Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Indirect Rollovers Can Be Complicated To Manage

With an indirect rollover, you receive a check for the balance of your account that is made payable to you. That might sound good, but as a result, you are now responsible for getting it to the right place. You have 60 days to complete the rollover process of moving these assets to your new employer’s plan or an IRA.

If you dont complete the rollover within this 60-day window, you will owe income taxes on the amount you failed to roll over. If you’re under 59 1/2, you will also face a 10% penalty tax. Indirect rollovers can be made once a year.

Handling A Previous 401k

You usually have a few options when it comes to handling a 401k from a former employer. These include leaving the 401k where it is, rolling it into a taxable or nontaxable Individual Retirement Account or transferring it to a 401k with your current employer and cashing it out. Of all your options, cashing out will cost you the most now and in the future. You will have to pay income taxes on the withdrawal along with a 10 percent early withdrawal penalty. Youll also lose the tax benefits offered by the 401k as a qualified retirement plan.

Also Check: How To Withdraw From 401k Fidelity

Recommended Reading: Can I Invest In Stocks With My 401k

Better Return Than Comparable Index Funds Across More Periods

10-year trailing periods, rolling monthly. Period analyzed is 20 years ended 9/30/2022.

Percentage of periods with better returns than comparable index funds

Average additional return over comparable index funds across all periods analyzed

Past performance is no guarantee of future results.

a history of strong performance

Find Out Your Fully Vested Account Balance

When checking your 401 account balance, you may have never considered the amount youd take with you if you were to quit or lose your job today. While your personal contributions are always fully vested, your employer matching contributions and profit-sharing contributions r may be subject to a vesting schedule.

Take a look at the provisions of your 401 plan regarding employer contributionsas they may state that you earn these deposits over time. If you leave before earning a certain number of vesting years of service, you may not be entitled to receive 100% of the employer contributions in your account.

Under a cliff vesting schedule, employer contributions only become vested after a minimum number of years. Under a graded vesting schedule, employer contributions are vested over time. Your quarterly benefit statement should provide you with an idea of your vested percentage, but be sure to verify your vesting with your employer before requesting a distribution.

When doing a cost-benefit analysis of accepting a new job offer, it may be prudent to review the cost of losing the unvested portion of your retirement account.

Dont Miss: How To Recover 401k From Old Job

Don’t Miss: How Much Will Be In My 401k When I Retire

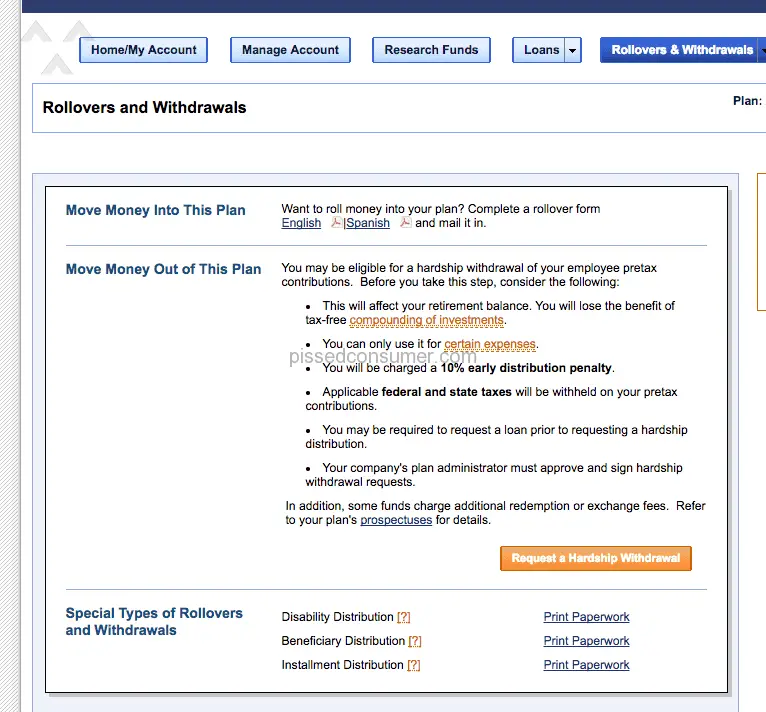

Move Money To New Employer’s 401

Although there’s no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

Do You Have A Choice In Whether You Roll Over An Old 401

It might surprise you to learn that former employers absolutely can and often do kick people out of their prior companys 401 plan.

