Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Motivation To Not Withdraw Funds From A 401k

Every time youre tempted to borrow from your 401k, take a look at this chart below. It shows you when you will become a 401k millionaire based on various portfolio allocations and return assumptions.

Not only is paying a 10 percent penalty painful for a hardship withdrawal, so is losing out on years of compounding.

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Don’t Miss: Who Can Open A Solo 401k

Start An Emergency Fund

“An emergency fund will help avoid debt traps and maintain your peace of mind,” Seuthe said.

Transferring money that would previously have gone toward your monthly student loan payment into a savings or money market account could go a long way toward building up a cash cushion to reach those long-term goals.

Most financial experts recommend having at least six months’ worth of expenses set aside in an emergency fund. However, Niang advises clients to save closer to 12 months, considering surging inflation and a clear slowdown in the economy.

“A looming recession could impact employment,” she said. “If you have a job that is pretty recession proof, then maybe you need three months. If you have a very specific job that is highly impacted by the recession, then definitely having 12 months is what we would recommend.”

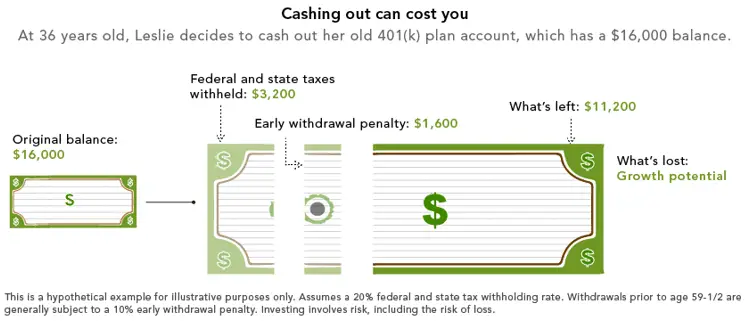

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Also Check: What Is A 401k Audit

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Recommended Reading: How Much Invest In 401k

What Is The 4% Withdrawal Rule

The 4% rule is when you withdraw 4% of your retirement savings in your first year of retirement. In subsequent years, tack on an additional 2% to adjust for inflation.

For example, if you have $1 million saved under this strategy, you would withdraw $40,000 during your first year in retirement. The second year, you would take out $40,800 . The third year, you would withdraw $41,616 , and so on.

Potential advantages: This has been a longstanding retirement withdrawal strategy. Many retirees value this strategy because its simple to follow and gives you a predictable amount of income each year.

Potential disadvantages: Lately, this approach has been criticized for not considering the effects of rising interest rates and market volatility. Indeed, if you retire at the onset of a steep stock market decline, you risk depleting your savings early.

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses dont necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Recommended Reading: When Can I Withdraw From My 401k

You May Like: How To Calculate Rate Of Return On 401k

Direct Dividends And Capital Gains To Your Money Market

As you were building your savings, you probably used your earnings to buy more shares of your investmentsthat’s how you benefit from compounding.

But now that you’re spending money from your accounts, consider having your earnings sent to your money market fund rather than reinvested, at least in your taxable accounts.

Here’s why: You’ll incur taxes on these gains when they’re paid out. If you reinvest them and then turn around and withdraw them in a few months, you’ll likely have to pay taxes on them again.

The investment returns you accumulate on the savings in your account.

Alternatives To Using Your 401 To Buy A House

Even if youre short on cash and facing hardship, there are other options you might want to consider before tapping into your 401 account to cover the down payment on a house.

IRA Account

If you have an IRA, you should look there for extra funds before considering an early withdrawal from your 401. IRAs are built with special provisions for first-time home buyers, which the IRS defines as anyone who hasnt owned a primary residence within the previous 2 years.

Under these provisions, first-time home buyers are allowed to withdraw up to $10,000 without incurring the 10% penalty. However, that $10,000 is still subject to state and federal income taxes. If your withdrawal exceeds $10,000, then the 10% penalty is applied to the additional distribution.

A Roth IRA is an even better option, if you have one. Some plans allow you to make a hardship withdrawal, and up to $10,000 can be withdrawn tax-free for the express purpose of a first-time home purchase.

FHA Loan

A Federal Housing Administration loan is a government-backed mortgage with looser requirements designed to make it easier for first-time home buyers to purchase a property. This includes low down-payment options and lower credit score requirements. For this reason, an FHA loan may be a better option than making a withdrawal from your 401.

- Mortgage term

- Size of your down payment

Read Also: How 401k Works After Retirement

Convert To An Ira To Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Also Check: How Much Tax On 401k After Retirement

Are Railroad Retirement Benefits For Life

The Railroad Retirement Act is a Federal law that provides retirement and disability annuities for qualified railroad employees, spouse annuities for their wives or husbands, and survivor benefits for the families of deceased employees who were insured under the Act.

How many years does it take to be vested in railroad retirement?

Employees with at least 10 years of creditable railroad service, or at least 5 years of creditable railroad service after 1995, are vested in Railroad Retirement and eligible for retirement and disability annuities.

Can you lose your railroad retirement?

Once a current connection is established at the time the railroad retirement annuity begins, an employee never loses it, no matter what kind of work is performed thereafter.

What is the maximum railroad retirement benefit 2020?

In computing the benefit to be paid in the year of retirement, social security does not include earnings in the year of retirement. Such earnings may later increase the benefit under the recomputation rules. Note: Maximum taxable compensation during 2020 is $137,700 for tier 1 and $102,300 for tier 2.

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

You May Like: Why Is Roth Ira Better Than 401k

What Is A 401

The IRS and other government agencies can be confusing.

And for something as important as retirement plans, it’s imperative that you understand your options.

A 401 plan is a retirement saving and investing plan that many companies offer their employees.

The plan awards employees with tax breaks on any money they contribute.

There are a few different plans though, so it’s important to check with the IRS website and your employer to see which one works best for you.

Can I Borrow From My 401k If I No Longer Work For The Company

401k Plan Loans An Overview. There are opportunity costs. If you quit working or change employers, the loan must be paid back. If you cant repay the loan, it is considered defaulted, and you will be taxed on the outstanding balance, including an early withdrawal penalty if you are not at least age 59 ½.

Dont Miss: When Can You Use Your 401k

You May Like: How To Set Up 401k Contributions

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you.If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Also Check: Can You Use 401k To Buy Investment Property

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

Recommended Reading: Is It Better To Contribute To 401k Or Roth 401k