Option : Roll It Over To An Ira Or New 401

If you find a new job that offers a 401 plan, you can opt to roll your money from your old 401 into your new one. Because jobs are scarce right now, though, you may not be able to find a new job right away. In that case, you can roll your funds over to a traditional IRA or Roth IRA.

Traditional IRAs and Roth IRAs are similar in many regards, but they have one key difference: How your money is taxed. Contributions to a traditional IRA are tax-deferred, meaning you wont pay taxes upfront but you will pay income taxes when you withdraw your money. Roth IRAs are the opposite: You will pay taxes when you make the initial contributions, but your withdrawals are tax-free. Which option you choose will depend on your personal preferences. If you want an immediate tax deduction, a traditional IRA might be the way to go. Or if you want tax-free retirement income, you might choose a Roth IRA instead.

Recommended Reading: How To Get Money Out Of 401k Without Penalty

How Do I Transfer An Old 401 To My New Job

Even if youre happy at your job, its always a good idea to keep your options open. If youre considering a move to a new company, one of the first things youll need to do is figure out what to do with your old 401. Fortunately, transferring an old 401 to your new job is usually a pretty straightforward process.

So, if youre planning a job change, dont forget to take care of your retirement savings. With a little effort, you can ensure that your hard-earned money stays right where it belongs in your pocket.

What Taxes Will You Owe

If you have a traditional 401 account, you have to pay income tax at your ordinary rate on any distributions you take. Ordinarily, you would also have to pay a 10 percent penalty if youre under the age of 59 1/2 for taking money out. But the CARES Act has waived the usual penalty for those who lost household income as a result of the coronavirus pandemic for money withdrawn from a retirement account before December 30, 2020.

Initially, the CARES Act provision waiving the usual penalty for early withdrawal of retirement funds only applied to people directly affected by the coronavirus. But the IRS later expanded the definition of who qualifies to tap funds in a 401 or other employer-sponsored retirement plan, or an IRA.

It now also includes anyone whos experienced negative financial consequences as the result of a spouse or a member of the household being diagnosed with the coronavirus or losing income or a job as a result of the coronavirus pandemic. That means that you would qualify if, for example, you or your spouse was laid off or has seen work hours reduced, or lost business , because of the virus. You may also qualify if you had to stop working or cut work hours because of a lack of childcare during the pandemic.

Read Also: How To Protect 401k From Market Crash

Recommended Reading: Is There A Cap On 401k Contributions

You Can Keep It Where It Is Roll It Over Into A New 401 Roll It Into An Ira Or Cash It Out Heres How To Decide

Choosing what to do with a 401 when leaving an employer can be one of the biggest financial decisions an investor makes.

Across the board, 401s have taken big hits in recent months. While many investors have heeded the general advice to stand pat and give markets time to recover, there are times when investors are forced to make decisions regarding their accounts.

One of those moments is when you leave your employersomething many people are being forced to do these days. What you do with your 401 as you depart can have a big impact on your financial future.

