Average 401k Balance At Age 45

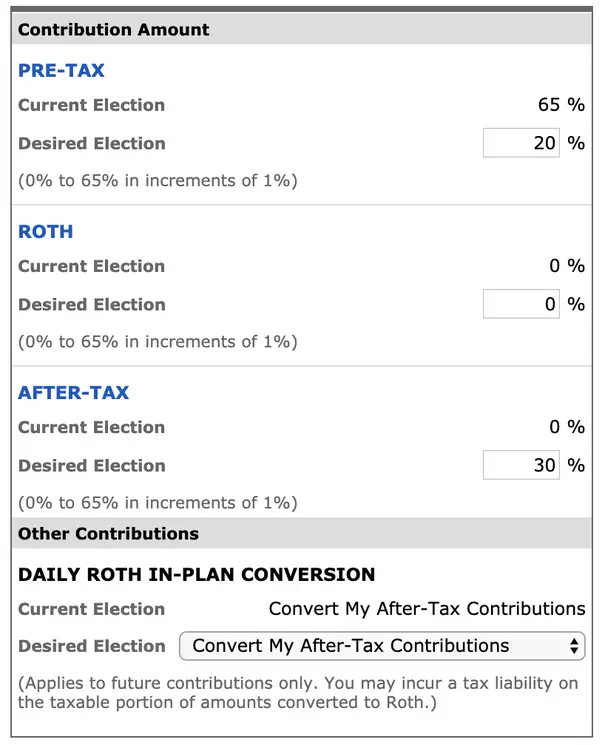

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Use An Outside Company Like Beagle

If your search in the above databases doesnât provide any results, utilizing an outside company to find your old 401s and do the difficult work of consolidating them is a great option.

Beagle is the first company of its kind that will do the difficult work for you. We will track down your old 401s and find any hidden fees in your current 401 plan.

Then, they will provide you with options on how best to rollover your 401s into one convenient, low-cost investment option.

This is a great option for anyone who is not sure where to start or even where to begin looking.

Leverage All The Resources At Your Disposal

There are many tools available to help you understand your financial life in more detail, and when these tools are so readily available, not leveraging them can result in a huge blind spot when it comes to your finances. Simply having this information will help you understand if you are on the right track, and how to accelerate your progress on your retirement goals. If working with a financial advisor is an option for you, this can be an invaluable resource, especially as you get closer to retirement. A financial advisor who has your best interest in mind can help you strategize and address potential gaps in your savings and retirement income plans.

Read More: 7 Essential Steps for Retirement Planning

You May Like: How To Protect Your 401k In A Divorce

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Contributions After Age 72

With some retirement accounts, you cannot contribute once you turn age 72, even if you’re still working. That means any money you might have contributed on a pre-tax basis is instead taxed at your current rate. And that’s likely to be higher than the rate you’ll pay once you retire.

Notably, 401s don’t have this drawback. You can continue to contribute to these for as long you’re still working. Even better, while you’re working, you’re spared from taking mandatory distributions from the plan, provided you own less than 5% of the business that employs you.

You May Like: How To Set Up 401k For Employees

How To Locate An Old 401 Plan

The first step that you should always take when trying to track down old 401 plans is to call the human resources department of each of your former employers.

They should be able to tell you whether you still have 401 plans with their companies.

If you cant find the number to the HR department, try calling your previous supervisor or boss and ask him or her to get you in touch with HR.

If you have an old 401 plan statement available, then you can contact your previous plan administrator and they should be able to tell you where your plan is now.

Or you can contact a former co-worker who still works at your old company and ask him or her to give you your plans current contact information.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Read Also: How To Roll Over 401k To New Job

Reference An Old Statement

Because companies reorganize, merge, get acquired, or go out of business every day, its possible that your former employer is no longer around. In that case, try to locate a lost 401k plan statement and look for contact information for the plan administrator. If you dont have an old statement, reach out to former coworkers and ask if they have an old statement.

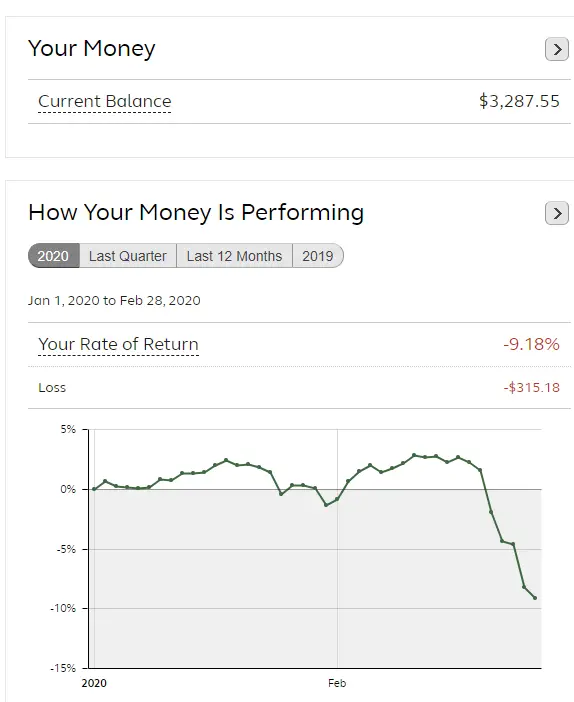

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

You May Like: How Do I Open A 401k

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

How Do I View Confirmations Online

Confirmations for the previous 36 months will be available online, and these are generally available to be viewed the morning after the transaction occurred. If you are signed up for E-delivery of your confirmations, we will notify you by e-mail when an account confirmation is available to view online. As a protection to you, confirmations of changes of address and banking information will also be mailed to your address of record.

