How Can You Withdraw From 401k Without Any Penalties

Knowing that you have such a large sum of money sitting there waiting for retirement can be hard for some people to fathom, and they might wonder about whether they can withdraw it early.

Getting access to these funds before your retirement age will come with penalties though, so, unfortunately, you wont be able to take any of it out without paying in some way or another.

Taking an early withdrawal from a 401k or IRA account means youll be liable for penalties, and these are usually in the form of tax.

When you make contributions to your 401k account theyll be tax-free with the understanding that tax will be charged when you start to withdraw, but if you do it early those tax rates are even higher.

Withdrawing money from your IRA or 401k before the age of 59.5 means youll have to pay the standard federal income tax according to your personal tax rate as well as a 10 percent penalty.

This 10 percent is based on how much money you plan on withdrawing, but not the remainder thats left in your account.

Some states also impose further state income tax that needs to be considered depending on where you live.

Given these harsh penalties, its not generally recommended to take anything from your 401k account unless its deemed a financial emergency.

Recommended Reading: How To Get My 401k Money From Walmart

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Does 401k Withdrawal Count As Income For Stimulus Check

A: Unfortunately, the answer would likely be yes. A withdrawal that boosted your income past those thresholds would make you ineligible. Theyre counting the adjusted gross income, which is $75,000 for an individual and $150,000 for a couple, President and CEO of Kendall Capital, Clark Kendall, said.

You May Like: Can You Contribute To 401k And Roth Ira

Recommended Reading: Can You Cash Out 401k After Leaving Job

What Are Exceptions To 401k Early Withdrawal Penalty

There are a few exceptions to the minimum age of 59½. The IRS offers retribution without penalty in special circumstances related to death, disability, medical expenses, child support, spousal support, and active military activity, said Bryan Stiger, CFP, a counsel. Betterments 401 financial statement.

What are the exceptions to the 10% penalty for early withdrawal?

Up to $ 10,000 for an early IRA withdrawal that is used to buy, build, or rebuild a first home for a parent, grandparent, self-employed spouse, or you or your spouses child or grandchild may be exempt from at a penalty of 10%. You have to meet the IRS definition of a home buyer for the first time.

Is the 10 early withdrawal penalty waived for 2021?

Although the initial provision for 401k withdrawals without penalty has expired at the end of 2020, the Consolidated Appropriations Act, 2021 provided a similar withdrawal exemption, allowing eligible individuals to take a qualified disaster distribution. up to $ 100,000 without being subject to the 10% penalty. what would be

Which of the following is not an exception to the 10 early withdrawal penalty for an IRA?

The following distributions are not subject to the 10% penalty tax: Death of IRA owner. Distribution to your designated beneficiaries after your death. Most non-spouse beneficiaries have settled inherited accounts in 10 years.

Taking A 401k Loan Might Not Be Such A Good Idea

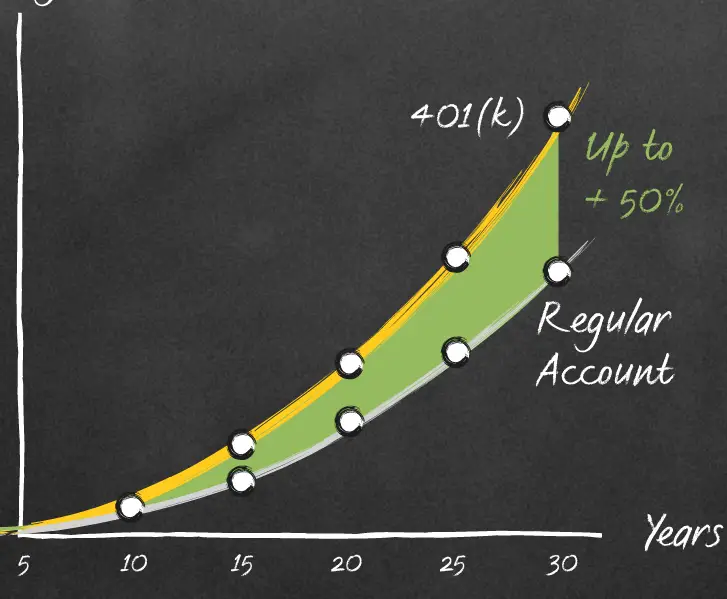

A 401K is supposed to help you have money in retirement. When you temporarily take money out of the plan, it inhibits its ability to compound with interest or stock market growth. You may end up with less money in retirement than if you had left the money in your 401K. In addition, if you terminate your employment, youll owe a 10% penalty and income taxes on the balance unless you can pay the loan back right away. 401K loans may also have fees and the payment terms are often very inflexible. Finally, taking a 401K loan may be a sign of broader financial distress.

