Year Period To Avoid 25% Penalty

Before you proceed with rolling over your SIMPLE IRA to a Solo 401k, first confirm that it has been at least two years since you first contributed to it. Reason being, you will be hit with a 25% distribution penalty on the amount of the rollover if you rollover the SIMPLE IRA before the two year period has expired.

QUESTION: Ive had my SIMPLE IRA for more than 2 years. Can I transfer it to a solo 401k plan?

ANSWER: YES you can transfer the SIMPLE IRA to the solo 401k plan since you have had the SIMPLE IRA for more than 2 years. See the following regulation:

QUESTION: Ive received the rollover check from my Edward Jones SIMPLE IRA and deposited into my Schwab pre-tax brokerage account. I just want to confirm that, per our conversation last week, no other action is required on my part at this time to complete the rollover. Next year, I just need to confirm that I receive a 1099R from Edward Jones with code G indicating that the SIMPLE was rolled over to a qualified account. Is that correct?

ANSWER: Yes, that is correct as a code G communicates to the IRS that the SIMPLE IRA funds were directly rolled over to the solo 401k plan.

About Mark Nolan

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

How To Report The Rollover On Your Tax Return

- You must report any transaction when you submit your annual tax return for both direct and indirect rollovers.

- Your IRA brokerage will send you a Form 1099-R that will show how much money you took out of your IRA.

- On your 1040 tax return, report the amount on the line labeled IRA Distributions. The Taxable Amount you record should be $0. Select rollover.

Also Check: How To Start My Own 401k

Is A 401 Plan Or A Simple Ira Best For My Small Business

401 plans are the most popular employer-sponsored retirement plan in the country, but theyre not always the best fit for a small business. Sometimes, an IRA-based retirement plan like a SIMPLE IRA is a superior alternative. While 401 plans and SIMPLE IRAs both offer automatic payroll deduction a convenience feature that makes saving for retirement 15 times more likely they have little else in common.

To choose the retirement plan thats best for your company, you should weigh its pros and cons:

|

|

|

|

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Also Check: How To Lower 401k Contribution Fidelity

How To Upgrade Your Simple Ira To A 401 Plan

If you are a business owner currently sponsoring a SIMPLE IRA, then you are likely familiar with some of the limitations of a SIMPLE IRA. For example, required annual contributions, immediate vesting schedule, no Roth or loan option, not to mention the contribution limits are significantly lower than many other types of retirement plans. Good news, there is a simpler way to save for retirement! If youve ever wondered about upgrading your SIMPLE IRA to a 401 plan, youve come to the right place.

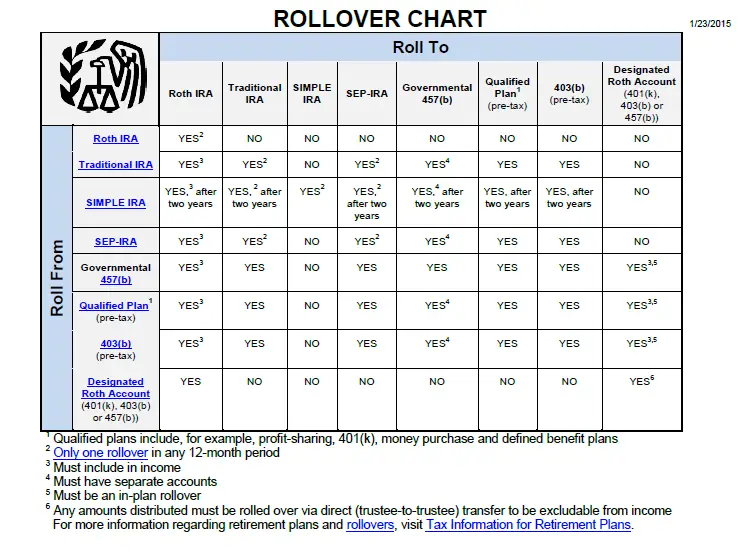

A SIMPLE IRA is a common plan for employers to start out with, however, most businesses quickly outgrow their SIMPLE IRA and find its time to upgrade to a 401 plan. The below chart outlines some common reasons why many business owners find a 401 plan a better fit than a SIMPLE IRA:

Changing a SIMPLE IRA to a 401 plan is easy, but the deadline to do so for 2022 is approaching fast. See below for a Step by Step Guide and timeline:

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022:

Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, it’s probably best to consult with a financial advisor to weigh your options.