An employer is the one thats really paying for any fees in your retirement account, says Andrew Meadows, senior vice president at Ubiquity Retirement + Savings. So if youre below a certain balance, the law says you can be kicked out of your plan in order to reduce costs for the employer.

This is known as a force-out that, pursuant to IRS guidelines, allows employers to remove previous employees from their retirement plan if they have less than $5,000 vested in the account. While its not an issue for everyone, if you have less than $5,000 in an old employers plan, then you might have found yourself on the receiving end of a notice to take action.

If you miss the deadline to take action and roll over the money yourself, your former employer is required to move the balance to a low-cost IRA if it is more than $1,000. If its less than $1,000, they have the option to just write you a check, and you will then be penalized for an early withdrawal if you do not deposit it into a retirement savings account within 60 days.

You May Like: Can You Transfer A 403b To A 401k

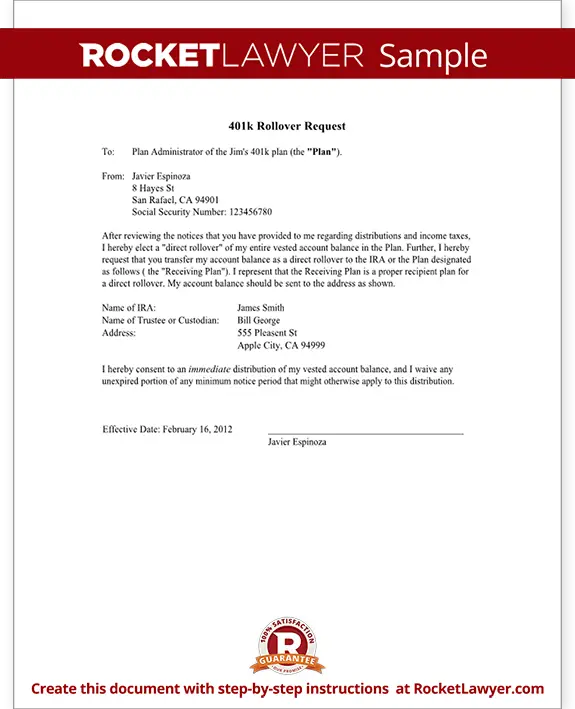

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the new financial institution with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your plan administrator is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

How Do I Find My Previous 401 Process

- Method 1 of 3: Contacting Your Old Employer or Plan Administrator. Find I let you know the outdated saying.

- Method 2 of 3: Searching the National Registry and Other Databases. Search for the plan administrator on a central authority database.

- Method Three of three: Accessing Your Funds. Verify your identity if important.

Dont Miss: What Is The Difference Between Annuity And 401k

Read Also: Can You Withdraw Your 401k When You Leave A Company

Search The National Registry

Still not having any luck? Past employers may list you as a missing participant if you no longer work for the company but left your 401 behind. The National Registry of Unclaimed Retirement Benefits is a nationwide, secure database listing retirement plan account balances that have been left unclaimed .

Also Check: How To Fill Out A 401k Enrollment Form

Solo401kcom And Our Easy Rollover Process

Our proprietary software helps you complete and generate a rollover packet to send to your current custodian in two minutes or less. Your rollover packet includes all the relevant compliance paperwork proving your Solo 401k is an IRS-approved plan, including a copy of our IRS Opinion Letter, and a sample 1099-R so your custodian can document the rollover as a direct rollover.

The simple six steps are:

Don’t Miss: When Can I Sign Up For 401k

Leave It With Your Former Employer

If you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. If you have a substantial amount saved and like your plan portfolio, then leaving your 401 with a previous employer may be a good idea. If you are likely to forget about the account or are not particularly impressed with the plans investment options or fees, consider some of the other options.

If you leave your 401 with your old employer, you will no longer be allowed to make contributions to the plan.

Our Results Stand On Our Strategic Investing Approach

While all investment managers crunch numbers, we don’t stop at surface-level analysis. Instead, our strategic investing approach takes us beyond the numbers to find the best potential investments for your portfolio.

-

Rigorous Field ResearchOver 525 of our investment professionals go into the field to see firsthand how companies are performing.3

-

Prudent Risk ManagementWe carefully manage risk and seek to maximize value for our clients over longer time horizons.

-

Experienced ManagersOur skilled portfolio managers have deep experienceaveraging 22 years in the industry and 17 years with T. Rowe Price.4

You May Like: How Do I Know Where My 401k Is

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Move Your Old 401 Assets Into A New Employers Plan

You have the option to avoid paying taxes by completing a direct, or “trustee-to-trustee,” transfer from your old plan to your new employer’s plan, if the employer’s plan allows it.

