Can My Employer Match My Designated Roth Contributions Must My Employer Allocate The Matching Contributions To A Designated Roth Account

Yes, your employer can make matching contributions on your designated Roth contributions. However, your employer can only allocate your designated Roth contributions to your designated Roth account. Your employer must allocate any contributions to match designated Roth contributions into a pre-tax account, just like matching contributions on traditional, pre-tax elective contributions.

You Expect To Earn More Money In The Future

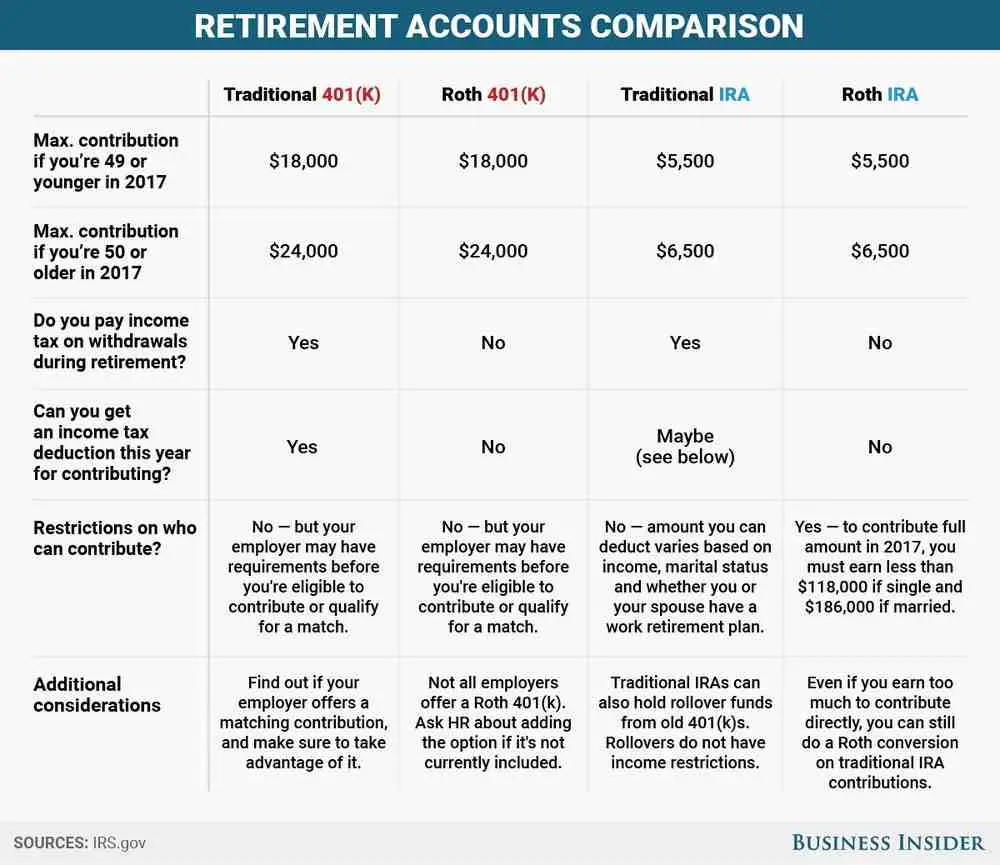

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Read Also: How Does 401k Work In Divorce

How To Reduce Tax

If you have a large 401 balance, you may get hit with a large tax bill after transferring it to a 401. But instead of rolling over the entire balance at once, you can make partial 401-to-Roth IRA conversions over a few years. Because youd be transferring smaller amounts at a time, youd owe less in taxes throughout.

Speak with an accountant or tax advisor about ways to minimize taxes on 401 to Roth IRA transfers.

Recommended Reading: Can I Take Monthly Distributions From My 401k

Roth Ladders And Early Retirement

Those planning to retire early can also benefit from Roth ladders, as they can access tax-free withdrawals of their contributions before age 59½, as long as the money has been in the account for five years. Trying to take money out before that could mean paying penalties in addition to income tax.

If you are planning to retire early, the timing of your Roth ladder is crucial, Swart says.

Oftentimes people will start these Roth conversion ladders at least five years before they’re going to need the money, so that they can wait out that five-year period.

Do I Have To Convert The Entire Amount In My Traditional Ira Or Qrp

No. You may convert just a portion of your assets, and there is no limit to the number of conversions. To help manage the taxes due on each conversion, you may convert smaller amounts over several years. Keep in mind, if you want to take a distribution, each conversion has its own five-year waiting period to avoid the 10% additional tax if you are under age 59 1/2.

Don’t Miss: Should I Do 401k Or Roth Ira

Does Separate Account Refer To The Actual Funding Vehicle Or Does It Refer To Separate Accounting Within The Plan’s Trust

Under IRC Section 402A, the separate account requirement can be satisfied by any means by which an employer can separately and accurately track a participants designated Roth contributions, along with corresponding gains and losses.

