Use A Roth Ira Before Retirement For Other Purposes

The ability to tap money in a Roth IRA without penalty before age 59 1/2 allows for flexibility to use the Roth IRA for other purposes. In essence, this account can act as an emergency fund and could be used to pay off significant unexpected medical bills or cover the cost of a childs education.

But its best to only tap into these funds if its absolutely necessary. And if you must withdraw any money from a Roth IRA before retirement, you should limit it to contributions and avoid taking out any earnings. If you withdraw the earnings, then you could face taxes and penalties.

Dont Miss: What Is 401a Vs 401k

Roth Conversions: When Should You Convert Your Ira Or 401 To Roth

Roth conversions remain popular as many fear that tax rates will only increase in the next few years, so why not convert now at lower tax rates and let the account grow and come out tax-free at retirement. Remember, if you have a traditional IRA or 401, then that money grows tax-deferred, but you pay tax on the money as it is drawn out at retirement. If you have traditional dollars where you obtained tax deductions for those contributions, you then have to pay tax on the amount you want to convert to Roth.

When you are contributing you get zero tax deductions on Roth IRA and Roth 401 contributions but they grow and come out tax-free at retirement. Whats better? Well, in the end, the Roth account is a much better deal as youre pulling out what you put in AND the growth of the account after years of investing and saving. Thats likely a larger amount than what you put in so youd typically be a better-paying tax on what you put in rather than paying tax on the larger sum that you will take out later. The trade-off, of course, is youre playing the long game. Youre skipping a tax deduction or paying tax now to convert in return for tax-free growth and tax-free distributions at retirement. The Roth seems to be the better deal. Yet, most Americans have been sucked into traditional IRAs and 401s because we get a tax deduction when we put the money in a traditional account, saving us money on taxes now.

Roth 401s As An Alternative

A Roth 401 combines the employer-sponsored nature of the traditional 401 with the tax structure of the Roth IRA. If your employer offers this type of plan, youll contribute after-tax money to your account and you wont owe taxes when you start receiving distributions. If your employer offers a match, though, that money is in a traditional 401 plan. So if you choose to convert it, you will owe taxes on it the year you do so.

If youre looking to do a rollover from a Roth 401 to a Roth IRA , the process is quite simple. All youll have to do is follow the same steps as if you were rolling over a traditional 401 to a traditional IRA. The tax structure is staying the same. If youre looking to convert your Roth 401 into a traditional IRA, youre out of luck. Unfortunately, this isnt possible, since you cant un-pay taxes on the money in your Roth 401.

You May Like: How To Find Your 401k

What Is A Roth Conversion

A Roth conversion involves taking money from a tax-deferred account and moving it into a Roth account, where it will grow tax-free. Taxes will come due on the amount you move into a Roth in that tax year, just as they would if you took the funds out in retirement.

The IRS doesnt care whether youre reinvesting the tax-deferred account distribution or youre spending it on your retirement pleasures, when its withdrawn from your traditional IRA. That money wasnt taxed at the time you made contributions, so its taxable now.

The tax is due for the tax year in which the distribution is taken. For example, you would report the income on your 2021 tax return filed in 2022 if you take the conversion withdrawal any time from Jan. 1 through Dec. 31, 2021.

What Are The Benefits Of A Roth Ira

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Read Also: Can I Open A 401k On My Own

Can You Withdraw Contributions From A Backdoor Roth Ira

And you can withdraw both your contributions and earnings from a Roth IRA with no taxes or penalties after you turn 59 and a half, as long as the account is at least five years old. Otherwise, you will be subject to the 10% tax penalty unless an exception applies .

How do you remove a backdoor from a Roth IRA?

To reverse a conversion by returning an account to traditional IRA status, you must submit the required form to the Roth IRA trustee or custodian by October 15 of the year following the conversion.

Can I withdraw my contributions from a Roth IRA conversion without a penalty?

As a general rule, you can withdraw your contributions from a Roth IRA at any time without paying any taxes or penalties. If you withdraw money from a conversion too soon after that event and before the age of 59 and a half, you could incur a penalty.

When You Should Consider Converting A 401 To A Roth Ira

If you anticipate your tax bracket being higher in retirement due to required minimum distributions or other sources of income, then it may make sense to pay income tax now while you are in a lower tax bracket.

Another reason to convert to a Roth is when you have a sizable pool of tax-free Roth assets relative to your tax-deferred retirement accounts. The tax benefits of a Roth IRA are most significant in this case. If your Roth IRA savings are only 5% or 10% of your entire retirement savings, it may not be enough to justify the loss of tax deferral.

Keep this in mind as an isolated conversion of relatively small dollar value may not make a material impact on your overall wealth. A financial plan can help you weigh whether maintaining tax-deferred growth is a better strategy to maximize your wealth.

