Why You Should Consider A 401 Loan Instead Of Hardship Withdrawal

If youre in need of extra funds and have no other options outside of your 401 plan, consider taking a plan loan. First, check out your 401 plan document to see if it allows for plan loans. If allowed, you can borrow up to 50 percent of the vested portion of your 401 balance. Youll pay interest as youre paying the loan off, but it is credited back into your account. And as long as you pay the loan back, its not taxable. In addition, you can still contribute to the 401 plan and pay back the loan at the same time, although it may be wiser to put that additional money toward the principal to get it paid off in a shorter time saving on interest charges.

A loan is better than a hardship distribution because with a loan, you can restore your 401 balance by paying the loan back. But there are no payback provisions for hardships once the hardship distribution is made, its out your 401. You will need to make other arrangements to cover any shortage in your retirement savings objective due to the hardship distribution.

Read Also: How To Cancel 401k Plan

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

You May Like: How To Roll 401k Into Ira

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

What Can I Do With My Small 401k After I Leave My Job

You can leave your 401 with your former employer or roll it into a new employer’s plan. You can also roll over your 401 into an individual retirement account . Another option is to cash out your 401, but that may result in an early withdrawal penalty, plus you’ll have to pay taxes on the full amount.

Don’t Miss: How To Find 401k Account Number Fidelity

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment education, and integration with leading payroll providers.

How Can I Pull Out My Money From My 401

Cashing out a 401 can be a tempting idea, especially if you are facing financial difficulties or need to raise money for a major purchase. But even though the money in the account belongs to you, it is subject to certain rules and restrictions due to the tax advantages it provides account owners. One of the rules related to cashing out a 401 relates to the employment status of the account owner. You are allowed to cash out a 401 while you are employed, but you cannot cash it out if you’re still employed at the company that sponsors the 401 that you wish to cash out.

TL DR

You can cash out a 401 while you are employed, but you cannot cash it out if you’re still employed at the company that sponsors the 401 that you wish to cash out.

Read Also: What To Do With 401k If I Leave My Job

Calculating The Basic Penalty

Assume you have a 401 plan worth $25,000 through your current employer. If you suddenly need that money for an unforeseen expense, there is no legal reason you cannot simply liquidate the whole account. However, you are required to pay an additional $2,500 at tax time for the privilege of early access. This effectively reduces your withdrawal to $22,500.

There are certain exemptions that you can use to take a penalty-free withdrawal however, you will still owe taxes on that money. These are for immediate and heavy financial needs that constitute a hardship withdrawal. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary. These include:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence (such as losses from fires, earthquakes, or floods

You likely will not qualify for a hardship withdrawal if you hold other assets that could be drawn from, such as a bank account, brokerage account, or insurance policy, in order to meet your pressing needs.

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Read Also: Does The Maximum Contribution To 401k Include Employer Match

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

Recommended Reading: Where Do I Go To Withdraw My 401k

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choicesleave your money in the plan until you reach the age of required minimum distributions , convert the account into an individual retirement account , or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

Don’t Miss: How Much Should I Contribute To My 401k

Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Can You Borrow From Your 401k For A Down Payment On A Home

Key Takeaways You can withdraw funds or borrow from your 401 to use as a down payment on a home. Choosing either route has major drawbacks, such as an early withdrawal penalty and losing out on tax advantages and investment growth. Its obviously better if you can save the money elsewhere and not take or borrow the cash from your future.

Read Also: What Is A Safe Harbor 401k Plan

Borrowing 401 Funds To Buy A Home

The second option for accessing your 401 funds to buy a house is to take a loan from your plan. Since this is essentially loaning money to yourself, you dont have to pay the early withdrawal penalty or income tax on the amount you initially withdraw. As long as you pay it back on time, you wont owe the IRS any extra money for this type of withdrawal.

You can take $10,000 or half your vested amount in the plan , up to a maximum of $50,000. This type of loan is provided by your 401 plan provider double check that they do allow it and they will set the interest rates for it and the loan term. You should also note that youll owe tax on the repayments you make, unlike your original contributions.

Taking Out A 401 Loan

If you need to access the assets from your plan but arent entitled to any other variety of withdrawals, you could take out a loan against your 401 plan if your plan provider authorizes this. Make sure to check this information with your plan administrator.

This is essentially borrowing the assets from your future self and you will have to pay it back to the same account with interest. You can take out up to 50% of the funds from your account or up to $50,000. The time limit for paying off this loan is usually up to five years.

Even though it can be tempting, there are many disadvantages to taking out a loan against your 401 and we will delve into all of them later.

Read Also: How Do I Draw Money Out Of My 401k

Why Are People Cashing Out 401k

Cashing out a 401 gives you immediate access to funds. If you lose your job and use the money to cover living expenses until you start a new job, an early 401 withdrawal might help you avoid going into debt. … Leaving money in the account, rather than taking it out, could help you reach those financial goals.

