Trading Securities Using A 401 Brokerage Account

Until recently, investment options provided in a 401 were mainly mutual funds, annuity contracts, guaranteed accounts, and company stock. However, some plans now allow plan participants to buy and sell securities using a 401 brokerage account, also known as a self-directed brokerage account.

A 401 self-directed brokerage account allows investors to take big risks with retirement savings. Usually, employers who offer 401 brokerage accounts must list the 401 with specific investment firms that offer brokerage services. Participants are then allowed a specified window when they can move funds from their 401 account into the brokerage account. Once the transfer is made, participants can trade various securities such as stocks, mutual funds, and ETFs tax-free. In some cases, investors can take greater risks such as trading on margin and trading call and put options.

Trade Stocks In A Solo 401k Plan

Now you have an understanding of how convenient it is holding a stock brokerage account inside of your Solo 401k. With that, youre going to want to know about strategies available inside the brokerage account. Coming soon is Part 2 of this blog that will cover more in-depth topics including:

- How do I trade options?

- Can I buy futures in my retirement plan?

- How do I short stocks in a Solo 401k?

- Can you do uncovered calls in a retirement plan?

- Can I buy LEAPS in a retirement plan?

Perhaps you are currently most comfortable investing in stocks and bonds. In the future it may be worth expanding your vision to learn about alternative investments like real estate or bitcoin. Or perhaps youre already highly experienced with alternative investments. For diversification, youd like to cast an even wider net for your portfolio that includes a brokerage account. A Solo 401k is the one account that puts you in full control of when, where, and how you want to invest.

Stocks To Buy For Your Rollover Ira: Senior Housing Properties Trust

Few companies in the world have better demographic tailwinds supporting them than Senior Housing Properties Trust . Americas Baby Boomers are aging rapidly, and Senior Housing is there to meet their needs.

Despite its name, Senior Housing is not a pure play on the senior housing market, since 29% of SNHs portfolio is invested in independent living facilities with another 23% in assisted living. Medical office buildings make up 42% of the portfolio. And importantly, 97% of Senior Housings net operating income comes from private-pay properties exposure to Medicare is minimal.

As a REIT, Senior Housing escapes federal taxation so long as it dishes out virtually all of its income as dividends. And even by REIT standards, Senior Housings yield is fat at 9.3%.

Senior Housings stock price has lagged its peers for a long time. When you buy this REIT, you do so with the understanding that most of your return will coming from the dividend. And by holding Senior Housing in a rollover IRA, you can avoid having to share that dividend with Uncle Sam.

Donât Miss: How To Pull From 401k

Don’t Miss: What Amount Should I Put In My 401k

Investment Real Estate Swap Question:

Good question. However, such transaction would run afoul with the prohibited transaction rules. While it is true that siblings are not disqualified parties on the surface, what would make such transaction prohibited is that the siblings would be using their respective solo 401k plans to swap their personal investment properties.

