Eligibility & Contribution Limits

Your eligibility for a 401 plan simply depends on whether your employer offers them. Generally, you have to inquire a little bit more about taking advantage of an employer match program.

On the other hand, without an employers help, a Roth IRA may not prove available to everyone. For one, you have to find an institution with which to open your account. Some institutions may only accept applicants with high deposit amounts, limiting their products to more wealthy clients.

Its important to note, however, that Roth IRAs offer a solid savings option for those with lower income. This is because you fund a Roth IRA with after-tax money, making your withdrawals tax-free. This structure comes in handy for people who see themselves in a higher tax bracket in retirement.

Plus, Roth IRA rules and limitations tend to phase out higher earners. For tax year 2023, total contributions to Roth IRAs cannot exceed $6,500, or $7,500 for those over 50. Those numbers were $6,000 and $7,000 respectively in 2022. To the opposite, 401 plans have much higher contribution limits.

For tax year 2023, you can contribute up to $22,500 to your 401. For tax year 2022, the limit was $20,500. Dont forget that if your employer matches your 401 contribution, their match does not count towards that limit. Instead, you have to ensure your total annual 401 contributions do not exceed the lesser of 100% of your salary or $66,000 in 2023.

Retirement Accounts Are Essential For Planning For The Future

In addition to having retirement accounts, having a high savings ratewhich is essentially how much money you save each month compared to your gross incomecan also be highly beneficial.

Retirement accounts are essential for financial success and so that you can have a solid amount of money saved up when you retire. With a better understanding of an IRA vs. 401k, you can move onto Chapter 7, where well cover the differences between a 401 vs. 403b.

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Third-party links are provided as a convenience and for informational purposes only. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Save more, spend smarter, and make your money go further

Q: Can I Open A Roth Ira And Another Retirement Account

A: Yes! You can contribute to a Roth IRA, 401, traditional IRA, and as many other accounts you want and you should!

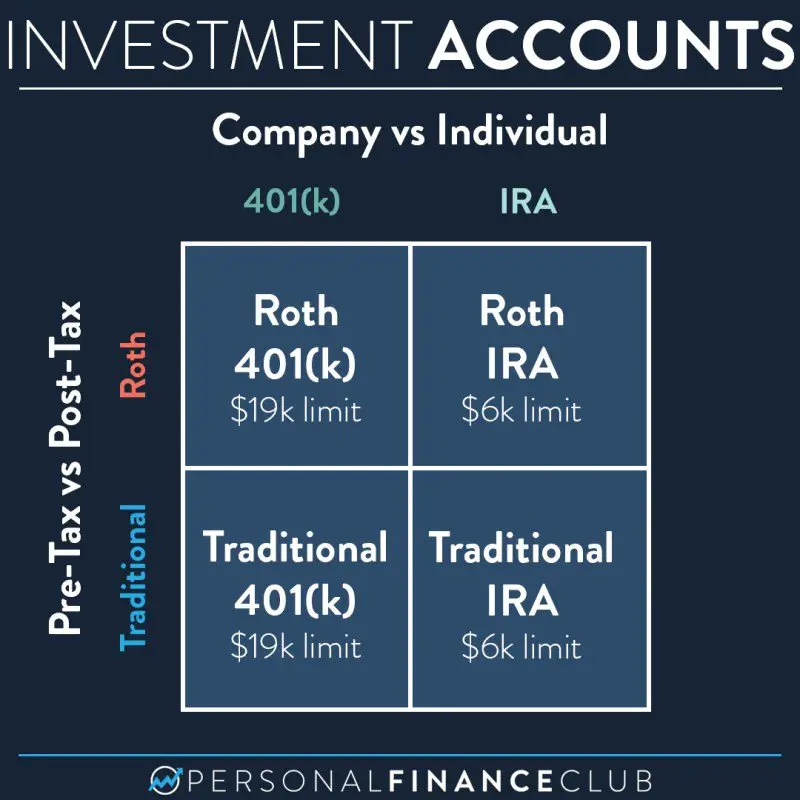

But, make sure you understand the different tax rules associated with each. Tax-deferred accounts include 401s, 403bs, traditional IRAs, solo 401s, and SEPs. Post-tax accounts include Roth 401s and Roth IRAs.