Also Check: Can I Take A Loan From My 401k

The Cares Act And 401k Withdrawal

The CARES Act was signed into law in 2020 to help provide financial stability and relief for individuals and businesses affected by COVID-19. As a result, it has implications on making 401 withdrawals. Under the CARES Act, early 401 withdrawal penalties are eliminated for qualified individuals making withdrawals up to $100,000 for coronavirus related distributions.

While the CARES Act eliminates early 401 withdrawal penalties, income tax on the distributions of pre-tax assets would still be owed but could be paid over a three-year period. Individuals could “recontribute” the funds to a retirement account within three years without regard to contribution limits.

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Also Check: How Do You Transfer 401k To New Job

Avoid Early Withdrawal Penalty

Withdrawals made before age 59 ½ are subject to a 10% early withdrawal penalty and income taxes depending on your tax bracket. However, if you leave your current employer at age 55 or later, you may qualify to get a penalty-free 401 withdrawal. However, the distribution will still be subject to ordinary income tax at your tax bracket. The IRS requires that an employee must have left their employer to qualify for a penalty-free distribution. This rule is known as the Rule of 55, and it does not apply to earlier plans or Individual Retirement Accounts.

Learn Whether You Can Qualify To Supplement Your Income

For many Americans, the balance of their 401 account is one of the biggest financial assets they own — but the money in these accounts isn’t always available since there are restrictions on when it can be accessed.

401 plans are meant to help you save for retirement, so if you take 401 withdrawals before age 59 1/2, you’ll generally owe a 10% early withdrawal penalty on top of ordinary income taxes.

However, there are limited exceptions. For instance, if you incur unreimbursed medical expenses that exceed 10% of your adjusted gross income, you can withdraw money from a 401 penalty-free to pay them. Similarly, you can take a penalty-free distribution if you’re a military reservist called to active duty.

Because the exceptions are narrow, most people must leave their money invested until 59 1/2 to avoid incurring substantial taxes. However, there is one big exception that could apply if you’re an older American who needs earlier access to your 401 funds. It’s called the “rule of 55,” and here’s how it could work for you.

Don’t Miss: How Can You Get Money From Your 401k

Withdrawing Funds From 401 After 55 But Before 59

If you are 55 or older and still working for the company managing your retirement savings, you cannot take a penalty-free distribution until you are 59 ½. However, you may still qualify to take a hardship withdrawal if you have a qualified expense. You will owe income taxes and a 10% penalty tax on the distribution you take. You may also qualify for a 401 loan if your retirement plan provides this benefit.

Looking For A Financial Advisor

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Depending on your tax situation, both Luber and Whitney say it also might make sense to take a portion of your 401 and do a Roth IRA conversion. However, its important to review the tax consequences of a move like this with a tax professional.

Keep in mind that any money converted to an IRA would make the funds ineligible for the rule of 55 and prevent penalty-free access for five years under Roth conversion rules. That said, moving funds into a Roth IRA allows you to benefit from years of valuable tax-free investment growth.

Before you leave your job, make sure you look at all your accounts and assets and review the potential tax consequences, Whitney says. Then decide what is likely to work best for you.

Also Check: How Much Do You Get From 401k

To Keep Your Living Arrangements Intact

Being at risk of eviction or foreclosure is a serious emergency for you and your family, in which case using retirement funds can be a viable option. If your landlord or mortgage lender hasnt provided any options or assistance during this difficult time, you may consider paying your rent or mortgage with this money.

Withdrawing Funds From 401 At 72

If you are age 72, you must start taking annual distributions from the 401, commonly known as required minimum distributions . You must take the first distribution by April 1 of the year you turn 72, and thereafter, you will be required to take the annual withdrawals by December 31 each year. If you delay in taking the first distribution, you must take two distributions in the same year, which will push you to a higher tax bracket. If you miss taking a mandatory distribution, the IRS imposes a 50% penalty on the amount you were required to take during the specific period.

An exemption to the RMDs is if you are still working. To qualify for this exception, you must not own 50% or more of the employerâs company. You can use this exception to delay taking the mandatory distributions until when you stop working.

Recommended Reading: Is 401k Protected From Bankruptcy

People May Have Different Reasons For Withdrawing Funds Early From A 401k

- Financial Hardship: People sometimes withdraw funds early due to financial hardship . Example include: medical care, expenses related to the purchase of a home, tuition, and funeral expenses

- Discretionary Spending: People may withdraw funds from a 401K because they prefer to have the money now rather than save it for retirement. In general, we do not recommend this strategy

- Early Retirement: Some people retire earlier than the standard retirement age. In this case, it is understandable why they may want to access funds early since they are no longer working

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Recommended Reading: How To Withdraw From Fidelity 401k

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

Dont Miss: Does Borrowing From 401k Affect Credit Score

When Should You Make A 401 Early Withdrawal

Considering the 10% penalty, financial planners often advise taking an early withdrawal from your 401 as a last resort. Since penalty-free withdrawals are available for a number of financial hardships and situations, plan participants who take an early withdrawal with a penalty are often in serious financial straits.

