What Percentage Of My Income Should I Contribute To My 401

You can use the 401 calculator to get straightforward, dollars-and-cents answers to many important questions about your retirement. When it comes to how much you ought to be saving, however, things arent quite so simple. It depends on your age, how many years you plan to work and, ultimately, on the kind of lifestyle you want to have after you retire.

Some advisors recommend saving 10-15% of your income as a general rule of thumb. If you save that much from the time you first start working in your 20s until you retire, that may be fine. If youre starting your retirement savings later in life, however, you will want to save more than that to try to catch up. While there are few hard and fast rules on exactly how much you should save, here are some general guidelines:

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

-

All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

-

Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

How Much Should You Save Each Paycheck

As most people rely on a single stream of income, saving a portion of your paycheck is vital to ensure that you can not only afford emergency expenses such as medical care or urgent home repairs, but further that you can comfortably save for future milestones such as holidays, larger purchases such as a home, or even your eventual retirement.

You May Like: Can You Take Out From Your 401k

Why Is It Important To Contribute To Savings Every Month

The earlier you contribute to your retirement savings, the more youll have saved up when its time to clock out for the last time. Its also easier to save for retirement when youre young and have less responsibilities. You want to aim to have a high savings rate, which usually means youll either be able to retire earlier or have more money during retirement.

There are many benefits of contributing to savings every month, such as:

- Compounding interest: Compound interest will add significantly to your retirement savings, especially if you start saving early on. Compound interest is the process of earning interest on your original earrings and then continuing to earn interest on top of that.

- Peace of mind: Contributing to your retirement savings each month will also give you peace of mind that youll have enough money saved up, especially if youre planning on early retirement.

Now that you know the why of it, well help you answer how much of your paycheck should you save?.

The Matching Contribution Bonus

For people who start saving early and take advantage of employer-sponsored plans, such as 401s, hitting savings goals isnt as daunting as it may sound. Employer matching contributions could significantly reduce what you need to save per month. These contributions are made pre-tax and it’s the equivalent of “free money.”

Say you save 3% of your income during a year and your company matches that 3% in your 401, “you will make a 100% return on the amount you saved that year,” said Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Mass.

Read Also: How To Move 401k To Vanguard

Contribute More When Youre Young

Kyle Kroeger, Founder of Financial Wolves

I’ve been contributing the max amount to 401 since my second year out of college. I think anyone should strive for contributing the max contribution limit as soon as possible out of college, even if it requires you to find a job on the side. Why? Because as a young professional your income is only expected to rise. If you can price in the max contribution into your budgeting right from the start, your income will rise too.

A lot of people will increase their contributions when they get a raise. That just means that your take-home pay will stay the same. That makes it much harder psychologically to continue to increase your contributions. Most people don’t even end up doing it. Bite the bullet early and max out from the get-go!

Max Out Your Contribution

While that sounds like a lot of money from a 4% contribution, it may not be enough to sustain the lifestyle you want in retirement. Based on the often-used “4% rule” for retirement and using our preceding example, a $900,000 nest egg would safely produce $36,000 in annual income in retirement. Withdrawing any more than this greatly increases the chances you’ll eventually run out of money. Even when you factor in Social Security, it might not be enough.

Fortunately, you can save more than your employer is willing to match — a lot more, in most cases.

One popular strategy is to increase your contributions by 1% per year until you hit the maximum amount you’re comfortable with saving. Any small increase can make a big difference. Returning to our example, consider how small increases in elective contributions affect retirement savings in the long run.

Assumes $60,000 starting salary and 2% annual salary increases. Also assumes 7% annual investment returns.| Your Contribution |

|---|

You May Like: How To Rollover Ira Into 401k

Contribute As Much As You Can

Todd Kunsman, Founder of Invested Wallet

The answer to how much someone contributes is always, as much as you can or max it out! But knowing everyone’s income level and finances are different, I think the best answer should be to start with enough to get the company match. Some companies may offer a 100 percent match of the first 6 percent contributed or 100 percent of the first 3 percent contributed, for example. Whatever that number is, make sure that is what you contribute or you risk leaving money on the table!

I personally did not understand this early in my career and was not getting the full match. I wanted more money in my pocket instead of towards my 401, but in doing so, I left thousands of dollars behind.

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021-2022 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $26,000 including catch-ups.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, PA. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

Also Check: How To Set Up A Solo Roth 401k

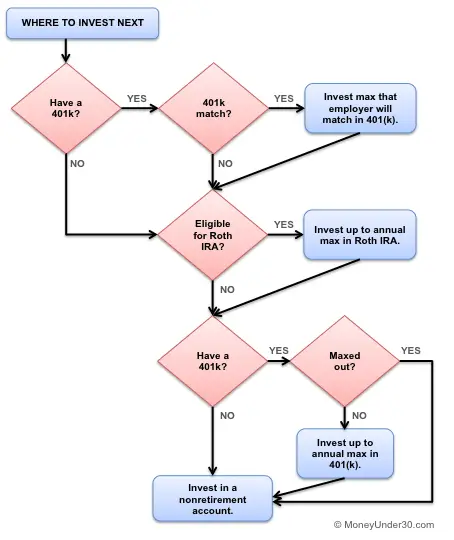

How Do I Invest 15% For Retirement

The first place to start investing is through your workplace, especially if it offers a company match. If your employer offers a Roth 401 or Roth 403, then you can invest the entire 15% of your income there and youre done. With a Roth option, you contribute after-tax dollars. That means your money grows tax-free, plus you dont pay taxes on that money when you take it out at retirement . Talk about making investing super easy!