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

You May Like: Should I Get A 401k

Beware The Pro Rata Rule On Conversions

If you have traditional IRA accounts with deductible contributions, youll need to factor that in if you convert any nondeductible amounts into a Roth IRA. Youll need to follow the IRSs pro rata rule, which forces you to calculate the tax consequences considering your IRA assets in total.

In effect, youll have to figure out what proportion of your funds have never been taxed that is, deductible contributions and earnings to your total IRA assets. That percentage of the conversion is subject to tax at ordinary income tax rates.

Its a complex calculation and can create significant confusion.

Why Would You Want To Convert A 401 Into A Roth Ira

When youre employed by a company that offers a 401 plan, its an indispensable investing tool. Many companies match some of your contributions, which is essentially free money.

However, when you leave that job, this is a great time to look at the 401 youve been given and evaluate what is working for you, says Nicole Stanley, a financial coach and founder of Arise Financial Coaching.

Here are some of the most common reasons you might want to convert your 401 into a Roth IRA:

You May Like: How Much Of My Paycheck Should Go To 401k

Conversion To A Roth Ira

Anyone can convert a 401 to a Roth IRA once a year there are no income limits like there are with regular Roth IRA contributions. You also dont have to convert your entire 401 to a Roth IRA at once or even at all. You can split the rollover between an IRA and a Roth IRA if you wish.

A Roth IRA offers unique benefits, but a complete analysis should be done prior to the Roth conversion. Some of the key retirement planning considerations are:

- Do I expect my tax bracket to be higher in retirement than it is now?

- Do I have cash available to pay the tax without dipping into my Roth IRA or other retirement money?

- Does a Roth IRA conversion fit into my overall retirement planning and wealth strategy?

Paying Taxes On Your 401 To Roth Ira Conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401s are funded with pre-tax dollars, so you must pay taxes on your 401 to Roth IRA conversions. In most cases, the funds you’re converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year’s tax bill.

The effect on your tax bill depends on how much you’re converting and how much other taxable income you’ve earned during the year. If you’re not careful, your 401 to Roth IRA conversion could push you into a higher tax bracket, meaning you’ll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket throughout the year and striving to keep your total taxable income, including conversions, under your bracket’s upper limit.

You may not owe taxes on the full amount of your 401 to Roth IRA conversion if you’ve made nondeductible 401 contributions in the past. But that’s where things get a little hairy. Nondeductible 401 contributions are funds you contribute to a traditional 401 but don’t get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax deferred until you withdraw them.

You May Like: Can I Roll A Simple Ira Into A 401k

Converting A Traditional Ira To A Roth Ira

Converting a traditional IRA to a Roth IRA lets you transfer all or a portion of your traditional accounts into a Roth IRA. But it comes with a tax bill. Because contributions to a traditional IRA may be tax-deductible, income taxes are typically due on distributions from the accountand that includes conversions. You would have to pay income taxes on all of the pre-tax contributions and tax-deferred investment earnings transferred to the Roth account.

You can also make nondeductible contributions to an IRA and then convert them to a Roth.

Where Should I Put My Retirement Money After I Retire

Roll over to an IRA. This option can also retain the tax-deferred advantage of a lump-sum distribution while offering a range of investment options. Alternatively, you can invest part or all of the lump-sum rollover in an annuity. It can provide you with a guaranteed income stream throughout your retirement.

What is the safest retirement fund?

No investment is completely safe, but there are five that are considered the safest investments you can have. Bank savings accounts and CDs are usually FDIC insured. Treasury securities are government-backed notes.

Where should a retiree put their money?

You can mix and match these investments to suit your income needs and risk tolerance.

- Immediate Fixed Annuity.

- Real Estate Investment Trusts

Also Check: Why Is Ira Better Than 401k

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around is now easier than ever. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. However, allocating your retirement funds to new plans becomes tricky upon leaving the company.

The new allocation rules took effect in 2015, but taxpayers chose to apply them to distributions as early as September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula, resulting in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You can now choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

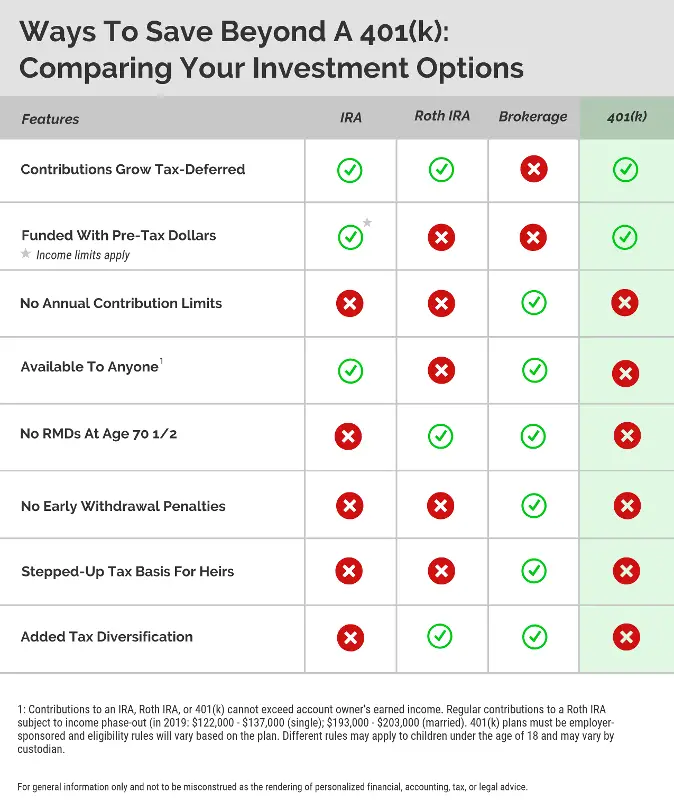

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.