Also Check: Can I Use 401k To Pay Off Debt

Pros And Cons Of A Roth 401k

A big advantage that the Roth 401k has over the Roth IRA is the possibility of an employer matching your contributions up to a certain percentage. Employer matches are the closest thing there is to free money, so if youre deciding between a Roth 401k vs. a Roth IRA keep this in mind. Its also important to note here, though, that if you receive an employer Roth 401k match, the matching funds would also go into a traditional 401k.

A con, however, is that a Roth 401k account typically has fewer investment options than a Roth IRA.

Roth 401k Vs Roth Ira: How Are They Different

The biggest differences between a Roth 401k and a Roth IRA are their different annual contribution limits, eligibility criteria, and whether or not you will need to take required minimum distributions .

Lets start with the annual contribution limits.

In 2022, you can contribute up to $20,500 per year and a catch-up contribution of $6,500 per year if youre age 50 or over to a Roth 401k. However, the annual contribution limit for Roth IRAs is much lower: just $6,000 per year, or $7,000 if youre 50 years of age or over.

Another big difference between the Roth 401k and the Roth IRA is the eligibility criteria. If you make too much money, you cant open or contribute to a Roth IRA. More specifically, for tax year 2022, you are not eligible for a Roth IRA if your modified adjusted gross income is:

- $144,000 or more if you are single or head of household

- $214,000 or more for married couples filing jointly

With Roth 401ks, the only eligibility criteria is that your employer offers this option.

Another big difference is that you dont need to take Required Minimum Distributions from Roth IRAs. But with Roth 401ks, you must start taking RMDs when you turn 70½ years old.