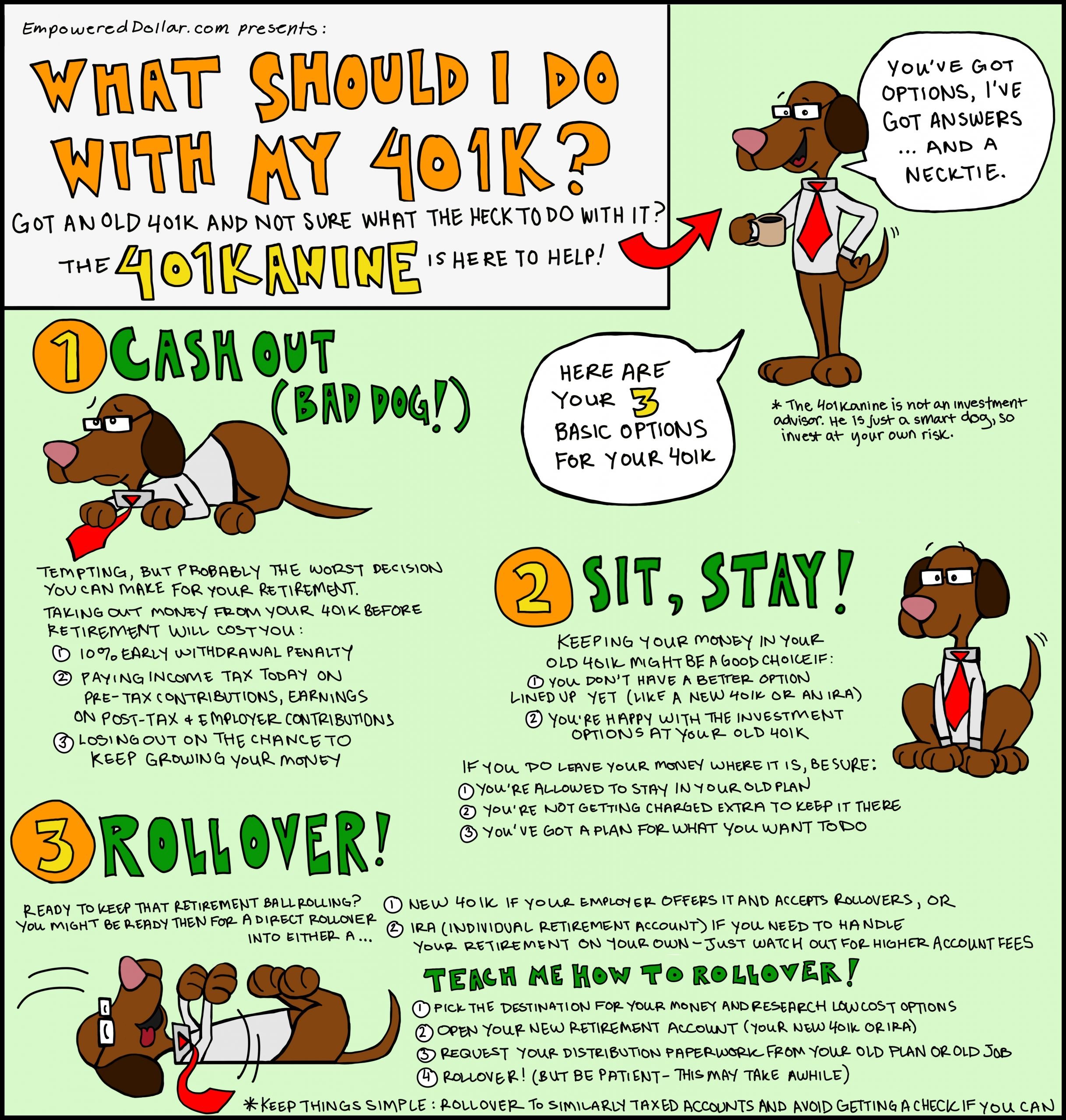

Generally, a 401 plan participant leaving a job may choose to leave the money where it is roll it over into a new employers 401 plan roll it into an individual retirement account or cash it out, which can be a costly move.

None of these decisions should be taken lightly.

At the highest level, the decision to roll over from a 401 to an individual retirement account is often six of one, half a dozen of another but the time when its different, you have to understand where those differences are, says Joel Dickson, global head of enterprise advice methodology at Vanguard Group, one of the largest 401 record-keepers in the country.

What follows is a look at some of the most important factors in weighing whether to do a rollover, and to which type of account.

Your age

Low plan balance

If you leave it to the sponsor, the money wont immediately be allocated to the investments of your choice.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Read Also: How To Pull Money From A 401k

Roll It Over Into A New Retirement Account

You should not leave the old 401 account the way it is with the old employer. Basically, if you have too many investment accounts, you will have more responsibilities.

There will be a lot of tax documents to wait for, as well as email addresses, beneficiaries, and addresses to update when they change. Also, its easier to manage investments when you have all of them in a single place rather than spread across different places.

If you get a new job that also offers you a 401 account option, you can roll over the old 401. This is a great thing to do, especially if the new plan has some unique investment options and lower fees. If there isnt any 401 plan available, you can consider rolling it over into an IRA.

Ramit Sethi, financial expert and author of New York Times bestseller I Will Teach You To Be Richrecommends doing just this:

The majority of people will choose to roll over the 401 funds into an IRA, or individual retirement account. From a tax benefit standpoint, the IRA works in a similar manner to the 401, minus the contribution from your employer, of course. And since its a personal IRA, you have full control of the account and investments.

