You Can Still Withdraw Early Even If You Get Another Job

You arent locked in to early retirement if you choose to take early withdrawals at age 55. If you decide to return to part-time or even full-time work, you can still keep taking withdrawals without paying the 401 penaltyjust as long as they only come from the retirement account you began withdrawing from.

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the new financial institution with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your plan administrator is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Dont Miss: How To Withdraw Money From 401k Early

Also Check: Where To Start A 401k Plan

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

Read Also: What Is The Maximum I Can Contribute To My 401k

Will You Be Able To Add Crypto To Your 401

Though Fidelity will make it possible to add Bitcoin to 401 accounts, this doesnt mean that every employee whose plan is overseen by the company will be able to do so.

Thats because 401 accounts are ultimately the responsibility of employers, who have a fiduciary responsibility to their employees. At the moment, most analysts predict that most companies wont allow their employers to add Bitcoin at least not right away. Though Bitcoin might be suitable for some employees, its unlikely to be a responsible investment for those close to retirementand because of the way that most employers administer 401 plans, the same investment options must be open to all plan participants.

These concerns have recently been echoed by the Department of Labor. Though the federal agency hasnt gone as far as banning crypto from retirement plans, it issued a compliance assistance document in March 2022 that reminded plan overseersthat is, employers who must act solely in the best interest of participating workersthat they were responsible for choosing prudent options. And it strongly suggested that cryptocurrencies didnt yet appear to meet that bar.

The net effect of these concerns is that most employees wont be able to add Bitcoin to their 401 accounts anytime soon.

Recommended Reading: Should I Transfer 401k To New Employer

Don’t Miss: Can I Take My 401k If I Leave My Job

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

Read Also: How To Find A Deceased Person’s 401k

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59.5 is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

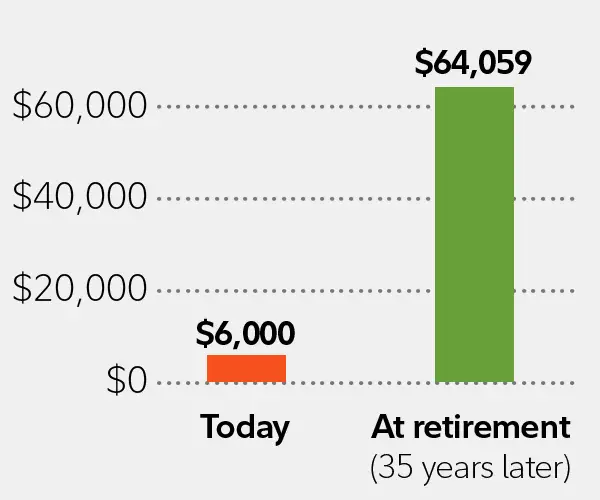

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

Fidelity Funds Are Renowned For Their Managers Stock

Fidelity celebrates good stock picking. The firm holds a contest every year for its portfolio managers: They get 60 seconds to pitch one idea, and the best pitch wins a dinner for four. The best performer after 12 months also wins dinner.

Maybe thats why many of the best Fidelity funds stand up so well in our annual review of the most widely held 401 funds.

Here, we zero in on Fidelity products that rank among the 100 most popular funds held in 401 plans, and rate the actively managed funds Buy, Hold or Sell. A total of 22 Fidelity funds made the list, but seven are index funds, which we dont examine closely because the decision to buy shares in one generally hinges on whether you seek exposure to a certain part of the market.

Actively managed funds are different, however. Thats why we look at the seven actively managed Fidelity funds in the top-100 401 list. We also review seven Fidelity Freedom target-date funds as a group as they all rank among the most popular 401 funds. And we took a look at Fidelity Freedom Index 2030 it has landed on the top-100 roster for the first time, and while its index-based, active decisions are made on asset allocation.

This story is meant to help savers make good choices among the funds available in their 401 plan. It is written with that perspective in mind. Look for our reviews of other big fund firms in the 401 world, which currently include Vanguard, and will soon include American Funds and T. Rowe Price.

Read Also: How To Check My 401k Balance

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Read Also: Where To Put My 401k

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. SmartAssets financial advisor matching tool makes it easy to quickly connect with professional advisors in your local area. If youre ready, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Read Also: Is It A Good Idea To Borrow From Your 401k

Why Solo 401k Loan Not On Fidelity Statement Question:

Looking at my solo 401k brokerage account and Im confused on how the account is showing up. I wrote a check for the solo 401k participant loan proceeds , and it looks like the account is showing the actual balance has decreased. Is this just how Fidelity is accounting it or did this actually come from the balance as a withdrawal? Where can I see the actual loan balance/ information?

Best For Mutual Funds: Vanguard

Vanguard

Vanguard is well known for its own mutual funds and ETFs. If you prefer investing in Vanguard funds, a Vanguard Individual 401 plan gives you easy access with no trade costs, making the company our reviews best choice for mutual funds.

-

No fee to establish an account

-

Trade the Vanguard family of funds with no commissions or load fees

-

Roth contributions allowed

-

$20 annual fee for each Vanguard fund held in this type of account

-

401 loans are not supported

If youre looking to stick with a well-respected list of mutual funds from Vanguard, choose the Vanguard Individual 401. The account doesnt have an annual fee on its own for accounts with at least $10,000 in Vanguard funds. It charges a $20 annual fee below that balance plus a $20 annual fee for each Vanguard fund held in the account. Depending on how you invest, this fee can add up fast and could be a reason to consider buying those Vanguard funds elsewhere. You can also trade stocks and ETFs with no commission, in addition to options and fixed-income investments.

Vanguards founder, the late John Bogle, is credited as a pioneer in index investing, bringing the first index fund to market in 1976. Vanguard remains a leader in investment funds as the second-largest asset manager in the world with about $7.2 trillion under management.

Read our full Vanguard review.

Read Also: Can Rollover 401k To Roth Ira

If Im Eligible Should I Take A Distribution From My 401 Or Ira

Even with the new rules in place, its still advisable to exhaust most other resources, such as emergency funds or other easily accessible forms of savings, before tapping into your retirement accounts.

But if you are considering taking a distribution from your IRA or 401, think through the following first.

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Know: The Best Roth IRA Accounts

Also Check: How To Take A Loan Against 401k

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

Don’t Miss: How To Use My 401k To Start A Business