The 38% Medicare Surtax

The amount you convert from a traditional IRA to a Roth IRA is treated as incomejust like all taxable distributions from pretax qualified accounts. Therefore the conversion amount is part of your MAGI, and it may move you above the surtax thresholds. This may cause you to incur the additional Medicare surtax on your investment income.

For more information on this, read Viewpoints on Fidelity.com: 6 key Medicare questions

But, once your money is in a Roth IRA, the shoe is on the other foot. Because nontaxable withdrawals from a Roth IRA arent part of your MAGI, a Roth IRA conversion may potentially enable you to limit your exposure to the Medicare surtax down the road.

Recommended Reading: Should I Transfer 401k To New Employer

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Its also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, its a good way to save money, stay organized and make your money work harder.

You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

Recommended Reading: How To Open 401k For Small Business

Rollover Iras: A Way To Combine Old 401s And Other Retirement Accounts

If you decide a 401 rollover is right for you, we’re here to help. Call a Rollover Consultant at .

One great thing about a 401 retirement savings plan is that your assets are often portable when you leave a job. But what should you do with them? Rolling over your 401 to an IRA is one way to go, but you should consider your options before making a decision. There are several factors to consider based on your personal circumstances. The information provided here can help you decide.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: How To Check Your 401k Balance Online

What Is A Rollover Ira

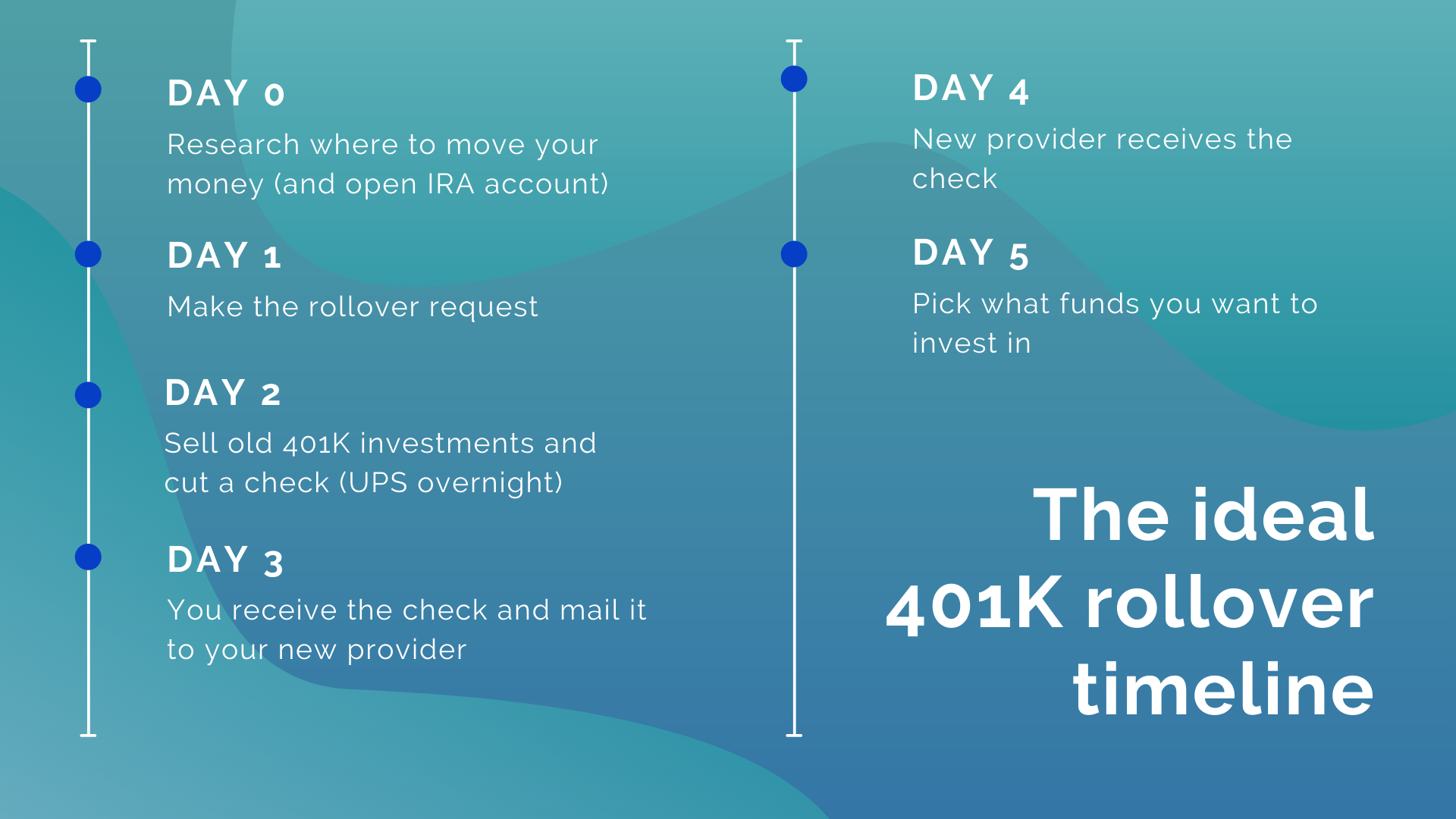

A rollover IRA is an individual retirement account often used by those who have changed jobs or retired. A rollover IRA allows individuals to move their employer-sponsored retirement accounts without incurring tax penalties and remain invested tax-deferred. Consolidating multiple employer-sponsored retirement accounts can make it easier to monitor your retirement savings.

*Note: If you have an existing rollover or traditional IRA at Prudential, you can roll your assets into that account.

Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRAs tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount youd like to convert. Heres a closer look at how 401 to Roth IRA conversions work and how to decide if theyre right for you.

