Are Businesses Required To Match Employees Contributions To A 401 And What Is The Standard Match

While businesses arent required to offer a contribution match, its still a good idea. Robertson said matching contributions generate goodwill and, since they are deductible, drive down a businesss tax liability.

If you want to offer a matching program but are afraid some employees will just take the money and run, consider a vesting schedule. With a vesting schedule, employees cant take the employers contributions until they have participated in the retirement plan for a certain length of time.

For example, employer matching contributions might not fully vest for three years. If an employee leaves for another job before those three years are up, they arent entitled to all of the contributions the employer has made on their behalf. They do get to take all of the money they have personally contributed with them, of course.

Some companies opt for profit-sharing contributions to employees 401 accounts when business is good. As mentioned above, these contributions are also tax deductible.

The typical 401 match is called a safe harbor nonelective match of 3% of salary, Pyle said. This means the employees get 3%, whether or not they participate in their employers 401 plan. Other match types are 100% on the first 3% of salary deferred and 50% on the next 2% of salary deferred.

Setting Up A 401 Plan

Finally, heres the nitty-gritty left to do to start your companys retirement plan:

1. Collect employee data. In order to make sure employees qualify for enrollment in the new plan, youll need to prepare an accurate census of employee information, including names, birth dates, hiring dates, salary information, and more.

2. Identify a Plan Manager. You as the employer will manage the plan, some small businesses may have another employee, like an HR manager, be named as the official Plan Manager for your plan. In addition to the business owner acting as a fiduciary, the person chosen as Plan Manager may also have fiduciary responsibilities. Itll be their job to work with your adviser and other providers to facilitate plan administration.

3. Determine the new plans start date. You will also need to decide when you want to roll out the plan and allow employees to enroll. Often, you can set up your plan to start by the following month’s payrollwhich means employees will be able to start saving for retirement into the plan.

4. Set up payroll. Finally, youll need to make sure that your payroll system is set up to handle employee deferrals according to your plan design. Fisher specifically helps our clients with this step as it can be tricky depending on your payroll provider.

Optimize Your 401 Allocations

A 401 is an account type, not an investment. Once you contribute money, youll need to decide how you want to invest it by choosing an investment option available in your 401 plan. Typically, 401s don’t offer individual stock investments. Instead, you’ll likely have a choice of several mutual funds, which are investments that contain a basket of stocks and bonds. Youll need to determine how you want to divide your money between the different fundsa process called asset allocation.

There is no universally correct allocation for everyone, as it depends on your risk tolerance and investment goals, which may change over time.

When you are young, you can afford to invest a little more aggressively and take advantage of potentially high returns. In other words, investing in your 20s means you have a long time horizon before retiring, allowing for a higher risk tolerance since you have many years for your 401 investments to bounce back from any market downturns.

As a result, you may opt for a more aggressive growth strategy by investing in stock funds versus bond funds, which are usually deemed a safer option.

Don’t Miss: How To Convert Traditional 401k To Roth Ira

How Much Does It Take To Open A 401

When you start a 401 plan for your company, there might be a one-time setup fee. This fee will cover things such as setting up the plan and educating the company employees about the 401 plan. In addition, there will likely be a monthly fee based on the number of participants and the amount of assets in the plan. The cost of the fee will depend on which 401 provider you choose.

How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2022, salary deferrals are $20,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

You May Like: How To Withdraw Money From 401k Early

How Do Employers Choose The Best Mutual Funds To Offer Employees

Managing investments is sometimes beyond the expertise of employers. Thats why many of them outsource the process of selecting, diversifying and monitoring plan investments to an investment advisor. Professional assistance helps ensure that the investment options are in the best interest of the plan and its participants.

This article is intended to be used as a starting point in analyzing 401k and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. ADP, Inc. and its affiliates do not offer investment, tax or legal advice to individuals. Nothing contained in this communication is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

