Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Ways To Pay Off A 401 Loan Faster

Ready to quit your job, but have a 401 loan and want to avoid penalties and taxes? Here are a few action items you can do today to pay off your loan quickly:

#1 Round Up Payments

Every time you make a payment, round up to the nearest hundred . If you pay $420 each month, round up your payments to $500. Do this for 12 months, and youll have paid an additional $960 and take off the loan term a little over 2 months.

#2 Make Extra Payments

The fastest way to bring down the balance and pay your 401 loan in full is to make extra payments each month. If you cant do that, then plan to make larger quarterly payments.

#3 Use Your Tax Refund

If youre getting a refund this year, apply the full amount to your 401 loan balance. Even if you only get $200 back, the extra payment will make a difference.

#4 Tap Into Your Savings

This option is not ideal, but if you want to leave your job ASAP , it may make sense to do so to avoid penalties and taxes. Just make sure to put the money back as soon as possible.

What May Be The Cons Of Rolling The Money Over To An Ira

- Money in an IRA isnt as well-protected against lawsuits as money in a 401

- Money in an IRA is never eligible for Rule-of-55 withdrawals

Again, if you choose this option, a direct rollover is almost always your best option.

If your old plan was a Roth, you can do the rollover into a Roth IRA to preserve its tax-free status. If you do this, its best to roll it over into an existing Roth IRA if you have one since the 5-year clock until you can withdraw your contributions tax and penalty-free has already been ticking for a while, potentially past the 5-year mark.

If your old plan wasnt a Roth, you may still want to consider converting it by rolling over into a Roth IRA, especially if you expect your income to be lower than usual this year, especially if this places you in a lower tax bracket.

Recommended Reading: Does Mcdonald’s Offer 401k

Assets May Also Be Temporarily Frozen

Access to your funds, vested or not, may also be blocked if litigation related to the plan is in process. In such instances, assets may be temporarily frozen, Portnoff says. Similarly, according to Rischall, short-term restricted access to your funds may happen in the event the plan sponsor is changing record keepers or there is a blackout period in which funds cannot be changed or accessed in any way. You should know about this in advance, he adds: This is legal, and notices must be provided to active participants at least 30 days prior to the blackout start date.

Recently terminated employees may also be subject to different rules regarding access to their plans. These rules are governed by things such as resolving any lingering financial issues around a workers departurean outstanding loan, for example. If youve taken out a 401 loan and leave your job, youll have a specified time period in which to pay it back.

Finally, a lock may occur due to suspected fraudulent activity on the account. While fraud alerts are meant to protect account holders, sometimes they may be unaware of the alert and will need to call customer service to release the hold.

Do You Get Your 401 If You Quit

Be aware of the following rules regarding your old 401 account:

-

If your 401 has a total investment of more than $5,000, your employer may allow you to leave the account with them even after you quit the job.

-

If your account has a balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check.

-

If the total investment amount in your old 401 is between $1,000 and $5,000 and your employer wants to force you out, they must transfer the amount to your IRA.

Read Also: How Can I Borrow Money From My 401k

Plan Options When You Leave A Job

If you have an employer-sponsored 401, you will likely be faced with four options when you leave your job.

- Stay in the existing employers plan

- Move the money to a new employers plan

- Move the money to a self-directed retirement account

Before deciding, here are a few things to consider with each option.

The Great Resignation: How To Handle Your 401k If You Leave A Job

for it, thats terrific youre taking a smart approach. That said, dont forget about your retirement savings.

Workers often leave their 401Ks behind when they leave a job, resulting in roughly $1.35 trillion dollars thats just floating around in the ether. Youre really going to need that money in the future, folks!

To find out how to best handle the savings youve accrued when you leave a job, we chatted with Stephen Molyneaux, founder and CIO of . He gave us some excellent tips to keep in mind, so if youre considering leaving , read on.

Dont abandon your money

Molyneaux told Yahoo Money that hes astounded when new clients come to his company and have left a series of 401Ks behind at past jobs. Luckily, there are many ways to prevent this mistake.

Make sure when you are leaving a job to take your retirement plan with you or keep up with the one established by your former employer, he said. Consolidate them if you have a series of them. You may get better economies of scale under your investments. There are always lots of little pitfalls when you leave these plans behind.

Learn the difference between 401Ks and IRAs

Keeping your 401K as mentioned above is one option, but there are others, especially for those leaving jobs to open businesses.

Understand the benefits of a Roth IRA

Molyneaux said one thing that people should consider if they plan to leave a job is how a Roth IRA can be advantageous to them.