Dont Miss: How To Move A 401k To A Roth Ira

Also Check: Is It Good To Convert 401k To Roth Ira

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

You Want To Increase Your Tax Diversification

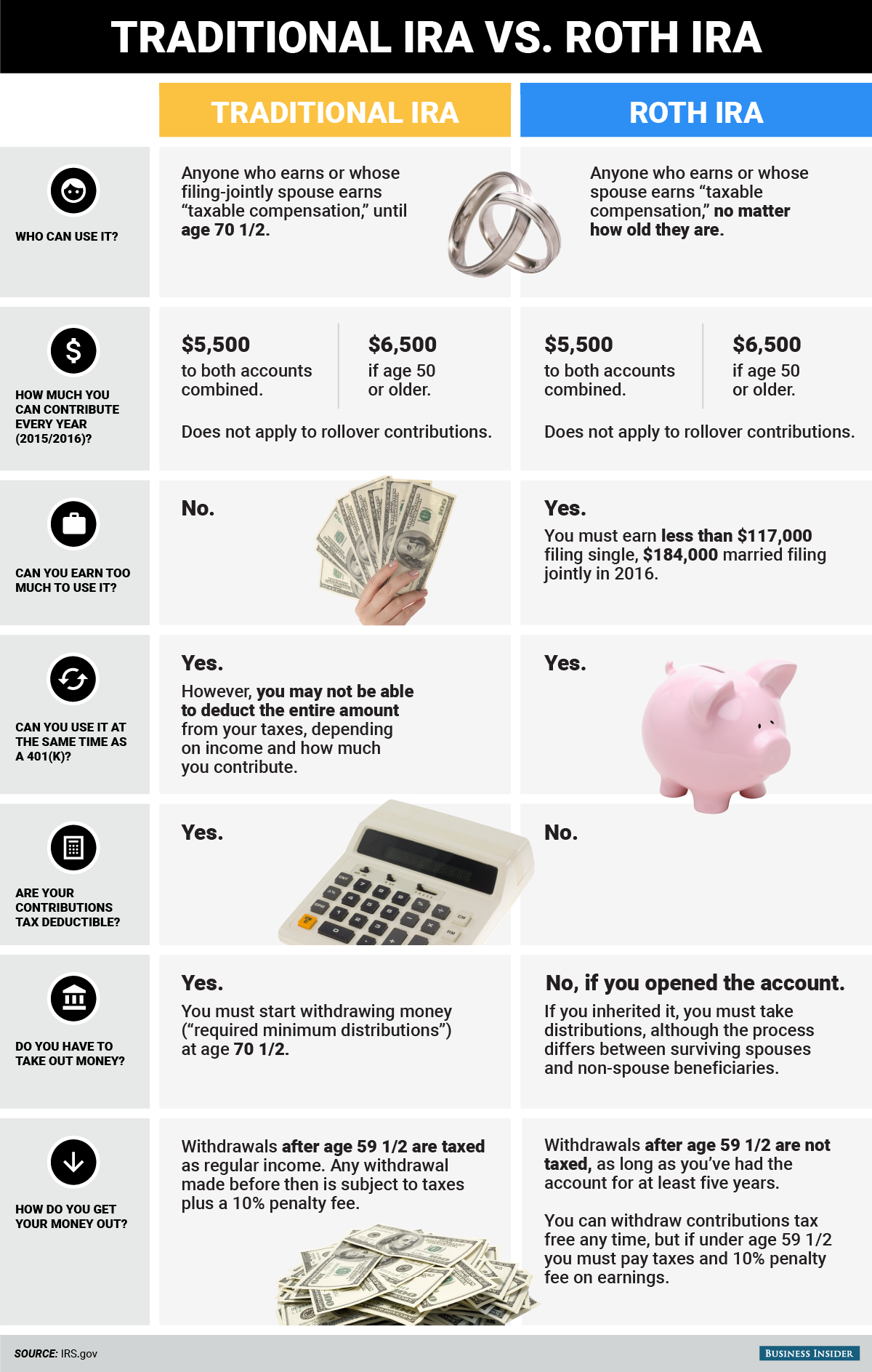

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

You May Like: What Happens To 401k During Divorce

A Tax Loophole Lets High Earners Contribute Indirectly To A Roth Ira

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

High-income earners cant contribute directly to a Roth IRA. But thanks to a tax loophole, they can still make contributions indirectly. If you take advantage and maximize your retirement savings, you can save tens or even hundreds of thousands of dollars on taxes over the years. Let’s delve deeper into this loophole and the benefits of setting up a backdoor Roth IRA.

Why Move The Plan To Canada

Reasons may include:

- consolidating investment management and advisory services to one country to simplify affairs, save money on professional fees and bring peace of mind

- mitigating currency risk and the impact of investment restrictions that may be imposed on non-residents and

- reducing exposure to U.S. estate tax, because U.S.-based retirement plans are considered U.S. situs assets for estate tax purposes. U.S. estate tax is assessed on value, not gain, at the same graduated rates that apply to U.S. persons.

Also Check: How To Borrow From 401k To Buy A House

You May Like: How To Change A 401k To A Roth Ira

Alternatives To Roth Ira Rollovers

If you want to move your old 401 account, there are other options that are available to you besides a Roth IRA.

If you have a new 401 plan offered to you at your new employer, you could roll the old 401 plan into your new plan. Similar to opening a Roth IRA, there are a few easy steps to take to move your old 401 into a new employers plan.

You could also roll over your 401 into a Traditional IRA. You wont pay taxes when you convert the money to a Traditional IRA, as you will be taxed when you withdraw the money in retirement. You may want to do this, as Traditional IRAs typically offer more investment choices than workplace 401s.

