Open Schwab Investment Account: Rolling Over From A Schwab Ira

Open a Company retirement account . Include the first 4 pages of your Adoption Agreement and your trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Complete the Schwab IRA distribution form In section 2, mark that you’re completing a direct rollover to a qualified retirement plan:

In section 3, you should not need to have taxes withheld as this is a direct rollover from one qualified retirement plan to another:

In section 5, notate the funds will go to another Schwab account:

Fax your application and documents to Schwab at 888-526-7252, Attn: new accounts.

Note: It is not required you fund the account when establishing the Company retirement account. Additionally, you can submit your transfer documents rolling over funds while you establish the new Company retirement account.

The above steps will accomplish opening a new Company retirement account, withdrawing the funds from the Schwab IRA, transferring them to the new Company retirement account with Schwab and then accepting the rollover as your own plan administrator.

Retirement Accounts For The Self

There is also a bucket of plans that make sense for the self-employed or for small business owners.

The SIMPLE IRA is a workplace account thats only for small businesses. Though IRAs are traditionally for individuals, small business owners can set up a SIMPLE IRA for both themselves and their employees. It works similarly to other workplace plans, but it is not optional. If your boss sets up a SIMPLE IRA and you are eligible, you are automatically enrolled. The SEP-IRA is similar, but all contributions are made by the business owner, not by the employees themselves.

Those without employees can choose a solo 401. This plan mimics a 401 for the self-employed or business owners with no employees. A solo 401 maximizes your contribution amount, allowing you to contribute the maximum of $20,500 per year as an employee in addition to a maximum of 25% of your compensation as the employer.

Why Saving Is Hard For The Self

The reasons for not saving toward retirement wont be a surprise to any self-employed person. The most common include:

- Lack of steady income

- Education expenses

- Costs of running the business

Setting up a retirement plan is a do-it-yourself job, just like everything else an entrepreneur undertakes. No human resources staffer is going to walk you through the company-sponsored 401 plan application. There are no matching contributions, no shares of company stock, and no automatic payroll deductions.

Youll have to be highly disciplined in contributing to the plan and, because the amount you can put in your retirement accounts depends on how much you earn, you wont know until the end of the year how much you can contribute.

Still, if freelancers have unique challenges when saving for retirement, they have unique opportunities, too. Funding your retirement account can be considered part of your business expenses, as is any time or money you spend on establishing and administering the plan. Even more important, a retirement account allows you to make pretax contributions, which lowers your taxable income.

Many retirement plans for the self-employed allow you, as a business owner, to contribute more money annually than you could to an individual IRA.

Also Check: How Much Do You Need In 401k To Retire

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers below all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list below offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Don’t Miss: How Do You Pull Out Your 401k

Managing 401 Plans For A Small Business

Setting up a 401 can be complicated, but you don’t have to do it alone. Look for a provider with an excellent track record that can help you get started, manage your plan, and even share ideas and guidance to maximize the value to you and your employees. Doing so can go a long way in ensuring an ongoing, positive benefit for years to come.

How Do You Open A 401

Do the following to open your 401:

Don’t Miss: How 401k Works After Retirement

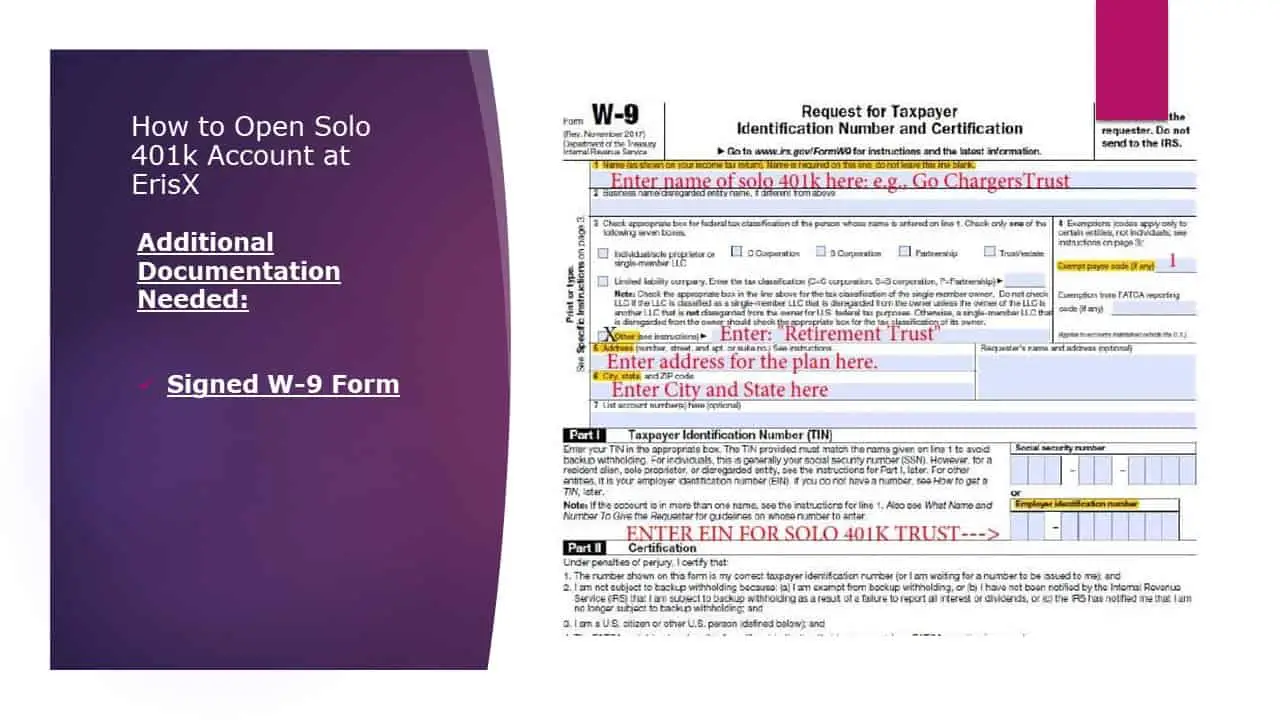

What Paperwork You Need To Fill Out To Open Your Account

I was surprised at how much paperwork is required to open a solo 401k account. You’d think it would be simple, with very common forms to fill out. However, it’s completely the opposite. It becomes even more challenging if you add a Roth solo 401k, and you have to do double the paperwork if you’re adding a spouse to your plan.

When opening your solo 401k plan, you will need to create the following documents. You will need to create separate plan documents for both your Traditional and Roth Solo 401ks. They are both considered separate plans for tax purposes.

Plan Documents For Traditional Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Plan Documents For Roth Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Required Documents For Individual

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

Required Documents For Spouse

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

When you’re done with all these documents, you’ll have two solo 401k plans, and 4 accounts .

What’s So Great About 401 Accounts

A 401 is a popular type of employer-sponsored retirement plan that’s available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they haven’t met this criterion yet.

In 2021 you’re allowed to contribute up to $19,500 to a 401 or up to $26,000 if you’re 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but you’ll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees’ 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Also Check: Should I Transfer My 401k To An Annuity

Best For Real Estate: Rocket Dollar

Rocket Dollar

Rocket Dollar allows you to invest in anything you can pay for with a checkbook. That means you can invest in real estate and other non-traditional assets while enjoying the tax advantages of a solo 401 account.

-

Checkbook control allows you to invest in real estate and other alternatives

-

Support for 401 loans and Roth contributions

-

Option for upgraded account that includes free wire transfers, checks, tax form filing, and other features

-

Basic accounts require $15 monthly fee and $360 setup fee

-

Premium accounts require a $30 monthly fee and $600 setup fee

If you dont want the limitations of traditional financial markets, you may want to consider Rocket Dollar. Instead of stocks, ETFs, mutual funds, and bonds, Rocket Dollar accounts give you the control to buy any asset with your solo 401 that the IRS allows. That can include rental properties, fix-and-flip real estate, or land that you think will appreciate in value. You can invest outside of real estate as well, such as private investments in a startup or precious metals, however, Rocket Dollar’s flexibility makes it the solo 401 that’s best for real estate.

