Which Account Is Right For You

Traditional 401

- Taxes: You make pre-tax contributions and pay tax on withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are added directly to your 401 account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72

- Heirs are subject to RMDs and taxed on distributions

Roth 401

- Taxes: You make after-tax contributions and don’t pay tax on qualified withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are deposited into a separate tax-deferred account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72 however, you could roll over funds to a Roth IRA to avoid RMDs

- Heirs are subject to RMDs but not taxed on distributions

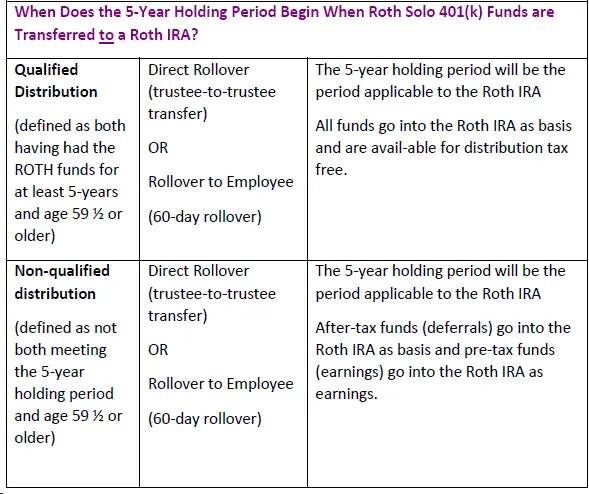

Now that you have a better understanding of a Roth 401, you might be wondering how it differs from a Roth IRA. Contributions to either account type are made with after-tax dollars, and you won’t pay taxes on qualified distributions. The differences between the two types of Roth accounts come down to contribution limits, income limits, and RMDs.

Roth 401 Vs Traditional 401 Withdrawal Rules

Early withdrawal rules are very similar for both Roth 401s and traditional 401s. The main difference is the income taxes you pay on your contributions.

With a traditional 401, you pay income taxes on any contributions and earnings you withdraw. With a Roth 401, income taxes only apply to your earnings since you have already paid up front on the money you put into the account. The 10% IRS early withdrawal penalty still applies to both plans.

First You Need To Understand Contribution Limits

Before we get into how to contribute to multiple 401s and IRAs, we need to understand the limitations.

The IRS sets limits to how much you can contribute to your retirement accounts. 401s have different contribution limits than IRAs.

The contribution limit for any 401 account is $19,500. This limit is for total contributions, whether to just one account or split between a 401 and Roth 401. If you are 50 and older, you can contribute an additional $6,500 as a catch-up bonus.

Additionally, if you receive an employer match, the total contribution for a 401 canât exceed $58,000, or $64,500 if youre 50 and older.

For IRAs, the IRS limits annual contributions to $6,000 for each account. Individuals 50 and older can contribute an additional $1,000.

You May Like: How To Find Out If You Have Unclaimed 401k Money

Recommended Reading: How To Invest Your 401k In Real Estate

Amount Of Roth Ira Contributions That You Can Make For 2022

This table shows whether your contribution to a Roth IRA is affected by the amount of your modified AGI as computed for Roth IRA purpose.

| If your filing status is… | And your modified AGI is… | Then you can contribute… |

|---|---|---|

| or qualifying widow |

< $204,000 |

|

| or qualifying widow |

> $204,000 but < $214,000 |

|

| or qualifying widow |

> $214,000 |

|

| and you lived with your spouse at any time during the year |

< $10,000 |

|

| and you lived with your spouse at any time during the year |

> $10,000 |

zero |

| single, head of household, or and you did not live with your spouse at any time during the year |

< $129,000 |

up to the limit |

| single, head of household, or and you did not live with your spouse at any time during the year |

> $129,000 but < $144,000 |

a reduced amount |

| single, head of household, or and you did not live with your spouse at any time during the year |

> $144,000 |

zero |

What Happens To A Roth 401 When You Change Jobs

When you change jobs, you can roll all of your Roth 401 contributions, without limit, into a new account with the new employer. The manager of the old account must complete a direct rollover to the manager of the new account. To avoid tax penalties, make sure the check is not made out to you personally and make sure the rollover is from one Roth 401 to another Roth 401.