If you own your own business, then you could open a self-employed 401 plan and convert an old workplace 401 to this account. A self-employed 401 plan offers many of the same benefits as a traditional 401, except that, as a business owner, you could make contributions both as an employee and employer. This helps minimize your business income and maximize your retirement contributions.

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Read Also: What Happens To 401k When You Leave Company

Roll Over Your Money To A New 401 Plan If This Option Is Available

If youre starting a new job, moving your retirement savings to your new employers plan could be an option. A new 401 plan may offer benefits similar to those in your former employers plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, youll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plans features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employers 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employers 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if youre still working.

Can I Do A Roth Conversion If I Am Retired

Yes, you can do a roth conversion at any time. Just keep in mind a roth conversion always comes with a tax bill. When you move the funds from your 401k or IRA, you will also be missing out on tax-free growth.

If you retire at 59 ½ then it might not make sense to do a roth conversion ladder as your funds for a 401k/IRA will then be accessible penalty-free.

You May Like: Do Part Time Employees Get 401k

What Are The Rules For Putting Money In A Roth Individual Retirement Account

Most people who earn income will qualify for the maximum contribution of $6,000 in 2022, or $7,000 for those ages 50 and older. If your income falls within the Roth individual retirement account phaseout range, you can make a partial contribution. You cant contribute at all if your modified adjusted gross income exceeds the limits.

Keep Your 401 With Your Previous Employer

In this instance, you wont change a thing. Just make sure that you actively monitor your investments in the plan for performance and remain aware of any significant changes that occur.