Explore penalty-free withdrawal options

You May Like: Where Do I Go To Borrow From My 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Roll It Over Into A New Retirement Account

You should not leave the old 401 account the way it is with the old employer. Basically, if you have too many investment accounts, you will have more responsibilities.

There will be a lot of tax documents to wait for, as well as email addresses, beneficiaries, and addresses to update when they change. Also, its easier to manage investments when you have all of them in a single place rather than spread across different places.

If you get a new job that also offers you a 401 account option, you can roll over the old 401. This is a great thing to do, especially if the new plan has some unique investment options and lower fees. If there isnt any 401 plan available, you can consider rolling it over into an IRA.

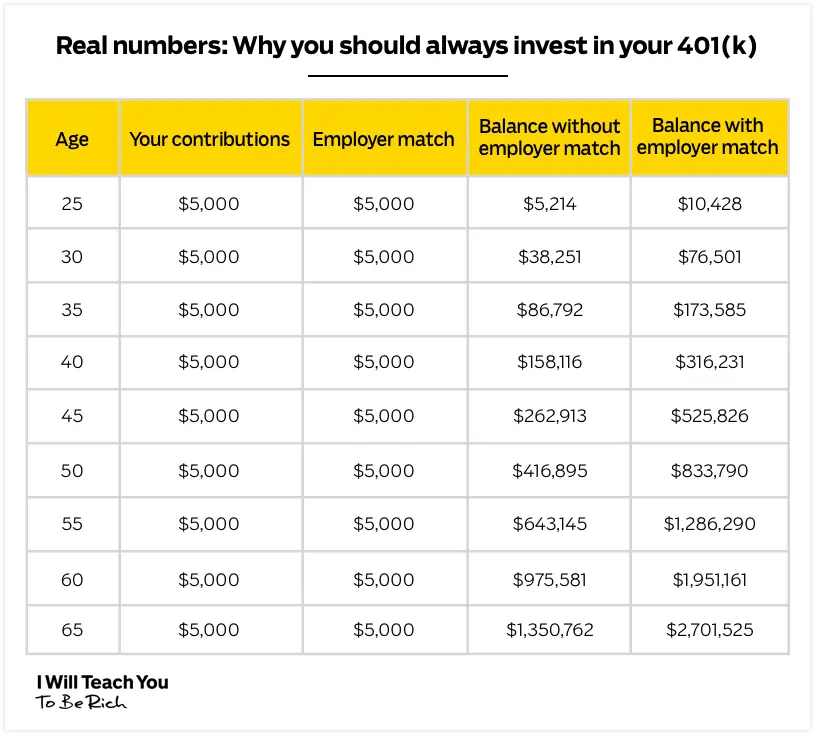

Ramit Sethi, financial expert and author of New York Times bestseller I Will Teach You To Be Richrecommends doing just this:

The majority of people will choose to roll over the 401 funds into an IRA, or individual retirement account. From a tax benefit standpoint, the IRA works in a similar manner to the 401, minus the contribution from your employer, of course. And since its a personal IRA, you have full control of the account and investments.

Read Also: What Percentage Of Paycheck Should Go To 401k

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

What May Be The Pros Of Rolling The Money Over To The New Plan

- The most obvious is that if your balance doesnt meet the old plans minimum requirement to stay, typically $5000, you cant leave it in the old plan, so this is the only way to have that money benefit from the advantages of a 401

- You dont have to be concerned that youll lose track of the money if you leave it in the old plan, and youll gain the simplicity of tracking one less account

- Your new plans investment options may be better than those available to you in your old employers plan or through an IRA for example, it may give you access to unique investments such as institutional-class shares and/or funds closed to new investors

- Your new plans fees may be lower than those in your new employers plan

- Your new plan may offer a free or low-fee advisory service that can help you make more informed investment decisions

- If youre 55 or older, and your new plan allows it, if you leave employment before turning 59½, you may be able to start withdrawing money under the so-called Rule of 55

- Money in a the new 401, just as in the old one, has better protection against lawsuits than money in non-retirement plans or IRAs

- If the new plan allows it, youll have access to 401 loans, where you borrow money from your account and when you pay it back, the interest goes into the account

Read Also: What Is An Ira Vs 401k

Don’t Miss: How Long Does It Take To Transfer 401k To Ira

What Happens To Your 401 When You Quit

Most Americans today have an average of 12 jobs in their lifetime. Gone are the days of getting a job straight out of school and staying there until the day you retire. With moving jobs often comes the question, what should I do with my old 401? Most people dont want 12 retirement accounts sitting around. Youll want to ensure you are setting yourself up for financial success in retirement. Deciding what to do with your retirement plan when you quit your job is an important decision to make.