Log in to view your confirmations or update your paperless preferences:

Recommended Reading: How Can I Invest My 401k Money

How To Find Your Old 401 Accounts

1. Contact your former employer

You can start your search for your missing retirement savings by contacting your former employers human resources department. Simply tell them youre a former employee who wants to access a 401 plan you left behind. Then, theyll likely ask you for identifying information and dates of employment to help search their record.

If the HR department can locate your 401 account, theyll let you know what your options are for accessing the account. They can also give you steps to take to roll those assets over into your new employers 401 or to a rollover IRA account.

However, you might run into a hiccup if youre previous employer has been acquired by another company. In this case, you can search online for news about the acquisitions details, including the name and location of the purchasing company. If youre still in touch with former colleagues from that job, they may be able to provide you with the information as well.

2. National Registry of Unclaimed Retirement Benefits

If your online sleuthing doesnt turn up the information you need to find your old 401, dont despair. You can search the National Registry of Unclaimed Retirement Benefits, which helps employers connect with former employees who have left assets behind in a retirement plan.

3. U.S. Department of Labors Abandoned Plan Search

4. Use Beagle, the 401k super sleuths

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Also Check: Can A Sole Proprietor Have A Solo 401k

How To Find Old 401 And Pension Accounts

The challenge will be finding that money and claiming it. If youve worked a dozen jobs and are now in your fifties and looking forward to retirement, theres a good chance youll struggle to remember everywhere you worked. But how do you find old 401 and Pension Accounts?

You might remember carrying bags in a hotel one summer but you might also struggle to remember the name of the hotel or when exactly you were there.

The good news is that you dont have to try to remember every place youve ever worked and that might have given you pension payments.

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

Read Also: What Happens To 401k If I Die

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Read Also: How To Lower 401k Contribution Fidelity

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Picking The Best Option

Figuring out what to do can be difficult, as there may be complex tax and investment return implications for each decision.

In many cases, unless youre ready to retire, moving the funds into a new retirement account is often a good option. If your funds are in an IRA that was opened in your name, the IRA provider may be charging high fees. And, unless the old employer offers a much better plan than your current options, consolidating your money within a few accounts can make it easier to track your investments and help you qualify for discounts or benefits from plan administrators.

The easiest way to do this is with a direct transfer, where the money never touches your hands. Otherwise, 20 percent of the money has to be withheld for taxes, and you only have 60 days to deposit the funds into the new retirement account or the withdrawal will be treated as a cash out.

Fair warning, there can still be a lot of paperwork involved with a direct transfer. However, the company that youre sending the money to will often be able to help you with the process.

No matter what option you choose, if youve got old retirement accounts floating out there its in your best interests to track that money down sooner than later. The more you know about your retirement funds, the more options you may have the next time youre faced with a major financial setback. At the very least, youll understand where you stand as you prepare for retirement.

Also Check: Can You Withdraw From Your 401k

Don’t Miss: How To Convert A 401k Into A Roth Ira

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Read Also: Should I Have An Ira And A 401k

Average 401k Balance At Age 22

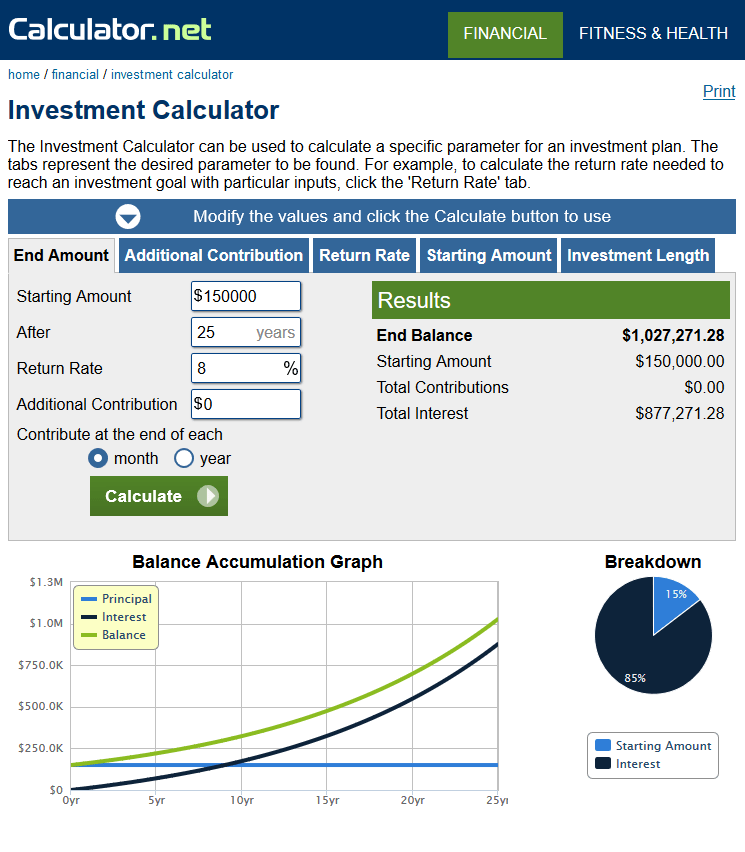

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart , compounding interest is no joke.

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

Don’t Miss: How To Rollover A 401k Into A Self Directed Ira

Check Unclaimed Property Databases

If youre still unable to locate your plan, try searching for it via unclaimed property databases. Keep in mind that youll want to have your name, Social Security number, employer name and the dates you worked for your former employer at the ready.

Some databases worth searching include:

- Pension Benefit Guaranty Corporation:

- If you had coverage under an old pension plan, the PBGC can help you locate your unclaimed plan.

Before you sift through these databases, its a good idea to verify that you contributed to a 401 at your old job in the first place. You can see any amounts contributed to your 401 by referring to Box 12 of your W-2 from when you worked for your former employer.