, you may pay higher taxes in retirement on your RMDs.

If youve lost your job, or your income level drops, you can convert your 401 assets at your new, lower, tax bracket. Say, for example, you convert your 401 assets to a Roth IRA, you may be paying taxes at a reduced rate right off the bat, explains Markwell. And if taxes rise between now and your retirement target date, at which time youd otherwise take distributions, you will have further benefited tax-wise from that earlier conversion.

Keep in mind that establishing an IRA with efficient growth goals may call for more active management on your part, depending on your retirement goals. A financial professional can help tailor your investments to your individual strategy and also help you revisit and refine that plan as needed.