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Read Also: How Do You Borrow From 401k

Who Should Get A Solo 401

Solo 401 plans are best for business owners who want the most flexibility in how they save for retirement. Before signing up for a Solo 401, you may also want to consider a SEP IRA or SIMPLE IRA as well.

Solo 401 plans take more paperwork to get started but offer more flexibility in what you are able to contribute. For example, SEP plans only accept employer contributions, while a solo 401 takes contributions from either the employee or employer. SIMPLE IRAs are available to businesses with up to 100 employees. SEP IRAs dont have that limit.

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

Don’t Miss: How To Transfer 401k From Old Employer

How To Set Up Your First 401

On your first day of work, your HR representative may have told you about an employee benefit called a 401 and that your company would even match your contributions up to a certain percent. Problem is, you may not be sure what a 401 is and why you should have one.

The short answer is this: a 401 is one of the best financial tools available to help you save for retirement.

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

Don’t Miss: Why Choose A Roth Ira Over A 401k

Organize And Rebalance Your Accounts

After years of neglect, your forgotten retirement accounts may not be properly balanced. This means there may be too much emphasis on one type of investment, or not enough on another.

If you plan to keep the IRA or company plan open, you may want to consider diversification, so theres the right amount in stocks, bonds, U.S. investments or international exposure thats appropriate for your investment goals and risk tolerance.

Youll need to check each account individually at first. However, if you can list them all in one place, youll see how your combined investment diversification stands up. An online tracking service can continue to monitor your accounts, possibly flagging you if you need to consider rebalancing again.

Online tracking services cant do the rebalancing for you, however youll have to go to each individual account to manage the rebalancing. And if the diversification seems off but its not time for you to rebalance, youll have to look at each individual account to determine which one may be out of balance the most.

Following Are Some Tips To Take Into Account When Opening The Bank Account For Your Self

Explain that a self-directed 401k falls under the Internal Revenue Code and point the banker to the following IRS website:

Explain that a solo 401k falls under the retirement trust umbrella and that the business owner can serve as the trustee of the 401k trust. The above IRS web page confirms this, and here is the specific language.

Trusts and trustees. 401 plans are funded through a trust established to hold and invest the plans assets. At least one trustee is appointed to have responsibility for the activities of the trust and its assets. This is a serious responsibility with considerable potential for liability. Trustees might include the business owner, an employee, or a financial or trust institution.

Explain that the business owner as trustee direct all investments and decide on the bank or credit union of where to hold the solo 401k trust liquid funds therefore, the bank will not serve as the trustee of any of the alternative investments and will not administer or safe-keep the solo 401k participant loan documents. Instead, these are responsibilities reserved for the trusteetypically the business owner.

Recommended Reading: Who Is Eligible For Solo 401k

How Much Should An Employer Contribute To The Plan

The amount you as an employer decide to contribute is entirely up to you. As you make this decision, consider the tax savings you can receive for making employer contributions. Employer matches are tax-deductible on federal corporate income tax returns, and some administrative fees associated with managing a 401 plan are tax-deductible as well.

You can match as much as you want as long as it stays within the IRS limitations, which combine both employer and employee contributions. According to the IRS, this combined total is the lesser of 100 percent of an employee’s compensation or $61,000 for 2022, not including “catch-up” elective deferrals of $6,500 for employees age 50 or older.

Also consider factors such as the positive impact a matching contribution can have on employee morale and worker retention strategies. Given the steep costs of hiring and training new employees, an employer match offers the opportunity to truly invest in your workforce. These considerations may help guide your decisions about how much to contribute to the 401 plan.