Read Also: What Happens When You Roll Over 401k To Ira

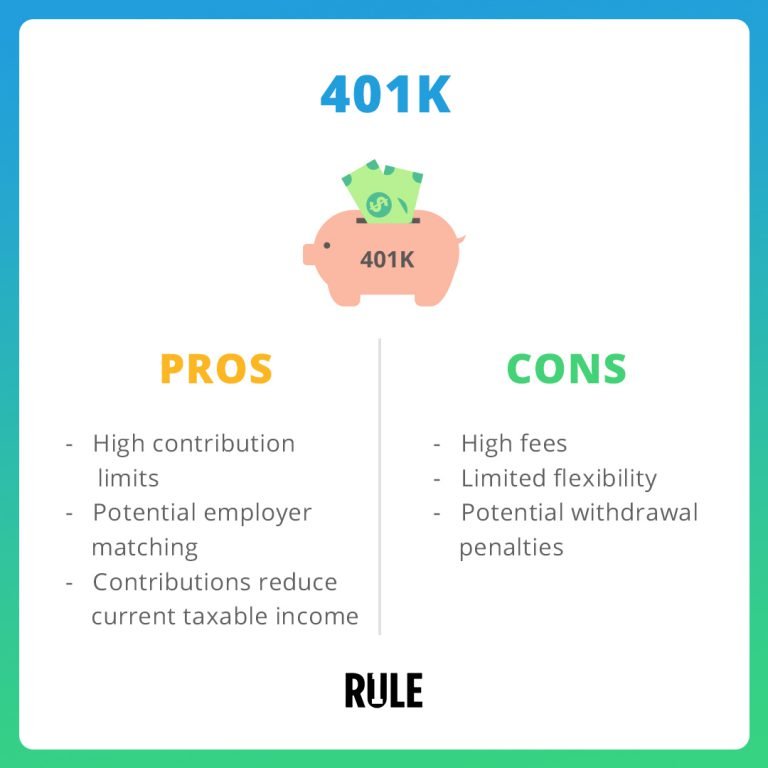

Should You Invest In Company Stock In Your 401

This is part two of a two part series on 401s: determining if you should invest in your company stock in your 401.

If you missed part one, you can find it here. We highlight the five things you should do before maxing out your 401.

Maybe well do a part three. Not sure yet If you have any ideas or questions or 401s then let me know!

Anyway, to the topic at hand.

While in this article we are focusing on whether or not you should invest in your company stock in your 401, this is also a broader topic. It includes if you should invest in your company stock at all .

Well dive into all of that and more, but first, a quick refresher on 401s. If youre already a 401 expert, you can skip ahead to the next section of the article.

And, if you havent heard of Blooom, theyre a 401 robo-advisor that can give you a free 401 check-up, offering great tips and advice on how to optimize your 401. You can get your free analysis with them below:

Not Sure if Youre Doing this 401 Thing Right?

Read Also: Do You Pay Taxes On 401k Withdrawals

Should You Own Stocks In Retirement

Suppose you have $200,000 saved, and you decide it would be okay to die with exactly $0 in the bank. In the meantime, youll need $10,000 per year for the next 30 years to live. Your $200k would have a required minimum return of around 3.35% to accomplish your lifestyle goal of $10,000 per year.

If you can accomplish that goal with something safe and guaranteed, like an immediate annuity, then why take on risk? On the other hand, what if you had $300,000 saved? Then, perhaps the first $200k could be used to secure your lifestyle goal the remainder could be used to invest in stocks. At that point, you could afford to take a risk with the extra $100k.

But what if you require your stock portfolio to earn average returns in order for your plan to work? In that case, you could not afford to take the risk.

Your Solo 401k Account Has All Of The Options

There are few limitations with a brokerage account opened in the name of your Solo 401k. You can invest in any openly traded stocks, mutual funds, options trading, and other derivatives.

One advantage in having a brokerage account inside of your Solo 401k is the ease of transferring money. Once funds are inside your 401k, you never have to be concerned about fund rollovers, sending checks between accounts, or any similar hassles. Although the brokerage account is a separate account within your Solo 401k, all of your funds are expediently in the same place. Its just a separate account for holding funds that have a different purpose. Moving funds between internal accounts are not considered a transfer or rollover, which means no troublesome IRS reporting is required. As the Solo 401k plan administrator, always keep an internal accounting of fund movements. However, as plan admin you can also easily move funds back and forth as you see fit.

You May Like: How To Start My 401k

About 40% Of Companies Offer Self

Illustration by Jon Krause

While most IRA providers allow you to invest in a broad universe of mutual funds, exchange-traded funds and individual stocks, the rules for 401s and other employer-provided retirement plans are typically more restrictive. Most offer a limited menu of mutual funds from which to choose, including target-date funds, which are one-stop portfolios of stocks, bonds and other assets that gradually become more conservative as you near retirement.

Many employees are just fine with a limited selection. Studies have shown that offering workers too many options reduces participation rates. Faced with too many choices, some workers simply throw up their hands and walk away. In addition, employers are required by law to act in the interest of plan participants, which makes them reluctant to offer untested or risky investment choices.