You May Like: When I Withdraw From My 401k

But Which Calculator Can You Trust

Please pay close attention because you could lose $100,000 or more with the wrong Roth Conversion Calculator.

There are over a hundred free ones online, and thats about what they are worth.

So many are simplistic and chintzy its as if some teenager threw one together for a school project.

Many of these online calculators cut corners. They dont ask enough questions about your personal situation to give meaningful results.

So the one-size-fits-all approach wont do when your lifes savings is on the line.

Even worse: more than two out of three calculators gave wrong answers, according to the prestigious CPA Journal.

And most of the calculators require you to enter your private financial information in an online form. NEVER do that.

There are good, expensive IRA conversion calculators that tax professionals use for their clients.

You get what you pay for.

But I practically give away the one I use for my clients.

Now, my Roth conversion calculator is one of the most powerful available today.

Yet its easy to use

With a click of your mouse, youll open the Excel spreadsheet. On the front page, you will quickly:

Just click the mouse and youll see everything unfold before your eyes.

Its that easy.

Check out what the pros say:

Even though its worth every penny of that $1,000 value and because I have a multi-year waiting list for new clients

I feel an obligation to nearly give away my Roth IRA conversion calculator spreadsheet.

A Conversion May Affect Government Programs

If you participated in government healthcare programs or others that depend on your income, its vital to note that a conversion could affect your eligibility in those programs or their cost.

The Roth conversion is viewed as taxable income in the year it occurs, says Keihn. This means that it could affect your eligibility for Obamacare or financial aid or your childrens financial aid. If you are on Obamacare or completing a FAFSA application, it is important to factor that into the decision of how much to convert, if any.

People who are two years from receiving or are receiving Medicare benefits need to know that their Medicare premium most likely will go up two years after they convert to a Roth IRA, says Gilbert. Medicare has a two-year look-back to determine premiums and in the year you convert, your income will be higher than other years. But this is a one-year spike that will then decrease the following year.

Read Also: How Can You Take Out Your 401k

You May Like: How To Invest 401k In Stocks

Will You End Up In A Higher Tax Bracket

All or a portion of the money you convert could be considered “reportable income” by the IRS. If you’re on the cusp of the next tax bracket, there’s a chance you’ll get bumped up in the year you convert.

To avoid this, consider converting a portion of your traditional IRA. This could help you:

- Stay out of that higher tax bracket.

- Spread the taxes related to the conversion over a few years instead of getting hit with the entire bill in 1 year.

Dont Wait All Year To Pay

Most people pay their income tax to the government with every paycheck. Its automatically withheld, based on the withholdings you claim on Form W-4. As the year goes on, your taxes are withheld for you. You dont have to write a separate check to the government until you file your taxes. And thats only if you didnt have enough money taken out and you still owe.

But small business owners and corporations make estimated quarterly tax payments. These entities must estimate how much tax theyll owe based on their income and expenses. And then, each quartertypically on the 15th of April, June, Sept., and Jan. of the following yearthey fill out a form and send in their payments.

Why is this important to note? If you convert a substantial traditional IRA to a Roth IRA early in the year, your quarterly incomeand therefore, your quarterly taxeswill increase.

Say you convert during the first quarter of the year. You would need to pay the tax triggered by the conversion when your quarterlies are due. In this example, that would be by April 15.

If you wait until the end of the year or when you file your taxes, you could owe penalties and interest.

Read Also: Where Can I Rollover My 401k To An Ira

Pros And Cons Of A Roth Conversion

Your current income tax rate, your expected future tax rate, and the anticipated rate of return on your investments all factor into whether a conversion is a good, or bad, idea for you. These might not be easy determinations to make. Fortunately, there are many calculators available online to assist you.

The most critical issue might be whether you have the money available to pay the taxes that will come due. If you have to use any of the money you took out of your tax-deferred account to pay the taxes, this might be a strong indication that a Roth conversion might not be appropriate right now. Youre just giving the IRS a portion of your retirement savings before you have to.

-

Favors lower tax bracket early on

-

Major savings possible

-

Early tax hit can be detrimental to higher tax brackets

-

Funds must be reinvested to get the benefits

Eligibility Tax And Investment Considerations

A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan, such as a 401 or a traditional IRA, to a Roth IRA. Converting makes sense if you believe that the benefit from your money growing tax-free will be greater than the immediate cost of paying the taxes due at the time of the conversion.

A Roth conversion of an existing retirement account is a major decision, particularly in a year when your income might be at least marginally off-track due to circumstances beyond your control. Making the right call for your circumstances can be easier when you understand the logistics and the tax implications of such a move.