ADPRS-20220422-3172

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

You May Like: How To Start A 401k For My Company

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

How Do I Set Up A Small Business 401

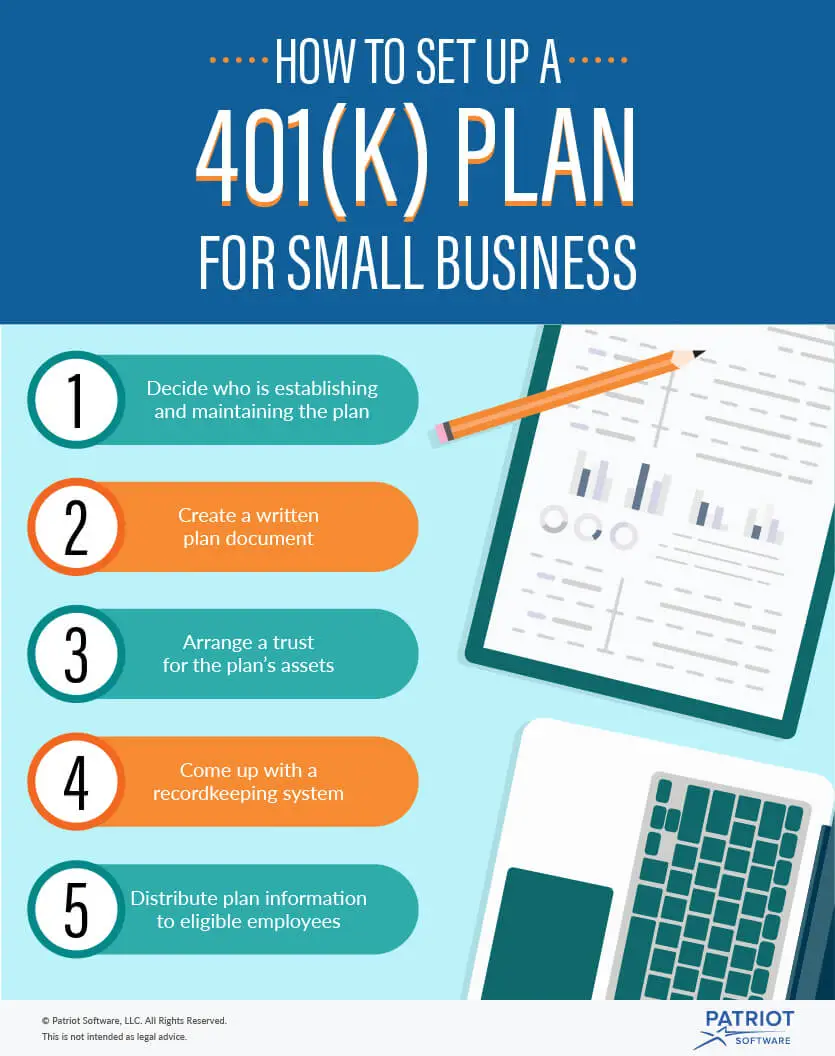

If youre ready to set up your small business 401, these are the four steps youll need to take.

For small businesses that are ready to help their employees save for retirement, the IRS website covers the actions you need to set up a 401 plan. In case you dont speak in tax code, heres a more approachable step-by-step guide.

Also Check: Can An Individual Open A 401k Account

Alternatives To A 401

Not every employer will offer a 401, so you may not have it as an option. However, that doesnt mean you cant save on your own and still take advantage of compound growth.

If your employer doesnt provide access to a 401, you may want to consider an individual retirement account or Roth IRA. These accounts let you save for retirement while offering some tax advantages, but they don’t offer the benefit of a company match. Also, IRAs have lower annual contribution limits than 401s. For example, the maximum annual contribution amount is $6,000 for 2022.

Create A Written Plan

Unless you hire a professional or financial institution to establish and maintain the 401, you must create a written plan document. If a professional or financial institution is handling the plan for you, theyll write the written plan.

The written plan needs to have all the terms and conditions of your 401 plan. Its a legally binding document, so you might want to turn to a professional for help.

Your document needs to list information such as:

- What type of 401 plan youre offering

- What features you want the plan to have

- The process of contributing funds

- The process of distributing funds to employees

Don’t Miss: How To Borrow Money From 401k Fidelity

What’s The Difference Between A Traditional 401k And A Roth Ira

The primary difference between a 401k and a Roth IRA is how the savings are taxed. Contributions to a 401k are made before tax deductions, whereas those to a Roth IRA are made after tax deductions. When employees retire, their income from a 401k savings plan is subject to taxes. Qualified withdrawals from a Roth IRA, on the other hand, are tax free.

Consider Diversifying With A Roth 401

A Roth 401 can also be an effective retirement-savings option, especially when youre early in your career and in a lower tax bracket. While contributing to a 401 allows you to lower your tax burden, there is no similar tax benefit for contributions to a Roth 401 however, investment growth and qualifying withdrawals taken in retirement are tax-free.