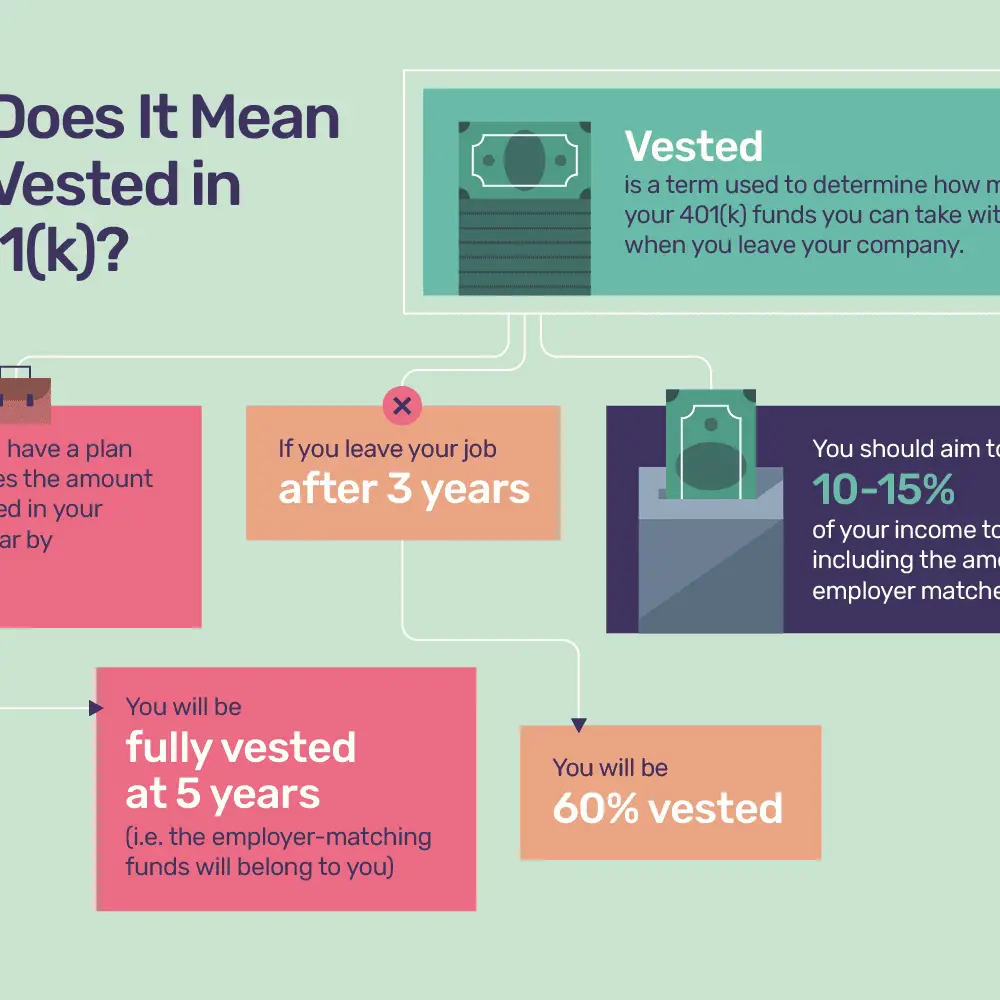

What Happens To A 401k When You Quit

So, youve decided to quit your job. What now? Very often, employees leave their jobs without considering what to do with their retirement account. As a result, they end up leaving that account behind, in the 401 plan of the former employer. The thing to keep in mind in this situation is that you will not be able to contribute to the account anymore if you quit. The money you contributed still belongs to you, though, so you have to think about what to do with it.

Usually, plans let employees who leave their job keep the funds in their accounts as long as there is more than $5,000 saved. When there is less than $5,000 in your account, you can get a check from the plan sponsor so your account can be closed.

Other people choose to leave the money they saved behind. After all, its very easy to simply walk away and forget about the 401 plan you made with the former employer. But its not the best thing to do. Basically, when you leave the account behind, you dont monitor it anymore. Because of that, you dont know what happens with your money, and this is not good considering that its money you worked for every month. Moreover, if you leave money in various 401 plan accounts you made with different employers, the issue may become even worse.

You May Like: How To Fill Out 401k

What Happens To My 401k After I Leave My Job

If youâre like many Americans retiring or leaving their jobs for new ones, then you may be wondering what you should do with the savings in your employer-sponsored 401k.

The good news is, your contributions are safe, and theyâre still owned by you. But you do have to make a decision about where youâll keep the account and investments.

Ultimately, you have four options:

- Keep your 401k with your former employerâs plan

- Roll your 401k over to an IRA

- Transfer your 401k from your former employerâs plan to your new employerâs plan

- Cash out your 401k savings

What Happens To My 401 If I Quit My Job

When you leave a job, you have several options for what to do with your 401.

You can cash it out, leave it with your old employer, or roll it into an IRA. Each option has different tax implications, so choosing the one thats best for your situation is important.

If you cash out your 401, youll have to pay taxes on the amount you withdraw. You may also be subject to a 10% early withdrawal penalty if youre younger than 59 1/2. If you decide to leave your 401 with your old employer, youll still be subject to taxes and penalties if you withdraw the money before retirement. However, leaving your money in a 401 can be a good way to keep it invested and grow over time.