You May Like: How To Open Up A 401k

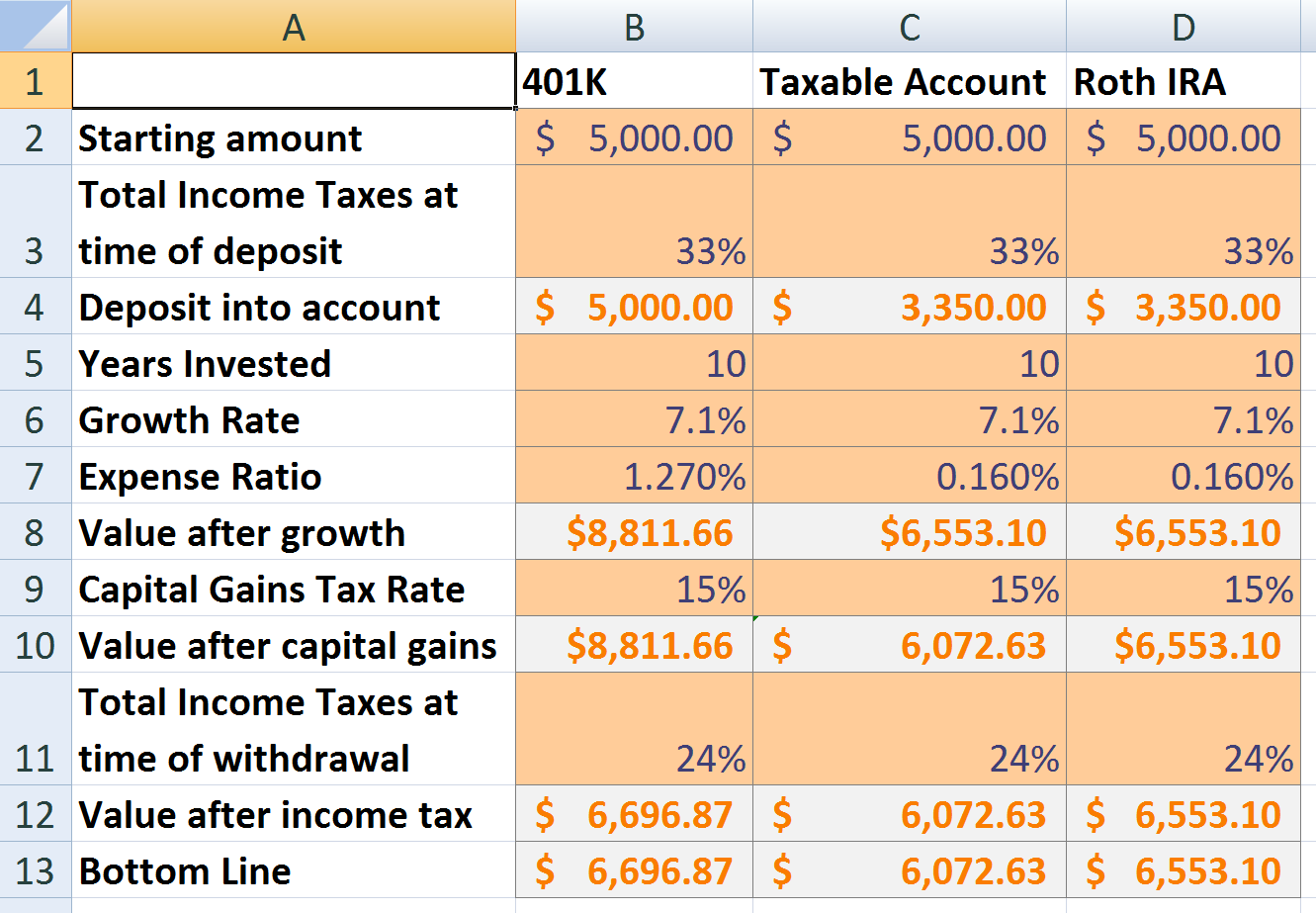

Should You Invest In A 401k Or A Roth

Many new investors wonder if they should invest in a 401k or Roth IRA. Both are tax-advantaged retirement accounts, but there are differences between the two. Ideally, you should be getting the most out of your 401k and Roth IRA. This is what they do. But if youre just starting out, this is a lot of money. Some people cant add that much.

Cares act 401k withdrawal deadline 2021

Additional Roth Ira Calculators

Roth IRA Conversion Calculator – Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same funds in your Roth IRA. Comparing the two will help you determine if a Roth IRA conversion is right for you.

