Looked For Unclaimed Money

Ghosted 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the websites directions, if you get a hit on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

How Retirement Benefits Can Go Missing

Its rare for a person to stay with one company an entire career. Additionally, some companies go out of business after several years of successful operations. With both people and companies in constant transition, it is common for people to lose track of their accrued retirement benefits. Whats more, people might know they have retirement benefits available to them but not know how to find what they have.

For example, lets say a person worked for a company from ages 25 to 35, but now is 45. The company the person worked for over a decade ago has gone under. That money is still completely their own, it just might be challenging to find them.

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

You May Like: What Happens To Your 401k When You Die

What Are The Best Retirement Plans For You

-

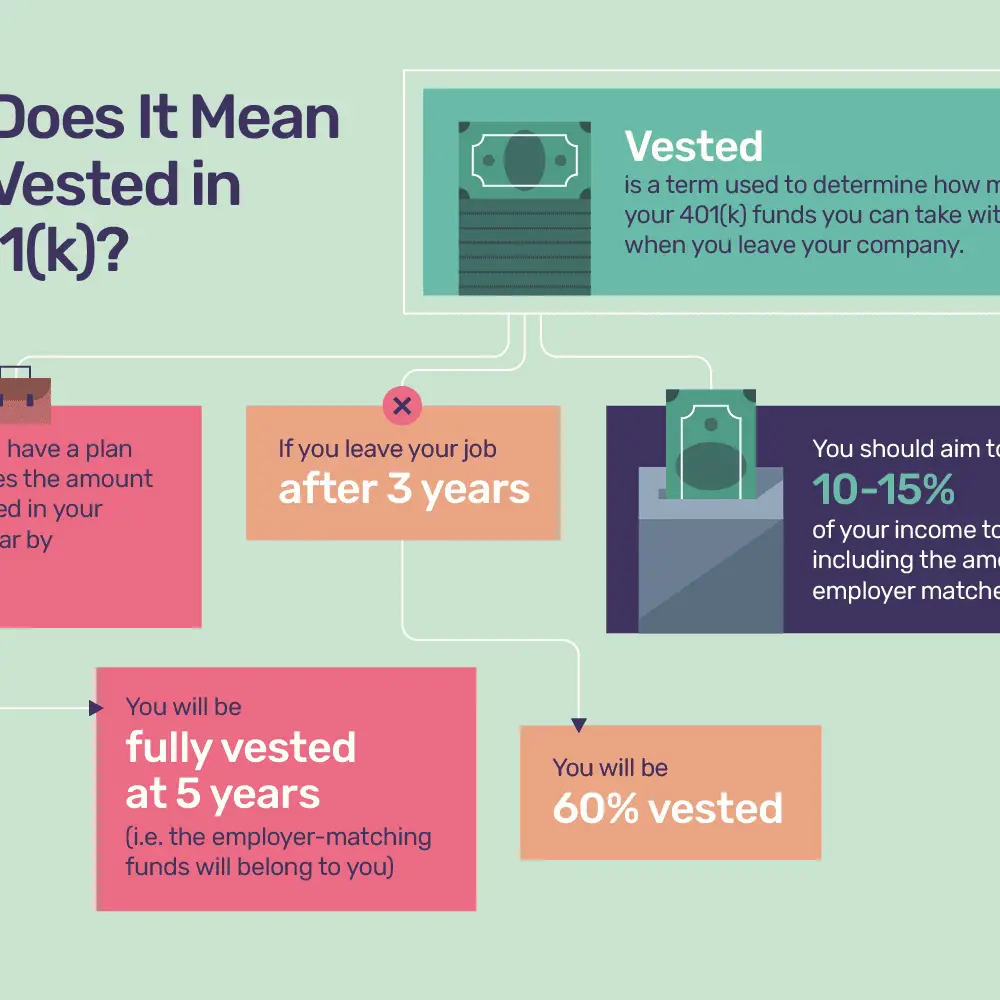

If you have a 401 or other workplace retirement plan: First you may want to contribute enough to get any free money offered by your employer via the company match. For more on the pros and cons of these plans, jump to our section on employer-sponsored retirement plans, including 401s, 403s, 457s, defined benefit plans and TSPs.

-

If youve maxed out your 401 or you dont have a retirement plan at work: Consider an IRA. Jump to our section on the pros and cons of four types of IRAs, including traditional and Roth IRAs. If you already know you want an IRA, check out our round-up of the best IRA providers.

-

If youre self-employed or the owner of a small business: Jump to our section about retirement accounts designed specifically for you, including the , Solo 401, SIMPLE IRA and profit sharing.

Weâll walk you through the various types of retirement plans below. Bear in mind, these are the retirement plans or accounts available to you depending on your situation. For more information on which investments to choose inside your retirement account, connect to our guide on retirement investments here.

How To Find An Old 401

Quick Answer

To find an old 401, there are three main places you should look. Start your search by looking through your documents, then try contacting your former employer and checking your states unclaimed property website.

In this article:

Millions of forgotten 401 retirement accounts are begging to be claimed. As of May 2021, an estimated 24.3 million 401s holding $1.35 trillion in assets had been left behind by people who changed jobs, according to financial services company Capitalize.

If you’ve lost track of an old 401, what do you do? Well, don’t panic. To find an old 401, start by searching your files, then contact your former employer’s HR department and check with your state’s unclaimed property agency.

Read Also: How To Move Your 401k To A Roth Ira

What Happens If My Former Employer Writes Me A Check For The Lost 401 Funds

If your former employer writes you a check for your lost 401 then you have 60 days to deposit them into a qualified plan. If you dont then the IRS could treat it as a distribution. This means that the money will be taxed as ordinary income and it may also trigger a 10% early withdrawal penalty if youre not yet 59½. Its important to talk to a financial advisor who can advise you on where you should put that money.