What Hardship Withdrawals Will Cost You

Hardship withdrawals hurt you in the long run when it comes to saving for retirement. Youre removing money youve set aside for your post-pay-check years and losing the opportunity to use it then, and to have it continue to appreciate in the meantime. Youll also be liable for paying income tax on the amount of the withdrawaland at your current rate, which may well be higher than youd have paid if the funds were withdrawn in retirement.

If you are younger than 59½, its also very likely youll be charged at 10% penalty on the amount you withdraw.

You May Like: What Happens To 401k In Divorce

Alternatives To Cashing Out

If you want to make a more conservative decision, you can leave your money in your 401 k when you change to a different company or employer. Cashing out your 401 k isnt a requirement, after all. If youre happy with your old employers 401 k, we recommend that you leave the money where it is. You can withdraw it once you retire. This is also a great way to avoid paying excessive income tax.

You can also stretch out the time that you withdraw money from your 401 k. The funds dont have to come out in a lump payment. A plan participant leaving an employer typically has four options , each choice offering advantages and disadvantages. You can leave the money in the former employers plan, if permitted Roll over the assets to your new employer plan if one is available and rollovers are permitted Roll over the funds to an IRA or cash out the account value. The more time between your payments, the easier it is to avoid paying extra tax on the money. This is because funds from your 401 k are considered part of your taxable estate.

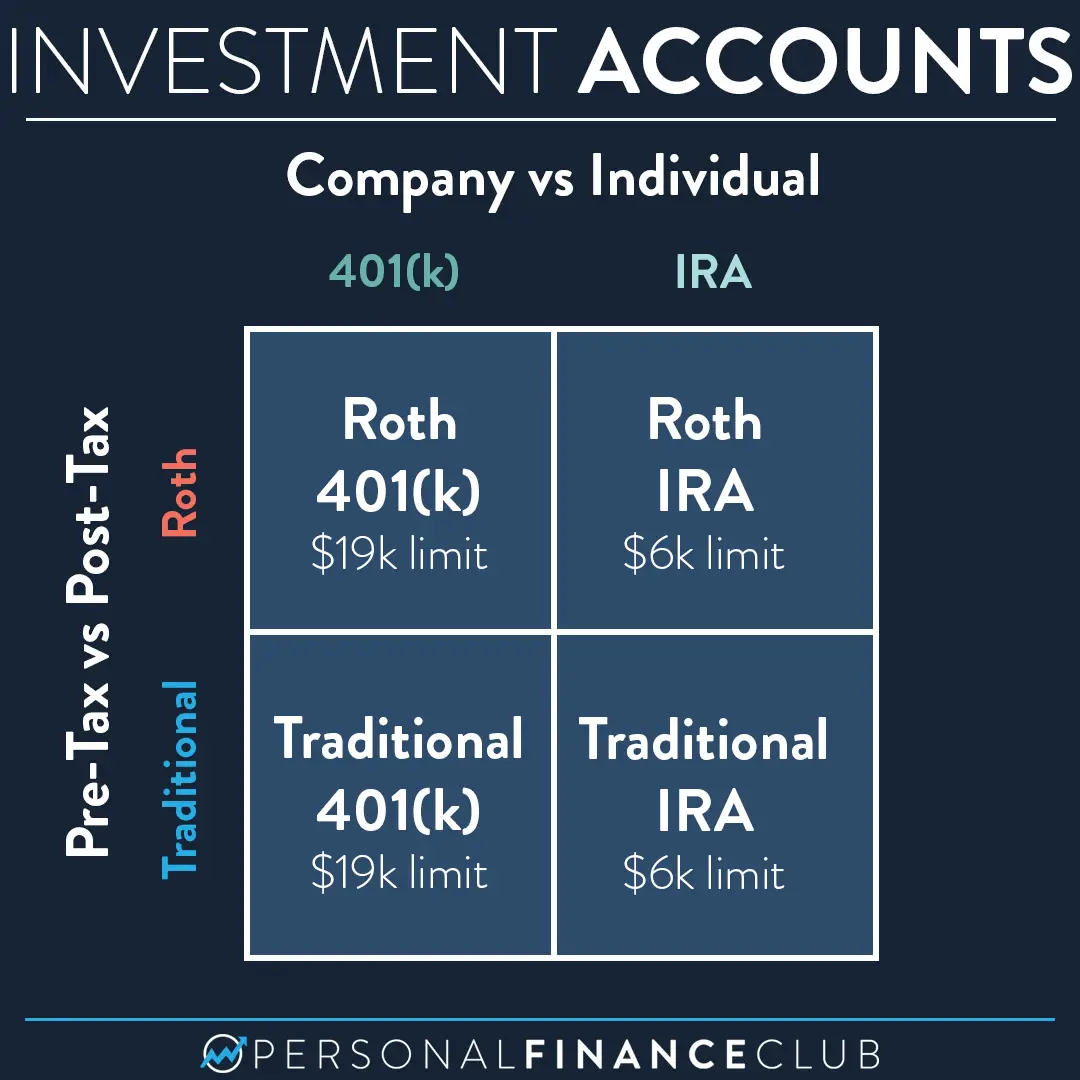

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

Also Check: How To Hide 401k In Divorce

How Do I Take A Loan From My 401k

How to Borrow from Your 401

Can You Be Denied A Hardship Withdrawal

Most 401 plans provide loans to participants who are facing financial hardship or have an immediate emergency need such as medical expenses or college education. If the reason for the 401 loan is a luxury expense that does not meet the financial hardship criteria, the loan application could be denied.