Recommended Reading: How To Lower 401k Contribution Fidelity

How Contributing To A 401 In Your 20s Compounds

Lets compare the effects of the two employer-matching plans. Lets say you are 25 years old, will earn $40,000 per year without a raise until you turn 65, and earn a steady 6% on your savings while contributing 5% of your salary to the 401 annually. How much will you have saved under each matching arrangement?

- With a 50% match, your savings would grow to $464,286.

- With a 100% match, your savings would grow to $619,048.

Thats a difference of $154,762nearly four years’ worth of your salary. Thinking of it in those terms should make it seem like a much bigger deal than an extra $1,000 per year. But if starting early is so important, how would waiting affect your savings? Under each plan, if you wait until you are 35 to start saving, youd have the following:

- With a 50% match, your savings would grow to $237,175.

- With a 100% match, your savings would grow to $316,233.

By waiting 10 years to start matching your contributions, youd be losing about half of what you could have gained in retirement savings. Thats the difference of saving a mere $2,000 per year for 10 years, for a total of $20,000.

In other words, starting early and contributing to your 401 in your 20s allows you to take advantage of the employer match, which is free money. However, contributing early when you’re young also allows you to maximize the power of compounding, which is the interest earned on your interest over the years.

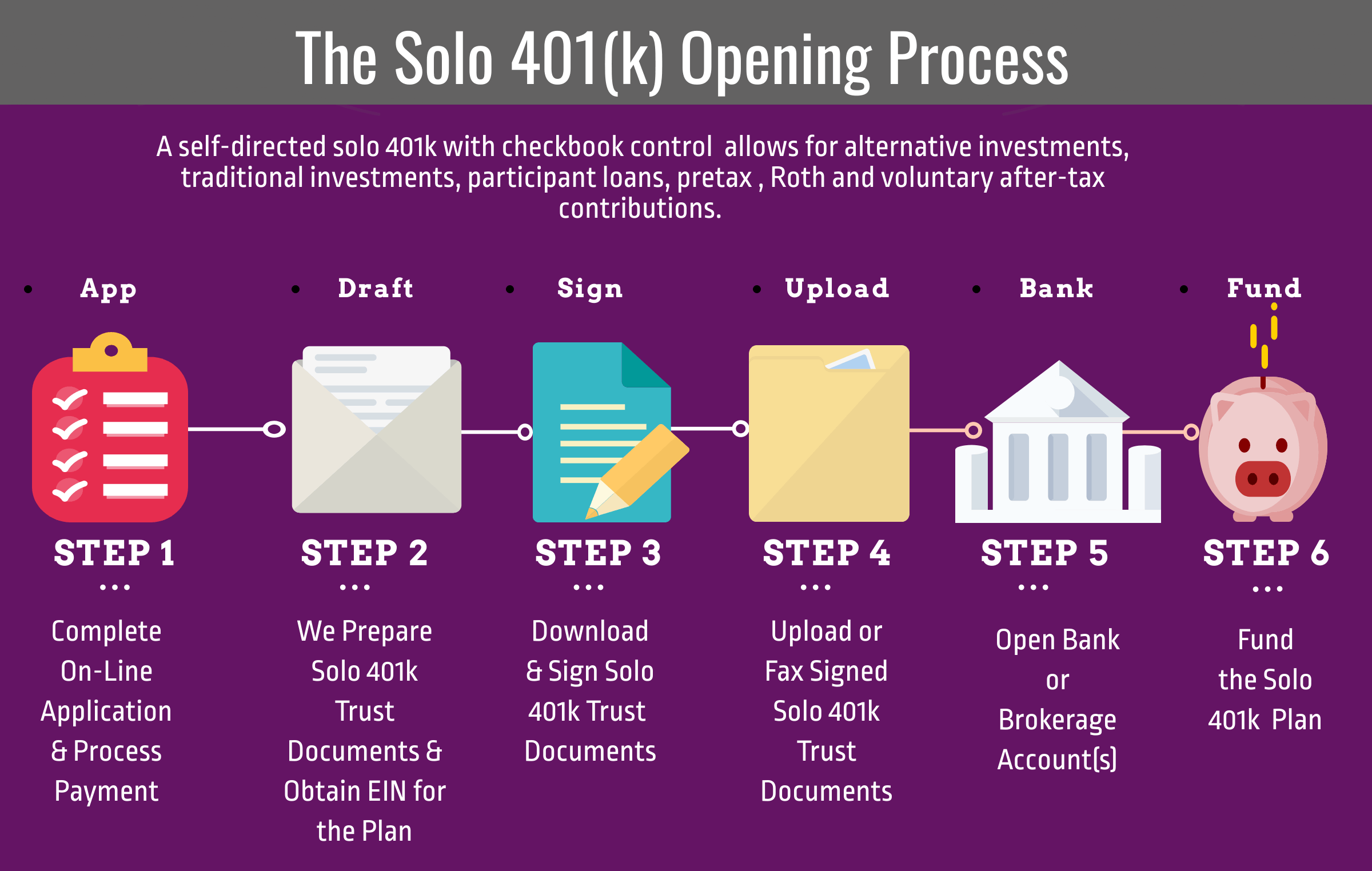

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

Read Also: Can You Transfer Money From 401k To Roth Ira

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax year 2021 and $20,500 or 100% of compensation for tax year 2022. If you are over 50, an additional $6,500 catch-up contribution is allowed bringing the total contribution up to $26,000 for 2021 and $27,000 for 2022. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $58,000 for tax year 2021 and the maximum 2022 solo 401k contribution is $61,000. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to $64,500 for 2021 and $67,500 for 2022.

What Investments Should You Pick

Once youâve started your 401, youâll need to choose what you want to invest your funds into. Most 401 plans default to a target-date fund. These funds contain a mixture of stocks and bonds and are reallocated yearly to match your risk tolerance as you near retirement. Using your estimated retirement dateâor target dateâthe fund shifts more of your investments towards less-risky bond funds to limit your chance of losing money right before you retire.

However, many 401 plans provide many more options for their participants to invest their money. The average plan has about 19 different investment funds to choose from, ranging from mutual funds and index funds to international stock funds and bonds.

If you wish to invest your 401 in something other than a target fund, youâll need to reinvest your funds yourselfâeither through your online 401 portal or your 401 planâs custodian.