If you are an employer looking to offer retirement options to your team, contact Human Interest for more information on the possibilities. Well show you all the plans available to your companys size and corporate structure.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment education, and integration with leading payroll providers.

Don’t Miss: How To Rollover A 401k From One Company To Another

What Are The Similarities Between A Roth 401 And A Traditional 401

Now that we know the differences between a Roth 401 and a traditional 401, lets talk about how theyre similar.

The Roth 401 includes some of the best features of a 401, but thats where their similarities end.

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts.

But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But whatever you do, do not pull that money out of the investment itself!

Before you roll over accounts, sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and figure out whether it makes sense for your situation.

Recommended Reading: How Can You Take Out Your 401k

If Your Tax Rate Is Low Now And You Expect It To Be Higher In Retirement

-

You may want to make contributions with after-tax dollars which you can do with a Roth 401.

-

Then you wont pay taxes at that higher rate when you take qualified distributions in retirement.

-

This scenario of lower rate now, higher rate later can affect many workers, especially those early in their careers. Your income and standard of living likely will increase over time, so you may want to draw more money in retirement than youre earning now.

-

Theres also the possibility of across-the-board legislative tax increases current tax rates are low when put in historical context.

Can I Max Out 401k And Ira In 2022

A 401 plan has a higher contribution limit than a traditional or Roth IRA$20,500 versus $6,000 in 2022. You can contribute more if youre 50 or older, and there are special rules if you participate in both types of retirement plans.

Can I max out a 401k and an IRA in the same year?

Limits on 401 plan contributions and IRA contributions do not overlap. As a result, you can contribute fully to both types of plans in the same year as long as you meet the different eligibility requirements.

What is the max 401k and Roth contribution for 2022?

After taxes starting in 2022, employees under the age of 50 can defer up to $20,500 of their wages into a pre-tax regular account or a Roth 401 account. However, you can make additional after-tax contributions to your traditional 401, allowing you to save more than the $20,500 cap.

You May Like: Can I Rollover 401k To Ira

Is Charles Schwab Good For Roth Ira

Charles Schwab Schwab shines all around, and it remains an excellent choice for a Roth IRA. Schwab charges nothing for stock and ETF trades, while options trades cost $0.65 per contract. And mutual fund investors can find something to love in the broker’s offering of more than 4,000 no-load, no-transaction-fee funds.

Limitations On Having Both An Ira And 401

As mentioned, while you are always eligible to contribute to both retirement accounts, if your income is too high, you may not be eligible for the tax benefits of both. To work through this yourself you need to answer two questions:

If you answered no to the first question, then youre set. However, if you or your partner participate in a work-sponsored retirement plan such as a 401, you will be ineligible to deduct your IRA contributions because your income exceeds whats known as the phase-out limit.

If you are filing as single or head of household, the phase-out limit is between $64,000 and $74,000. If your income is less than $64,000, you are eligible for full tax deduction of your contribution to an IRA. If its over $74,000, you are not eligible, and if you are in between you are eligible for a partial deduction.

If you are filing jointly, the limit is $103,000 to $123,000. The same rules apply .

You May Like: How To Find Your Fidelity 401k Account Number

What Are The Contribution Limits In 2022

Contribution limits for Roth and traditional 401 plans are the same. You can contribute as much as $20,500 to a 401 plan in 2022, an increase of $1,000 from 2021. Those 50 and older will be able to add another $6,500 the same catch-up contribution amount as 2021 for a maximum contribution of $27,000. These limits are adjusted every year.

Your employer may contribute to your 401, too, and there is a limit to the combined amount you and your employer can contribute to 401 plans. For those age 49 and under, the limit is $61,000 in 2022, up from $58,000 in 2021. For those 50 and older, the limit is $67,500 in 2022, up from $64,500 in 2021. You cant contribute more than your earned income in any year.