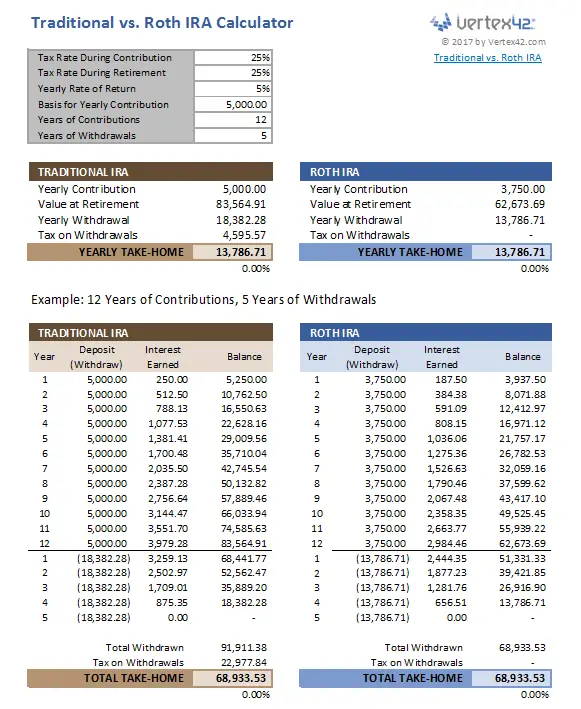

Roth IRA vs. Traditional IRA Calculator – Use this calculator to determine which retirement account is best for you – a Roth IRA or a Traditional IRA. Discover why your current tax rate and expected future tax rate play a pivotal role in your decision.

Roth IRA Savings Calculator – Use this calculator to estimate the inflation-adjusted value of your Roth IRA at retirement age. Experiment with different starting balances, annual contributions, rates of return, inflation rates, and retirement ages to help set the parameters of your retirement plan.

Roth IRA Contribution Calculator – Use this calculator to determine the dollar amount of the annual contribution you need to make in order to meet your desired Roth IRA retirement balance.

Check out our new and follow us on !

Are you confused or frustrated by the stock market? Learn how to build real wealth selecting individual stocks for your Roth IRA…

Read more about what’s new on the Roth IRA blog.

Hi, I’m Britt, and this is my wife, Jen. Welcome to our Roth IRA information website!

But you want to know the best part? …You can do the same thing! Anyone with a hobby or a passion can create a profitable site that generates extra income.

You May Like: How To Calculate Max 401k Contribution

Converting An Ira To Roth After Age 60

Retirement savers who convert pre-tax retirement accounts such as IRAs to after-tax Roth IRAs after reaching age 60 can keep growing funds tax-free and then make withdrawals in retirement without paying taxes. They avoid early withdrawal penalties and also dont have to take required minimum distributions , which can hike their post-retirement taxes. On the downside, theyll have to pay a hefty tax bill when they convert, and then wait five years to make tax-free withdrawals. A financial advisor can provide valuable insight and guidance as you consider what to do with your IRA.

Understand How Taxes Work Before You Make A Move

The main difference between traditional retirement accounts and Roth IRAs are when taxes are paid. For example, a traditional IRA typically allows you to take an up-front tax deduction and pay your tax bill during retirement. However, if you convert your traditional IRA to a Roth IRA and you already received a tax deduction, you’ll have to pay income taxes for the year.

There are ways around a hefty tax bill, but it can be tricky if you contribute to other traditional IRA assets like a . You should seek the help of a professional to determine if a backdoor Roth IRA is the best strategy for you before making a move.

Recommended Reading: What Is An Ira Account Vs 401k

Backdoor Roth Ira To The Rescue

When your income exceeds the threshold, you won’t be permanently banned from the Roth IRA club. You may be able to legally sneak your money into the account through the backdoor Roth IRA.

Here’s how it works. If you have a traditional IRA or 401, you can move those funds to a Roth IRA. This can come in handy if you’re trying to shelter your retirement balances from hefty taxes during retirement.

Let’s say you have $50,000 in your 401. You can do a direct rollover or ask about the 60-day rule. You’ll pay taxes on your conversion from a traditional 401 to a Roth IRA when you make the switch, but you’ll lock in tax-free gains and income later. If you think you’ll be in a higher tax bracket later, this may be a smart move for you to make.

What Should I Do With An Old 401

You might have an old 401or severallying around from previous employers. Transferring the money from a 401 to your new employers Roth 401 might seem like an appealing option. But just remember, youll get smacked with a tax bill if you go that route.

Rolling your old 401 into a traditional IRA is another way to go. Youll have more control over your investments and will be able to choose from thousands of funds with the help of your financial advisor. Plus, you wont face any tax consequences since youre moving from one pretax account to another.

If you arent able to transfer your money into your new employers plan but think a Roth is for you, you could go with a Roth IRA. But just like with a 401 conversion, youll pay taxes on the amount youre putting in. If you have the cash available to cover it, then the Roth IRA might be a good option because of the tax-free growth and retirement withdrawals.

Don’t Miss: Can You Move An Ira To A 401k