It can be easy to pay less attention to your old retirement accounts, since you can no longer contribute. So, transferring old 401 assets to your new plan could make it easier to track your retirement savings.

You May Like: Should You Roll Over Your 401k

Decide Between A Traditional Or Roth Ira

The type of IRA you roll your old 401 money into will depend on what kind of 401 youre transferring the money from.

In most cases, if you have a traditional 401, youll probably want to roll the money into a traditional IRA. That way, you wont have to pay any taxes on the transfer .

If you had a Roth 401, thats a different story. You could roll the money you contributed into a Roth IRA completely tax-free and continue to enjoy tax-free growth and tax-free withdrawals in retirement. But your employers contributions are treated like traditional 401 contributions . . . so that money needs to either be rolled over into a traditional IRA or you can pay the taxes to roll them into a Roth account.

Easy, right? Traditional to traditional, tax-free today. Roth to Roth, mostly tax-free today and tax-free in retirement.

Rolling Over To The New Employers Plan

The main advantage of rolling the money to the new employers plan is the money will have the greatest creditor protection afforded by law. The law that governs 401s and many other employer retirement plans offers you unlimited protection of your retirement money from creditors and lawsuits. This can be extremely important for business owners, surgeons, or others who are at a heightened risk of being sued.

I often advise clients with a heightened risk of lawsuits to leave money in their 401 for the asset protection provide provided under ERISA. If you are exposed to significant liability or have a high chance of being subject to a lawsuit, leaving the money in the 401 is likely the better idea. If youve received advice to roll over to an IRA and would like a second opinion, please feel free to schedule a no-cost consultation.

Recommended Reading: How To Roll Over 401k To New Company

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Donât Miss: How To Get 401k From Old Employer

How Long Do I Have To Rollover My 401 From A Previous Employer

When leaving a job many ask, âHow long do I have to rollover my 401?â Usually, your previous employer will rollover a 401 for you. If you receive a check youâll have 60 days to roll it over to avoid penalties.

Leaving a job can be a stressful time. Tying up loose ends and preparing for your next venture can cause certain things to fall through the cracks. Namely, forgetting to bring your 401 with you. There are a few things to remember when you go to rollover your 401 from a previous employer.

If your previous employer disburses your 401 funds to you, you have 60 days to rollover those funds into an eligible retirement account. Take too long, and youâll be subject to early withdrawal penalty taxes.

However, there are alternatives to your previous employer cashing out your 401 when you leave that can make the process much easier.

You May Like: What Is Max I Can Put In 401k

A Closer Look At Your Available Options

The good news is whatever money thats in your 401 is yours to do with as you like. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may need to roll it over or into a brokerage account that you own completely.

Pension Benefit Guaranty Corporation

The PBGC is a good place to start for anyone who has already lost track of their pension. They maintain a database2 of unclaimed pensions that lists approximately 38,000 people who are eligible for pension payments that could not be located by the PBGC or their former employer.

The PBGC does not have anything to do with defined contribution plans like 401s and 403s. To find one of these plans start with your former employer. If the company has gone out of business, try the Department of Labors Form 5500 search. Plan administrators are generally required to file Form 5500 annually. The form should contain the name of the plan administrator and their contact information. Unfortunately, the search only goes back to 2009. This wont help if the plan went out of business before 2009.

Read Also: How Much Will My 401k Grow If I Stop Contributing

Recommended Reading: How Can I Pull My 401k Money Out

What Happens To Money Left In An Old 401

If youve ever had a 401 account with an employer and lost track of it after youve left youre not alone.

We estimate that there are over 25 million orphaned 401 accounts just like yours. These are accounts tied to former employers that continue to have money in them, but are not actively being monitored or used.

At Capitalize, we help people find these old, orphaned 401 accounts and consolidate them into a new retirement account for free. This helps them better keep track of their retirement savings over time.

The money youve put away in a 401 account remains yours even after youve left that job. Most of the time its still at the same financial institution that managed it while you had it. This financial institution is known as a 401 provider. Its a company engaged by your former employer to hold and manage your 401 assets. You can see a full list of 401 providers here.

Some of the time, though, your money has been transferred to a new institution. That generally happens in one of three cases:

- Your former employer changes their 401 provider when this happens your 401 account will be transferred over to the new institution.

- Your former employer is acquired by another company when this happens your account usually gets transferred to the 401 provider used by the acquiring company.

- Your account balance was under $5,000 and was transferred to an IRA at a different institution this is known as a forced rollover and is allowed by some 401 plans.