Read Also: How To Check For 401k

Cash Or Other Incentives

Financial institutions are eager for your business. To entice you to bring them your retirement money, they may throw some cash your way. In late 2021, for example, TD Ameritrade was offering bonuses of up to $2,500 when you rolled over your 401 into one of its IRAs. If it’s not cash, free stock trades can be part of the package at some companies.

Best Practices And Strategies For Rolling Existing Retirement Funds Into An Annuity

Determining how much of your retirement savings should be in an annuity should start with an analysis of your routine expenses. Ideally, you should make sure you have a guaranteed income stream to fund at least 80% of your budget. This income stream can come from Social Security, a pension or annuities.

When you consider rolling your retirement savings into an annuity, you should be familiar with the types of annuities and the benefits and drawbacks of each. Some investment advisors say that variable annuities are not a good option because they can be expensive, complicated and unpredictable. Fixed annuities, however, are less costly to the purchaser and more reliable as far as an income stream.

You should consult a financial advisor to chart out your budget moving forward and determine how much of your retirement savings should be used to purchase an annuity. You should determine what type of annuity works best for you and whether you should purchase specific riders to modify the contract to meet your needs.

You could also use various strategies, such as annuity laddering, which takes advantage of different types of annuities to construct the income stream you need, or a split-funded annuity, which enables you to get the best of different types of annuities.

You May Like: How To Find Out If Deceased Had 401k

It Involves A Roth Conversion And Following Rules To Avoid A Penalty

If you leave your job and leave behind a Savings Incentive Match Plan for Employees individual retirement account , you have the option to roll over the SIMPLE IRA balance to a traditional IRA or another SIMPLE IRA planor, depending on your new employers plan, you may be eligible to roll the funds into a 401 plan with your new employer.

If, however, your ultimate goal is to roll over your SIMPLE IRA to a Roth IRA, you need to process a Roth IRA conversion. Follow these steps to complete the transaction.

I Can’t Find Any Specific Irs

- I can’t find any specific IRS guidance regarding a trustee-to-trustee transfer to a SIMPLE IRA from an IRA that is not a SIMPLE IRA, but it seems that such a trustee-to-trustee transfer pursuant to IRS Revenue Ruling 78-406 should be permitted because the restriction on the movement of funds to a SIMPLE IRA disappears upon the SIMPLE IRA reaching the 2-year mark. Given the absence of specific guidance, though, perhaps the clearing firms are just being cautious about allowing such transfers.

- I’m not sure what the benefit would be for the participant to move funds to a SIMPLE IRA from an IRA that is not a SIMPLE IRA other than to consolidate accounts for simplicity.

Recommended Reading: How Do I Cancel My 401k With Fidelity

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

How To Roll An Ira Into A 401

The IRS offers two to consider when making the switch from an IRA to a 401. However, each company may have its own rules about whether theyâll accept rollover funds. A companyâs HR department may be able to advise how to proceed.

- Direct rollover: With this approach, the IRA plan administrator rolls funds directly into the 401 account. No taxes will be withheld from the transfer amount.

- 60-day rollover: Here investors have 60 days from the date they received a distribution to roll it over to another plan. Taxes will be withheld from a distribution, so investors will need to use other funds to roll over the full amount of the distribution.

Having a clear rollover plan ahead of time can help investors avoid unnecessary tax liabilities when transferring IRA funds into a 401.

Don’t Miss: Can I Use My Fidelity 401k To Buy A House

What Is A 401k Rollover

A 401 rollover occurs when you choose to roll over the funds thatyou have left behind in your former employers 401 plans. Completing thistype of rollover is a good idea for a couple of reasons.

People today change jobs an average of12 times during their lifetimes. If you have contributed to 401 plans atmultiple former employers, it can become difficult to keep track of all of yourinvestments. The investments allowed in 401 plans are often limited, andthey may include company stock. If your former employer goes under, yoursavings may go with it.