Recommended Reading: How To Get Money From Your 401k

Early Withdrawals From A 401

You can typically start making penalty-free withdrawals from your 401 at the age of 59½.

But life doesnât always go as planned. Money management can be hard, and unexpected financial challenges can pop up at any time. So, while saving for retirement is important, people donât always have enough in their savings account to cover an unexpected expense.

So if you need to take an early withdrawal from your 401, here are some things youâll want to be aware of:

- 401s have an early withdrawal tax penalty of 10%.

- There are qualifying life eventsâlike certain medical expensesâthat are exempt from a tax penalty.

Instead of an early withdrawal, another option could be to take out a loan against your 401. When it comes to borrowing from a 401, here are a few things to keep in mind:

- The loan needs to be applied for through and approved by the employer or plan administrator.

- Loan amounts are limited to 50% of the 401 balance or a maximum of $50,000 if the account is fully vestedâwhichever is lower.

- As the IRS explains, âGenerally, the employee must repay a plan loan within five years and must make payments at least quarterly.â But there are some exceptionsâlike using a 401 loan to buy a home.

- If an employee borrows from their 401 and then leaves the company, the employer may require the outstanding balance in full. In this case, a borrower has until the due date of their tax return to pay it back.

Find The Right 401 Provider That Meets Your Needs And Goals

A 401 plan provider covers the administrative burden of establishing and running the plan, which can include:

- Auto-enrollment

- Trust setup

- Tax filing

You can expect to pay a monthly charge for this service. Some 401 providers work with preferred brokers, while others offer the freedom to choose any broker. Depending on the broker, this financial adviser may choose the investments for the plan or help plan participants choose their own investments.

Also Check: What Age Can I Draw My 401k

Maintaining 401k Plans For A Business

Most 401k plans are subject to the requirements of the IRC and the Employee Retirement Income Security Act , which provide minimum standards that protect individuals in retirement plans. Administering and maintaining plans that comply with these regulations ranges in difficulty from the moderate to the complex.

How To Set Up A 401

Some employer responsibilities come with setting up a 401 plan for a small business. You might be met with some fees for establishing the plan.

Establishment fees typically range from $1,500 $3,000 but could be more or less depending on the business. Some companies might be able to get the fee waived, but this is typically reserved for large businesses. And remember, thanks to the SECURE Act, you can deduct qualifying setup costs.

To set up a 401 plan, follow these steps:

Don’t Miss: How To Rollover 401k When You Change Jobs