You May Like: Can I Convert 401k To Roth 401 K

Key Takeaways: Differences Between An Ira And 401k

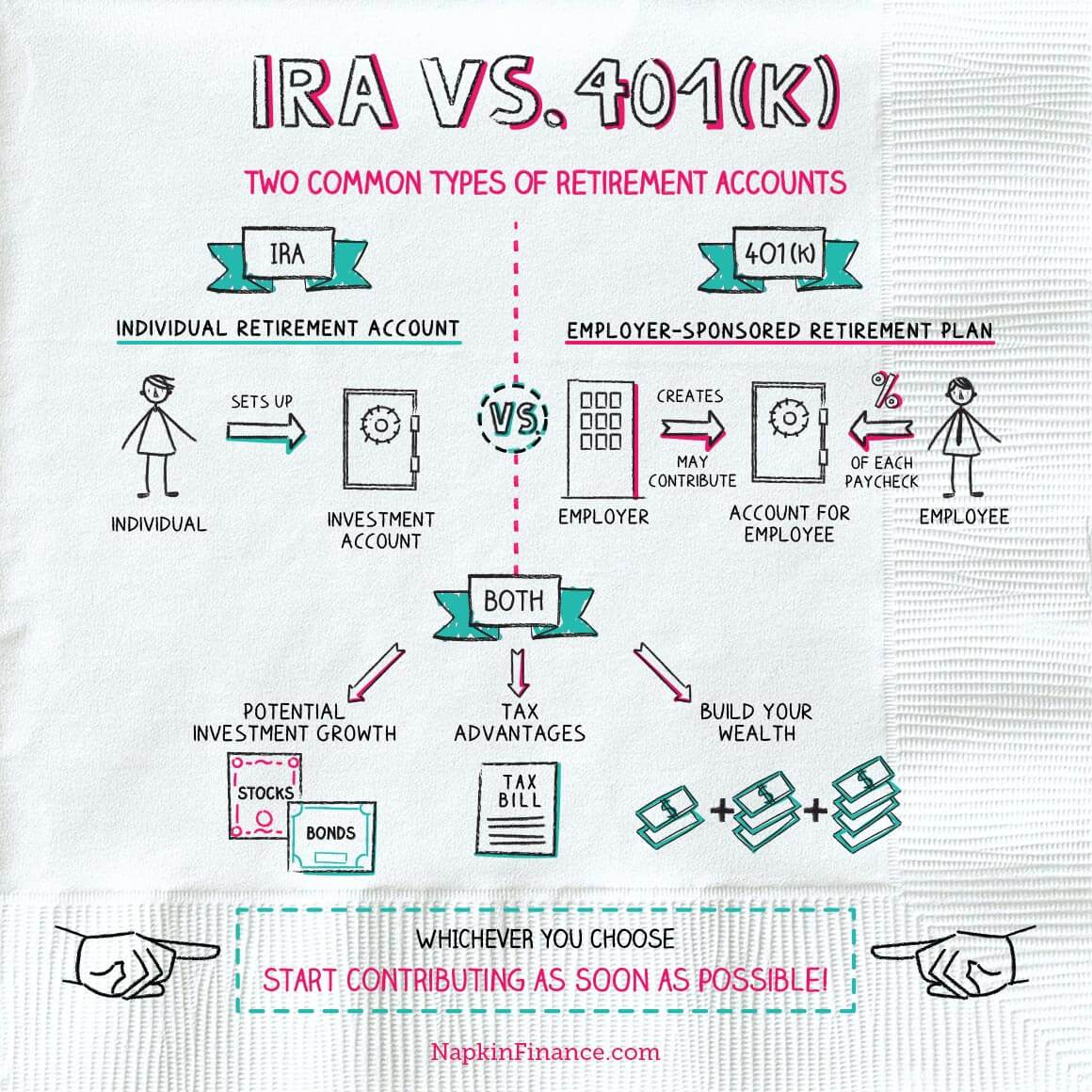

- A 401k is an employer retirement account and an IRA is an individual retirement account.

- A traditional IRA gives you a tax deduction upfront on your contributions and earned interest.

- A Roth IRA doesnt allow you to deduct your contributions.

- A tax-deferred 401k allows you to save taxes today and save for retirement.

- You can combine a 401k and IRA.

- In a Roth 401k, your funds are removed after taxes, meaning you are paying taxes as you contribute.

- If your company offers a 401k with a company match, you should set up your 401k and contribute the match amount.