Rolling An Ira Into A : Is This Possible

For some reason, this is one of those questions that has people confused even though the answer is fairly simple. In short, you can definitely rollover an IRA into a Self-Directed Solo 401. The reason for this is that the Solo 401 is an IRS approved Qualified Retirement Plan. The IRS states this clearly in its regulations:Kinds of rollovers from a traditional IRA. You may be able to roll over, tax free, a distribution from your traditional IRA into a qualified plan. These plans include the Federal Thrift Savings Fund , deferred compensation plans of state or local governments , and tax-sheltered annuity plans plans).However, there is one caveat. Although most kinds of IRAs may be rolled over into a Solo 401, there is one exception to the rule. The IRS regulations say that Roth IRAs may not be rolled over into a Qualified Plan. Thus, if you have a Roth IRA, you are fairly limited as to rollover options. The Roth IRA obviously doesnt prevent you from opening another account, but the specific funds themselves are somewhat inaccessible.This is not true, however, with a Roth 401. A Roth 401 may be rolled over into a Self-Directed Roth Solo 401 without any problems.

Also Check: Can A Sole Proprietor Have A 401k

Disadvantages Of A 401 Rollover Into An Ira

Rolling over a 401 into an IRA does have some disadvantages, so youll have to weigh these against the advantages.

- Early separation from service. All retirement plans discourage you from taking withdrawals before reaching the age of 59 ½. Thats what the 10% early withdrawal penalties are all about. But the penalty is waived on distributions taken from a 401 plan as early as 55 under the . This exemption does not apply to IRA accounts.

- Greater legal protections for employer plans. As ERISA plans, 401 plans are generally protected from . However, under federal bankruptcy laws, up to $1,362,800 in traditional and Roth IRAs are protected in bankruptcy proceedings. And in most states , IRAs are also protected from creditors.

- Convertibility to a future employer plan. While you can generally roll over a previous employer 401 to a new employer plan, the same is not generally true with an IRA.

- Youre happy with the investment performance of your existing plan. If you dont have much investment experience, and youre satisfied with the returns on your old 401, moving the money to an IRA may not be in your best interest.

What Are Your Options

When you leave an employer with whom you had a SIMPLE IRA, you have a few options for those assets. Funds from a SIMPLE IRA can be rolled over into another SIMPLE IRA, a traditional IRA, or another qualified plan, such as a 401. But just like with a 401, you have to ensure that you follow the proper process. This can help you avoid taxes or penalties on the asset transfer.

Opt for a trustee-to-trustee transfer, which will cash out your assets in your former employer’s SIMPLE IRA plan. Then, either cut a check or do a wire transfer for the benefit of your rollover SIMPLE IRA. That way, the funds can be deposited in your new rollover account.

Also Check: Can You Transfer 401k To Another Company

Limiting Taxes With A Simple Ira Rollover

You will normally pay income tax on withdrawals you take from your SIMPLE IRA plan. You’ll have to pay an additional 10% penalty if you take withdrawals before you reach age 59½ unless you qualify for an exception, such as if you have a disability or you receive the withdrawal as an annuity.

You can avoid either of these financial losses if you roll your SIMPLE IRA assets into a 401 when you leave your employer. Your age isn’t a factor in this case, either, because the rollover isn’t considered to be a withdrawal when you time it properly.

Where Do Traditional And Roth Rollovers Go

- At Rocket Dollar’s preferred banking partner, you can open two trust bank accounts: One for Traditional dollars and one for Roth dollars.

- If you plan on making both Traditional and Roth contributions, you should open both accounts! MAKE SURE to name them correctly, and that you do not commingle Traditional and Roth dollars!

- If you plan on making Roth conversions, you should open a third trust bank account for pre-tax conversions. This is commonly referred to as an “After Tax” account.

- You can open as many or as few checking accounts as you wish for whatever suits your needs. Many customers only open one if they only want to make one type of contribution.

- If you are having a spouse join you as part of your Solo 401 plan, keep in mind you will need to double the number of bank accounts. Spousal money cannot commingle. Even though there is one Solo 401, spouses are two different taxpayers.

Also Check: How To Find Out If Someone Has A 401k