If your employer matches your contributions to your 401, 403 or Thrift Savings Plan , you can reach your 15% goal by following these three steps:

For example, if your company will match 3% of your 401 contributions, invest 3% in that account and then put the remaining 12% in a Roth IRA. If that remaining 12% would put you over the annual contribution limit for a Roth IRA , max out the Roth IRA and then go back to your workplace 401 to finish out investing 15%.7

Here are two key takeaways: First, you need to invest 15% of your gross salary, not your take-home pay. Second, do not count the company match as part of your 15%. Consider that extra icing on the cake!

How To Answer Salary Question In An Interview

Say youre flexible. You can try to skirt the question with a broad answer, such as, My salary expectations are in line with my experience and qualifications. Or, If this is the right job for me, Im sure we can come to an agreement on salary. This will show that youre willing to negotiate. Offer a range.

Read Also: How To Get A Loan From Fidelity 401k

Breaking Down A Paycheck 50/30/20

So, what does that strong yet sustainable balance look like? And how do you implement it? Poorman suggests the popular 50/30/20 rule of thumb for paycheck allocation:2

- 50% of gross pay for essentials like bills and regular expenses

- 30% for spending on dining/ordering out and entertainment

- 20% for personal saving and investment goals

Lets break it down: essentials first, savings and investments second, and entertainment third.

Read Also: What Percent Should You Put In 401k

Contribute The Maximum Amount Your Employer Matches

Robert Johnson, Ph.d., CFA, CAIA, and Professor of Finance at Creighton University

Perhaps the worst financial mistake anyone can make is turning down free money. If one doesnt contribute enough in a 401 plan that has a company match to earn that match, one is basically turning down free money. Contributing the max to your 401 also reduces your tax bill. Investors should do whatever it takes to participate in your companys 401 plan to the level to get your full employer match.

Company matching requirements vary considerably by company. For instance, some firms will match contributions dollar for dollar up to a certain maximum. On the other hand, some plans require the employee to invest a certain minimum percentage of salary before the firm will contribute any employer match.

Recommended Reading: What Is The Difference Between And Ira And A 401k

How Much Should You Save

Academic retirement saving studies use the term replacement rate. This is the percentage of your salary that youll receive as income during retirement from your retirement accounts. For example, if you made $100,000 a year when you were employed but receive $38,000 a year in retirement payments, your replacement rate is 38%. The variables included in a replacement rate include savings, taxes, and spending needs, and this rate may go up and down during the course of your retirement depending on a variety of factors such as market fluctuations, and your tax bracket, which could be subject to change.

The Two Fundamental Rules Of Retirement Savings

Here are two rules that will apply to almost everyone:

You May Like: Should I Rollover My 401k To A Traditional Ira

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

Put Your Savings On Automatic

Once youve determined your savings goals, I highly recommend that you arrange an automatic transfer to your savings or investment accounts each month that way, you won’t have to consciously make the “save or spend” decision each month. A payroll deduction plan is ideal for retirement, especially if it goes into a tax-advantaged plan like a 401 or an IRA account. plan contributions are often matched to some degree by your employermaking your effective savings rate even higher.)

You May Like: How To Get My 401k From Walmart

The Effect Of A Few Percentage Points Over Time

When determining what to contribute, dont set your sights too low: A couple of percentage points can make a big difference.

Even if you start small, its important to start saving as early as you can and let time do the work of accumulating interest for you. Make a goal to increase your contribution each year and stick to it.

For example, this graph shows how much someone earning $60,000 annually would save after 30 years, investing at different levels. In this example, a couple of percentage points can be worth more than $150,000 in the end.

Potential value after 30 years

$ thousands

Example is for illustration purposes only. Assumes $60,000 salary, bi-weekly contributions, 3% annual pay increase, and a 7% rate of return. Investments will fluctuate and when redeemed, may be worth more or less than originally invested. Balances shown are pre-tax and are subject to income taxes upon distribution. Values do not account for fees and expenses.

This information is a general discussion of the relevant federal tax laws provided to promote ideas that may benefit a taxpayer. It is not intended for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties. Taxpayers should seek the advice of their own advisors regarding any tax and legal issues specific to their situation.