If you really like your current investment options and are paying low fees on the investments, this might be the right choice for you.

You May Like: How To Start My Own 401k

Converting A Traditional 401 To A Roth Ira

Youll owe some taxes in the year when you make the rollover because of the crucial differences between a traditional 401 and a Roth IRA:

- A traditional 401 is funded with the salary from your pretax income. It comes right off the top of your gross income. You pay no taxes on the money that you contribute or the profit that it earns until you withdraw the money, presumably after you retire. You will then owe taxes on withdrawals.

- A Roth IRA is funded with post-tax dollars. You pay the income taxes up front before it is deposited in your account. You wont owe taxes on that money or on the profit that it earns when you withdraw it.

So, when you roll over a traditional 401 to a Roth IRA, youll owe income taxes on that money in the year when you make the switch.

The total amount transferred will be taxed at your ordinary income rate, just like your salary. Tax brackets for 2021 range from 10% to 37% and remain the same for 2022.

Question 2 Of : Can You Transfer Retirement Funds To A Roth Ira

You May Like: When Can You Take Out Your 401k

Is There A Limit On How Much I Can Roll Over Into A Roth

No, there are no limits on the total amount you can roll from your other retirement account into a Roth IRA. However, it may be beneficial to spread out your rollovers over multiple tax years to limit your tax bill. In contrast, the annual contribution limit for direct contributions to Roth IRAs for the tax years 2021 and 2022 is just $6,000 per year .

Traditional 401s Vs Roth 401s

Employer-sponsored 401 plans are an easy, automatic tool for building toward a secure retirement. Many employers now offer two types of 401s: the traditional, tax-deferred version and the newer Roth 401.

Of all the retirement accounts available to most investors, such as 401 and 403 plans, traditional IRAs, and Roth IRAs, the traditional 401 allows you to contribute the most money and get the biggest tax break right away. For 2021, the contribution limits are $19,500 if you’re under age 50. If you’re 50 or older, you can add an extra $6,500 catch-up contribution for a total of $26,000. In 2022, the amount is $20,500.

Plus, many employers will match some or all of the money you contribute. A Roth 401 offers the same convenience as a traditional 401, along with many of the benefits of a Roth IRA. And unlike a Roth IRA, there are no income limits for participating in a Roth 401. So if your income is too high for a Roth IRA, you may still be able to have the 401 version. The contribution limits on a Roth 401 are the same as those for a traditional 401: $19,500 or $26,000 , or $20,500 in 2022, with the $6,500 catch-up amount, depending on your age.

Read Also: How To Get Money From 401k After Retirement

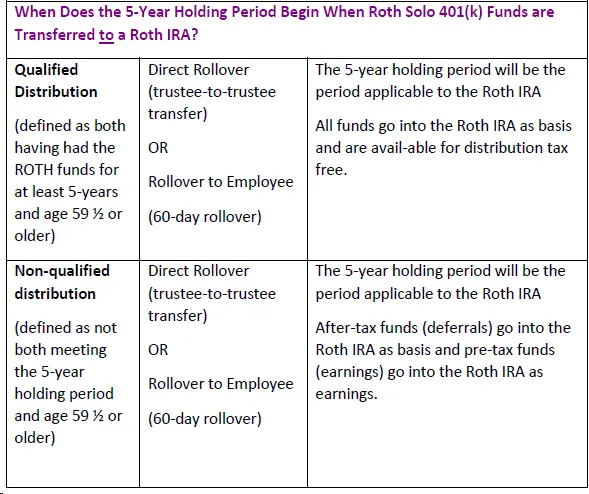

Converting From An Employer

You can convert other retirement accounts, such as an employer-sponsored 401 or 403 plan, too, once you leave your job. Some plans let you access the money while youâre still workingâan âin-service distribution.â However, you usually have to reach age 59½ before you can do so.

If you want to convert assets from your 401 or another employer-sponsored plan to a Roth IRA, make sure the money is transferred directly to the financial institution through a trustee-to-trustee transfer. If your company issues the check to you, it must withhold 20% of the account balance for tax purposes. Then youâll have just 60 days to deposit all the money into a new Roth accountâincluding the 20% that you didnât receive. That must come from another source. Miss the deadline and any money not rolled over to a Roth IRA will be subject to a 10% early withdrawal penalty if you’re younger than 59 ½.