How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

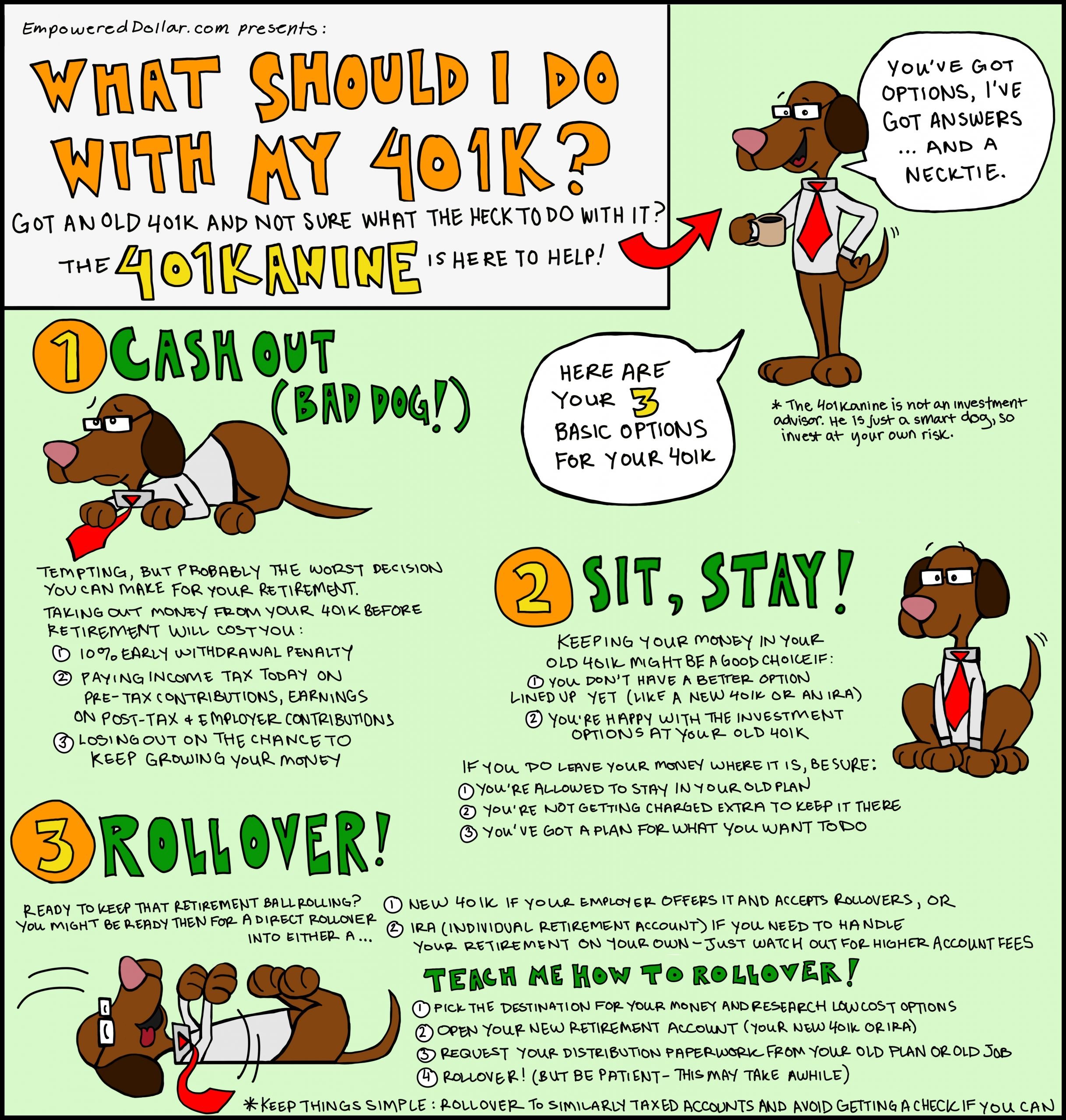

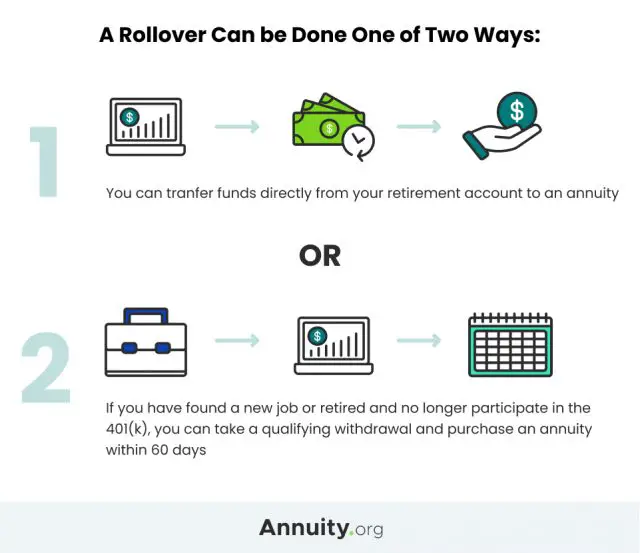

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Find The Right Mix Of Stocks And Bonds