You May Like: Can You Rollover A Pension Into A 401k

Leave The Money Alone

This money will only get taxed when you take it out of the account or make distributions.

We discussed 401 and how the phenomenon is that you never know what taxes will be like in the future and whether its best to cash out your 401 now or later.

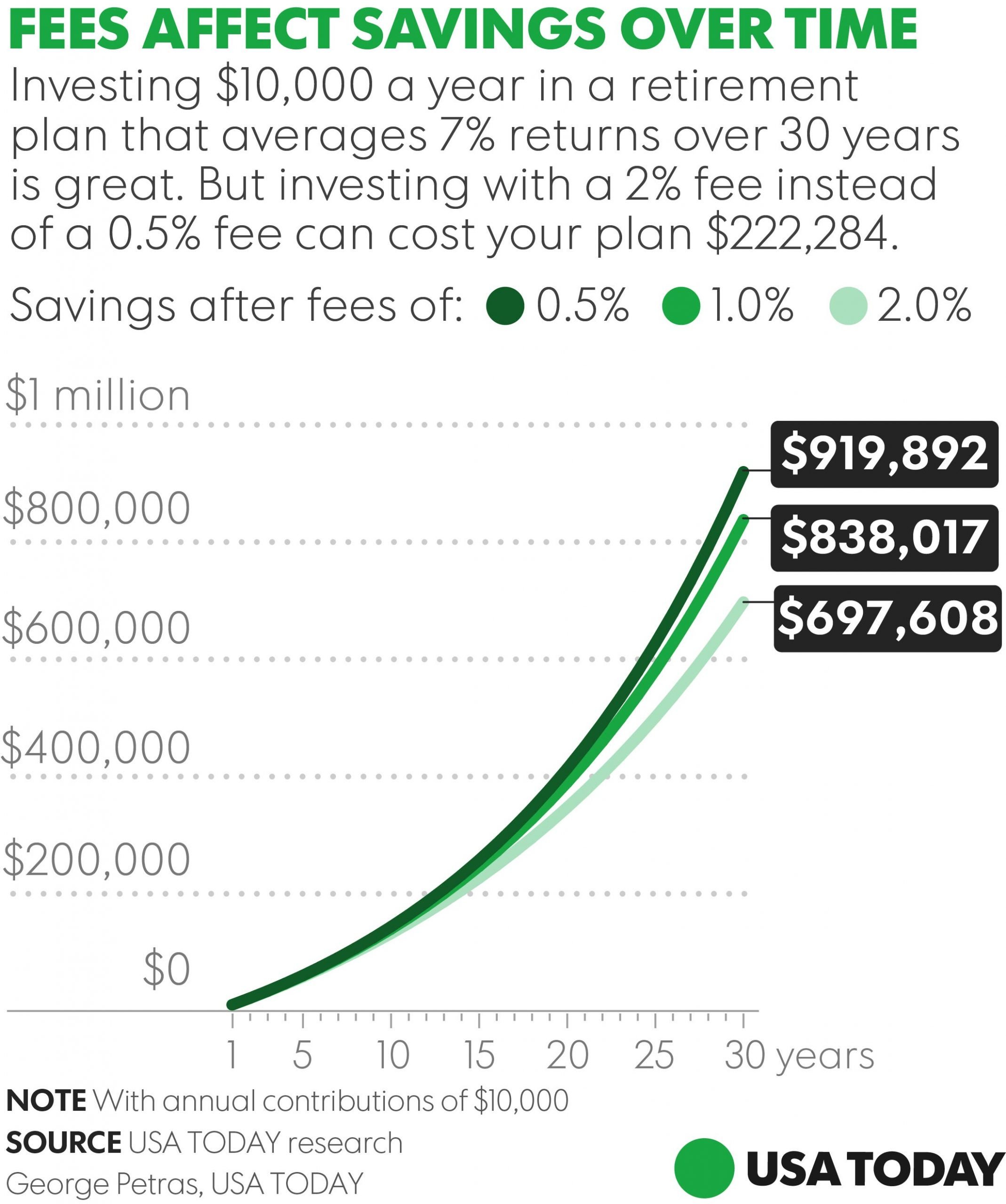

However, compound interest only works if you leave the funds alone. Taking a few hundred dollars from your plan now could cost you thousands in the future. So its best not to take your money out and let it increase without interruptions.

Every time you make a withdrawal, you squander some part of your funds to taxes because its considered your income and just gets added to your tax bracket at the end of the year. Also, every time you make an early withdrawal you will most likely have to pay the 10% penalty fee.

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Don’t Miss: Can I Get My 401k If I Quit