Don’t Miss: What Amount Should I Put In My 401k

A Conversion May Lead To More Taxes

When you convert a traditional IRA or traditional 401 that has used pre-tax contributions or IRA), youll end up with a tax bill. Youre recognizing that contribution as income, and you must pay taxes on it the taxes you didnt pay when it went into the account.

If you convert a Roth 401 into a Roth IRA, you skip the tax hit, because theyre both after-tax accounts. However, any employer match in a Roth 401 is technically held in a traditional 401, meaning that portion of the account cannot be converted without incurring some taxes.

Disadvantages Of Roth Conversion

You expect your tax rate in retirement to be lower. If youre in a high federal tax bracket today and expect your retirement income to be low enough that your tax rate will be lower, too, Roth conversions dont make any sense. That said, you still face the wildcard issue of what Congress might do with tax rates in coming years.

Paying taxes upfront. Do you have the free cash flow to handle the extra tax hit from a Roth conversion? If you have high-rate credit card debt, or your emergency fund is a bit thin, you might want to tackle those issues before giving yourself a bigger tax bill.

Social Security issues. If youre already collecting Social Security, whether the payout is taxableand the extent to which it will be taxedis based in part on your income. The year you do a Roth conversion, your taxable income will rise, which could cause a portion of your Social Security benefit to be taxed or push you into a situation where more of your benefit is taxed.

Less bankruptcy protection. Creditors cant touch money inside a 401 account, but there is a limit on the protection of IRA assets. The current combined IRA amount protected from creditors is $1,362,800. This cap is reset every three years to adjust for inflationthe next adjustment will be in April 2022.

Also Check: Should I Manage My Own 401k

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

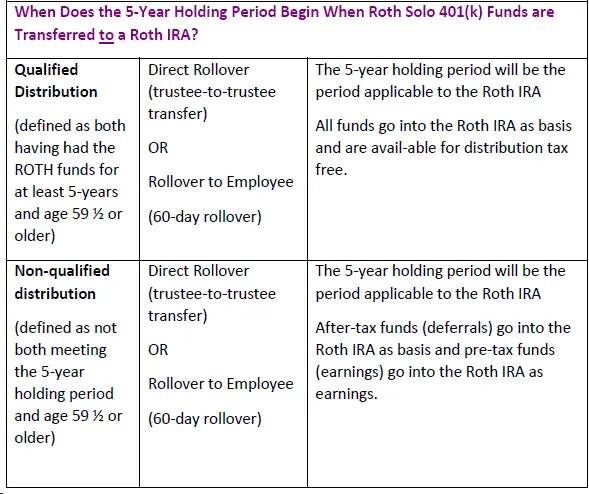

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Do Roth Iras Have Required Minimum Distributions

One huge advantage to structuring your retirement account as a Roth IRA is that there are no required minimum distributions . This means you can simply leave the money in the Roth IRA if you dont need it immediately in retirement. Should you pass on before fully using up the money in your Roth IRA, it would transfer to your designated beneficiary. If this is your spouse, the same rules apply as for you . The Roth IRA can actually be passed on to your heirs without incurring estate taxes, although there are some rules around how and when they have to start drawing it down.

Also Check: Should I Open A 401k

How To Convert Your 401 To Roth Ira

LAST REVIEWED Dec 13 20199 MIN READ

When you leave your job, one of the options regarding your 401 account is to transfer your 401 funds into a Roth IRA . It might not be the first thing that comes to mind, as contributions to a Roth IRA are from post-tax earnings while those to a 401 account are from pre-tax earnings. To qualify for a 401 rollover to a Roth IRA, you must meet the Internal Revenue Services income limits.

Consolidate Your Retirement Accounts

Consider consolidating your financial assets at Wells Fargo to help you simplify your finances and get a better view of your overall financial picture. For a start, we can explain the various options for your retirement plan savings and How to transfer your IRAs.

Income tax will apply to Traditional IRA distributions that you have to include in gross income. Qualified Roth IRA distributions are not included in gross income. Roth IRA distributions are generally considered qualified provided a Roth IRA has been open for more than five years and the owner has reached age 59½ or meets other requirements. Both Traditional and Roth IRA distributions may be subject to an IRS 10% additional tax for early or pre-59 ½ distributions.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

Read Also: Should You Convert 401k To Roth Ira