Rules For Early Withdrawals

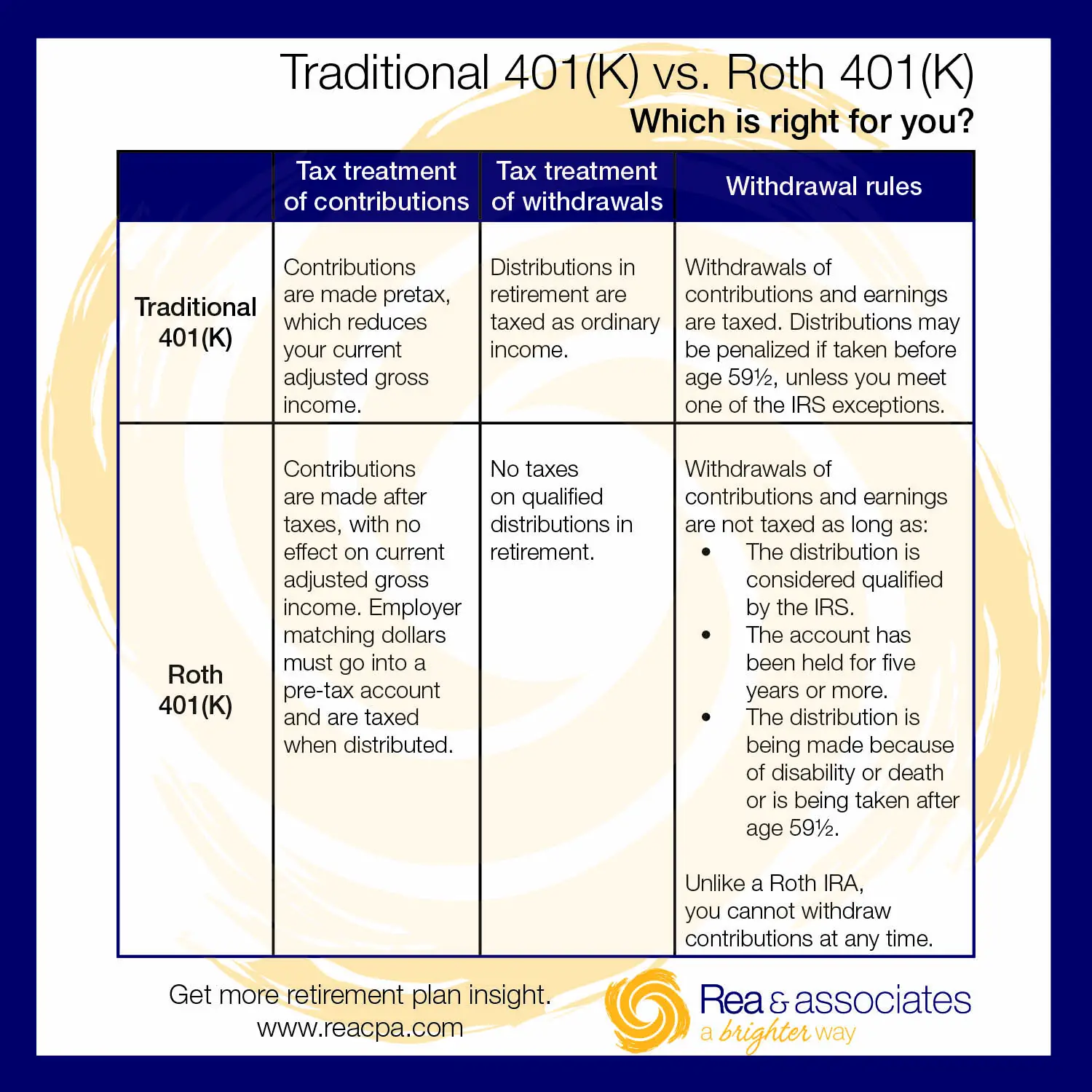

Withdrawals from both Roth 401s and Roth IRAs are tax-free if they meet certain criteria:

- The accounts must be held for at least five years.

- The account holder reaches age 59½, or distributions are made in the event of disability or death.

With a Roth IRA, you can always take out the money you contributed without tax repercussions. But with a Roth 401, if you want to withdraw money early, you may end up paying a 10 percent penalty tax on any earnings taken out, but not on your contribution amounts. Otherwise, to access your 401 funds without tax, you generally would have to take out a loan with the Roth 401, if the plan permits.

With a Roth IRA, you can withdraw up to $10,000 to buy, build or rebuild a first home and avoid paying taxes and the 10 percent early withdrawal penalty even if you are under age 59½. You can also take out money for qualified educational expenses while avoiding taxes and penalties.

Also Check: How Long Will My 401k Last When I Retire

What Is A 401

A 401 is a retirement savings plan many employers offer as a way to encourage employees to save for retirement. Basically, you tell your employer how much you want to invest in your 401usually as a percentage of your salary or a specific amount each pay periodand that money is automatically taken out of your paycheck and put into retirement savings. Voila!

According to Ramsey SolutionsThe National Study of Millionaires, 8 out of 10 everyday millionaires built their wealth through their companys 401.If all those millionaires could use the boring, old 401 to get to millionaire status, so can you!

What Can Your Budget Accommodate

If you were to contribute the same amount to your 401 via Traditional or Roth, your take-home pay would be higher if you opted for Traditional. Depending on your expenses and financial plans, that might be more important for you.

If you are not as reliant on that money today, and prefer that your retirement savings be out of sight, out of mind, Roth contributions are a way to save a bit more for tomorrow . Your contributions and earnings on interest will grow tax-free and you wont be tempted to spend that money youve earmarked for retirement in your checking account. Moreover, when you make a qualified withdrawal from a Roth account, you wont owe any taxes. Think of it like a gift to future you.

In contrast, when you withdraw from a Traditional account when you retire, you will owe taxes on everything you withdraw – theres no delineation between your contributions and your earnings.

Recommended Reading: How To Invest In A 401k For Dummies

Can I Have A Roth 401k And A Roth Ira

Yes, you can have both a Roth 401k and a Roth IRA. Keep in mind the contribution limits for each account.

If you receive a Roth 401k option through your employer, heres one strategy to consider: contribute enough money to your Roth 401k to receive the company match, since this match represents a risk-free return on your investment. Then you can also open a Roth IRA and contribute any additional retirement money you have to this account in order to diversify your retirement savings.

Ira Vs : What Is The Difference

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

The biggest difference between an IRA vs. a 401 is the amount you can save. You can save over three times as much in a 401 vs. an IRA $20,500 versus $6,000. But not everyone has access to a 401, because these are sponsored by an employer, typically for full-time employees.

Other than that, a traditional IRA and a 401 are similar in terms of their basic provisions and tax implications. Both accounts are considered tax deferred, which means you can deduct the amount you contribute each year unless you have a Roth account, which has a different tax benefit.

Before you decide whether one or all three types of retirement accounts might make sense for you, it helps to know all the similarities and differences between a 401 and a traditional IRA and Roth IRA.

Also Check: How To Liquidate Your 401k

When Should You Use A 401

If your employer offers a 401, it may be worth taking advantage of the opportunity to start contributing to your retirement savings. After all, 401s have some of the highest contribution limits of any retirement plans, which means you might end up saving a lot. Here are some other instances when it may be a good idea:

Q: Are There Income Limits To Make A Roth Ira Contribution

A: Yes, there are income limits for Roth IRA contributions.