Check Unclaimed Property Databases

Unclaimed property databases can help you find abandoned financial accounts and reimbursements that are yours when the provider cant find your new contact information. Each state operates a property database, and you can enter your name to search.

After finding any unclaimed property, you can follow the steps to get your money. Its free to search using a website like the National Association of Unclaimed Property Administrators. You will also avoid phishing scams that appear when doing a basic google search for your states database.

Tip: Imposter sites may ask for your Social Security number and other personal details. You may need to enter your street address on legit sites to find relevant matches. The advanced search features can be helpful if you have a common last name like Smith or Jones.

You can also use to look for unclaimed property for free. This service also offers free credit score monitoring and identity monitoring. For more information, check out our full . In addition to potentially finding your old 401, you may also be eligible for these products:

- Security deposits

- Tangible property

Recommended Reading: What Is The Difference Between Roth Ira And 401k

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Investment Choice And Fee Transparency

With our open architecture platform, you can choose from thousands of investment options with no proprietary requirements. Fee transparency means you know exactly what youre paying for, and our return of mutual fund revenue share policy gives revenue share payments from mutual funds back to participants.

Dont Miss: Can You Add To A Roth Ira After Retirement

You May Like: What Happens To 401k If You Leave Job

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like, until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Alternatively, you could do a 401 rollover to move that money into another retirement account.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Search Unclaimed Property Databases

If a company terminates its retirement plan, it has more options on what its allowed to do with the unclaimed money, no matter what the account balance.

It might be rolled into an IRA set up on your behalf, deposited at a bank, or left with the states unclaimed property fund. Hit up missingmoney.com, run in part by the National Association of Unclaimed Property Administrators, to do a multistate search of state unclaimed property divisions.

Note that if a plan administrator cashed out and transferred your money to a bank account or the state, a portion of your savings may have been withheld to pay the IRS. Thats because this kind of transfer is considered a distribution and is subject to income taxes and penalties. Some 401 plan administrators withhold a portion of the balance to cover any potential taxes and send you and the IRS tax form 1099-R to report the income. Others dont, which could leave you with a surprise IRS IOU to pay.

Recommended Reading: How Do I Get A 401k Loan

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isnt a good example of that mindset.

Exhibit A is the U.S. Department of Labors Abandoned Plan Database. The database can tell you if your companys old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plans name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Dont Miss: How To Use Your 401k To Invest In Real Estate

You Found Your 401 Plan Now What

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money with the purpose of building a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

Rolling over your 401 into an IRA is a relatively simple process. First, you need to open an IRA, which you can do though most banks, brokerage firms and robo-advisors. The funds from your old 401 then can be sent directly to your new IRA. If you prefer to keep all your investments in one place and your current employer offers a decent 401, then you may want to consider rolling over the funds into that account .

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Don’t Miss: How To Rollover A 401k From A Previous Employer

Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

Read Also: Mutual Of America Retirement Funds

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

Also Check: What Age Can You Collect 401k

What To Do With An Old 401

You might be able to leave your old 401 money where it is if its in your former employers plan. One reason to do so is if you have access to certain mutual funds that charge lower management fees available to institutional clients like 401 plans that arent available to individual investors. But youre not allowed to contribute to the plan anymore since you no longer work there.

Reasons to move your money to an IRA or to roll it into a current employers plan include access to a broader range of investments, such as individual stocks, a wider selection of mutual funds, and more control over account fees.

Contact Your Former Employer’s Hr Department

Another way to locate an old 401 is to contact your former employer’s HR department. The department should be able to tell you the name of the plan administrator along with the contact information.

If that ends up reuniting you with the old 401, you can leave the account with your former employer, roll it over into an individual retirement account , roll it over into your current employer’s 401 or cash out the account.

So, what if your former employer is no longer in business or you aren’t able to track them down? The money should be somewhere. You just need to hunt for it. One place to look is the federal government’s Abandoned Plan database.

You May Like: How Long Does It Take To Get 401k After Divorce

How To Find And Claim Your Old Retirement Accounts

Whether you quit on your own accord, are fired, or laid off, leaving a job can be hectic. In the midst of the transition, dealing with a retirement account might get pushed pretty low on your to-do list.

While the money you contributed is yours forever, accounts can sometimes get forgotten about in the shuffle. And, in some cases, you may not have even realized youd had a retirement account if your employer automatically signed you up and withheld contributions.

Whether intentional or not, you can wind up with a handful of retirement accounts at different companies and lose track of some of them over time. Former employers and plan administrators may lose track of your current contact information.

Heres how to check and track down old accounts, and what you can do to get your finances organized.

Reference An Old Statement

Because companies reorganize, merge, get acquired, or go out of business every day, its possible that your former employer is no longer around. In that case, try to locate a lost 401k plan statement and look for contact information for the plan administrator. If you dont have an old statement, reach out to former coworkers and ask if they have an old statement.

You May Like: How Do I Get My 401k Information

Check Unclaimed Property Portals

If the DOL cant point you in the right direction, you may have to try unclaimed funds portals. When money is left in a 401 for an extended period after employment ends, the money is sometimes transferred to a state unclaimed property office. These offices hold unclaimed funds until the rightful owner claims them.The good news is that its fairly simple to find your money using one of several database search programs. Sites like MissingMoney.com, Unclaimed.org, or searching the National Registry of Unclaimed Retirement Benefits at unclaimedretirementbenefits.com can help you find old accounts using your name and state of residence.

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Also Check: How Long Will 500k Last In 401k