Each TDF has a specific year in its name. Acme TDF 2030, Acme TDF 2045 etc. Pick a TDF with a year that is close to when you expect to retire, thats it, youre done. That single TDF will invest in a mix of stocks,bonds and cash. If youre in your 20s, 30s and 40s it will tilt more towardstocks, and in your 50s and 60s will move more of the portfolio into bonds and cash.

Save For Retirement By Getting The Most Out Of Your 401 Plan

- Post published:December 20, 2022

- Post category:Tax & Estate Planning

Socking away money in a tax-advantaged retirement plan can help you reduce taxes and help secure a comfortable retirement. If your employer offers a 401 or Roth 401, contributing to the plan is a smart way to build a substantial nest egg.

If youre not already contributing the maximum allowed, consider increasing your contribution. Because of tax-deferred compounding , boosting contributions can have a major impact on the amount of money youll have in retirement.

With a 401, an employee makes an election to have a certain amount of pay deferred and contributed by an employer on his or her behalf to the plan. The amounts are indexed for inflation each year and not surprisingly, theyre going up quite a bit. The contribution limit in 2023 is $22,500 . Employees age 50 or older by year end are also permitted to make additional catch-up contributions of $7,500 in 2023 . This means those 50 and older can save a total of $30,000 in 2023 .

Contributing to a traditional 401

A traditional 401 offers many benefits, including:

- Contributions are pretax, reducing your modified adjusted gross income , which can also help you reduce or avoid exposure to the 3.8% net investment income tax.

- Plan assets can grow tax-deferred meaning you pay no income tax until you take distributions.

- Your employer may match some or all of your contributions pretax.

Contributing to a Roth 401

Looking ahead

Don’t Miss: Should I Rollover My Old 401k To New Employer

Hands Off Until Retirement

A dangerous quirk of 401s is that when you leave a job you are allowed to cash out your 401. Thats typically a really bad move. You will likely owe a 10 percent early withdrawal penalty, and income tax if you had a Traditional 401. Earnings on a Roth 401 withdrawal you take out early will also be subject to tax.)Moreover, money you cash out today is money you wont have for retirement.

Two Annual Limits Apply To Contributions:

You May Like: How To Get Funds From 401k

You May Like: Can You Create Your Own 401k

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Read Also: How Can You Take Money Out Of Your 401k

You May Like: How To Find Out If I Have 401k

What Are The Benefits Of A 401

There are two main benefits to a 401. First, companies usually match at least a portion of the money you put into your 401. Second, there are tax benefits for these accounts. If your contributions to your 401 are pre-tax, you don’t have to pay taxes on the gains you earn over time when it comes time to withdraw money for retirement. If your contributions are post-tax, you get to deduct your contributions on your federal income tax return.

Increase Your Contributions Automatically

Depending on how much you make and how comfortable you want to be in retirement, you should be aiming to save anywhere 10 to 20 percent of your income in your 401 at a minimum.

If your employer enrolled you in the plan automatically, your default contributions may be set as a low as 3 percent, which is a pretty big deficit.

If you’re on a tight budget because you’re paying down student loans or saving for a home, bumping up your contributions by 10 or 12 percent all at once may put too much stress on your finances.

Increasing what you’re saving by 1 to 2 percent a year is an easy solution and you can set it up so that it happens automatically. That way, you’re not seeing your paycheck shrink by a huge amount.

Still not sure you can swing it? Here’s a quick example to show you how painless it can be. Annie is 30 years old, single and making $52,000 a year.

She contributes 3 percent of income into her 401 and her employer chips in a 50 percent match.

If she increases that 4 percent, her paycheck would drop by $7 per pay period but she’d add $111,000 to her savings, with a 7 percent annual return. That’s a pretty good return for what’s basically the equivalent of lunch money.

Also Check: How To Take A Loan Out Of Your 401k

Make Sure You Qualify For The Maximum Match

If you have job-hopped in the past five or so years your new employer may have automatically enrolled you into a 401 plan. Thats a well-intentioned move to get you saving for retirement. However, you should check how much of your salary you are contributing. Many employers set the contribution rate at just three percent or so of your annual salary. In most cases, that’s not nearly enough to earn the maximum matching contribution.