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Access to thousands of financial advisors.

Expertise ranging from retirement to estate planning.

Match with a pre-screened financial advisor that is right for you.

Answer 20 questions and get matched today.

Connect with your match for a free, no-obligation call.

Also Check: How Much Can You Put In 401k Annually

Mixing Roth And Traditional

The contribution limits are the same for Roth and traditional versions of 401s and IRAs.

If you want to contribute to both a Roth and a traditional 401, the maximum amounts remain the same. You can split your contributions between accounts in any way you like.

One financial strategy, for those who want to maximize their tax-advantaged savings: Open both types of Roth accounts. You can invest up to the combined allowable limits in a Roth 401 and a Roth IRA.

Contributions In Excess Of Annual Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the annual limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

Read Also: How Do You Take Money Out Of 401k

What Are The Advantages Of A Roth Ira

Roth IRAs allow taxpayers to make after-tax contributions from time to time and then withdraw their contributions and income tax-free upon retirement. This is very beneficial, especially for young savers who are likely to have a higher tax bracket in retirement.

Roth ira vs brokerage accountWhat is the difference between an IRA and a brokerage account? The securities account is managed like a savings account with a bank. However, your brokerage money can grow faster because it is invested in financial assets. Consequently, the brokerage account is more focused on growth. An IRA can also be called a minor escrow or escrow account.What do banks offer Roth IRA?Roth Bank IRAs generally

Also Check: What Is A 403 B Plan Vs 401k

How Much Should I Put In My Roth Ira Monthly

The IRS, in 2021, closes the maximum amount that you can contribute to a traditional IRA or Roth IRA $ 6,000. Seen the other way, its $ 500 a month you can donate throughout the year. If you are age 50 or older, the IRS allows you to contribute up to $ 7,000 annually .

How much should you put into a Roth IRA? The most you can contribute to all your traditional and Roth IRAs is the smaller of: For 2020, $ 6,000, or $ 7,000 if you are age 50 or older at the end of the year or. compensation to you for the year. For 2021, $ 6,000, or $ 7,000 if you are age 50 or older by the end of the year or.

Don’t Miss: Can You Leave Your 401k At Your Old Job

Saving For Retirement In A Roth Ira

If you meet the income requirements for contributions, there are two compelling reasons to use a Roth IRA for retirement savings.

How Much Should A 65 Year Old Have In Retirement Savings

Since higher earners will receive a smaller portion of their income in retirement from Social Security, they generally need more assets relative to their income. We estimated that most people looking to retire around age 65 should aim for assets that are between seven and 13½ times their gross pre-retirement income.

What does the average 65 year old have saved for retirement?

Those who had retirement accounts did not have enough money in them. According to our research, people aged 56 to 61 have an average of $163,577. Those aged 65 to 74 have even less. If that money were converted into a life annuity, it would only amount to a few hundred dollars a month.

Also Check: Can I Convert My 401k To Gold

Comparing 2022 And 2023 Limits

The chart below provides a breakdown of how the rules and limits for defined-contribution plans , 403, and most 457 plans are changing for 2023 vs. 2022.

| Defined Contribution Plan Limits | |

|---|---|

| $150,000 | +$15,000 |

* The catch-up contribution limit for participants age 50 or older is available to those turning 50 at any time during the year. For instance, if you were born on New Year’s Eve, it applies.

How Roth 401 Matching Works

Your employer can match your Roth 401 contributions just as they do with a traditional 401, but with one major difference: Matching contributions go into a traditional 401 account instead of your Roth 401. Even if you choose to contribute to a Roth 401 only, you’ll maintain both a Roth and a traditional 401 accountthe latter for your employer’s matching contributions. Because your employer’s contributions go into a traditional 401, you don’t pay taxes on them.

Employer plans vary. Some offer generous matching policies as a benefit to employees, while others don’t offer matching at all. Two common types of matching programs include:

You May Like: How Do I Get A Loan From My Fidelity 401k