Where Should You Put Your Savings

Different savings goals may fit different savings accounts. Long-term savings typically benefit you the most in investment and retirement accounts. Short-term savings may be better suited for savings accounts. Strategically planning out your savings goals can help you maximize your investments and avoid penalties.

- Checking account: Not all checking accounts offer growth opportunities. These accounts are used for everyday purchases like your rent, WiFi, and groceries.

- Savings account: Savings accounts are interest bearing and are often used for short-term savings goals. These accounts are easily accessible in case of an emergency and help grow money thats not being used.

- Money market account: Money market accounts typically offer higher yields and fluctuate with the market itself. These accounts often have minimum balance and other maintenance requirements. In some cases, higher balances could unlock higher yields as well.

- Contribute to your 401K: Investing in your 401K sets you up for retirement. 401K contributions have the potential to grow your investments significantly and lower your monthly taxable income.

- If youre tempted to cash out your 401 early as a way to pay off debts, its very important to weigh the pros and cons as doing so can cut your investment earrings and push back your retirement date.

You May Like: How To Cash Out 401k After Leaving Job

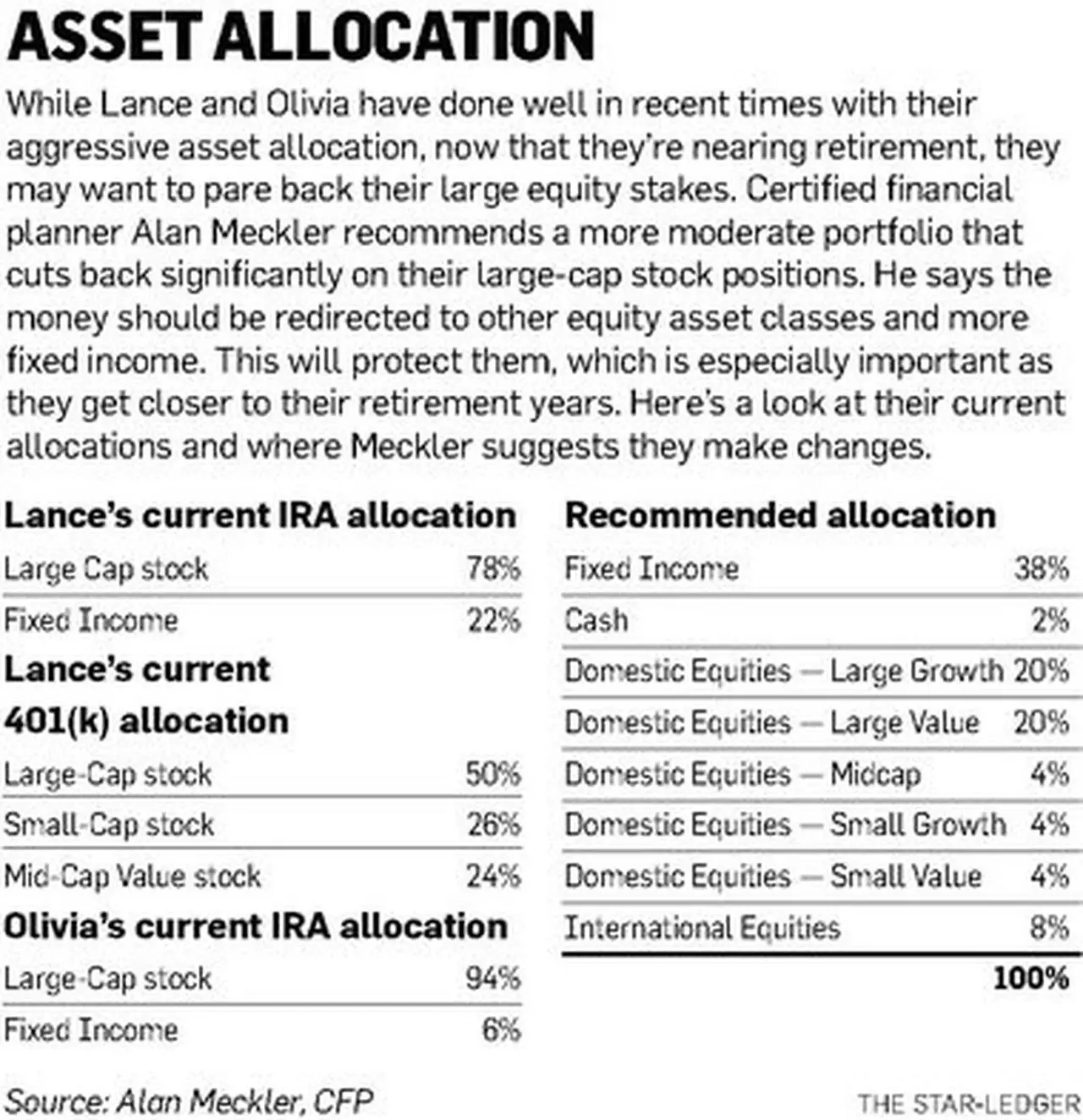

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.