For instance, its common for employers to offer to match a portion of an employees contribution, up to a maximum of six percent of their salary. If you are only contributing three percent, you arent going to earn the maximum match. Confirm that your contribution is at least enough to earn the maximum match. Thats the absolute lowest rate you should consider.

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If youre pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Also Check: How Can I Find My Old 401k

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various stock market sectors do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, the small-cap portion of the portfolio will likely grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed toward the best-performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

Try not to borrow from your plan. Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since you’ll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan. Plus, you will often be unable to make 401 contributions until the loan has been paid off.

Don’t Make Changes In A Down Market

When the markets take a dive, your first impulse might be to change your contributions. That can work against you, however.

“Participants should not be tempted to decrease their contribution percent when the market goes down,” said wealth advisor Robert Runnfeldt at David A. Noyes & Company. “By adding to their 401 every paycheck, participants end up with a below-average dollar cost average price. This takes place because, when the market is low, you buy more shares for investing the same amount of money.”

Recommended Reading: Where Is My Old 401k

Youll Still Need To Be Mindful Of Taxes

Youll still owe income tax on your distribution from any tax-deferred retirement account. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

Also worth noting: The income can be claimed all at once in 2020 for tax purposes, or spread evenly over the next three years. In many cases, dividing it evenly over three years may result in a better tax situation, as its less likely to bump you into a higher tax bracket in any single year.

If your income is expected to be lower in 2020 than the subsequent two years, though, it could make sense to claim all of the income on your 2020 tax return. Not only might this minimize the effective tax rate you pay on this income, but youll also have two years to pay back the distribution and ultimately get a refund.

Keep in mind that if you have a Roth IRA, it may still be a better choice for withdrawals than your 401 or IRA. Thats because savers can always withdraw contributions from their Roth IRA penalty- and tax-free.

Dont Miss: Should I Rollover 401k To New Employer

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Its fairly easy to put money into a 401, but getting your money out can be a different story. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal.

But 2022s high inflation, rising interest rates and rocky stock market all have some investors itching to cash out early. In a November 2022 Wells Fargo & Company study,

If youre thinking of cashing out a 401 before you reach 59½, proceed with caution. You could pay a steep price.

Read Also: How Do I Draw Money Out Of My 401k

Read Also: What Happens To 401k When You Get Fired

Use A Retirement Calculator

This might sound like a simple step, but using the various retirement tools available to you can have a profound impact on the decisions you make. One example of this is using a retirement calculator to track how savings habits will impact retirement readiness, said Geno Cufone, senior vice president of retirement plan administration for Ascensus.

Nearly 18% of calculator users increased their contributions after use, and 37% of employees who werent saving started contributing after using a retirement calculator, according to recent Ascensus data.

Find Out: How Much Do I Need To Retire?

Get To Know Roth Iras

Once you’ve built a financial foundation, consider adding a Roth IRA, which can provide tax-free income once you retire. A Roth IRA can be a good alternative if your company doesn’t offer a 401.

Another advantage of tax-free withdrawals from a Roth IRA is that Medicare premiums are based on your taxable retirement income. Reducing your health care costs in retirement means you’ll keep more of the money you have coming in and make your retirement savings last longer.

Also Check: Can You Keep Your 401k In A Chapter 7

Rollover Money: An Easy Option

If youre still working and you cant get money out of your 401 with any of the techniques above, there might be another approach. If you ever made rollover contributions to your 401 into your existing 401, for example), you might be able to take those funds back out. You wont have access to your entire 401 account balance, but you might get a nice chunk of change outat any time, for any reason. Employers are often unaware of this option, so you may need to ask your employer to do some research with your Plan Administrator.

Again, you may have to pay income taxes and tax penalties, and youre raiding your retirement savings, so only use this option when you have no other choice.

Next Up: Curious About Meeting?

Dont Make Changes In A Down Market

When the markets take a dive, your first impulse might be to change your contributions. That can work against you, however.

Participants should not be tempted to decrease their contribution percent when the market goes down, said wealth advisor Robert Runnfeldt at David A. Noyes & Company. By adding to their 401 every paycheck, participants end up with a below-average dollar cost average price. This takes place because, when the market is low, you buy more shares for investing the same amount of money.

Also Check: How Do You Withdraw Money From Your 401k

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

How To Max Out Your Retirement Savings

Women face a financial gender gap in retirement. These steps can help you save what youll need.

Why are women more likely to need more moneyand have less savedfor retirement?

Financial realities such as a likelihood of living longer, higher health care costs, the pay gap, the investing gap, and time out of the workforce can all be factors. That’s why saving and investing as much as possible can be a smart way to help close the retirement gender gap.

You May Like: How Much Can You Contribute 401k