The self-directed brokerage option. But what if youre interested in taking a little more risk in exchange for potentially higher returns? About 40% of companies offer self-directed brokerage accounts in their 401 plans, which allow participants to invest in a much broader menu of mutual funds, ETFs and, in some cases, individual stocks. A small 401 provider, ForUSAll, is even allowing its participants to invest up to 5% of their account balance in cryptocurrency.

Can You Invest Your 401 In Individual Stocks

According to CNBC, 36 percent of Americans dont think theyll ever have enough money to retire. So if youve got a 401k through your employer and youre making regular pre or post-tax contributions each month, youre in great shape financially.

But as a working professional with a standard 401k and a talent for spotting amazing stocks, you might be wondering how much control over your retirement fund you really have.

Can you purchase individual stocks through your 401k? Can you use those funds to buy shares in Amazon or Disney? Read on to find out the answers to these questions and more.

Don’t Miss: How To Rollover A 401k Without Penalty

Go With The Simplest Option

Alternatively, you can opt for a target-date fund, which takes most of the guesswork out of the equation. With these funds, you select a “target” retirement year and risk tolerance, and the fund is automatically set to an appropriate asset allocation for you. These are great options for beginner investors.

“Most people aren’t interested in researching selecting funds for their 401,” Charles C. Weeks, a Philadelphia-based CFP, tells CNBC Make It. “Target date funds will help people avoid blowing up their portfolios by making avoidable mistakes like putting too much in one asset class, chasing returns by investing based on past performance and/or letting greed and fear dictate their investment strategy.”

Over time, the fund will automatically rebalance, becoming more conservative as you near retirement. If you choose a target-date fund, you only need to choose the one fund otherwise you’re essentially canceling out its benefits. Another mistake to avoid with target-date funds is choosing a year without researching how it will change its mix of stocks and bonds over time, Howard Pressman, a Virginia-based CFP, tells CNBC Make It.

How Do You Own Stocks In Retirement

If you meet the criteria above, the next thing to understand is how to own stocks. This doesnt mean putting a large portion of your funds in a single stock. It also doesnt mean sprinkling your money across a handful of stocks that you researched or read aboutunless it is a small part of your total retirement funds, and you dont require that portion to help you meet your retirement income needs.

What it should mean is putting an appropriate portion of your money into a diversified portfolio of stock index funds. By doing that, you get exposure to nearly 15,000 publicly traded companies across the globe. You also significantly reduce the amount of investment risk you are taking.

You May Like: Can I Rollover My 401k To A Roth Ira

Option #: Single Stocks

When you buy single stocks, youre basically betting on the performance of one company. Most people who dabble with buying and selling stocks try to time the market. Theyll buy a stock when its value is low and then plan to sell after its value rises in order to make a profit.

Instead of taking a buy and hold approach to investingwhich means you hold on to your stocks for longer periods of time regardless of what the stock market is doingmost stock traders will try to sell their stocks after just a few days or weeks to make a quick profit.

The Bottom Line: Lets be really clear herewe do not recommend investing in single stocks! Theres just too much risk in having your investments tied to the performance of just a handful of companies. And unless you have a crystal ball lying around, its very difficult to pick out the winners from the losers. Investing in single stocks is more like going to a casino in Vegasyou walk in expecting to make a small fortune but youll probably walk out with shattered dreams and empty pockets.

Ways Around The Limitations

One way to use your 401 to purchase private stocks is to take out a 401 loan. Not all plans have provisions for retirement loans, so once again, you will need to check with your plan administrator for more information. The IRS also has its own set of rules that govern retirement plan loans. Visit the agencys website for more retirement plan topics covered in depth.

Converting or rolling your 401 into an individual retirement account, or IRA, is another way for you to purchase private stocks using your 401. Before trying to access the funds in your 401, be certain you are familiar with how your plan is structured as well as any IRS consequences you could face.

References

Tips

- Research the funds in your 401 to determine what companies and industries it includes. If you donât want to take the risk of borrowing or withdrawing from your 401 to purchase privately-held stocks, you can adjust your 401 to invest in funds that target the specific companies or industries in which you have interest.

Warnings

- Contributions to 401s enjoy preferential tax treatment. Carefully research how changes to your account would affect your taxes and balance those considerations with the risks associated with privately-held stock purchases.