With a traditional IRA, you can still make an IRA contribution, even if you exceed the income limits . But with a Roth IRA, you are not permitted to make a contribution at all once you exceed the income limit .

Here are the income limits for 2022.

You May Like: How To Get My Walmart 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Past performance is no guarantee of future results.

Investing involves risk, including risk of loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

What Is A Roth Ira

A Roth IRA is a retirement savings account you can open yourself. When you hear the word Roth, your ears should automatically perk upbecause a Roth IRA allows your savings to grow tax-free. Thats right: tax-free. That means once you turn 59 1/2, you can withdraw money from your account, and you wont owe a penny in taxes!

Read Also: Can You Set Up A 401k On Your Own

Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

A Roth 401 and a Roth IRA sound similar and they are.

Also Check: How Much Do You Get Taxed On 401k

Is It Better To Invest In A 401 Or Roth Ira

If youre wondering whether its better to contribute to a 401 or a Roth IRA, dont because you should be investing in both. Experts agree that the first account you should take advantage of should be a 401, if youre eligible through one at your job. Make sure you are putting enough to get the employer match first.

As I mentioned earlier, an employer match is free money that you dont want to miss, Yu said.

Then move onto your Roth IRA. Try to max out the $6,000 a year , and $6,500 a year . If you are eligible, and if you have enough money after that, go back to your 401 and max it out to the entire $20,500 annual limit.

Roth Ira Vs 401k Recap

If you contribute to both a Roth IRA and a 401k you are taking advantage of the two biggest retirement accounts. These accounts will help your savings grow faster and larger than a non-tax-advantaged brokerage account.

The more you contribute to your retirement savings accounts each year, the more money you will have in retirement.

Since its impossible to know what tax bracket youll be in at various stages in retirement, its great to have both accounts. Its not a bad idea to have some retirement savings in pre-tax and post-tax accounts.

Then you can strategize your distributions to minimize your tax liability and diversify your retirement holdings.

Dont let a lack of planning when youre young ruin your future.

Being a frequent golfer I get to meet a lot of people, especially older people. Anytime I meet someone who is retirement age I ask them if they wouldve done anything different in their 20s or 30s.

Nine out of 10 times I hear how they wish they had started saving earlier.

Use a 401k and Roth IRA to start funding your retirement plan, and your future self will thank you. Remember: Act as if retirement is on the horizon.

You May Like: How To Move 401k Into Ira

Choosing Between A Roth 401k And A Roth Ira

As with anything financial planning, theres really no one-size-fits-all answer to this question. The best way to figure out which account makes more sense for you is to talk to your financial advisor about your specific situation, but here are a few scenarios to help guide your conversation.

A Roth 401k might be the better choice if you:

- Earn too much money to open and contribute to a Roth IRA.

- Want to take advantage of an employer match.

- Want to contribute as much money as possible.

- Appreciate the ease of signing up at work and having contributions automatically deducted from your pay each pay period.

A Roth IRA might be the better choice if you:

- Want access to a wider range of investment options.

- Want to be able to withdraw contributions tax- and penalty-free before you turn 59½ without making a plan loan.

- Have no inclination toward taking RMDs when you turn 70½.

Difference Between 401k And Roth Ira

January 3, 2011 Posted by Andrew

401k vs Roth IRA

There is no age consideration when you are planning to take a retirement plan. Planning should be done at the early stages of the carrier but if you have overlooked it then it can be done at any stage of your carrier. A person who is planning for the retirement should be well aware of all the plans available to him. Among the best plans in the U.S. 401 K and Roth IRA top the list. These plans are very retirement friendly as they provide good tax benefit. Both the plans are designed to give maximum benefit on retirement, but are slightly different from each other.

401k

401k is a defined contribution plan initiated by the employer, where the employees can elect to contribute a portion of their salary towards the 401k plan. What employer does is he holds back some part of the salary of the employee and uses it as a contribution towards a fund which the employee gets after retirement. In some instances, the employer matches the contributions by the employee with some money on his own every year.

The deduction made from the salary towards this fund is not taxed till the withdrawal during the retirement , which is a benefit for anyone who opts for this plan. The interest earned on the amount is also tax free. Upon retirement you can elect to receive the distribution as a lump sum or distributed as monthly payments upon retirement.

Roth IRA

More information on Roth IRA

Difference between 401k and Roth IRA

Also Check: How To Use Your 401k Money