Ive seen people take withdrawals for a number of reasons, Stiger says. Everything from a childs tuition to a spouses burial expenses the hope is that distributions are used for larger, more unexpected expenses like medical emergencies, keeping a home out of foreclosure or eviction, and in a down period, putting food on the table.

Taking an early withdrawal can make sense if you are able to take advantage of a penalty-free exception, use the Rule of 55 or the SEPP exemption. But might make sense to exhaust other options firstcheck out these 10 ways to get cash now. And keep in mind, contributions to a Roth IRA can always be withdrawn without penalty if youre truly in a bind.

Also Check: Can You Borrow Money From 401k To Buy A House

Loans Versus 401 Distributions: Which To Choose

With these new rules, the lines between a 401 loan and withdrawal can become a bit blurred. Both let you access up to $100,000 of your retirement funds penalty- and tax-free, but there are slight differences.

If you take a withdrawal:

-

Repayment isnt required.

-

Theres no withdrawal penalty.

-

It will be taxed as income initially, though you can claim a refund if you pay back the distribution in three years.

-

You have tax options.

Is It Better To Be Fired Or To Quit

CON: Quitting can make it harder to pursue legal action later. If you want to pursue a wrongful termination or retaliation claim against your employer, it’s going to be much harder to do that if you quit voluntarily, Stygar noted. If you leave willfully, in a lot of cases, you forfeit those claims.

Don’t Miss: What Is The Penalty For Cashing Out A 401k

Tips For Retirement Planning

- Meet with your financial advisor to discuss the pros and cons of retiring early. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering leaving the workforce ahead of your normal retirement age, learn how it changes your retirement income plan. Use a retirement calculator to estimate how much youll need to retire. A 401 calculator can give you an idea of how much youll be able to grow your savings. This is important to know ahead of your target retirement date.

Understanding 401 Early Withdrawals

If an account holder takes withdrawals from their 401 before age 59½, they may incur penalties in the form of additional taxes. The additional tax for taking an early withdrawal from a tax-advantaged retirement account is 10% on top of any applicable income taxes.

The 10% early withdrawal tax may be waived if the account owner withdraws 401 funds in order to pay for certain qualified expenses, however.

Read Also: How To Convert Traditional 401k To Roth Ira

Rolling Over Funds In A Roth 401

You can avoid taxation on your earnings if your withdrawal is for a rollover. If the funds are simply moving into another retirement plan or a spouses plan via direct rollover, no additional taxes are incurred.

If the rollover is not direct , the funds must be deposited in another Roth 401 or Roth IRA account within 60 days to avoid taxation.

When you do an indirect rollover, the portion of the distribution attributable to contributions cannot be transferred to another Roth 401 but it can be transferred into a Roth IRA. The earnings portion of the distribution can be deposited into either type of account.

Things To Know About The Rule Of 55

Before you start withdrawing money from your 401, though, its important to understand five things about the IRS rule of 55.

1. Public safety employees get an extra five years.

Police officers, firefighters, EMTs, and air traffic controllers are considered public safety employees, and they get a little extra time to access their qualified retirement plans. For them, the rule applies in the calendar year in which they turn 50. Double-check to ensure that your plan meets the requirements, and consider consulting a professional before withdrawing money.

2. You can withdraw only from the plan specific to the employer.

Before you start taking distributions from multiple retirement plans, its important to note that the 401 withdrawal rules for those age 55 and older apply only to your employer at the time you leave your job. So you can only take those penalty-free early 401 withdrawals from the plan you were contributing to at the time you left your job. The money in other retirement plans must remain in place until you reach age 59 1/2 if you want to avoid the penalty.

3. You must leave your job the calendar year you turn 55 or later.

4. The balance must stay in the employers 401 while youre taking early withdrawals.

5. You can withdraw from your 401 even if you get another job.

You May Like: How To Sell 401k Stock

Calculate Your Earnings And More

The Internal Revenue Code sections 72 and 72 allow for penalty free early withdrawals from retirement accounts. The IRS limits how much can be withdrawn by assuming any future earnings will be at most 120% of the Federal Mid-Term. This conservative approach can help assure that you will not prematurely deplete your retirement account. However, if you have a higher rate of return your account can actually grow, even with your distributions. On the other hand, if you suffer losses your account balance may end up shrinking faster than you might expect. This calculator is designed to examine the affects of 72/ distributions on your retirement plan balance.