Writer Bio

Don’t Miss: How To Split 401k In Divorce

Which Option Is Right For You

There’s no wrong answer when it comes to deciding where to invest, and the right move for you will depend on your tolerance for risk as well as how much time and effort you’re willing to put into your investments.

Individual stocks can be riskier than a 401, because it’s up to you to choose the right companies. If you invest in a few bad stocks, it’s possible to lose a lot of money. But if you invest in even one fantastic stock, it could potentially be lucrative. You’ll just need to decide whether that potential for reward is worth the risk.

Also, consider how much time you can afford to spend on building a portfolio. Many people don’t have hours to spend researching stocks, and even if you do have that time, not everyone has enough interest in it to make individual stocks worthwhile. That’s OK, and it simply means that a 401 may be a better fit for your situation.

Both individual stocks and a 401 can be fantastic investments, but the right option for you will depend on your personal preferences. Regardless of which approach you choose, investing in the stock market can put you on the path to generating wealth that lasts a lifetime.

The Motley Fool has a disclosure policy.

More Difficult To Create Sound Retirement Portfolio

The vast range of investment alternatives available inside a brokerage account can make it harder to construct a sound portfolio, and numerous transactions with their corresponding fees and commissions will inevitably erode the returns received by participants.

Those who do not have a predetermined investment plan also risk allowing their investment decisions to be driven by their emotions, which can lead to chasing hot stocks or funds and buying high and selling low.

Read Also: How To Cash Out Your 401k Fidelity

What Kind Of Investments Are In A 401

A 401 plan will typically offer a range of investments, but any single plan may not offer all possible types of investments. The most common investment options include:

- Stock mutual funds: These funds invest in stocks and may have specific themes, such as value stocks or dividend stocks. One popular option here is an S& P 500 index fund, which includes the largest American companies and forms the backbone of many 401 portfolios.

- Bond mutual funds: These funds invest exclusively in bonds and may feature specific kinds of bonds, such as short- or intermediate-term, as well as bonds from certain issuers such as the U.S. government or corporations.

- Target-date mutual funds: These funds will invest in stocks and bonds, and theyll shift their allocations to each based on a specific target date or when you want to retire.

- Stable value funds: These funds invest in low-yield but very safe assets, such as medium-term government bonds, and the returns and principal are insured against loss. These funds are more appropriate for investors near retirement than for younger investors.

Some 401 plans may also allow you to buy individual stocks, bonds, ETFs or other mutual funds. These plans give you the option of managing the portfolio yourself, an option that may be valuable to advanced investors who have a good understanding of the market.

Should You Buy Individual Stocks

If youve got a traditional 401k, you may not be able to make direct purchases. But if you want to buy individual stocks, you do have multiple investing options available to you. All you have to do is open an account, choose your stocks, compare different investing services Motley Fool vs Morningstar, and watch your portfolio grow.

Did you enjoy reading this post? Check out the rest of our site to see more content like this!

You May Like: How To Transfer 401k From Charles Schwab To Fidelity

Investing 101 For Your 401

Many peopleâs first exposure to investing is their employerâs 401 plan. But what is investing and what do you need to understand to retire the way youâve envisioned? Well, letâs cover some basics, offer some quick education resources, and dive into how to think about saving for retirement with your 401.

What is Investing?Investing is putting your money into assets with the goal to receive income or profit. Common asset classes in investing are stocks and bonds, and may include Real Estate Investment Trust , commodities, etc. For definitions of these types of investments, scroll through our glossary. Know that your 401 will typically have a fund that holds one or more of these asset types such as a basket of stocks or bonds.

What Types of Investments Do 401 Plans Offer?401 plans will typically offer a curated list of Exchange-Traded Funds , or traditionally, mutual funds. A 401 plan is designed to provide a diversified investment line-up to help you invest for tomorrow while minimizing the chance for sustained large losses. This is typically why you donât see the option to purchase individual stocks. An employer is required to review and monitor the investment offering to ensure itâs appropriate and has good funds â or employers will have this professionally managed if they donât have investment experts on staff .