Rolling over your 401 into an IRA is another option. With an IRA, youll have more control over how your money is invested. And, if you roll over your 401 into a Roth IRA, your withdrawals in retirement will be tax-free. Talk to a financial advisor to find out which option is best for you.

- You can keep your 401 with your former employer or transfer it to a new employers plan.

- You can also convert your 401 into an Individual Retirement Account via a 401 rollover.

- Another choice is to withdraw your 401, which may result in a penalty and taxes on the entire amount.

Also Check: How Much Can You Put Into A Solo 401k

On And After Your Last Day

Youre firing off your last emails and riding off into the sunset. Even if youre crying good riddance inside, make sure to leave on a positive note. Reach out to the people youve worked with to tell them about your move. And make sure your goodbyes are gracious and appreciative.

Careers are long, and you never know when you might cross paths with someone again or end up needing a reference. Burning bridges only means youll have fewer paths open to you in the future, so leave them standing strong.

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Need further help? Talk to our experts for professional advice on anything and everything related to 401.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment advising, and integration with leading payroll providers.

Read Also: How Do You Cash Out A 401k

You Could Just Leave Your 401 Alone

The money will remain invested, and the financial firm handling your 401 will keep mailing you quarterly statements telling you how it is doing. Any future growth will be tax-deferred.But this passive choice comes with an opportunity cost. If you just leave the 401 assets in the plan, youre giving up control and flexibility. Your investment choices may be limited, the plan fees may be high, and you may not be able to quickly access your money or do what you want with it. If you have a trail of old 401s left with a bunch of former employers, things can get really complicated when you retire especially when you have to take Required Minimum Distributions . Leaving the money in the plan may not be the wisest choice.

Inaction Can Lead To Automatic Cashing Out

It may seem odd, but you can choose to do nothing.

Many employers allow former employees to leave 401 accounts invested in the companys plan. You will not be able to make future contributions to this specific account, but the investment portfolio will otherwise continue as normal. It will grow based on its underlying investments. You can make changes to the assets based on the rules and preferences of this specific 401 account. And the existing account manager will continue to oversee these investments. Most companies use an outside financial firm to manage their 401 accounts, so your ongoing relationship would be with that firm rather than with your former employer.

Not every employer allows this though. If you have a relatively small amount of money in your account, some employers will close out your 401 automatically when you leave.

If you have less than $1,000 in your account, the IRS allows your employer to automatically cash you out of its plan. In this case you will receive a check for the account balance. Your employer will withhold income taxes, but you will not pay early withdrawal penalties as long as you place this money into a qualified retirement plan, generally an IRA, within 60 days.

If you have more than $5,000 in your account, many employers will allow you to keep your account in place. However, even then they may apply onerous terms such as high maintenance fees and access restrictions. Plans like this are rarely a good option for retirement savers.

Recommended Reading: How To Cash In My 401k Early

Make Sure You Do Something With Your 401

Your 401 money represents an important component of your retirement savings. It’s critical that you manage this money effectively both while you are working for an employer and when you leave.

You have several choices for this money when you leave your job. It’s important to make an affirmative decision for this money whenever you leave a job. This can be the difference between achieving your retirement goals and falling short.

So You Want to Learn About Investing?

Use Old Benefits And Choose New Ones

Ask your human resources departments what dates benefits end and new ones begin.

- Health insurance: Compare current and new coverage, and get details for anything thats continuing, such as specialty medications.

- Dental and vision insurance: Especially if you wont have this coverage when you change jobs, schedule appointments as soon as you can.

- Life insurance: Voluntary policies can be converted to an individual policy. Instead of being deducted from your payroll, youll pay the premium directly to the insurance company.

- Retirement savings: Check out the options for existing funds later in this article.

Read Also: How To Borrow Money From 401k Fidelity

Option #: Roll Over Your Old 401 To Your New Employers Plan

If your new employer offers a 401 plan, then you have the option to essentially transfer the balance of any 401 account tied to a previous employer into the 401 account you open with your new employer. These balance transfers are known as rollovers, where you roll the balance of your old account into your new one. And, these rollovers are far more financially prudent than the previous two options we explored above.

When you roll your old balance into your new 401 account, all of your funds stay completely intactno taxes, no fees, nothing. That money is free to continue growing tax-free, and any funds you roll over dont count towards the annual 401 contribution limit . That means you can continue making contributions to your new 401 account regardless of the size of the balance that you roll over from your old one, which is great for building wealth over the long term.

There are a couple instances where rolling money from an old 401 into a new one might make more sense than simply rolling it into an IRA .

Rolling your old 401 balance into your new one isnt a bad option by any means, and youll have to make that call based on your own individual financial situation.

Theres one more option youll want to consider, however, and that is:

Dont Miss: Who Has The Best 401k Match