In this article, we will discuss your top 4 options on what to do with your old 401 when you leave a job. 401 basics

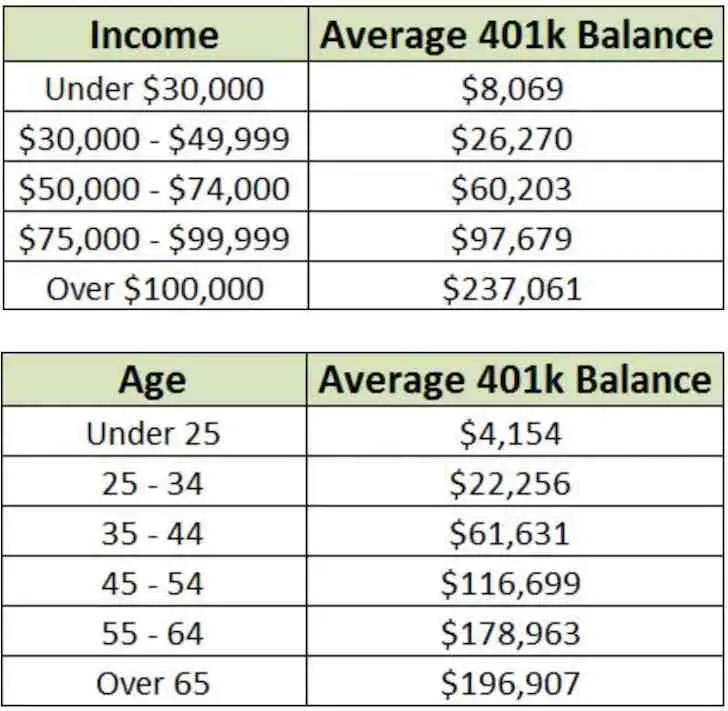

Before we get into the details of what happens to your 401 when you leave a job, lets start with some basics of the 401. Many people have access to a 401 retirement plan. This is a plan offered through an employer and allows employees to save either pre-tax or post-tax money out of their paychecks each month. Many employers also offer a matching contribution to their employees 401 accounts. 401 accounts have limits on what the employee can add, and the total that can be contributed to the account during each tax year.

401 vesting

Now that you know the basics of a 401 and what vesting means, lets discuss your options for the 401 when you leave your job.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Recommended Reading: How To Take Money Out Your 401k

Cashing Out Your 401 After Leaving A Job

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

Repay Any Loans From Your 401

When you leave your job, make sure that you have no outstanding loans from your 401. If you do, pay them off as soon as possible after your last day of work.

You have until the due date of your tax return to repay any loans you have taken from the plan, or you will default on the loan because your method of paying back the loan–your paycheck–stops when you stop your employment.

If you default on the loan, you can expect your former plan to notify the Internal Revenue Service via an IRS Form 1099-R, which will report the unpaid amount.

That amount will be treated as taxable income subject to income tax. If you’re under age 59.5, you’ll have to pay a 10 percent early withdrawal penalty, as well.

Read Also: Can You Take Out Your 401k

What May Be The Pros Of Rolling The Money Over To An Ira

- You dont like the old or new plans investment options better than what you can access in an IRA

- You dont like the old plan and/or youre concerned youll lose track of the money if you leave it in the old plan, and the new plan doesnt accept rollovers plans, you can roll them all into the same IRA or IRAs)

- Fees may be higher than a no-load IRAs in both your old and new 401 plans

- If your balance is high enough, you may be able to access free or low-fee investment advice from the manager of your rollover IRA

Also Check: Should You Move Your 401k To An Ira

Heres What Happens To Your 403 If You Get Fired

Usually: nothing. Unless your account is very small, the plan may not be able to force you to take the funds. But that doesnt mean you should leave your old 403 where it is.

Your contributions to your 403 cant be taken away or forfeited. Contributions to your 403 made by your employer may be subject to vesting requirements.

In this case, any money that isnt vested as of the date you were fired or laid off is no longer yours. Funds that you are 100% vested in will stay in your account and can be rolled over to an IRA, transferred, or converted to a Roth IRA.

Don’t Miss: How To Get Money From Fidelity 401k

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Also Check: How Much Can I Take From 401k For Home Purchase